Benzenoid Market Report Scope & Overview:

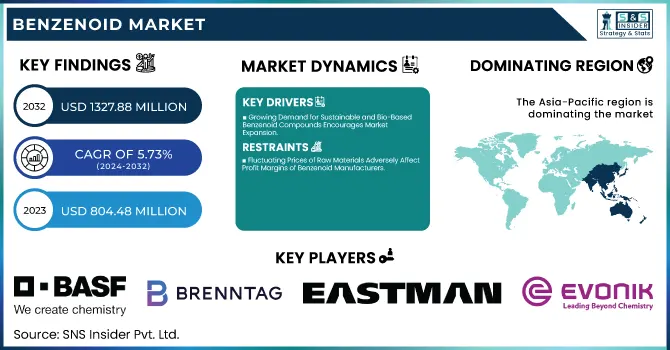

The Benzenoid Market Size was valued at USD 804.48 Million in 2023 and is expected to reach USD 1,327.88 Million by 2032, growing at a CAGR of 5.73% over the forecast period of 2024-2032.

To Get more information on Benzenoid Market - Request Free Sample Report

The Benzenoid Market is expanding rapidly, fueled by its crucial role in fragrances, flavors, and pharmaceuticals. Our report provides a detailed supply chain analysis, tracing raw materials to final applications. A thorough regulatory landscape assessment explores compliance challenges and evolving industry norms. With an in-depth raw material analysis, key feedstocks like benzyl chloride and toluene are evaluated for availability and pricing trends. The report also examines production capacity and utilization rates, highlighting manufacturing efficiencies across regions. Sustainability concerns are addressed through the environmental & sustainability impact, focusing on eco-friendly production methods. Additionally, contract manufacturing and outsourcing trends reveal cost-effective production strategies shaping the industry’s future. This comprehensive approach ensures deep insights into the benzenoid market’s growth trajectory.

Benzenoid Market Dynamics

Drivers

-

Growing Demand for Sustainable and Bio-Based Benzenoid Compounds Encourages Market Expansion

The benzenoid market is witnessing significant growth due to the rising demand for sustainable and bio-based ingredients. With increasing environmental awareness, consumers and manufacturers are shifting away from synthetic chemicals and opting for natural alternatives derived from essential oils, flowers, and plant extracts. Regulatory authorities are also emphasizing sustainability, enforcing guidelines that encourage the use of bio-based ingredients in cosmetics, personal care, and food industries. Many companies are investing in green chemistry and biotechnology-driven extraction techniques to develop eco-friendly benzenoid compounds with minimal environmental impact. Fermentation-based processes and enzymatic synthesis methods are gaining traction, enabling large-scale production of bio-benzoids with improved efficiency. Premium beauty and fragrance brands are particularly inclined towards bio-based formulations as consumer preferences continue shifting toward natural and organic products. The food and beverage sector is also adopting bio-benzoids to meet clean-label requirements. As sustainability becomes a core industry focus, bio-based benzenoid compounds are gaining a competitive edge, creating opportunities for market players to innovate and expand their eco-friendly product portfolios.

Restraints

-

Fluctuating Prices of Raw Materials Adversely Affect Profit Margins of Benzenoid Manufacturers

Raw material price fluctuations present a significant challenge for the benzenoid market, affecting production costs and profit margins. Key raw materials such as benzyl chloride, toluene, and cinnamyl alcohol are heavily dependent on crude oil supply and are influenced by geopolitical tensions, trade restrictions, and market volatility. These factors lead to inconsistent pricing, making cost forecasting difficult for manufacturers. Additionally, the rising demand for bio-based benzenoid compounds has increased competition for natural raw materials, further driving up procurement costs. Supply chain disruptions caused by global trade restrictions, environmental concerns, and production limitations also contribute to pricing instability. Many manufacturers are forced to adjust pricing strategies or seek alternative raw material sources, impacting profit margins and product quality. Companies are increasingly focusing on sustainable sourcing and vertical integration strategies to mitigate raw material risks. However, continuous fluctuations in raw material pricing create uncertainties, limiting the ability of industry players to expand operations, invest in new technologies, and maintain a competitive edge in the global benzenoid market.

Opportunities

-

Rising Demand for Personal Care and Luxury Fragrances Creates Growth Prospects for Benzenoid Manufacturers

The increasing consumer preference for high-end personal care and luxury fragrance products presents significant opportunities for benzenoid manufacturers. Premium perfumes, skincare, and personal care products formulated with high-quality aromatic compounds are gaining traction, particularly in emerging markets where disposable incomes are rising. The growth of the beauty and personal care industry is driven by an increasing emphasis on self-care, wellness, and premium lifestyle choices. Market leaders are investing in innovative scent compositions using benzenoid compounds to cater to evolving consumer preferences for unique and long-lasting fragrances. Additionally, the expansion of e-commerce and digital marketing has increased the accessibility of luxury brands, further driving demand for high-quality aroma chemicals. Personalized and customized fragrance solutions are also gaining popularity, encouraging companies to develop novel benzenoid-based formulations. With the ongoing trend of clean-label and sustainable beauty products, the demand for bio-based and naturally derived benzenoid compounds is expected to surge, opening up new revenue streams for manufacturers looking to capitalize on the premium fragrance and personal care market segment.

Challenge

-

Complex Supply Chain and Trade Restrictions Create Distribution Challenges for Benzenoid Market Players

The benzenoid market relies on a complex global supply chain, making it susceptible to trade restrictions, logistical disruptions, and geopolitical uncertainties. Variations in regulatory policies across different regions impact the seamless distribution of benzenoid compounds, leading to supply chain inefficiencies. Additionally, raw material shortages due to trade restrictions, environmental concerns, or production limitations can cause supply disruptions and increased costs. Companies must implement robust supply chain management strategies to mitigate risks and ensure steady product availability. Investing in local production facilities, diversifying supplier networks, and adopting digital supply chain technologies can help industry players navigate these distribution challenges effectively.

Benzenoid Market Segmental Analysis

By Source

Natural benzenoid dominated the market in 2023, accounting for 58.2% of the total market share. The demand for natural benzenoid has surged due to increasing consumer preference for organic and bio-based ingredients in perfumes, cosmetics, and food products. Regulatory organizations such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have imposed stringent guidelines on synthetic chemicals, encouraging the use of natural benzenoid. Additionally, the International Fragrance Association (IFRA) promotes the adoption of naturally derived aromatic compounds in the fragrance industry. Major fragrance companies, including Givaudan and Firmenich, are investing heavily in sustainable sourcing of benzenoid from essential oils and botanical extracts to align with green initiatives. The growing demand for natural flavors in the food and beverage industry is another key factor supporting this segment’s dominance. Governments worldwide have also introduced initiatives supporting sustainable farming of raw materials like cloves, cinnamon, and vanilla, further enhancing the availability of natural benzenoid. As a result, the segment continues to witness expansion, driven by regulatory approvals, sustainability trends, and shifting consumer preferences toward natural and safe products.

By Product Type

Benzyl benzoate dominated the benzenoid market in 2023 with a 24.5% market share. This dominance is attributed to its diverse applications in pharmaceuticals, cosmetics, and food products. The compound is a widely used fixative in perfumes, enhancing the longevity of fragrances, which drives its demand in the personal care industry. Additionally, the World Health Organization (WHO) has listed benzyl benzoate as a crucial treatment for scabies and lice, increasing its importance in pharmaceutical formulations. The food and beverage industry also uses benzyl benzoate as a flavoring agent, aligning with the growing trend of clean-label products. Companies such as BASF and Emerald Kalama Chemical have ramped up production capacities to cater to the rising demand. Furthermore, advancements in chemical synthesis techniques have enabled manufacturers to produce high-purity benzyl benzoate for specialized applications. The cosmetics and skincare industry is also witnessing a surge in the adoption of benzyl benzoate due to its antimicrobial and preservative properties. With increasing regulatory approvals and its widespread industrial applications, benzyl benzoate is expected to maintain its leadership in the benzenoid market.

By Application

Flavors & fragrances dominated the benzenoid market in 2023, holding a 42.7% market share. The rising consumer preference for premium perfumes, air fresheners, and scented personal care products has significantly fueled this segment's growth. Regulatory organizations such as the International Fragrance Association (IFRA) have set safety standards to encourage the responsible use of benzenoid compounds in fragrance applications. Additionally, the food and beverage industry has increased its use of benzenoid-based flavors, such as vanillin and eugenol, in confectionery, dairy, and beverage products. Companies like Symrise and International Flavors & Fragrances (IFF) are continuously investing in research to develop innovative fragrance compositions using benzenoid compounds. The market growth is further supported by the rise in disposable income, changing consumer lifestyles, and the expansion of the luxury perfume segment. The increasing demand for natural and sustainable ingredients in fragrances has prompted manufacturers to explore bio-based benzenoid production. Moreover, collaborations between fragrance houses and biotechnology firms are driving innovations in synthetic biology, allowing for the efficient production of benzenoid from renewable sources.

Benzenoid Market Regional Outlook

Asia Pacific dominated the benzenoid market in 2023, holding a market share of 38.5%, driven by high production and consumption in key industries such as fragrances, cosmetics, and food & beverages. Countries like China, India, and Japan played a significant role in this dominance due to their well-established chemical manufacturing sector and increasing demand for personal care products. China led the market with its massive production capabilities and strong supply chain, supported by companies like Eternis Fine Chemicals and Jayshree Aromatics, which have expanded their production of benzenoid compounds. The China National Chemical Corporation (ChemChina) has also strengthened its footprint in aromatic chemicals, boosting regional growth. India followed closely due to its rising fragrance and flavor industry, with firms like Givaudan and Firmenich increasing investments in local production. Additionally, India’s thriving pharmaceutical sector has increased the demand for benzenoid derivatives such as benzyl benzoate. Japan has been a major consumer of high-end fragrances and flavors, particularly in the premium cosmetics and food industry. Rising disposable incomes and urbanization in emerging economies further fueled the regional market expansion. Government policies promoting sustainable sourcing and bio-based chemicals also played a crucial role in strengthening the Asia Pacific benzenoid market.

Moreover, North America emerged as the fastest-growing region in the benzenoid market during the forecast period, with a significant growth rate. The dominance is primarily due to rising demand in the personal care, food & beverage, and pharmaceutical industries. The United States leads the region’s growth, accounting for the highest benzenoid consumption due to its booming luxury fragrance and organic food industries. According to the Fragrance Creators Association (FCA), the U.S. fragrance industry contributes over $40 billion to the economy, driving demand for benzenoid compounds in perfumes and scented products. Additionally, the U.S. Food and Drug Administration (FDA) has increasingly approved benzenoid-based compounds such as vanillin and benzyl benzoate for pharmaceutical and food applications. Canada is witnessing strong growth in the clean-label food and beverage sector, with major players like International Flavors & Fragrances (IFF) expanding their presence. Mexico is emerging as a key contributor due to its growing cosmetics market, supported by increasing urbanization and consumer preference for luxury products. The region’s shift towards sustainable and bio-based benzenoid alternatives, along with stringent environmental regulations, is further accelerating market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Benzyl Alcohol, Benzaldehyde, Benzyl Acetate)

-

Brenntag SE (Vanillin, Benzyl Benzoate, Cinnamyl Alcohol)

-

Eastman Chemical Company (Benzyl Benzoate, Benzyl Alcohol, Benzaldehyde)

-

Emerald Kalama Chemical (Benzyl Benzoate, Benzyl Salicylate, Benzaldehyde)

-

Eternis Fine Chemicals Ltd. (Benzyl Alcohol, Cinnamyl Alcohol, Benzyl Acetate)

-

Evonik Industries AG (Benzyl Chloride, Benzyl Alcohol, Vanillin)

-

Firmenich SA (Vanillin, Cinnamyl Alcohol, Ethyl Vanillin)

-

Givaudan (Vanillin, Ethyl Vanillin, Benzyl Alcohol)

-

Haarmann & Reimer (Vanillin, Benzyl Salicylate, Cinnamyl Alcohol)

-

International Flavors & Fragrances, Inc. (IFF) (Vanillin, Benzyl Alcohol, Ethyl Vanillin)

-

Jayshree Aromatics Pvt. Ltd. (Benzyl Acetate, Cinnamyl Alcohol, Benzaldehyde)

-

Lanxess AG (Benzyl Chloride, Benzyl Alcohol, Benzyl Benzoate)

-

Mane SA (Vanillin, Cinnamyl Acetate, Benzyl Acetate)

-

Sensient Technologies Corporation (Vanillin, Ethyl Vanillin, Benzyl Alcohol)

-

Solvay S.A. (Benzyl Alcohol, Benzyl Benzoate, Benzaldehyde)

-

Symrise AG (Vanillin, Cinnamyl Alcohol, Ethyl Vanillin)

-

Takasago International Corporation (Ethyl Vanillin, Benzyl Salicylate, Vanillin)

-

Tennants Fine Chemicals Ltd. (Benzyl Alcohol, Benzaldehyde, Benzyl Acetate)

-

Treatt PLC (Benzyl Acetate, Benzyl Alcohol, Vanillin)

-

Valtris Specialty Chemicals (Benzyl Benzoate, Benzyl Chloride, Benzyl Alcohol)

Recent Developments

-

June 2024: Encina and BASF partnered to supply chemically recycled circular benzene from end-of-life plastics. BASF planned to use this in its Ccycled product portfolio, replacing fossil raw materials via a certified mass balance approach. Encina’s catalytic technology ensured high-yield circular feedstocks for plastic manufacturing, reinforcing both companies’ commitment to sustainability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 804.48 Million |

| Market Size by 2032 | USD 1,327.88 Million |

| CAGR | CAGR of 5.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Natural, Synthetic) •By Product Type (Benzyl Benzoate, Benzyl Alcohol, Benzyl Acetate, Benzaldehyde, Cinnamyl and Derivatives, Benzyl Salicylate, Vanillin & Eugenol, Others) •By Application (Flavors & Fragrance, Food & Beverage Products, Pharmaceuticals, Polymers & Plastics Additives, Paints & Coatings, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Givaudan, Firmenich SA, International Flavors & Fragrances, Inc. (IFF), Symrise AG, Sensient Technologies Corporation, Takasago International Corporation, Emerald Kalama Chemical, Eternis Fine Chemicals Ltd., Jayshree Aromatics Pvt. Ltd. and other key players |