Venous Leg Ulcer (VLU) Treatment Market Report Scope & Overview:

To Get More Information on Venous Leg Ulcer (VLU) Treatment Market - Request Sample Report

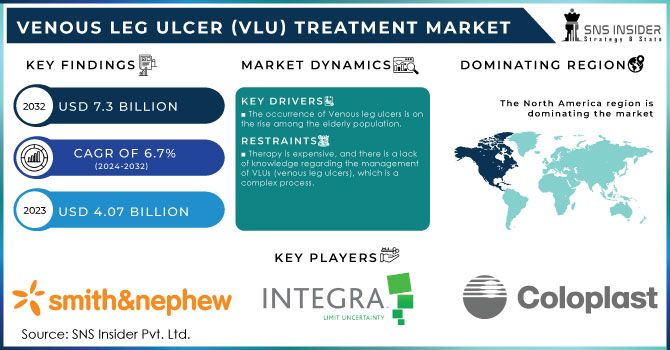

The Venous Leg Ulcer (VLU) Treatment Market Size was valued at USD 4.07 billion in 2023, and is expected to reach USD 7.3 billion by 2032, and grow at a CAGR of 6.7% over the forecast period 2024-2032.

A sore called a venous leg ulcer can develop above the ankle on the inside of the leg and can persist for a long time. This can occur due to a small wound that has been affected by high venous pressure. The NHS reports that venous leg ulcers account for more than 90% of all cases of leg ulcers, affecting almost 1 in 500 people in the UK. The market growth during the projected period is driven by the increasing prevalence of venous leg ulcers and the growing use of compression therapy to treat them. Over the coming years, the market for treating venous leg ulcers is predicted to expand due to an increase in innovative treatment procedures and greater public knowledge regarding the available options for treating this condition.

The market for venous leg ulcer treatments is being driven by the rising incidence of male pattern baldness. This condition has become more prevalent among males globally due to various risk factors such as smoking, poor dietary habits, stress, and inadequate intake of essential nutrients and minerals. As a result, the market is expanding due to the increased adoption of hair transplants among males. However, it is important to note that the text does not discuss the causes and treatments of venous leg ulcers.

MARKET DYNAMICS

DRIVERS

-

The occurrence of Venous leg ulcers is on the rise among the elderly population.

-

Although there have been innovations in technology for wound care, they have contributed to the increasing cost of healthcare.

Venous leg ulcers are frequently experienced by elderly individuals. This higher occurrence has led to a greater need for VLU treatments. Factors such as obesity, inactive lifestyles, and the frequency of venous diseases have contributed to the rise in venous leg ulcer cases, which has resulted in an increase in the demand for VLU therapy options. With the advancements in wound care products and treatment methods, the effectiveness and outcomes of VLU therapies have improved, which is beneficial for both patients and healthcare practitioners.

RESTRAIN

-

Therapy is expensive, and there is a lack of knowledge regarding the management of VLUs (venous leg ulcers), which is a complex process.

OPPORTUNITY

-

Developing economies and product development.

The ongoing research and development activities in wound care technology and VLU treatment methods offer promising opportunities for the introduction of new and more efficient products in the market. There is potential for VLU treatment providers to expand their reach in emerging nations, where there may be a growing patient population and expanding healthcare infrastructure. These untapped markets present an opportunity for growth and expansion.

CHALLENGES

-

There is inconsistency in uniformity, and issues with payments.

IMPACT OF RUSSIA-UKRAINE WAR

The ongoing conflict between Russia and Ukraine, as well as other neighbouring nations, could potentially disrupt trade and have negative consequences for various sectors, including healthcare. This disruption may lead to financial losses and affect the availability of medicines that rely on international commerce. Furthermore, wars can result in inflation and currency devaluation, which can reduce consumer purchasing power and increase the cost of healthcare supplies, such as treatments for osteoporosis.

The battle could also cause damage to medical facilities, including hospitals and clinics, thereby limiting their ability to provide quality healthcare services, including treatment for osteoporosis. Additionally, during times of war, medical staff and resources may be diverted to treat acute injuries related to combat, leaving less money and resources for treating non-emergency medical conditions like osteoporosis. There may be a shortage of medication due to disruptions in the pharmaceutical industry's supply chain, including osteoporosis treatments, caused by conflicts. Patients in conflict zones may face difficulties accessing medical facilities and receiving necessary treatments. Ongoing disagreements may lead to less funding being allocated for pharmaceutical and healthcare research and development, potentially hindering the development of new osteoporosis therapies.

IMPACT OF ONGOING RECESSION

During a recession, the development and launch of advanced VLU treatments may face obstacles due to a reduction in funding for research and development of new wound care products. Additionally, governments may alter healthcare regulations and payment procedures to manage costs, which could impact the accessibility and affordability of VLU therapy for patients. Moreover, economic downturns may lead to market consolidation, with smaller enterprises struggling while larger businesses may acquire or merge with others. These changes can affect the competition in the market and the availability of VLU treatments.

KEY MARKET SEGMENTATION

By Product

-

Compression Therapy

-

Compression Bandages

-

Compression Stockings

-

Others

-

Advanced Wound Dressings

-

Other

By End-user

-

Hospitals

-

Specialty Clinics

-

Homecare Settings

-

Others

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

REGIONAL ANALYSES

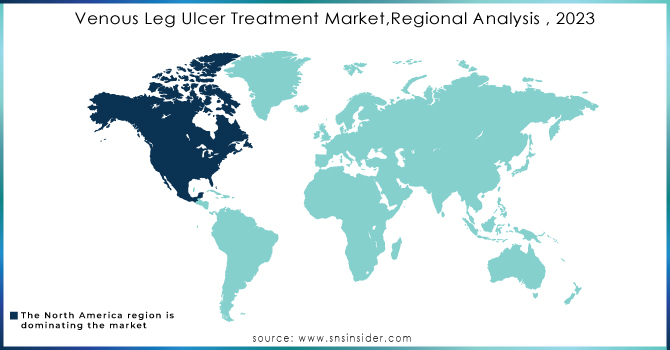

It is expected that the North American region will rank second in the worldwide VLU market. The growth of the venous leg ulcer market can be largely attributed to the introduction of new and innovative products by major competitors.

Our market research indicates that Asia Pacific is expected to experience the highest growth rate in the treatment of venous leg ulcers. This is due to the significant increase in the elderly population and a growing patient base for this condition in the region. On the other hand, the Middle East and Africa are projected to have moderate growth due to the increasing demand for affordable treatment options for venous leg ulcers that are currently unmet.

Do You Need any Customization Research on Venous Leg Ulcer (VLU) Treatment Market - Enquire Now

Key Players

The major players are Integra Lifesciences, Smith & Nephew, Coloplast Corp, URGO, 3M, Paul Hartmann, Bauerfeind, Cardinal Health, SIGVARIS GROUP, KCI Licensing, Inc. and others.

RECENT DEVELOPMENTS

MiMedx Group, Inc: In January 2023, MiMedx Group, Inc. has signed an exclusive distribution agreement with Gunze Medical Limited for the sale of EPIFIX in Japan. EPIFIX is a placental tissue allograft that is processed using PURION® technology. It acts as a semi-permeable barrier and helps promote wound healing by facilitating the cascade of healing.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.07 Bn |

| Market Size by 2032 | US$ 7.3 Bn |

| CAGR | CAGR of 6.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Compression Therapy, Compression Bandages, Compression Stockings, Others, Advanced Wound Dressings, Other) • By End-user (Hospitals, Specialty Clinics, Homecare Settings, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Integra Lifesciences, Smith & Nephew, Coloplast Corp, URGO, 3M, Paul Hartmann, Bauerfeind, Cardinal Health, SIGVARIS GROUP, KCI Licensing, Inc. |

| Key Drivers | • The occurrence of Venous leg ulcers is on the rise among the elderly population. • Although there have been innovations in technology for wound care, they have contributed to the increasing cost of healthcare. |

| Market Restraints | • Therapy is expensive, and there is a lack of knowledge regarding the management of VLUs (venous leg ulcers), which is a complex process. |