Bio-Based Construction Polymer Market Report Scope & Overview:

Get more information on Bio-Based Construction Polymer Market - Request Free Sample Report

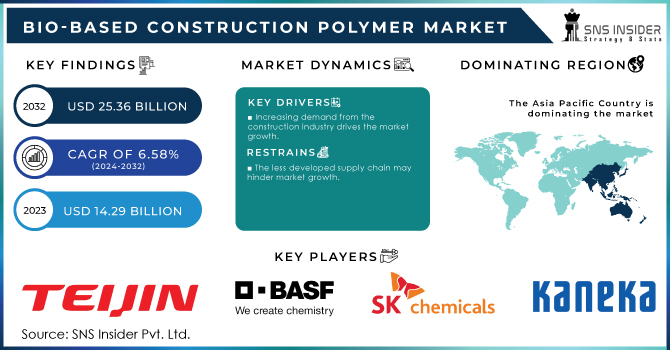

The Bio-Based Construction Polymer Market Size was valued at USD 14.29 billion in 2023 and is expected to reach USD 25.36 billion by 2032 and grow at a CAGR of 6.58% over the forecast period 2024-2032.

The rising awareness of the usage of petrochemical goods combined with the use of renewable resources is anticipated to drive the bio-based construction polymer market. One of the main causes of greenhouse gas emissions in many industrial operating facilities is the use of fossil fuels. Growing industry pressure to switch to bio-based products is the result of growing concerns about the carbon dioxide footprint of large-scale production facilities.

Moreover, the expansion of the bio-based construction polymers market is anticipated to be positively impacted by the advantageous regulatory environment in a number of nations and initiatives by regional governments in support of biopolymers. Government policies that support the use of bio-based raw materials for polymer manufacture include the lead market initiative UK and Bio Preferred U.S. To produce these polymers, large manufacturers are reorienting their attention to the development of sustainable technologies and are joining forces with multiple independent bio-based technology companies. The U.S. gross domestic product the value of all goods and services produced in the country USD 26,500 billion at a seasonally adjusted annual rate in the 1st quarter of 2023 and construction contributed USD 1,100 billion almost 4.0%. increase construction sector increase the demand of bio-based construction polymer market.

In August 2023, SCGC and Braskem partnered for bio-ethylene production for Green Polymer. It is one of the essential strategies of SCGC to expand its green business. It satisfies the demand for environmentally friendly plastic which has a robust growth rate, especially in Europe

Moreover, the construction sector is using more bio-based polymers as a result of expanded R&D efforts to create sustainable, environmentally friendly goods. High manufacturing costs and underdeveloped global supply chains, may hinder to impede the expansion.

Market Dynamics

Drivers

-

Increasing demand from the construction industry drives the market growth.

The construction industry is a expanding giant, constantly demanding more materials to keep pace with urban expansion and ever-growing infrastructure needs. Traditionally, these materials have been heavily reliant on fossil fuel derivatives. Market growth for bio-based construction polymers is anticipated as a result of growing awareness of the usage of petrochemical goods and the growing use of renewable materials.

Moreover, fuelled by urbanization and booming infrastructure development, the construction industry's unwavering growth is a major driver for the bio-based construction polymer market. As megacities sprawl and governments prioritize infrastructure projects, the demand for construction materials skyrockets. This ever-expanding market presents a golden opportunity for bio-based polymer manufacturers, as the industry increasingly embraces sustainable alternatives to traditional materials.

Growing in prominence are bio-based building polymers made from sustainable materials such as cellulose and plant-based starches. And constructing buildings with eco-friendly components like insulation panels, doors, and even structural beams all made from bio-based polymers. These ingenious materials not only reduce the construction industry's dependence on fossil fuels but can also match the performance and durability of traditional materials. In some cases, bio-based polymers can even be lighter and more manageable to work with, translating to faster construction times and potentially lower labor costs. This winning combination of environmental responsibility and practical advantages is driving a surge in demand from the construction industry, propelling the bio-based construction polymers market to new heights.

-

Rising initiatives by government agencies toward the development of green buildings are driving market growth.

Governmental organizations push for eco-conscious materials like bio-based polymers to provide tax percentages rebates or sliding grants toward those builders and developers who opt to go down the polymer path. The United States Department of Agriculture Program, places biobased products at the top of the federal shopping list ensuring a steady demand for bio-based polymers and coaxing manufacturers to pump resources into their growth. Likewise, the European Union Circular Economy Action Plan revolves around promoting sustainable circles while minimizing waste and maximizing resources. China has a Green Building Material Labeling Program. The program is managed by the Ministry of Ecology and Environment in China and gives out labels to those construction materials that satisfy certain environmental standards. When buildings use these green materials with a label, they can be eligible for tax deductions and other rewards. This program promotes the use of bio-based construction polymers an initiative towards encouraging the development and adoption of such materials as green material labels.

Restraint

-

The less developed supply chain may hinder market growth

The constraints in the supply chain of bio-based construction polymers are going to limit their widespread use. Yet as technology evolves and the demand grows, efforts are being made to overcome these challenges. Establishment of specialized production centers, expansion of distributor network, and development of transportation protocols: these are all measures that contribute to improving the situation. In overcoming these logistical challenges, bio-based construction polymers will be able to actualize their full potential and ultimately transform the construction industry into an environmentally sustainable one.

Opportunities

-

Development of new technologies in Bio-based polymers and plastics.

-

Increasing material versatility in applications for bio-based construction polymers is constantly expanding.

Market Segmentation

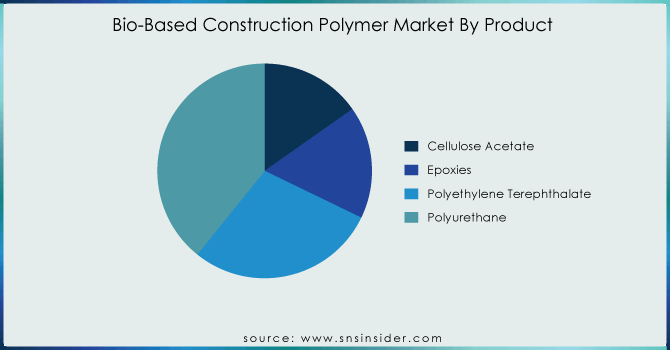

By Product

In 2023, polyurethane dominated the global demand and held a market share of more than 39.19% in the bio-based construction polymer industry. The market has a lot of potential due to the use of bio-based polyurethanes as insulation in the building and construction sector, especially in the United States and Europe.

In addition, the U.S. Environmental Protection Agency has commended improvements in sustainability made by polyurethanes as a hydrocarbon-based source of raw materials for polymers. A new report published by the EPA, Green Building Standards and Certification Systems for Low-Emitting Materials: Bio-based Polyurethane Products, highlights substantial environmental benefits from the use of bio-based polyurethanes products like those being developed through Cargill's Integrity joint venture.

PLA is anticipated to increase at the quickest rate over the projected period because of its growing popularity and many benefits over alternative goods. In the building business, it is a bio-derived monomer that is utilized as a foam, binder pore-forming agent, suspending agent, and coating adhesive.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

Based on the application pipe segment held the largest market share of around 38% in 2023. The building trade usage of plastics for everything from keeping the heat to joining pipes. Plastic mixtures are catching on big time for pipes and fittings. They're cheap to make, and don't rust, and won't weigh down. Builders often pick eco-friendly polymers for window frames, door parts, drains, gutters, floors, glass, wall panels, insulation, glues, cement, and roofs. These green options packs increase the demand in the market.

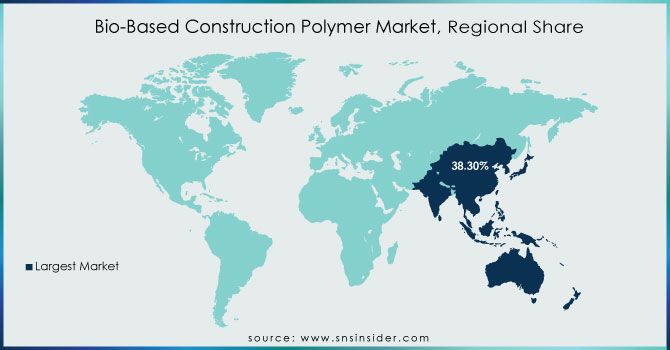

Regional Analysis

Asia Pacific dominated the bio-based construction polymer market in 2023 with the highest marker share around 38.30%. Market expansion will be aided by the start of new building projects, quick economic expansion, and the introduction of new goods. Paints and other materials to make building work easier are in high demand due to ongoing infrastructure improvement activities, especially in China, Japan, India, and Indonesia. The need for bio-based products will grow in the region due to the pleasant climate and the increase in public construction projects, especially in developing nations.

The need for bio-based polymers in the construction industry will rise in Europe as a result of government laws about carbon emissions during petroleum-based polymer manufacture. The bio-based construction polymers market will expand due to an increase in building and construction activity in North America. The growing desire to use bio-based polymers is expected to fuel the expansion of the bio-based building polymers market in Latin America, the Middle East, and Africa.

Key Players

Teijin Plastics, BASF SE, SK Chemicals, Kaneka Corporation, PolyOne, Covestro, Bio-On, Toyobo Co., Ltd. Mitsubishi Gas Chemical Company, Nature Works LLC, Evonik Industries, and Others.

Recent Development:

-

In August 2023, a value chain was created by Neste, LyondellBasell, Biofibre, and Naftex to integrate natural fiber with bio-based polymers to create building components. This combination of natural fiber and polymers with detectable biobased content in building components contributes to the creation of carbon storage to fight climate change.

-

In March 2023, BASF started producing Sovermol, Its first bio-based polyol, in India. This product meets the rapidly expanding need for environmentally friendly goods in Asia Pacific for use in New Energy Vehicles and protective industrial coatings.

-

In March 2023, Kolon Industries agreed to a joint development agreement with Stora Enso to develop and industrialize bio-based polyesters and applications. This joint venture helped the company to increase its expansion in the market.

| Report Attributes | Details |

| Market Size in 2023 | US$ 14.29 Billion |

| Market Size by 2032 | US$ 25.36 Billion |

| CAGR | CAGR of 6.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Chitosan Market, Epoxies, Polyethylene Terephthalate, Polyurethane) • By Application (Insulation, Pipe, Profile, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alterra Energy, Neste, Plastic2oil, BRADAM Group, LLC, Agilyx Inc., Covestro AG, TEIJIN LIMITED, Mitsubishi Chemical Corp, SABIC, Palram Industries Ltd., Avient Corporation, Teysa Technology Limited, Roquette, Trinseo, Asahi Kasei Corporation, and others. |

| Key Drivers | • Rising initiatives by government agencies toward the development of green buildings are driving market growth. |

| RESTRAINTS | •The less developed supply chain may hinder market growth |