Firefighting Foam Market Report Scope & Overview:

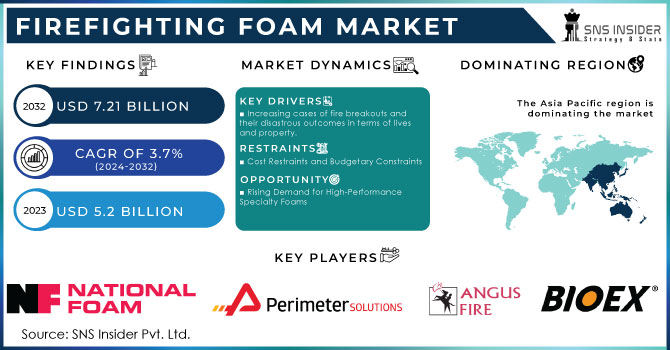

The Firefighting Foam Market Size was valued at USD 5.2 Billion in 2023 and is expected to reach USD 7.2 Billion by 2032, growing at a CAGR of 3.7% over the forecast period of 2024-2032.

Get More Information on Firefighting Foam Market - Request Sample Report

The Firefighting Foam Market comprises various stakeholders, and the report discusses key constituents such as the supply chain of raw materials, which is covered in detail including key products and procurement challenges. explores the production process and manufacturing trends, and highlights technological advancements. Consumer Behaviour drives foam choice due to effectiveness and environmental concerns The report also examines firefighting foam usage across different industries and evaluates market sentiment and consumer awareness, highlighting sustainability and safety as critical factors influencing future growth in the industry.

Firefighting Foam Market Dynamics

Drivers

-

Rising Industrialization and Urbanization Increases the Adoption of Firefighting Foam Across the Globe

The growing urbanization and expansion of industries across the world have led to an increased demand for improved fire protection solutions. In developing countries, with new factories and large storage, and storage space, the risk of fire hazards increases. Thus, urbanization leads to increased population densities and a greater dependency on, and expansion of, infrastructure, all of which increases fire risks in residential, commercial and public settings. The use of firefighting foam has been essential in solving these problems and has become a crucial part of any fire safety programme. The identification of firefighting foam as a necessary investment in countries building new or upgrading their fire safety infrastructure. Firefighting foam products are being used in various sectors including industries and urban centers due to such prioritization of safety measures, which is anticipated to contribute to the growth of the global firefighting foam products market. Furthermore, the quick establishment of residential and commercial structures in city regions further complicates the requirement for guarded fire security answers, involving foam products for viable firefighting.

Restraints

-

Environmental Concerns and Regulatory Restrictions on Harmful Chemicals Limit the Growth of Firefighting Foam Market

One of the significant restraints that is hindering the growth of the firefighting foam market is the environmental concerns associated with the chemicals used. Firefighting foams, and in particular foams containing per- and polyfluoroalkyl substances are increasingly scrutinized due to their persistence in the environment and their potential to harm ecosystems and human health. A large body of research around these chemicals' environmental impact has led governments and regulatory bodies to enforce tougher rules about their use. This has led to challenges for manufacturers seeking to implement reformulated products to meet regulations while still offering requisite fire suppression effectiveness. Although environmentally friendly alternatives are rapidly coming up these products often have higher production cost or are a compromise in performance, levelled challenge for firms in firefighting foam market to meet with regulation and customer needs.

Opportunities

-

Increasing Government and Corporate Investment in Fire Safety Systems Promotes Market Growth Potential

With the rise of population, the effect of corporate and governing bodies on purchasing power has resulted in the increased investment towards fire protection. As fire safety standards have tightened around the world, industries are required to upgrade their fire prevention systems. The need for optimal performance firefighting foam products, which are vital in the oil and gas, chemicals, aviation and manufacturing sectors, are now growing. Furthermore, the increasing demand for workplace safety and insurance regulations is encouraging organizations to spend on a holistic fire protection system. The market for firefighting foam is also fueled by public sector investments in firefighting infrastructure, like fire departments and emergency response crews. As private and public fixer get priority in terms of safety, this trend is anticipated to continue that would fuel significant market growth.

Challenge

-

Increasing Raw Material Prices and Supply Chain Disruptions Pose Significant Challenges for Firefighting Foam Manufacturers

Firefighting foam manufacturers continue to deal with increased raw material prices and supply chain issues. The dependence on specialized chemicals and materials in foam formulations can also subject the price of foam to price volatility due to the fluctuations in raw material prices of surfactants, fluoropolymers, and synthetic compounds. The global backlogs, due to pandemic, geopolitical tensions, impacts production times and delays deliveries of foam to essential industries. These issues are conspiring to stop manufacturers from being able to deliver more fire-fighting foam and at a competitive price. Additionally, delays in raw material procurement can impact product availability, affecting industries that depend on timely fire suppression solutions.” This pressures manufacturers to control production costs and find reliable supply chains so that they can continue operating to meet market demand.

Firefighting Foam Market Segmental Analysis

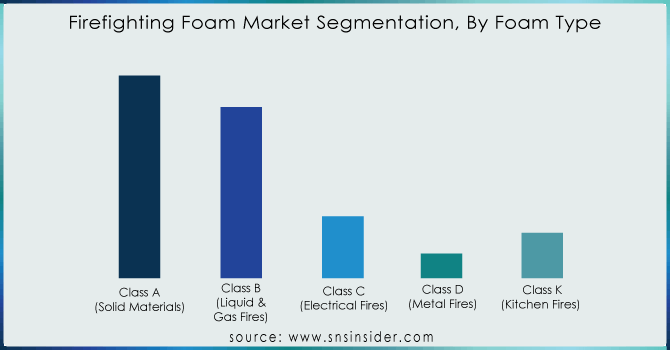

By Foam Type

In 2023, Aqueous Film Forming Foam dominated and held the largest share of the firefighting foam market with about 34% because of its broader application in essential industries that need prompt fire extinguishing. Due to its fire suppressing ability for flammable liquid very quickly, AFFF is widely used by oil and gas, aviation and chemical industries. Militaries and airports do not have a choice in using AFFF; the U.S. Department of Defense and the Federal Aviation Administration require it, solidifying the chokehold. Moreover, aforementioned performance over hydrocarbon-based fires has made AFFF the go-to option even with rising environmental concern over per- and polyfluoroalkyl substances (PFAS) in AFFF. Recent events, like fire outbreaks in petrochemical facilities, underline the need for it. For example, the National Fire Protection Association (NFPA) has yet to recommend against AFFF in high-risk environments, continuing to contribute to AFFF use.

By Material Type

The Class B firefighting foam accounted for the largest revenue share of around 45% in 2023, as it is needed in industries managing flammable liquids and gases, including oil refineries, chemical facilities and fuel storage units. Class B foams are critical in suppressing fuel-based fires, and are one of the most dangerous/most difficult to extinguish fires according to the International Association Fire Chiefs (IAFC) and the National Fire Protection Association (NFPA). Recent regulatory updates, including the European Union safety directives related to petrochemical storage facilities, have only made the demand for Class B firefighting foam more adamant. Rescue operations, such as fuel tanker fires and refinery explosions, require the application of potent Class B foams to minimize destruction, this fact has contributed Class B to capture the majority of the market share.

By End-Use

In 2023, oil and gas industry dominated and had the largest share of around 28% of firefighting foam market due to the fact that refinery, offshore platforms and fuel storage terminals have the great potential of flammable liquid fires. Stringent fire safety regulations laid down by organizations like the American Petroleum Institute (API) and the International Association of Oil & Gas Producers (IOGP), will augment the demand for high performance firefighting foam. Furthermore, soaring number of refinery expansions and new liquefied natural gas (LNG) projects fuel the growth of firefighting foam market. For example, Shell and ExxonMobil have extensive facilities fire hazard mitigation programs that are largely dependent on the specialized foams used for fighting such fires. Governments worldwide and regulatory organizations, such as the Occupational Safety and Health Administration (OSHA) in the United States, also impose strict mandates with respect to fire protection in the oil and gas sector, thus reinforcing the predominance of this segment.

Get Customized Report as per Your Business Requirement - Request For Customized Report

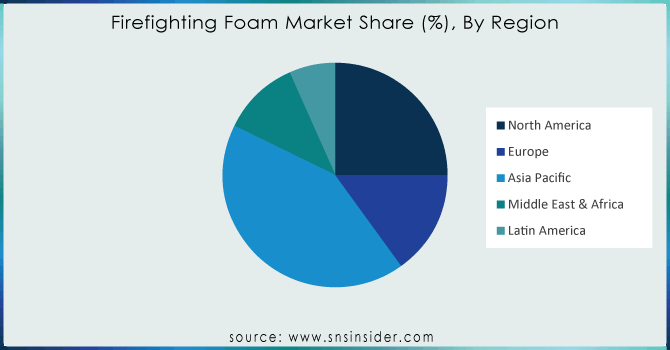

Firefighting Foam Market Regional Outlook

Asia Pacific dominated the firefighting foam market and accounted for around 34.6% share in 2023, owing to rapid industrialization, growth of the oil and gas sector, and stringent regulations regarding fire safety. One of the major contributors is the North America owing to its extensive manufacturing sector coupled with the increasing petrochemical facilities as well as the expansion of investment in fire protection systems. As the world's largest consumer, China has seen a spike in firefighting foam demand from expanding industrial zones and tight fire-safety regulations from, for example, the China National Standard for Fire Safety. In India, the need for fire suppression solutions in high-rise buildings is further exacerbated due to rapid urbanization and infrastructure projects such as the development of smart cities. Japan has long been a pioneer in environmentally sustainable firefighting foams, due to its well-established chemical and automotive industries adhering to global sustainability goals. Additionally, implementation of fluorine-free foams throughout the region, in light of adverse environmental concerns, has also governed regional market growth.

On the other hand, in 2023, North America emerged as the fastest growing region in the Firefighting Foam Market with a CAGR of 3.7%, owing to technology evolution, growing fire accidents, and government regulations for fire suppression system. Firefighting foams are also in increased demand across oil refineries, aviation, and defense in the United States and Canada. In the U.S., the fire safety regulations have been very stringent including various guidelines, by National Fire Protection Association (NFPA) and Environmental Protection Agency (EPA), prompting the industries to use next-gen foams with minimal effect on the environment. The presence of large firefighting foam manufacturers, like Johnson Controls and National Foam, has also catalyzed innovation into PFAS-free and biodegradables foams. The demand for firefighting foams for aircraft rescue and firefighting applications is driven by growing investments in the aviation sector in Canada, with airport expansions in cities such as Toronto and Vancouver. Additionally, planned fire safety measures by the government body and increasing awareness regarding fire hazards in industrial sectors are expected to aid market growth.

Recent Highlights

-

May 2024: Cross Plains Solutions, a firm that develops environmentally sustainable fire-fighting foams, has introduced SoyFoam, a fire extinguishing foam free of PF. SoyFoam is 100% free of intentionally added PFAS and manufactured with no fluorines.

-

April 2024: Tyco Fire Products, a company owned by Johnson Controls, agreed to pay US$ 750 Mn to settle claims brought by some U.S. public water systems in litigation asserting contamination of their water supplies by the continual toxic "forever chemicals" within firefighting foam manufactured by the firm.

-

March 2024: Angus has developed new fire foam that fights fires just as well, or even better, than older types that contain harmful chemicals (PFAS). This change comes because of stricter regulations and Angus Fire's commitment to sustainable solutions. They've stopped making the older foam as of 2024.

-

January 2023: The U.S. Department of Defense released a new challenge for firefighting foam makers. Their F3 Military Specification sets the toughest testing standards in the world for military-grade fire extinguishing agents. This version clarifies the significance of the F3 MIL-SPEC for foam concentrate manufacturers and highlights its rigor compared to other existing standards.

Key Players

-

Angus Fire (Angus Foam, FoamPro)

-

Ansul (Ansulite, Lite water)

-

Dafo Fomtec AB (Fomtec AFFF, Fomtec AR-AFFF)

-

DIC Corporation (DIC Fire Fighting Foam, DIC Alcohol-Resistant Foam)

-

Johnson Controls (Ansul Foam, AFFF 3% Foam)

-

Kerr Fire (KerrFire AFFF, KerrFire AR Foam)

-

National Foam (FireGuard AFFF, FireFoam)

-

Perimeter Solutions (FireIce, LIQUIDFIRE)

-

SFFECO Global (SFFECO Foam Concentrates, SFFECO AFFF)

-

Solberg (Polar Foam, Solberg AR-AFFF)

-

Albilad Fighting Systems Ltd (Albilad Foam, AFFF 3%)

-

Auxquima (Auxquima Fire Foam, AR-FFFP)

-

BIO EX S.A.S. (BIO EX F3, BIO EX FFFP)

-

Chemgaurd (Chemguard AFFF, Chemguard AR-AFFF)

-

Eau&Feu (Eau&Feu AFFF, Eau&Feu AR Foam)

-

Fabrik Chemischer Praparate von Dr. Richard Sthamber GmbH & Co. KG (Dr. Sthamer AFFF, Dr. Sthamer AR Foam)

-

Loshareh Chemical Industries (Loshareh Fire Foam, AR Foam Concentrate)

-

PGISystems (PGI Fire Foam, PGI AR Foam)

-

Shanghai Waysmos Fire Suppression Co. Ltd (Waysmos AFFF, Waysmos AR Foam)

-

Viking Group Inc. (Viking Foam, Viking AR-AFFF)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.2 Billion |

| Market Size by 2032 | USD 7.2 Billion |

| CAGR | CAGR of 3.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Foam Type (Alcohol-resistant Aqueous Film Forming Foam (AR-AFFF), Aqueous Film Forming Foam (AFFF), Fluoroprotein Foam (FP), Protein Foam (P), Synthetic Foam (S), High-expansion Foam (HEF), Medium-expansion Foam (MEF), Low-expansion Foam (LEF), Film-forming Fluoroprotein Foam (FFFP), Alcohol-resistant Film-forming Fluoroprotein Foam (AR-FFFP), Others) •By Material Type (Class A (Solid Materials), Class B (Liquid & Gas Fires), Class C (Electrical Fires), Class D (Metal Fires), Class K (Kitchen Fires) ) •By End-Use (Oil & Gas, Chemicals & Petrochemicals, Aviation, Marine & Offshore, Warehouses & Storage Facilities, Residential & Commercial Buildings, Transportation (Road & Rail), Military & Defense, Manufacturing Facilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | National Foam, Angus Fire, Perimeter Solutions, Johnson Controls, Dafo Fomtec AB, SFFECO Global, Kerr Fire, Solberg, Ansul, DIC Corporation and other key players |