Metabolic Disorder Therapeutics Market Size & Overview

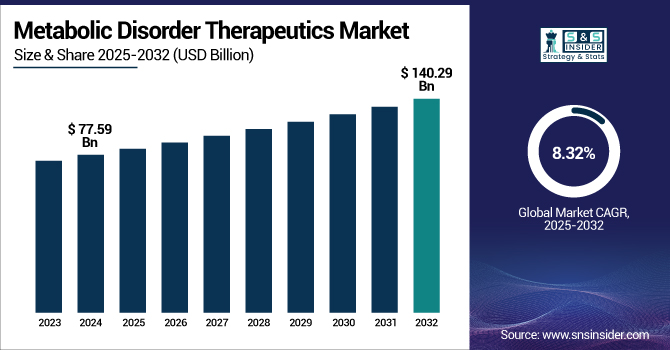

The Metabolic Disorder Therapeutics Market size was valued at USD 77.59 billion in 2024 and is expected to reach USD 140.29 billion by 2032, growing at a CAGR of 8.32% over the forecast period of 2025-2032.

To Get more information on Metabolic Disorder Therapeutics Market - Request Free Sample Report

The metabolic disorder therapeutics market is developing robustly, driven by the worldwide rise in disease cases of diabetes, obesity, and lysosomal storage diseases. Advances in technology in enzyme replacement and gene therapies, increased healthcare awareness, and better diagnostic capabilities are driving demand. In addition, increasing healthcare access in emerging markets and high R&D investments by pharmaceutical companies are expected to further drive market growth in the next few years.

For instance, Pfizer's research explains that metabolic disorders result when the chemical processes of the body do not work as expected. Such disorders can arise when organs like the pancreas or liver are not working as expected. Diabetes is one such metabolic disorder, with 37.3 million Americans suffering from it currently, accounting for 11.3% of the country's population, which is what is propelling the metabolic disorder therapeutic market trends.

The U.S. metabolic disorder therapeutics market size was valued at USD 28.23 billion in 2024 and is expected to reach USD 49.60 billion by 2032, growing at a CAGR of 7.36% over the forecast period of 2025-2032. The U.S. leads the North American metabolic disorder therapeutics market because of its well-developed healthcare infrastructure, high incidence of metabolic disorders, and robust pharmaceutical R&D environment. Diabetes, obesity, hyperlipidemia, and thyroid disorders are extremely common in the U.S., primarily because of sedentary lifestyles, dietary patterns, and the aging population

Metabolic Disorder Therapeutics Market Dynamics

Drivers

-

The Rising Prevalence of Metabolic Disorders is Driving the Global Metabolic Disorder Treatment Market

According to the International Diabetes Federation (IDF), in 2024, approximately 589 million adults aged between 20 and 79 years had diabetes globally, and it is estimated that this number would be 853 million by 2050. The World Health Organization (WHO) also reported in 2022 that over 890 million adults were living with obesity, which accounted for about 16% of all adults worldwide. These increasing statistics indicate the increasing need for suitable therapeutic measures to manage and cure metabolic disorders.

For Instance, according to NCBI, Metabolic syndrome patients are at roughly double the risk of developing atherosclerotic cardiovascular disease and have five times the risk of developing diabetes mellitus than the general population. It is also associated with enhanced atherosclerosis, type 2 diabetes with an early onset, and premature cardiovascular complications. In the last decades, sedentism and overconsumption of calories have promoted a significant increase in the prevalence of obesity, which has resulted in the number of cases of metabolic syndrome increasing significantly. More than 20% of the population in the United States and Europe is afflicted with this syndrome.

-

Advancements In Therapeutics Are Propelling the Metabolic Disorder Therapeutic Market Growth

Advancements in Therapeutics is the ongoing development of innovative and improved therapies for metabolic diseases, which has greatly improved patient outcomes. This encompasses the development of treatments like Enzyme Replacement Therapy (ERT) for lysosomal storage diseases, in which enzyme deficiencies can be treated with synthetic substitutes, and Gene Therapy, which addresses the root genetic causes of metabolic disorders, with the potential for cures instead of merely symptom control. The development of targeted biologics and small-molecule medications for diseases such as diabetes and hyperlipidemia is also providing more tailored and effective treatments. These technologies are improving the effectiveness, safety, and convenience of treatments, which increases demand in the marketplace and promises much for diseases that were once more challenging to treat.

Restraint

-

Stringent Regulatory Approvals for metabolic disorder therapeutic restrain the market growth.

Stringent regulatory approvals describe the complicated and lengthy procedures needed to obtain approval for new metabolic disorder therapies. They are required for safety and effectiveness, but may cause delays in product launches, higher development expenses, and reduced patient access to potential life-saving therapies on time.

Metabolic Disorder Therapeutics Market Segmentation Analysis

By Disease

In 2024, the diabetes segment dominated the metabolic disorders therapeutics market share with 30.16% based on the prevalent worldwide occurrence of diabetes, more specifically Type 2 diabetes, and it represents an emerging widespread public health problem. As a rising number of individuals are developing diabetes, mostly in areas such as North America and Europe, treatments are increasing. Moreover, technological advancements in drug formulations, including the creation of GLP-1 receptor agonists and SGLT2 inhibitors, have greatly enhanced patient outcomes and further increased the segment's growth. Government policies and healthcare initiatives that center on preventing and managing diabetes also play a part in the segment's dominance.

For instance, according to WHO, about 830 million individuals worldwide suffer from diabetes, most of them living in middle- and low-income nations. More than half of them have no treatment of any kind. Both the rates of diabetes and of untreated individuals have been rising steadily throughout the last few decades.

The Lysosomal Storage Diseases (LSDs) segment will demonstrate the fastest growth during the forecast period as a result of advancements in enzyme replacement therapies (ERTs) and gene therapies, which have considerably enhanced treatment opportunities for these rare yet severe disorders. The expanding awareness of LSDs and the rising number of diagnosed cases are propelling demand for targeted therapeutics.

By Therapy

In 2024, the Enzyme Replacement Therapy (ERT) segment dominated with 32.05% metabolic disorder therapeutics market share because it has long proven to be effective in treating numerous metabolic disorders, notably Lysosomal Storage Diseases (LSDs). ERT is a reliable treatment for diseases such as Gaucher disease, Fabry disease, and Pompe disease, where deficiencies of enzymes result in severe complications. The widespread adoption of ERTs by clinicians in clinical practice due to the high success rate in enhancing patient outcomes and FDA approvals for different ERT products, has supported the segment's leadership.

The gene therapy segment is expected to register the fastest growth in the forecast period on account of immense developments in genetic science and technology. Gene therapy presents a potential method of treating the source of metabolic diseases by directly altering the patient's genetic code.

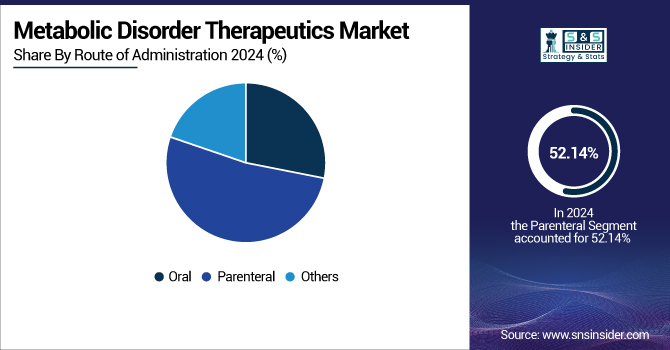

By Route of Administration

In 2024, the parenteral segment dominated the metabolic disorder therapeutics market with 52.14% market share because of the nature of most metabolic disorder treatments, especially enzyme replacement therapies (ERTs), which have to be delivered directly into the bloodstream. Parenteral administration, including intravenous (IV) and subcutaneous injection, keeps the therapeutic agents away from the digestive system so they can deliver more rapid and effective effects. This mode of administration is especially important in the treatment of diseases such as Lysosomal Storage Diseases (LSDs) and some genetic metabolic disorders, where accurate and uniform dosing is required for therapeutic efficacy. The consistency and established efficacy of parenteral therapy have played a major role in its market dominance.

The oral segment is projected to grow at the fastest rate during the forecast years with a 9.43% CAGR, influenced by increasing demand for treatment in a more convenient and patient-friendly format. Patient preference for oral administration is influenced by ease of use, lower reliance on healthcare professional intervention, and the probability of increased adherence to long-term treatment.

By Distribution Channel

In 2024, the Hospital Pharmacies segment dominated the metabolic disorder therapeutics market with 46.25% market share because of the highly specialized nature of treatments for these complex diseases. Several metabolic disorders, like Lysosomal Storage Diseases and uncommon genetic disorders, involve highly specialized drugs, such as enzyme replacement drugs and other biologics, that tend to be dispensed via hospital pharmacies. These treatments are generally required to be administered under the supervision of a professional because of their complexity, and hence, hospital outlets become the main channel of distribution.

The online Pharmacies segment will be growing the fastest during the forecast years due to growing consumer demand for convenience and expanding digital healthcare platforms. Online pharmacies provide patients with the convenience of ordering medication from home, which is especially desirable for long-term therapies that many people with chronic metabolic disorders have to undergo. The rise of telemedicine, coupled with the growing popularity of home delivery of prescriptions, has enormously increased the accessibility of online pharmacies.

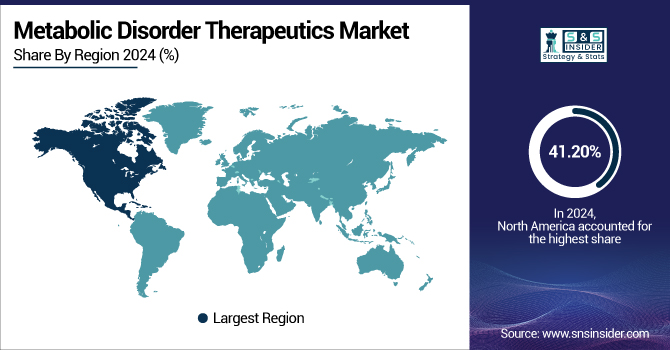

Metabolic Disorder Therapeutics Market Regional Outlook

North America dominated the metabolic disorder therapeutics market with 41.20% market share in 2024 because of its well-developed healthcare infrastructure, high level of disease awareness, and extensive presence of major pharmaceutical firms. The region has a high incidence of metabolic disorders, especially diabetes and obesity, which largely drives the demand for effective treatments.

Asia Pacific is expected to emerge as the fastest-growing metabolic disorder therapeutics market in the forecast period with 8.41% CAGR. Growth is driven by increasing healthcare spending, growing healthcare access, and rising metabolic disorder awareness across markets such as China, India, and Japan. The area is witnessing an increase in the prevalence of lifestyle diseases such as diabetes and hyperlipidemia as a result of urbanization, physical inactivity, and dietary habits.

Germany leads the metabolic disorder therapeutics market in Europe owing to its established healthcare system, robust pharmaceutical sector, and high incidence of metabolic disorders such as diabetes. The emphasis of the country on timely diagnosis, research investment, and availability of cutting-edge therapies further aids its dominance.

Latin America, and Middle East & Africa are experiencing significant metabolic disorder therapeutics market growth because of the increasing incidence of lifestyle diseases like diabetes and obesity. This is also driven by enhanced healthcare infrastructure, rising healthcare awareness, and increased government attention towards chronic disease management programs.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Metabolic Disorder Therapeutic Companies

Novo Nordisk A/S, Eli Lilly and Company, Sanofi S.A., Merck KGaA, AstraZeneca plc, AbbVie Inc., Amgen Inc., Takeda Pharmaceutical Company Limited, Biocon Ltd., BioMarin Pharmaceutical Inc., and other players.

Recent Developments

-

February 2025 – Nimbus Therapeutics, LLC ("Nimbus Therapeutics"), a biotechnology leader in computational drug discovery, today reported the achievement of a significant preclinical milestone in partnership with Eli Lilly and Company (Lilly). The milestone entails the design of a therapy against a particular isoform of AMP-activated protein kinase (AMPK) for the treatment of cardiometabolic diseases.

-

January 2024 – Cellarity Inc., a Flagship Pioneering-founded life sciences firm, revealed the expansion of its strategic research partnership with Novo Nordisk A/S. The collaboration will leverage Novo Nordisk's metabolic disease capabilities and Cellarity's proprietary platform to identify a new therapeutic candidate for metabolic dysfunction-associated steatohepatitis (MASH), a space with no approved treatments today.

-

October 2024 – Eli Lilly and Insitro made a partnership aimed at developing AI-based small interfering RNA (siRNA) treatments for metabolic diseases. The firms called the alliance a "new paradigm" in biotech-pharma partnerships, integrating Lilly's therapeutic development expertise with Insitro's machine learning-based discovery platform.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 77.59 Billion |

| Market Size by 2032 | USD 140.29 Billion |

| CAGR | CAGR of 7.74% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Disease (Lysosomal Storage Diseases, Diabetes, Obesity, Inherited Metabolic Disorders, Hypercholesterolemia, Other Metabolic Diseases) • By Therapy (Enzyme Replacement Therapy, Cellular Transplantation, Small Molecule-Based Therapy, Substrate Reduction Therapy, Gene Therapy, Drug Therapy) • By Route of Administration (Oral, Parenteral, Others) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Novo Nordisk A/S, Eli Lilly and Company, Sanofi S.A., Merck KGaA, AstraZeneca plc, AbbVie Inc., Amgen Inc., Takeda Pharmaceutical Company Limited, Biocon Ltd., BioMarin Pharmaceutical Inc., and other players. |