Corrosion Under Insulation (CUI) & Spray-On Insulation (SOI) Coatings Market Size and Overview:

Get More Information on Corrosion Under Insulation & Spray-on Insulation Coatings Market - Request Sample Report

The Corrosion Under Insulation (CUI) & Spray-On Insulation (SOI) Coatings Market was valued at USD 1.99 billion in 2023 and is expected to reach USD 3.09 billion by 2032, growing at a CAGR of 5.03 % over the forecast period 2024-2032.

Growing demand for protective coatings for Oil & gas, Petrochemicals, Marine, and Energy is the key factor for the growth of the Corrosion Under Insulation and Spray-On Insulation coating market. Such fields are dependent on upkeeping and infrastructure in an extreme environment where a corrosion issue can disrupt operations or create a safety hazard. To prevent the corrosion caused by moisture and temperature changes when the insulation is applied to the surface of the industrial asset, the CUI and SOI coatings provide an economical and efficient solution to enhance the life of the industrial assets. Increasing industrialized actions, demand for retaining old infrastructures, and adoption of corrosion-free solutions as well as products are the significant factors that are expected to drive the growth of the market.

-

In 2023, global investments in oil and gas reached about USD 700 billion, with the sector representing 45% of global CUI coatings demand. Investment in renewable energy grew by 15% to USD 500 billion worldwide. Furthermore, U.S. construction spending increased by 8.2% in the annual period from 2022 to 2023, also bolstering demand for corrosion protection services

The Increased Focus On Sustainable And Energy-Efficient Products Is Increasing The Demand For Advanced Coatings

Advanced coatings are gaining popularity due to their high thermal performance, ease of application, and the fact, that they cover even complex surfaces in a single spray pass. These coatings improve the energy efficiency of pipelines and equipment, making them a sustainable solution as industries focus on being environmentally sensitive and reducing energy consumption. Additionally, the introduction of new coating technologies which comprise durable and eco-friendly materials are anticipated to further accelerate the growth of the market in response to the emerging demands of several industrial applications. The global market in energy-saving materials for buildings, including smart coatings, is projected to be 10- 15% p.a. growth.

-

In 2023, U.S. construction market expansion was represented by 30% of energy-efficient materials. Moreover, the adoption of eco-friendly coatings in certain industries such as oil & gas and petrochemicals has increased by 20-25% at a slower pace, especially in those areas where stringent environmental regulations are in force.

Corrosion Under Insulation (CUI) & Spray-On Insulation (SOI) Coatings Market Dynamics

KEY DRIVERS:

Industrial Safety Regulations and Growing Risks Fuel Increased Demand for Corrosion Protection Coatings

With growing risks of equipment failure from corrosion and industries that are subject to rigorous safety standards such as oil and gas, petrochemicals, and energy the need for protective solutions is becoming vital. The implications of CUI can reach disastrous incidents, such as leaks, burstings, or equipment failures, that can bring about environmental damage, economic loss, and a risk to personnel. As a result, companies are spending more on high-performance coatings to mitigate such incidents to ensure the safety of products. The increasing need for protective coatings is also backed by strict government regulations that require the maintenance of vital infrastructure at regular intervals and prevent corrosion and other such factors, which, in turn, are expected to be some significant factors steering the demand for CUI and SOI coatings.

-

Corrosion has cost the U.S. pipeline industry USD 11 billion in last two decades, leading 60% of oil and gas firms to boost their corrosion protection budgets. In the oil and gas industry, the average price increase globally for corrosion control coatings has been 20-25%, while, following OSHA regulations for process safety management, industries spend a considerable sum each year on maintenance and corrosion prevention.

Energy Sector Growth Drives Demand for Durable Coatings in Harsh Environments and Infrastructure Protection

The growth of energy at a wide spectrum, with plenty of investments in renewable energy infrastructure growing alongside the historically strong demand for oil and gas. The energy sector frequently works in harsh and remote locations, where equipment endures extreme weather, high humidity, and wild temperature swings that accelerate corrosion. With the increase in global energy consumption due to renewable sources, including but not limited to wind, solar, and geothermal, a parallel demand for resilient, durable coatings that will survive these aggressive environments is driving industry innovation. The ease of application and flexibility offered by spray-on insulation coatings take them to their best use in such applications, allowing maximum protection with minimal consumption of resources while achieving the sustainable development goals of the industry. Moreover, this burgeoning energy spectrum is anticipated to serve as a major growth enabler for the overall market owing to a rising inclination towards minimizing maintenance costs and improving infrastructure longevity.

-

Global investments in renewable energy exceeds fossil fuel investments for the first time, surpassing USD 1.7 trillion in 2023. Solar and wind are projected to cover around 50% of the U.S. electricity mix by 2050. Hence, the energy sector is spending more on corrosion resistant coatings which are used to safeguard infrastructure against harsh environments, about 20-25%.

RESTRAIN:

-

Challenges in Adopting Corrosion Protection Coatings in Developing Industries and Technical Limitations

Limited awareness and adoption of the technology in a few of the industries, is a primary restraint in Global Corrosion Under Insulation (CUI) and Spray-On Insulation (SOI) Coatings Market. Although the oil and gas sector is using these coatings to a greater extent, all the sectors especially, in the developing area are not aware of the advantages this technology provides to the sectors in terms of corrosion protection and energy efficiency. The most common causes of CUI and SOI are still not well understood, and conservative maintenance practices can limit their widespread implementation. Another concern is the technical limitations of some of the selections. SOI coatings provide good insulation and corrosion protection, but may not be optimal for all applications, especially in high-temperature or complicated geometries. Some coatings may also be less durable or effective in shifting environmental conditions, requiring ongoing monitoring and maintenance to maintain their benefits.

Corrosion Under Insulation (CUI) & Spray-On Insulation (SOI) Coatings Market Segments

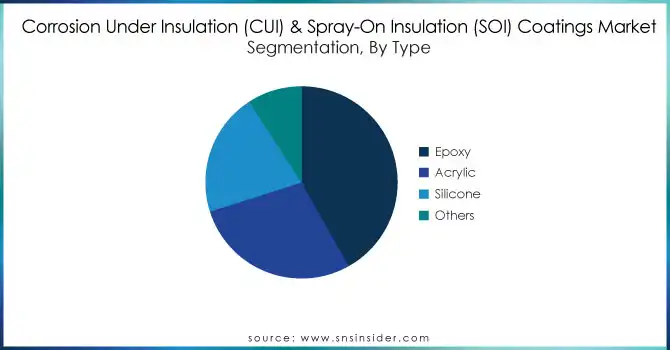

BY TYPE

Epoxy had a significant market share of 41.8% in 2023 owing to the excellent corrosion protection and durability epoxy coatings provide for long-lasting protection in aggressive industrial conditions. An excellent adhesion, and chemical and mechanical resistance, epoxy coatings are very effective in reducing corrosion under insulation (CUI), and are designed for this type of protection. The above-mentioned properties are the key reasons for epoxy coatings to be made use of in the oil & gas, petrochemicals, and energy industries, as they require a high degree of protection against corrosion. They dominate the market owing to their ability to handle range temperatures and harsh chemical exposures thus are the most desired solution in several industrial applications in 2023.

Silicone coatings are expected to grow with the fastest CAGR of all different types, 2024-2032, thanks to several unique properties, but particularly exceptional thermal stability and flexibility. Silicone withstands severe and rapid temperature variations better than most other coatings, making silicone coatings suitable for applications involving significant heat where other coatings would fail. Moreover, silicone is also highly impervious to water and is stable over time and when exposed to changing humidity levels. Silicone coatings provide the quality of non-melting and are high-temperature resistant. As more applications focus on energy, energy efficiency, and shortening maintenance downtime, the silicone coatings market will gain demand, particularly from the energy and power sector industries. These coatings also come with easier spray-on application methods, leading to increased adoption and faster growth projection for the forecast period.

BY END USE

Oil & gas and petrochemicals were the largest end-use industries in terms of volume, accounting for 46.6% market share in 2023, as these industries heavily rely on corrosion management solutions, especially in environments involving high temperatures, moisture, and chemicals. Pipelines, offshore rigs, refineries, and other critical infrastructure within these industries must have strong corrosion protection to prevent premature failure and keep the operation safe and sustainable. The manufacturing industry provides the largest segment in the CUI and SOI coatings market along with the supply-side coating demand as there is a high demand for corrosion-resistant coatings in these sectors to reduce downtime, lower maintenance costs, and prevent environmental hazards.

The energy & power segment will show the fastest CAGR throughout the forecast period owing to the surging demand for energy, particularly from renewable energy sources, as well as the need for maintenance and protection of infrastructure even in harsh environments. With nations hoping to move towards cleaner energy, attention is turning to power plants, wind farms, and solar plant upgrades and maintenance. CUI and SOI coatings are needed for insulative and corrosion protection of energy transmission and power generation equipment, particularly in extreme weather conditions therefore, the rising usage particularly in the above-mentioned sectors is expected to provide growth opportunities to the market in forthcoming years.

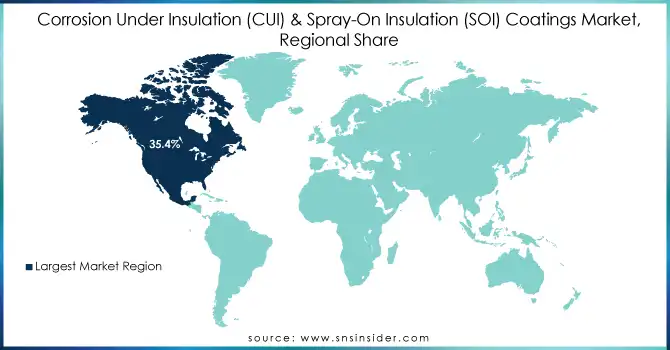

Corrosion Under Insulation (CUI) & Spray-On Insulation (SOI) Coatings Market Regional Analysis

North America held a 35.4% Market Share in 2023. CUI and SOI coatings are widely used to protect pipelines and platforms in offshore oil rigs, in particular, the Gulf of Mexico. In addition, power plants throughout the United States, such as Duke Energy and Pacific Gas and Electric, have used these coatings to reduce wear and tear within their infrastructure when operating in high-humidity and high-temperature environments. This broad-based penetration across industries drives the number one, North American market share.

Asia Pacific is projected to grow with the fastest CAGR over 2024-2032 owing to rapid industrialization, massive infrastructure projects, and enhanced energy demand. As the world's largest energy consumer, China has been spending heavily on renewable energy developments, such as wind and solar power plants, which also use sophisticated insulation and corrosion protection coatings. The large inland and offshore oil and gas operations of companies like China National Petroleum Corporation and Sinopec rely heavily on CUI and SOI coatings for pipeline, offshore platforms, and refinery protection. India too has a significant share across the globe and the focus of large companies like Reliance Industries is focused on enhancing the durability of their petrochemical plants using advanced coatings technology. With immense industrial growth and the continued development of sustainable energy.

Key players

Some of the major players in the Corrosion Under Insulation (CUI) & Spray-On Insulation (SOI) Coatings Market are:

-

AkzoNobel N.V. (Interpon Powder Coatings, Dulux Trade)

-

PPG Industries Inc. (Corroless, SIGMAGLIDE)

-

Jotun A/S (Jotun Epoxy, Jotun Alu-Zinc)

-

The Sherwin-Williams Company (Sher-Loxane, Macropoxy)

-

Hempel A/S (Hempadur, Hemplex)

-

Kansai Paint Co., Ltd. (Alumite, Kansaicoat)

-

Nippon Paint Co., Ltd. (Nippon Paint Industrial Coatings, Nippon Coatings)

-

RPM International Inc. (Carboline, Tnemec)

-

Tnemec Company Inc. (Tnemec 69, Series 66)

-

SPI Performance Coatings (Rust Shield, FiberShield)

-

Chugoku Marine Paints Ltd. (Resist T7, CMPT-CUI)

-

BASF SE (MasterSeal, Resistex)

-

International Paints Ltd. (Intershield, Interzone)

-

Axalta Coating Systems Ltd. (Alesta, Aquamix)

-

Becker Group (Becker Marine Coatings, Becker Industrial Coatings)

-

Sika AG (Sikagard, SikaCor)

-

Valvoline Inc. (Valvoline Heavy Duty, Valvoline Oil & Gas)

-

DuPont de Nemours, Inc. (Corrosion Resistance Solutions, Teflon Coatings)

-

AkzoNobel Industrial Coatings (Corlar, Ceram-A-Star)

-

Henkel AG & Co. KGaA (Loctite, Teroson)

Some of the Raw Material Suppliers for Corrosion Under Insulation (CUI) & Spray-On Insulation (SOI) Coatings companies:

-

Dow Chemical Company

-

BASF SE

-

Eastman Chemical Company

-

DuPont

-

Covestro AG

-

Huntsman Corporation

-

Arkema S.A.

-

Wacker Chemie AG

-

Solvay S.A.

-

Royal DSM

RECENT TRENDS

-

In May 2024, AkzoNobel's Como site secured the prestigious IATF 16949 certification. This certification signifies that the facility meets the most rigorous quality management standards specifically designed for the automotive industry.

-

In May 2024, Sherwin-Williams Packaging Coatings is revving up its production of BPA-free can coatings. After expanding facilities in Deeside, UK, and Tournus, France, they've begun churning out valPure V70. This move addresses both the rising demand for NBPA coatings in Europe and strengthens partnerships with customers across the region. The new plants will supply valPure V70 to Europe, the Middle East, Africa, and India.

-

In February 2024, Kansai Helios, a European subsidiary of Kansai Paint Co., Ltd., finalized its acquisition of Weilburger Coatings. Weilburger Coatings, formerly the industrial coatings business of GREBE Holding in Germany, encompasses all of WEILBURGER Coatings GmbH (Germany) and WEILBURGER Asia Limited (Hong Kong).

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.99 Billion |

| Market Size by 2032 | USD 3.09 Billion |

| CAGR | CAGR of 5.03% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Epoxy, Acrylic, Silicone, Others) • By End Use (Marine, Oil & gas and petrochemical, Energy & Power, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AkzoNobel N.V., PPG Industries Inc., Jotun A/S, The Sherwin-Williams Company, Hempel A/S, Kansai Paint Co., Ltd., Nippon Paint Co., Ltd., RPM International Inc., Tnemec Company Inc., SPI Performance Coatings, Chugoku Marine Paints Ltd., BASF SE, International Paints Ltd., Axalta Coating Systems Ltd., Becker Group, Sika AG, Valvoline Inc., DuPont de Nemours, Inc., AkzoNobel Industrial Coatings, Henkel AG & Co. KGaA. |

| Key Drivers | • Industrial Safety Regulations and Growing Risks Fuel Increased Demand for Corrosion Protection Coatings • Energy Sector Growth Drives Demand for Durable Coatings in Harsh Environments and Infrastructure Protection |

| Restraints | • Challenges in Adopting Corrosion Protection Coatings in Developing Industries and Technical Limitations |