Bioadhesives Market Report Scope & Overview:

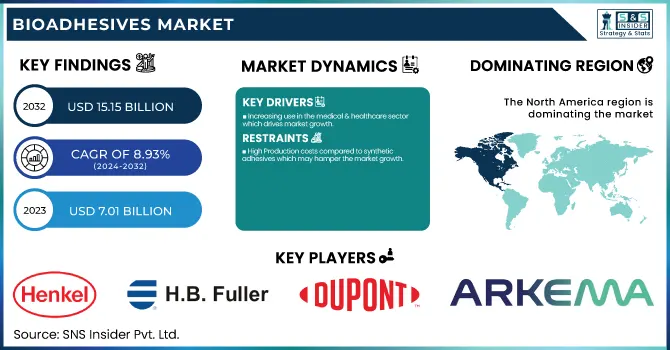

The Bioadhesives Market size was USD 7.01 Billion in 2023 and is expected to reach USD 15.15 Billion by 2032 and grow at a CAGR of 8.93 % over the forecast period of 2024-2032. The Bioadhesives market report provides an in-depth analysis of recycled tire output and utilization by country and type, highlighting production trends in 2023. This report provides key statistical insights and trends in the bioadhesives market, covering production capacity and utilization by country and type in 2023. It examines feedstock price fluctuations of natural polymers, starch, and proteins across major regions. The report analyzes the regulatory landscape, including biodegradability standards, reach compliance, and FDA approvals. Sustainability metrics such as carbon footprint, recycling, and waste reduction are also highlighted. Innovation and R&D investments in next-generation bioadhesives are assessed. Additionally, the study explores market adoption trends across key sectors, including packaging, medical, and woodworking. These insights offer a comprehensive view of market dynamics, sustainability shifts, and regulatory impacts shaping the industry.

To Get more information on Bioadhesives Market - Request Free Sample Report

Bioadhesives Market Dynamics

Drivers

-

Increasing use in the medical & healthcare sector which drives market growth.

The medical and healthcare sector is one of the main contributors to bioadhesive market growth globally, due to their biocompatibility, biodegradable, and nontoxic properties. Instead of using traditional synthetic adhesives in most applications, synthetic adhesives can often irritate non-prominent applications or adverse reactions in more important applications (drugs); therefore, bioadhesives have been successfully used in almost every known application, including wound care, tissue sealing, drug delivery systems, and surgical applications. The growing popularity of various minimally invasive surgery and advanced wound care solutions has provoked the usage of bio-based adhesives, particularly in both internal and external medical procedures in which synthetic adhesive may not be applicable. Moreover, rising government regulations and healthcare policies to promote bio-based and green medicinal materials are also fueling the growth of the market. Expansion of research and development efforts toward the development of next-generation high-adhesion bioadhesives with rapid healing and antimicrobial properties is one of the primary drivers for the adoption of bioadhesives in the global healthcare sector.

Restraint

-

High Production costs compared to synthetic adhesives which may hamper the market growth.

The high production costs for bioadhesives, in comparison to synthetic adhesives, seem expensive. Citing low molecular weight organic compounds that are derived from biological sources, bioadhesives are, in general, based on complex extraction, purification, and modification steps, increasing the total production cost per formulation and thus limiting the potential utilization scope. Also, the price of renewable raw materials varies by climate, crop, and the occasional supply chain restart, which adds yet another variable to prices. According to some reports, synthetic adhesives have long been preferred over bioadhesives owing to mature large-scale production, lower raw material costs, better prices, and world-class economies of scale across industries. The high cost of bioadhesives discourages manufacturers from switching to sustainable alternatives, disregarding their environmental agenda, especially in price-sensitive packaging, construction, and woodworking end-use markets. Although cost-reduction strategies via process optimization and advancements in biotechnology are being pursued, the price gap between bio-based and synthetic adhesives is an important barrier that may prevent widespread adoption and market growth.

Opportunity

-

Advancements in biotechnology and material engineering create an opportunity in the market.

Innovation in biotechnology and material engineering fostering prolonged performance, durability, and application range in bioadhesives provides considerable opportunity for the market. Novel approaches via enzyme-bonded adhesives, nanotechnology, and bio-polymer modification show improvements in bonding performance, water resistance, and thermal stability of bioadhesives, thus making them more competitive with synthetic counterparts. In addition, the development of next-generation bioadhesives with improved functionality is underway with the creation of genetically engineered proteins, bio-inspired adhesion mechanisms like muscle proteins, and gecko-inspired adhesion. Also, developments in microbial fermentation and bio-refining approaches are facilitating the low-cost, large-scale manufacturing of bioadhesives from renewable resources. With growing applications in all sectors such as medicine, packaging, construction, automobile, etc., these innovations are expected to accelerate market growth and hence the adoption of sustainable adhesive solutions.

Challenges

-

Scaling up production to meet industrial demand may challenge the market growth.

Supply chain challenges become intensified owing to the complexity of sourcing consistent and high-quality natural raw materials, such as proteins, starch, and lignin, which are essential for stable production. The bioadhesive formulations need to be processed using different processing systems which are not as effective when compared to the production of natural adhesive, leading to high operational cost and extended duration for production. Most of the current manufacturing infrastructures are structured to produce petroleum-derived adhesives and huge capital inputs are required to build new facilities, manufacturing equipment, and optimized processes to adapt bioadhesives. While market expansion could be decelerated by a significant long-term challenge, which is solution scaling without sacrificing adhesive quality, competitive pricing, and supply stability, the need for sustainable and eco-friendly adhesives is projected to rise across end-user industries such as packaging, construction, and healthcare.

Bioadhesives Market Segmentation Analysis

By Source

Plant-based held the largest market share around 72% in 2023. This is owing to the availability of raw materials, better bonding characteristics, and a wide range of industrial applications. Obtained from starch, soy protein, lignin, and cellulose, these adhesives provide a green, biodegradable, and non-toxic substitute for petroleum-based adhesives and are in line with global trends toward sustainability. Also, because they stick well, plant-based adhesives are used in packaging, woodworking, construction, and medical applications. Moreover, as the manufacturing sector gears towards reducing carbon footprints and adapting for bio-based materials, substantial, R&D investments have been made in developing the performance, water-resistance, and durability of plant-based adhesives. Additionally, their cost-effectiveness and scalability advantages over animal-based alternatives are also propelling the growth of the bioadhesives market on a green basis.

By Application

Paper & Packaging held the largest market share around 38% in 2023. This is primarily due to the increasing demand for sustainable and eco-friendly packaging solutions. The growing global regulations in using single-use plastics as well as non-biodegradable adhesives have increased the industry shift towards bio-based alternatives to comply with environmental compliance standards like EPA, REACH, and FDA regulations. Starch, soy protein, and cellulose-based bioadhesives are available, offering strong bonding in products such as corrugated boxes, labels, envelopes, cartons, and paper laminations. The packaging industry in particular has witnessed the rapid adoption of bio-based adhesives due to factors such as the e-commerce boom and increasing demand for recyclable and compostable packaging.

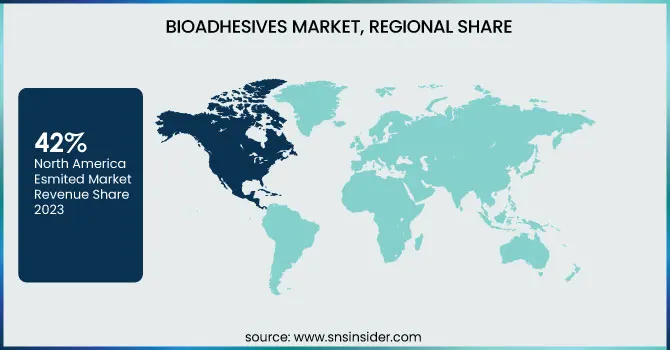

Bioadhesives Market Regional Analysis

North America held the largest market share around 42% in 2023. This is owing to the presence of major manufacturers, developed R&D activities, and stringent regulations that promote sustainable adhesives. In the U.S., stringent regulations on volatile organic compounds (VOCs) and petroleum-based adhesives from the U.S. Environmental Protection Agency (EPA) and Food and Drug Administration (FDA) have been furthering bio-based adoption: the lower emissions associated with bio-based adhesives are therefore increasingly implemented as substitutes. Moreover, the presence of matured paper & packaging industry is supported by rising e-commerce & demand for sustainable packaging solutions in the region. The dominance of bioadhesives due to the construction and woodworking sectors, which incline sustainable trends driving the adoption of low-emission and biodegradable adhesives in structural, flooring, and furniture applications. Additionally, higher investments in biotechnology and innovation have resulted in high-performance plant-based and medical bioadhesives, which in turn are contributing to driving the plant-based and medical bioadhesives market toward several applications in healthcare and surgical sites. North America continues to be the largest market for bioadhesives, owing to the presence of leading producers of bioadhesives and favorable government policies.

Asia Pacific held a significant market share in 2023. This is owing to the rapid growth of the end-use industries, supporting environmental regulations, and rising demand for sustainable products. The application of bio-based adhesives in paper & packaging, construction, woodworking, and medical applications has increased in countries such as China, India, and Japan. The booming e-commerce and packaging industry in the region along with the steps taken by various governments to support environmentally friendly solutions to the reduction of plastic waste is further driving the biodegradable adhesive demand. Furthermore, growing industrialization and infrastructure development across the Asia Pacific region are further propelling the availability of bioadhesives for construction and woodworking applications.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Henkel AG & Co. KGaA (Technomelt Supra ECO, Loctite)

-

H.B. Fuller Company (Fulltak SE 8301, Swifttak 5730)

-

DuPont de Nemours, Inc. (Liveo MG 7-9960 Soft Skin Adhesive, DuPont Hytrel)

-

Arkema SA (Sartomer Specialty Adhesives, Bostik Born2Bond)

-

Ashland Global Holdings Inc. (Aroset PSAs, Flexcryl)

-

Beardow Adams Group (Prodas Bio, BAMFutura)

-

Paramelt BV (Paraflex, Pearlstick)

-

Jowat SE (Jowatherm GROW, Jowacoll)

-

Ingredion Incorporated (Ecomass Adhesives, PureCircle)

-

EcoSynthetix Inc. (DuraBind, EcoSphere)

-

Tate & Lyle PLC (Bio-Agri Adhesives, Staramic)

-

Danimer Scientific (Nodax PHA Adhesives, Danimer 219)

-

The Compound Company (Yparex, EcoForte)

-

Premier Starch Products Pvt. Ltd. (GreenBond, EcoStick)

-

Avebe (Solvitose, Etenia)

-

Follmann GmbH & Co. KG (Folco Melt, Folco Bond)

-

Adhesives Research, Inc. (ARclad IS-8026, ARcare 90001)

-

Sika AG (SikaBond R&B-100, SikaMelt)

-

Momentive Performance Materials Inc. (SilGrip PSA810, CoatOSil)

-

3M Company (Scotch-Weld Bio-based Adhesive 6700NS, 3M Fastbond)

Recent Development:

-

In May 2023, H.B. Fuller acquired Beardow Adams, a leading industrial adhesive manufacturer based in the UK. This acquisition aims to strengthen H.B. Fuller's market presence by broadening its customer base and enhancing manufacturing capabilities across Europe and the United States.

-

In October 2023, DuPont launched the Liveo MG 7-9960 Soft Skin Adhesive, specifically developed for advanced wound care dressings and the secure, long-term adherence of medical devices to the skin.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.01 Billion |

| Market Size by 2032 | US$ 15.15 Billion |

| CAGR | CAGR of 8.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Plant-based, Animal-based) • By Application (Paper & Packaging, Construction, Woodworking, Personal Care & Cosmetics, Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henkel AG & Co. KGaA, H.B. Fuller Company, DuPont de Nemours, Inc., Arkema SA, Ashland Global Holdings Inc., Beardow Adams Group, Paramelt BV, Jowat SE, Ingredion Incorporated, EcoSynthetix Inc., Tate & Lyle PLC, Danimer Scientific, The Compound Company, Premier Starch Products Pvt. Ltd., Avebe, Follmann GmbH & Co. KG, Adhesives Research, Inc., Sika AG, Momentive Performance Materials Inc., 3M Company |