Benzene and its derivatives Market Report Scope & Overview:

Get More Information on Benzene its Derivatives Market - Request Sample Report

The Benzene and its Derivatives Market size was USD 34.2 billion in 2023 and is expected to reach USD 59.3 billion by 2032 and grow at a CAGR of 6.3% over the forecast period of 2024-2032.

The increasing demand for styrene and polystyrene is a key driver in the benzene and its derivatives market, driven by their extensive applications in packaging, construction, and automotive industries. An important benzene derivative is styrene, which is used to produce polystyrene, a widely used plastic for packing materials, insulating, disposable consumer products, or lightweight automotive parts. Polystyrene demand has also gained momentum, owing to the expansion of e-commerce and increased preference for durable and sustainable packaging solutions. In addition, improved construction technologies have maximized the application of styrene as an insulation material in energy-efficient buildings. For one, lightweight polystyrene parts help with fuel efficiencies in the automotive sector, which is all in line with industry-wide sustainability commitments. The diverse applications served in different industries and the strong growth in the emerging markets especially in the Asia-Pacific region assert the role of styrene in boosting the overall market for benzene derivatives.

In the United States, styrene facilities reported releasing 32 million pounds of styrene into the environment in 2022, highlighting environmental concerns associated with its production and use.

Increasing consumer goods requirement is one of the major factors driving the growth of benzene and its derivatives market. Products made from benzene like detergents, paints, coatings, and adhesives are vital constituents used in the manufacturing of domestic and industrial goods. The world is growing rapidly with both population and urbanization in emerging economies, like India and China which is giving a constant increase in the demand for daily consumer goods. The growing demand is also made more pronounced by measures like the Make in India initiative and the boost to manufacturing that the Chinese government is focusing on. The trend toward more sustainable and high-performing consumer products is also motivating the use of benzene-based chemicals to create more advanced solutions. The persistence of this demand highlights the significance of benzene derivatives in catering to the changing requirements of the worldwide consumer market.

In 2023, to meet the demands of the rapidly growing packaging and construction industries, Exxon Mobil Corporation announced plans to increase the manufacturing capacity of petrochemicals in the Asia-Pacific area, with a particular emphasis on styrene and polystyrene.

Benzene and its Derivatives Market Dynamics

Drivers

- Growing Demand from Downstream Industries in benzene and its derivative drives market growth.

Downstream industry demand is one of the important factors driving the market growth of benzene and its derivatives. As an intermediate chemical with wide applications in various downstream industries such as automotive, construction, packaging, and pharmaceuticals, benzene is one of the most common raw materials with multiple uses. For instance, benzene derivatives like styrene are an integral part of the automotive industry as they are used to manufacture lightweight, high-strength, and durable components which are essential to improve fuel efficiency and vehicle performance. Another benzene derivative is phenol, which the construction sector uses in making resins and adhesives that go into insulation materials, flooring and coatings. Moreover, Use of styrene-based products also form a major channel in the market, with polystyrene products dominating the area of food packaging, disposable cutlery, and containers, contributing to a substantial level of styrenic consumption in the packaging industry. The growth of these industries is also supported by growing consumer demands and technological advancements due to which benzene and its derivatives are increasingly needed, thereby fuel market growth during the forecast period. This trend is particularly prominent in developing countries, in which industrialization and urbanization are fastest in pace.

Restraint

- Fluctuations in crude oil prices hamper the benzene and its derivatives market growth.

Benzene is mainly obtained from petroleum during the refining process, the essential risk of crude oil price variations restraints the growth of the benzene and its derivatives market. Benzene, styrene, phenol, toluene, and styrene production costs are directly impacted by the volatility of crude oil prices. An increase in the price of crude oil increases the price of raw materials, which leads to an increase in the production costs of manufacturers, and we expect the prices of benzene derivatives to also increase. Price volatility can impact downstream industry profitability where these chemicals are used in feedstocks, particularly in price-sensitive segments including automotive, construction, and packaging.

Benzene and its Derivatives Market Segmentation

By Derivatives

Ethylbenzene accounted for the largest market share around 38% in 2023. This is because, with a growing focus on lightweight for fuel efficiency, the automotive industry's increasing preference for lightweight materials further escalates the demand for styrene-based products, coupled with styrene butadiene rubber (SBR) and other composites. Furthermore, with the expansion of the developing economy particularly the Asia-Pacific area the advancement and base improvement have been expanded inciting the development of ethylbenzene-based styrene.

By Application

Industrial chemicals held the largest market share around 38% in 2023. This is due to their use in several core industries such as automotive, construction, agriculture, and manufacturing. Benzene derivatives phenol, toluene, and cyclohexane are among the most widely used petrochemicals vital to the manufacture of many industrial chemicals necessary for plastics, synthetic fibers, rubber, adhesives, paints and coatings. For example, the automotive sector uses industrial chemicals to make strong yet lightweight components, and the construction industry incorporates benzene-based industrial chemicals into insulation materials, all kinds of coatings, and sealants. Industrial chemicals such as those made from benzene are also important for agriculture as they are used for fertilizers and pesticides. With their extensive application in most industries, their demand will always be there, therefore growing the market with the high pace of constant supply of these chemicals.

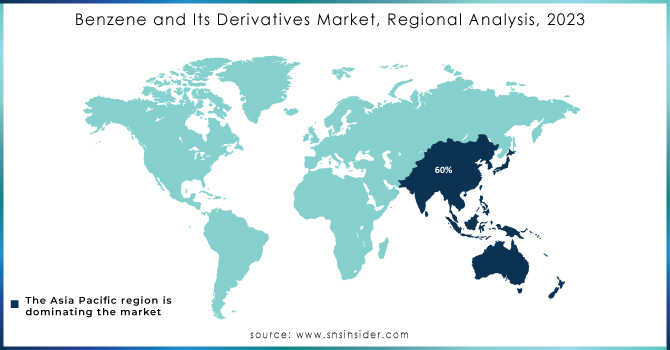

Benzene and its Derivatives Market Regional Analysis

Asia Pacific held the largest market share around 48% in 2023. This is growing demand from major end-use industries such as automotive, construction, packaging and electronics, in addition to rapid industrialization and urbanization. Asia Pacific is one of the largest production sites due to the high demand for benzene derivatives (including styrene, phenol, and toluene) in the production plants in China and India, and for other key benzene manufacturers in Japan and South Korea. Rapid growth in the automotive and construction industries coupled with rising infrastructure investments drives the growth of benzene-derived products which are used for the preparation of lightweight materials, coatings, and insulation. Furthermore, the expanding middle class in the Asia-Pacific region is increasing the demand for consumer goods and packaging, which has driven the demand for styrene and polystyrene. The presence of the largest consumer and producer of chemicals in the region China further provides an impetus to the market and forms a critical part of consideration for this report. Moreover, supportive government regulations endorsing industrial growth and the establishment of petrochemical plants in the region are another factor contributing to the sustainment of Asia Pacific in the global benzene derivatives market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

- BASF SE (Styrene, Toluene)

- China Petrochemical Corporation (Styrene, Benzene)

- China National Petroleum Corporation (Benzene, Cyclohexane)

- SABIC (Phenol, Styrene)

- Chevron Phillips Chemical Company LLC (Benzene, Toluene)

- LyondellBasell Industries (Polypropylene, Ethylene)

- Maruzen Petrochemical Co., Ltd. (Styrene, Ethylbenzene)

- Royal Dutch Shell Plc. (Benzene, Cyclohexane)

- Dow (Styrene, Polyethylene)

- Exxon Mobil Corporation (Toluene, Styrene)

- Ineos Group Ltd (Benzene, Ethylbenzene)

- Mitsubishi Chemical Corporation (Phenol, Toluene)

- Reliance Industries Limited (Styrene, Benzene)

- LG Chem Ltd. (Styrene, Ethylbenzene)

- Formosa Chemicals & Fibre Corporation (Styrene, Benzene)

- Huntsman Corporation (Phenol, Toluene)

- PVS Chemicals (Benzene, Toluene)

- BP plc (Benzene, Cyclohexane)

- Orbia Advance Corporation (Styrene, Phenol)

- PetroChina Company Limited (Toluene, Benzene)

Recent Development:

- In 2023, CNPC announced the completion of a new benzene production facility in Xinjiang, China, enhancing its capacity to supply downstream industries.

- In 2022, Chevron Phillips Chemical expanded its benzene production capacity in the United States to support the growing demand in the automotive and construction sectors.

- In 2023, LyondellBasell announced the development of a new plant in Europe to produce high-quality benzene derivatives for the packaging industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 34.2 Billion |

| Market Size by 2032 | US$ 59.3 Billion |

| CAGR | CAGR of 6.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Derivatives (Ethylbenzene, Cumene, Cyclohexane, Alkylbenzene, Others) • By Application (Industrial Chemical, Oil and Gas, Rubber and Plastics, Pharmaceutical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, China Petrochemical Corporation, China National Petroleum Corporation, SABIC, Chevron Phillips Chemical Company LLC, LyondellBasell Industries, Maruzen Petrochemical Co., Ltd., Royal Dutch Shell Plc., Dow, Exxon Mobil Corporation, Ineos Group Ltd, Mitsubishi Chemical Corporation, Reliance Industries Limited, LG Chem Ltd., Formosa Chemicals & Fibre Corporation, Huntsman Corporation, PVS Chemicals, BP plc, Orbia Advance Corporation, PetroChina Company Limited, and Others |

| Key Drivers | • Growing Demand from Downstream Industries in benzene and its derivative drives market growth. |

| Restraints | • Fluctuations in crude oil prices hamper the benzene and its derivatives market growth. |