Biocides Market Report Scope & Overview:

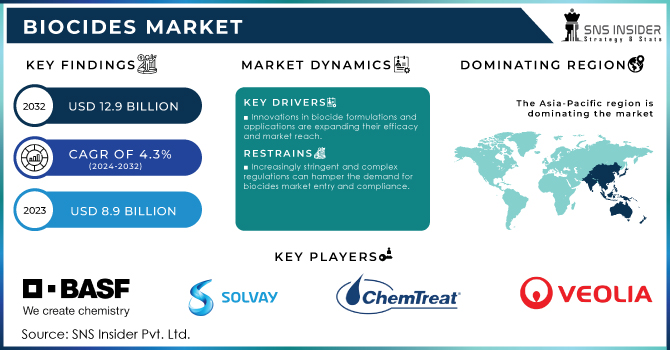

The Biocides Market Size was valued at USD 8.9 billion in 2023, and is expected to reach USD 12.9 billion by 2032, and grow at a CAGR of 4.3% over the forecast period 2024-2032. The biocides market has been driven by major changes based on the evolving regulations, technological changes, and growing applications across the wide array of industrial sectors. Biocides are the substances developed for the purpose of killing or adversely affecting any living organism that causes any damage or deterioration to manufactured products. New regulatory changes that have been pivotal and influential in regulating market dynamics span from Europe and other regions. A case in point is the European Union that has amended some laws upon advanced safety and protection of the environment. The EU New Biocidal Products Regulation mandates that the companies have to go through thorough scrutiny and allows the incorporation of a marked increase in stringency in labelling, all intended for well conducted effective and safe use of biocidal products. Indeed, such a new regulation is in fact and in reality, part of such an industry-wide shift towards greater oversight and harmonization of standards in biocides.

Get More Information on Biocides Market - Request Sample Report

The dynamics of the biocides market are subject to a variety of factors in the biocide segment: the regulatory demands, evolving technologies, consumer perceptions, and more. Regulatory bodies, such as the ECHA and a series of national agencies, are intensely involved in setting new and apt standards and guidelines for biocidal products. For example, as per the official website, the Danish Environmental Protection Agency has been in the front row for very long in implementing very strict regulations regarding biocides. There are substantial impacts upon the formulation, labeling, and marketing of biocidal products to ensure high safety standards for their marketing and for the information about their use to reach the users. Technological changes are also influencing the biocides market. Companies are investing in the development of more potent, eco-friendly biocidal products through research and development. An important development in this area happened in August 2024 when Univar Solutions has announced that it has collaborated with Arxada to bring an enlarged biocide product portfolio into the industrial market of Brazil. Very likely, this will add the availability of advanced solutions into Brazil, which is a booming marketplace for industrial applications. Such partnerships are indicative of the importance of innovation and market development within the industry.

Biocides market developments come one after another, underlining intensification of sustainability and safety concepts. In July 2024, one of the leading biocide manufacturers in Europe, Biocide BE, redesigned their ways of product registration and classification to follow new EU regulations. This is one example of the industry taking steps to comply with rigorous regulatory requirements in support of responsible and effective use of biocides, but it is also for better transparency and consumer trust in biocidal products.

In addition to these regulatory and technological developments, market dynamics for biocides are characterized by the increasing demand in a variety of end uses. Notably, one of the health care sectors that have remained the key driver for this product class is the intensive demand for biocidal products for infection control and hygiene management. Demand in biocidal products has been met by innovative companies that have developed new formulations and new applications for biocides, which are more effective and cause lesser harm. This trend has come to light even in the most recent news from GPC Gateway, in which a leading manufacturer relaunched its new biocide product because of an intense need for antimicrobial solutions in medical settings.

The biocides market is dynamic, pressured by continuous regulatory, major technical, and fast-changing consumers needs. The companies are agile in development, creating new technologies, new updated regulations, and development of wider product portfolios to meet the diversified requirements of the relevant industries.

Market Dynamics:

Drivers:

-

Enhanced safety and environmental regulations are driving the development and compliance of biocidal products.

Improved safety and environmental regulations are serving as major drivers of development and compliance for biocidal products, whereby companies are encouraged to bring out newer products and conform them to more stringent standards. For example, in January 2024, BASF pledged a radical revamp in its line of biocides for compliance with new EU legislation related to biocidal products, now requiring extensive safety tests and environmental impact assessments. This regulatory shift, as spearheaded by the European Chemicals Agency, insists that manufacturers provide detailed risk assessments and take measures in ensuring that their biocides do not cause harm to non-target organisms or ecosystems. In the same month of March 2024, the U.S. Environmental Protection Agency introduced new guidelines for biocidal products with an emphasis on rigorous testing and documentation of the long-term effects on human health and the environment. Therefore, Dow Chemical and other firms invest in research and development to come up with biocides that have improved safety profiles and reduced environmental footprints. The regulations make the industry innovate, and firms find new formulations to ensure effectiveness while at the same time being friendly to the environment. For instance, in June 2024, Syngenta launched a new range of biocidal products that are able to meet enhanced safety criteria brought about by the latest updates of relevant regulations, thus showing proactive industry consideration for compliance and sustainability.

-

Innovations in biocide formulations and applications are expanding their efficacy and market reach.

Biocide formulation and application innovations are quickly extending their efficacy and reach to market, as companies try to meet diverse and changing requirements in many industries. For instance, Clariant launched a new biocide formulation with a unique active ingredient that boosts antimicrobial efficiency while having a very good ecological footprint in February 2024. The innovation responds to rising consumer demand for products that assure higher performance but have minimal impact on the environment. Similarly, in April 2024, Lonza launched state-of-the-art biocide technology developed to apply in industrial cooling systems. It offers superior protection from the formation of biofilm and microbial contamination. This new application will drive operational efficiency while supporting the industry move to more sustainable solutions. In August 2024, the state-of-the-art biocide product was introduced into the food and beverage market by Ecolab. The new product will apply leap-forward technology that extends the effective period of activity with a corresponding extension of its shelf life, satisfying strict hygiene standards and improving safety. This example manifests how the biocides market is changing companies to innovate around certain challenges and grow their product portfolio into new applications and markets.

Restraint:

-

Increasingly stringent and complex regulations can hamper the demand for biocides market entry and compliance.

The increasing stringency and complexity of regulations can considerably hamper demand for market entry and compliance in the biocides industry. For example, the Australian regulatory authorities have introduced stringent new requirements for biocidal products since May 2024, which include detailed toxicity studies and prolonged environmental impact assessments. This type of regulatory overhaul had begun to pose challenges for companies such as Bayer, which needed to navigate the notoriously complex approval process for its new line of biocidal products. Similarly, another example comes in the form of additional biocide documentation and compliance requirements for agricultural uses, which the U.S. Environmental Protection Agency put into place in this same month of 2024, once more increasing the barriers to entry for the smaller manufacturers. Increasing regulatory demands raise operational cost and extend time-to-market, preventing new entrants and raising entry barriers for existing companies to offer or expand their biocide product line.

Opportunity:

-

Expanding biocide portfolios into rapidly growing markets, such as Brazil, offers significant growth potential.

Expanding biocide portfolios in fast-growing markets such as Brazil holds huge growth potential for the firms operating in this industry. It was a cue that the chemical company Lanxess took to heart and made a move by entering the Brazilian market with an increased product range of biocides, specially formulated for local industrial and agricultural requirements, in June 2024. It was a strategic move that capitalized on its booming agricultural sector in Brazil, which demands effective, environment-compliant biocides. Also in September 2024, BASF announced its entry into the Brazilian market with a view to establishing itself as a supplier of sophisticated biocidal solutions for the growing regional construction and healthcare industry. These are representative of wider trends in targeting high-growth markets. With increasing industrial activity amidst evolving regulatory environments, these present huge potential demand for new biocide solutions, hence offering tremendous growth opportunities to the companies.

Challenge:

-

Balancing the effectiveness of biocides with their environmental impact remains a key challenge for the industry.

The challenge has always been reconciling the efficacy of biocides with their environmental impact, and companies are now having to do this in an increasingly stringent legislative environment without sacrificing a bead of product performance. For instance, in March 2024, groups pegged Dow Chemical with criticism over its new, highly effective biocide product for industrial applications on the grounds of negative impacts on aquatic ecosystems. This mounted pressure on Dow to reformulate the product to reduce environmental impacts without losing its potency. In like manner, in October 2024, Syngenta was faced with a regulatory challenge while launching its new biocide slated to hit the agricultural market; while the original makeup of the product presented a question about the ability of the said product to cause soil injury, which made the company begin further research on how to create a more environmentally friendly version of the product. The instances are revealing of the continuous tussle in the industry to develop biocides that are at once highly effective and environmentally responsible.

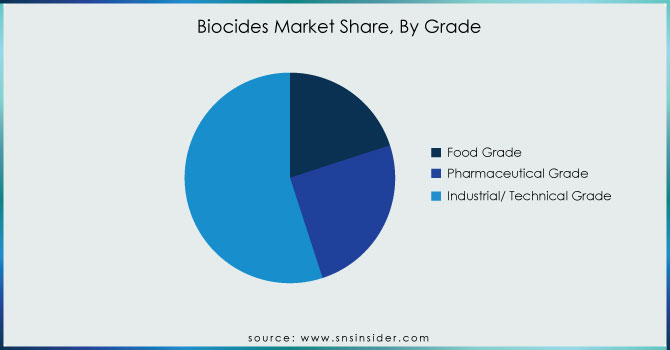

KEY MARKET SEGMENTS

By Grade

The Industrial/Technical Grade segment dominated and accounted for a substantial share of 55% the biocides market in 2023 because it finds high utilization in a wide range of industries, from water treatment and industrial processes to material preservation. For example, in April 2023, a global chemical manufacturer, Ecolab, announced that it has recorded strong growth in the area of industrial biocide solutions for key applications in large water treatment facilities and large industrial cooling systems. Another firm, BASF, has been developing advanced industrial biocides for applications in manufacturing and building and construction, thus further emphasizing this segment's leading position in the market. Hence, based on application, the Industrial/Technical Grade segment is anticipated to dominate the biocides market due to its wide reach of demand for an efficient and dependable range of biocides across industries.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Product Type

In 2023, the Quaternary Ammonium Compounds dominated and accounted for the largest share of about 40% in biocides market. The dominance of this segment is credited to the broad-spectrum antimicrobial efficacy and the versatility of quats in a wide variety of uses ranging from health care disinfection and food processing sanitation. For instance, in June 2023, Ecolab reported high demand for its quaternary ammonium-based disinfectants, widely used in hospitals and commercial kitchens, with a broad spectrum of activity against most pathogens. Diversey Holdings repeated this sentiment in August 2023 when it reported that its quaternary ammonium continued to be one of the key product areas offered, ensuring no compromise in hygiene standards across all industry sectors. The vast scope of application with corresponding effectiveness has put Quaternary Ammonium Compounds first in the world's biocides market.

By End-Use

In 2023, the water treatment segment dominated and accounted with a maximum share of approximately 45% in the biocides market. This dominance is mainly observed because biocides are being developed to deal with microbial growth and associated problems troubling various industrial and municipal water-based applications like municipal water systems, industrial cooling towers, and wastewater treatment facilities. For example, in July 2023, Nalco Water, a business unit of Ecolab Inc., demonstrated significant interest in its water-treatment biocides. These have become very important for protection against biofouling and to comply with strict water-quality regulations. Additionally, Veolia Environmental Services reiterated the prominence of biocides in its water treatment solutions back in September 2023, elaborating on the immense share of this sector in the market. This is expected due to the large-scale application of biocides and continuous regulatory focus on water quality management; as a result, Water Treatment dominated the biocides market.

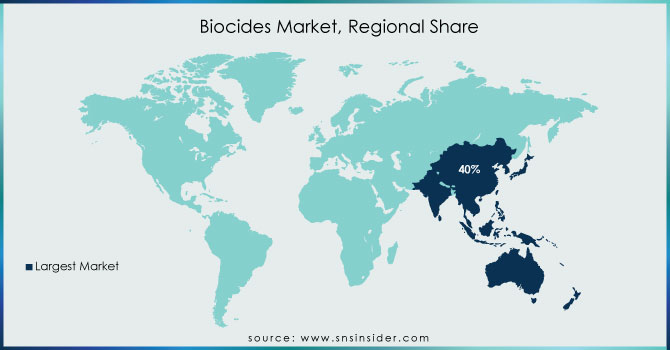

Regional Analysis

The Asia-Pacific region dominated the biocides market with a revenue share of about 40% in 2023, driven by rapid industrialization, increasing urbanization, and significant demand for biocidal products in various applications such as water treatment, agriculture, and industrial processes. For example, in April 2023, BASF highlighted its expansion in China and India, which was driven by rising regional demand for effective biocides in water management and industrial applications. The same goes for the August 2023 report of the Asia-Pacific Chemical Analysis and Market Research Group, which stated that there has been significant growth in biocide consumption across Southeast Asia as a consequence of growing industrial activity and agricultural development. Coupled with the already strong industrial base, this rapidly growing infrastructure made Asia-Pacific the most optimistic market for biocides.

Moreover, in 2023, North America witnessed growth of more than 7% in the biocides regional market, contributing an approximate 30% market share. The enhanced regulatory standards, rising investments in water treatment infrastructure, and the expanding use in industries such as healthcare and food processing are expected to increase the growth rate in this region. For instance, Ecolab declared in March 2023 that the demand of its biocide product had increased in North America due to rising legislation for sanitation and safety by the healthcare industry. In addition, new regulations by the U.S. Environmental Protection Agency (EPA) in September 2023 spurred the growth of advanced biocidal technologies. Only stringent regulations, along with raised investments from industrial and municipal sectors, have been the key driving forces behind North America's rapid expansion in the biocides market.

Key Players

The major key players are BASF SE, Solvay SA, Chemtreat Inc., Veolia Group, Lanxess AG, Lubrizol, Troy Corp., Shanghai Zhongxin Yuxiang Chemicals Co. Ltd., Hubei Jinghong Chemicals Co. Ltd., Wuxi Honor Shine Chemical Co. Ltd., Finoric LLC, and other key players mentioned in the final report.

Recent Developments

-

March 2024: UNIVAR SOLUTIONS LLC signed a distribution agreement with Arxada related to biocides and preservatives, enhancing product offering to the Brazilian industrial markets.

-

December 2023: Solvay completed the spin-off of its Specialty Businesses into a separate company, Syensqo. Both Solvay and Syensqo have now started trading separately on Euronext Brussels and Paris.

-

February 2023: Solvay completed the transaction in relation to the Divestment of its 50% stake in the Rusvinyl joint venture to Sibur. This has impacted its 2023 financials

-

March 2023: KRAHN Chemie extends cooperation with LANXESS after acquisition of a biocides business to broaden its product range and market presence in Germany, Austria, Belgium, and the Netherlands.

| Report Attributes | Details |

| Market Size in 2023 | US$ 8.9 Billion |

| Market Size by 2032 | US$ 12.9 Billion |

| CAGR | CAGR of 4.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Food Grade, Pharmaceutical Grade, Industrial/ Technical Grade) •By Product Type (Halogen Compounds, Organo-sulfur, Metallic Compounds, Quaternary Ammonium Compounds, Nitrogen, Organic acids, Phenolic, Others) •By End-Use (Water Treatment, Personal care, Wood Preservation, Food & Beverage, Oil & Gas, Agrochemicals, Pulp and Paper, Boilers, Cleaning Products, Paints and coatings, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Solvay SA, Chemtreat Inc., Veolia Group, Lanxess AG, Lubrizol, Troy Corp., Shanghai Zhongxin Yuxiang Chemicals Co. Ltd., Hubei Jinghong Chemicals Co. Ltd., Wuxi Honor Shine Chemical Co. Ltd., Finoric LLC and other players |

| Key Drivers | • Enhanced safety and environmental regulations are driving the development and compliance of biocidal products • Innovations in biocide formulations and applications are expanding their efficacy and market reach |

| RESTRAINTS | • Increasingly stringent and complex regulations can hamper the demand for biocides market entry and compliance |