Artificial Teeth Market Report Insights:

To get more information on Artificial Teeth Marke - Request Free Sample Report

The Artificial Teeth Market Size was valued at USD 1.87 billion in 2023 and is expected to reach USD 3.83 billion by 2032, growing at a CAGR of 8.32% from 2024-2032.

The artificial teeth market is experiencing a notable growth, primarily because of the growing number of dental issues, the increasing elderly population, and the rising interest in cosmetic dental treatments. Improvement in materials and technologies like the integration of regenerative medicine and biomaterials enhance the functionality and aesthetics of artificial teeth. Incorporation of stem cells and growth factors into dental implants will improve healing speed and reduce complications. Moreover, minimally invasive procedures, such as laser therapy and robotic assistance for surgical intervention, are steadily increasing their accuracy and decreasing recovery periods.

The World Health Organization, recently reported that the global prevalence of oral diseases is rising, and around 3.5 billion people suffer from oral health problems. This has created an emerging demand for superior dental services, like CAD/CAM dentures, offering customization as well as better patient outcomes. Emerging markets in regions such as Asia-Pacific and Latin America are becoming key growth areas, as increasing dental health awareness and an expanding middle-class drive demand for affordable solutions.

Companies are concentrating more on innovation and strategic partnerships to meet the changing needs. Some of the recent innovations are the introduction of new premium implant systems and partnerships for integrating state-of-the-art technologies such as MRI for dental use.

Still, costs remain a limiting factor in dental implants and prosthetics, particularly in poor economies. Despite the challenges, the artificial teeth market looks forward to sustained growth. Improvements in manufacturing processes, accessibility, and affordability create new consumers. Research into biomaterials and digital dentistry continues to transform the market. These technologies, coupled with a growing interest in aesthetic and functional restorations, will shape the future of global artificial teeth solutions.

Artificial Teeth Market Dynamics

Drivers

-

Technological advancements driving innovation in the artificial teeth market.

Advanced technologies, such as 3D printing and CAD/CAM systems, revolutionize the artificial teeth market, which can now produce highly accurate, customized dental solutions for specific patient needs. The production process has become more efficient and cost-effective while yielding superior aesthetic and functional results. Additionally, with the infusion of regenerative medicine and biomaterials, such as stem cells and growth factors into dental implants, healing time is shortened, and complications are minimized. For instance, Straumann launched its iEXCEL implant system in May 2024. It focuses on high precision and comfort for the patient.

The urgent requirement for new and affordable dental treatments has put pressure on manufacturers to include new technologies and solutions in their production lines, thereby creating a dynamic artificial teeth market.

-

Growing Demand in Emerging artificial teeth Market

Increased awareness about dental health among consumers in emerging markets, such as the Asia-Pacific and Latin American regions, growing disposable incomes, and an increasing dental tourism market are transforming the artificial teeth market to a greater extent. These regions have grown to be key growth drivers for the market, as it has been a hub for affordable yet superior quality dental care solutions.

To cater to that demand, companies are looking to widen their presence in these areas, targeting cost-efficient innovations. As an example, Dentsply Sirona formed a partnership with Siemens Healthineers in the year 2024 to explore advanced MRI applications for dental treatments. However, some of the low-income regions are facing the challenge of high costs associated with dental implants, and efforts are being made to minimize these costs by developing economical processes of manufacture.

Restraint

-

The high cost with dental implants and related procedures inhibits this market.

Dental implants are one of the most effective and long-term solutions for tooth replacement, and this typically involves a high price for the implants themselves as well as the surgical procedures necessary for their installation. This is a pricey treatment for many patients, especially in low- and middle-income regions, making it inaccessible to the market in many areas.

Several examples of single dental implant procedures that cost from USD 3,000 to USD 6,000 in developed countries feature other expenses for pre- and post-operative care, imaging diagnostics, and prosthetic customization. In regions where inadequate insurance coverage exists for dental procedures, the patients usually bear the full expenses out-of-pocket, further reducing adoption rates.

Emerging markets depend much on cost-effective alternatives and access. Companies are indeed working to develop more affordable options because of innovations in materials and production methods, but the cost factor has been a hindrance to wider market penetration for such companies. The challenge has to be addressed to unlock the full potential of the artificial teeth market across the globe.

Artificial Teeth Market Segments Analysis

By type

The complete dentures segment dominated the artificial teeth market in 2023 with a market share of 54%. Factors driving this growth include an aging global population, growing awareness about oral health, advances in dental technology, and rising cases of oral diseases. With advancing age, the requirement for complete dentures, i.e., those designed to replace all the natural teeth, is increasing. Increased awareness of oral health has also prompted individuals to seek restoration that will improve the look of their smiles, thereby enhancing their quality of life.

Government programs also have the effect of furthering this market. In 2023, the West Virginia government initiated the Denture Project, which brings low-income individuals and seniors to volunteer dentists to produce partials or dentures. The role that public programs have also played in expanding dental care access has had effects on the expansion of the market.

Full dentures also have undergone significant advancements in technology, making them much more comfortable, durable, and natural-looking. Such innovations, coupled with supportive programs and increased patient awareness, are accelerating the demand for complete dentures and are likely to drive growth in the artificial teeth market.

By Usage

The Removable Dentures segment dominated the artificial teeth market in 2023, with a market share of 59%. reflecting its widespread appeal as a cost-effective solution for missing teeth. Removable dentures are favored for their ease of removal and cleaning, offering users convenience and flexibility. Growing advancements in materials and technology are enhancing their aesthetics and comfort, with manufacturers focusing on creating dentures that closely replicate the appearance of natural teeth while ensuring a secure and comfortable fit.

Government initiatives further support the adoption of removable dentures. In Budget 2023, the Canadian government proposed a USD 13 billion investment over five years, followed by USD 4.4 billion in continuous funding, to implement the Canadian Dental Care Proposal (CDCP). This program aims to improve access to dental care across Canada, covering both full and partial removable dentures, making dental solutions more accessible to citizens. Such initiatives are expected to significantly boost market growth.

Additionally, the aging population is a major driver of demand for removable dentures. Tooth loss is a common issue among older adults, and this demographic trend is fueling the need for restorative dental solutions to improve oral functionality and quality of life. As a result, the removable dentures market is positioned for sustained growth, supported by innovations and rising government programs aimed at improving accessibility and affordability.

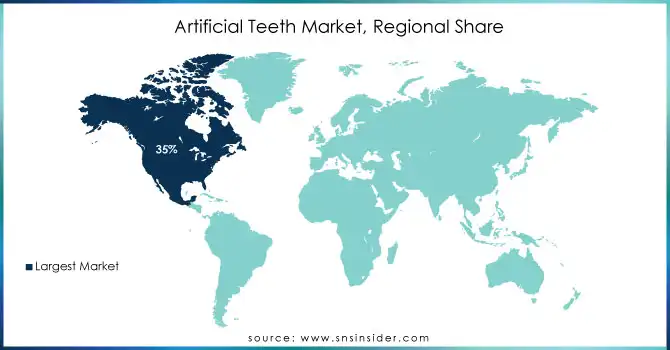

Artificial Teeth Market Regional Overview

North America was the most dominant region in the artificial teeth market in 2023 contributing with a market share of 35%, mainly due to factors such as increased dental problems associated with the aging population, increased awareness about oral care, and improvements in dental equipment. Digital dentures and 3D printing technology have greatly improved the fit, comfort, and aesthetics of dentures while reducing production times. This innovation is expected to continue driving growth for the next market period in the region.

Moreover, the aging population in North America also adds to the dental prosthesis market because oral tooth loss is a characteristic of this age group. These factors combined with a sound healthcare infrastructure in the region and the state of modern technology place North America as one of the primary markets for dental prosthetic appliances.

The artificial teeth market will experience the fastest growth in the Asia-Pacific region throughout the forecast period. The increasing awareness of oral health, rising disposable incomes, and the expanding middle class are fueling this growth. Nations like India, China, and Japan are seeing an increase in the need for dental services because of the growing number of older adults and higher rates of dental issues. The area is also a center for dental tourism, providing top-notch yet affordable dental services that draw in patients from around the world. The market is expanding even more due to advancements in technology and investments in healthcare infrastructure.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players in Artificial Teeth Market

-

Straumann Group (Straumann PURE Ceramic Implant, ProArch Dental Implant System)

-

Dentsply Sirona (Cercon ht Zirconia, Atlantis Abutment)

-

Nobel Biocare (NobelReplace Implants, NobelProcera Crowns and Bridges)

-

Zimmer Biomet (Tapered Screw-Vent Implant, All-on-4 Implant Concept)

-

3M (Lava Plus High Translucency Zirconia, Imprint 3D Starter Kit)

-

Danaher Corporation (NobelActive Implants, NobelPearl Ceramic Implant System)

-

Ivoclar Vivadent (IPS e.max Ceramics, PrograMill PC)

-

GC Corporation (GC Initial Zirconia, GC Fuji IX GP)

-

Bicon (Bicon Dental Implant System, Bicon Abutments and Connectors)

-

Astra Tech (Astra Tech Implant System EV, Atlantis Abutments)

-

BioHorizons (Laser-Lok Implant System, Tapered Internal Implant)

-

MegaGen (AnyRidge Implant System, AnyOne Abutment System)

-

Osstem Implant (TS III SA Implant, Osstem Straight Abutment)

-

Kavo Kerr (Targis CAD/CAM System, Variolink Esthetic Cement)

-

Neodent (Neodent Implant System, Neodent Abutments)

-

Henry Schein (NSI Implants, Dentrix Dental Software)

-

Cochlear Limited (Nucleus 7 Sound Processor, Kanso 2 Sound Processor)

-

Midmark Corporation (Bader Electric Operatory Chair, VMS Dental Unit)

-

Planmeca (Planmeca Romexis Software, Planmeca FIT CAD/CAM System)

-

Shofu Dental (Shofu Durafill Plus Composite, Shofu Adper Scotchbond Universal Plus Adhesive)

Key Suppliers

These suppliers play a significant role in providing materials, tools, and technology that enable the production of dental implants, abutments, prosthetics, and other related products.

-

Swiss Precision Diagnostics

-

Kuraray Noritake Dental

-

Bego

-

Bicon

-

Dentsply Sirona

-

Henry Schein

-

Vita Zahnfabrik

-

Shofu Dental

-

Zimmer Biomet

-

Biomet 3i

Recent Developments

-

In May 2024, Straumann made notable advancements in artificial teeth and dental implants with the launch of its premium implant system, iEXCEL, in France. This system promises enhanced precision and aesthetics for dental professionals.

-

In 2024, Dentsply Sirona made significant strides in the dental sector by partnering with Siemens Healthineers to develop cutting-edge MRI technology specifically designed for dental applications. This collaboration aims to improve diagnostic accuracy and treatment planning capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.87 billion |

| Market Size by 2032 | US$ 3.83 billion |

| CAGR | CAGR of 8.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Complete Dentures, Partial Dentures) •By Usage (Fixed, Removable) •By Material (All Ceramic, Metal-Ceramic, All-Metal) • By End User (Dental Hospitals & Clinics, Dental Laboratories, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Straumann Group, Dentsply Sirona, Nobel Biocare, Zimmer Biomet, 3M, Danaher Corporation, Ivoclar Vivadent, GC Corporation, Bicon, Astra Tech, BioHorizons, MegaGen, Osstem Implant, Kavo Kerr, Neodent, Henry Schein, Cochlear Limited, Midmark Corporation, Planmeca, Shofu Dental, and other players. |

| Key Drivers | •Technological upgrades that spur innovation in the artificial teeth market •Growing Demand in Emerging artificial teeth Market |

| Restraints | •High Cost of Dental Implants and Procedures |