Rubber Processing Chemicals Market Report Scope & Overview

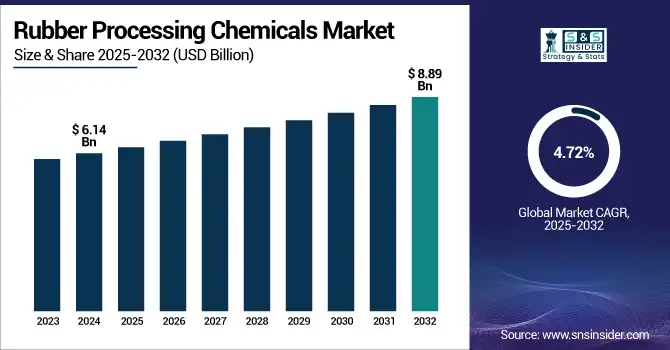

The Rubber Processing Chemicals Market size was USD 6.14 billion in 2024 and is expected to reach USD 8.89 billion by 2032, growing at a CAGR of 4.72% over the forecast period of 2025-2032.

To Get more information on Rubber Processing Chemicals Market - Request Free Sample Report

Rubber Processing Chemicals market analysis highlights increasing utilization in the automotive sector. The growth is driven by the increase in the global production and sales of vehicles (including trucks) and both continue their robust expansion, which further leads to an upsurge in demand for tires, seals, hoses, belts, and other rubber items that need to withstand a lot of kilometers and outside (as per AFPM) stresses and eventually wear and tear. This creates a need for very high-performance rubber processing chemicals, such as accelerators, anti-degradants, and processing aids, as these components require stringent performance, durability, and safety standards. Moreover, increased emphasis on fuel economy and preference for lighter-weight material in automobiles has compelled manufacturers to use advanced rubber technology, and this trend is expected to further augment the demand for these chemicals and drive the rubber processing chemicals market growth.

According to the data from the Open Government Data (OGD) Platform, the production of passenger vehicles in India rose to 4,901,840 units in 2023–24 from 4,587,116 units in 2022–23. With so many vehicles on the road, the demand for high-quality rubber components, including tires, hoses, and seals, is also on the rise, driving the vehicle manufacturing market forward.

Rubber Processing Chemicals Market Size and Forecast

-

Rubber Processing Chemicals Market Size in 2024: USD 6.14 Billion

-

Rubber Processing Chemicals Market Size by 2032: USD 8.89 Billion

-

CAGR: 4.72% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Rubber Processing Chemicals Market Trends

-

Rising demand for tires, automotive components, and industrial rubber products is driving the rubber processing chemicals market.

-

Increasing use of accelerators, antioxidants, vulcanizing agents, and softeners is boosting product performance and efficiency.

-

Growing automotive production and industrialization are fueling market expansion.

-

Focus on improving durability, elasticity, and heat resistance is shaping chemical formulation trends.

-

Adoption of eco-friendly and sustainable chemicals is gaining traction due to environmental regulations.

-

Technological advancements in polymer chemistry are enhancing processing and product quality.

-

Collaborations between chemical manufacturers, rubber producers, and research institutions are accelerating innovation and development.

Rubber Processing Chemicals Market Growth Drivers:

-

Growing Demand for High-Performance and Specialty Rubber drives the Market Growth

The increasing requirement for high-performance and specialty rubber is one of the main driving factors behind the growth of the rubber processing chemicals market. Rubber materials with better performance properties, such as elasticity, durability, heat, wear, and chemical resistance, and resistance to weathering, are serving industries of every kind, from automotive, aerospace, industrial machinery, and consumer goods. This trend in high-spec rubber applications has led to increased use of high-performance processing chemicals that are required for enhanced processing– specific process chemicals which imparts improved physical properties in processed rubber compounds such as processability, mechanical properties, fatigue resistance, vulcanization chemicals oil and heat resistance, ozone and UV stability, fire resistance, and other specifications of the final rubber products.

As per the Rubber Board, India is the third-largest producer and fourth-largest consumer of natural rubber in the world. It has around 6000 rubber units, including all types of industries including large-scale, medium-scale, and small-scale, producing around 35000 rubber products. It employs more than 400,000 workers and is a major driver of income throughout the economy.

Rubber Processing Chemicals Market Restraints:

-

Complex Manufacturing Processes May Hamper the Market Growth

The manufacture of rubber processing chemicals is complex, hence hindering the growth of the rubber processing chemicals market. Rubber additives, including accelerators, anti-degradants, and flame retardants, rubber chemicals industry are specialty chemicals produced using advanced technology and precise chemical reactions that are strictly controlled. This complexity requires heavy investment in research & development, skilled labor, and advanced manufacturing facilities. Furthermore, environmental and safety regulations also pose issues for manufacturers as they try to maintain product quality. This makes it difficult for smaller businesses to enter or establish themselves in the market, reducing competition and innovation. As a whole, they can hinder the broader market from growing, because only the established players with deep pockets can afford to navigate all these manufacturing challenges efficiently.

Rubber Processing Chemicals Market Opportunities:

-

Increasing Adoption in Healthcare and Medical Devices Creates an Opportunity in the Market

Rubber processing chemicals market, as medical and healthcare devices are gaining adoption This creates an attractive opportunity for the market. Health care requires quality, sturdy rubber solutions that these rubber manufacturers make use of in the form of gloves, tubing, seals, and also different medical tools that feature direct contact with clients. Such products, which need a certain level of rubber processing chemicals in order to improve their functionality, biocompatibility, and protection against sterilization.

With an upsurge in healthcare infrastructure facilities worldwide and the rise in demand for sophisticated medical devices, manufacturers are looking to develop rubber materials that conform to stringent regulatory standards while ensuring end-user or patient safety. The paper addition, this random phenomenon propels the demand for novel chemical additives which making space for opportunities for growth and new product evolution in the rubber processing chemicals market and driving the rubber processing chemicals market trends.

The U.S. government has approved substantial investments to bolster the pharmaceutical and medical device manufacturing sectors. These investments aim to enhance domestic production capabilities and reduce reliance on foreign supply chains.

Moreover, the U.K. government has recognized life sciences as a key growth sector, committing up to USD 640 million to enhance the manufacturing of treatments and medical devices. Despite facing challenges in attracting foreign investments, the U.K.'s strong research base and infrastructure continue to support innovation in medical technologies.

Rubber Processing Chemicals Market Segment Analysis

By Product, Anti-degradants segment dominates the Rubber Processing Chemicals Market.

Anti-degradants held the largest Rubber Processing Chemicals market share, around 48%, in 2024. It is used as it serves two main functions of improving the durability and performance of rubber products by preventing degradation from heat, oxygen, ozone, and other environmental factors. Such chemicals are commonly found in tires, auto parts, and many industrial rubber products used today, especially those that require long-life performance with good aging resistance. Rising demand for highly durable and long-lasting rubber components, in particular those used in the automotive and construction sectors, has seen an increase in the use of anti-degradants.

Accelerators held a significant Rubber Processing Chemicals market share as they provide momentum toward vulcanization that commercializes the fundamentals of vulcanizing. These compounds shorten the vulcanization period and temperature range, thus optimizing the manufacturing process and lowering its costs. They are most used for tyre production, hose and belt production, and numerous other automobile and industrial rubber products where high resistance against wear, along with precise mechanical properties, are desired.

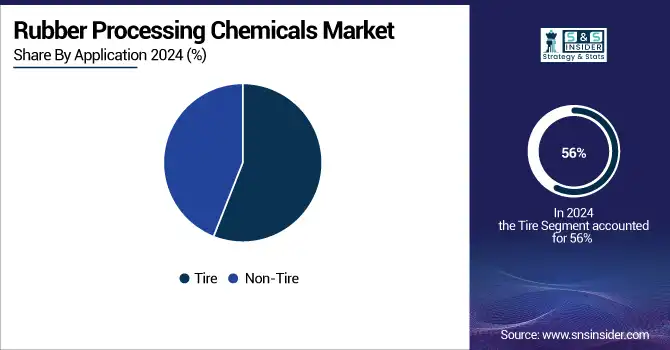

By Application, Tire segment dominates the market.

The Tire segment held the largest market share, around 56%, in 2024 owing to high global consumption of automotive tires in passenger vehicles, commercial trucks, and two-wheelers. As indispensable parts of a vehicle that need specific mechanical properties relating to resistance to wear and heat, elasticity, and traction, all these properties are improved using rubber processing chemicals including anti-degradants, accelerators, and processing aids for making tires. The growing production of vehicles, primarily in developing nations, and rising replacement tire demand have led to high consumption of these chemicals.

The non-tire segment holds a significant market share in the rubber processing chemicals market due to the consistency of seals, gaskets, hoses, belts, footwear, medical devices, and rubber parts for machinery and construction. These applications require properties such as flexibility, chemical resistance, weatherability, and durability, which are basically achieved by rubber processing chemicals such as accelerators, anti-degradants, and flame retardants. Growth in industries, such as construction, healthcare, industrial manufacturing, and consumer goods has led to increased demand for high-performance rubber products.

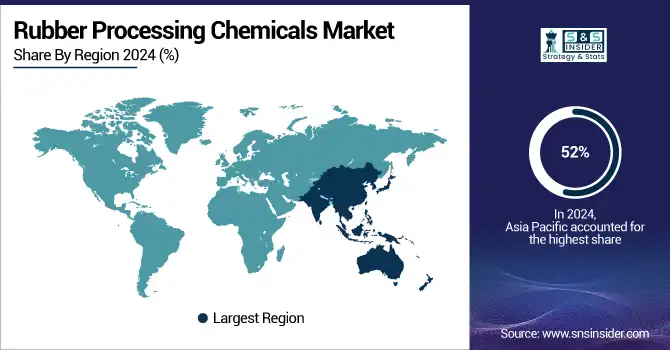

Rubber Processing Chemicals Market Regional Analysis

Asia Pacific Rubber Processing Chemicals Market Insights

Asia-Pacific held the largest market share, around 52%, in 2024. It is owing to rapid industrialization, high production of automobiles, and demand for rubber products in various end-use industries in that region. Countries, such as China, India, Japan, and South Korea, among others, serve as key markets for automotive manufacturing, tire production, and industrial goods are major consumers, and it is expected to drive the regional rubber processing chemicals market in the forthcoming years. The region's dominance is further reinforced by the availability of low-cost labor, the availability of raw materials, and government policies, broadly promote manufacturing and infrastructure. Moreover, the increasing number of people belonging to the middle-class section, coupled with the growing use of urbanization, has boosted the demand for automobiles, footwear, consumer goods, and construction materials, thus leading to hot rubber consumption.

In April 2023, China Petroleum & Chemical Corporation (Sinopec) is starting up its new copolymer production facility located in Hainan. This facility has an annual capacity of 170,000 tons for Styrene-Butadiene-Styrene (SBS) and Styrene-Ethylene-Butylene-Styrene (SEBS) copolymers and will be one of the largest production plants globally.

North America Rubber Processing Chemicals Market Insights

North America Rubber Processing Chemicals market held a significant market share and is the fastest-growing segment in the forecast period due to the presence of a well-established automotive, aerospace, and industrial manufacturing sector and the high demand for advanced rubber products. Increasing demand for high-performance, long-lasting, and specific rubber components in the region is driving the use of processing chemicals, which include accelerators, anti-degradants, and flame retardants. North America is also aware of technological innovations and research, which leads to trends toward more green and efficient rubber formulations. Regulatory agencies such as the EPA also promote safer, sustainable chemicals, driving the manufacturing industry toward more innovative processing technologies for green chemistry.

The U.S Rubber Processing Chemicals market size was USD 0.845 billion in 2024 and is expected to reach USD 1.35 billion by 2032 and grow at a CAGR of 6.10% over the forecast period of 2025-2032. The country’s growth is driven by an established industrial base, technology-driven innovations, and growth across various sectors, including automotive, aerospace, healthcare, and construction. The U.S. is one of the largest producers and consumers of vehicles, resulting in high demand for tires and rubber parts, which demand a range of processing chemicals to optimize performance, durability, and safety. Due to Ghana's significant concentration on R&D and advancement, advanced and environmentally friendly rubber compounds could be produced to satisfy progressing environmental regulations enforced by regulatory authorities, such as the EPA.

In April 2023, Ecore International purchased 360 Tire Recycling Group. Ecore International, which makes recycled rubber products in the U.S., has purchased 360 Tire Recycling Group to increase its sources of recyclable rubber tires and broaden its manufacturing capacity.

Europe Rubber Processing Chemicals Market Insights

Europe is expected to hold a significant market share during the forecast period owing to its long-established automotive, manufacturing, and construction sectors that require superior quality rubber products. A number of top tire and rubber product producers that use high-performance rubbers and rubbers to meet the toughest performance and durability specifications are located in the region. Additionally, the high-level emphasis on environmental regulations and sustainability in Europe has further induced innovations in sustainable and safer chemical formulations, driving the growth of the market. Moreover, the large number of chemical manufacturers and rampant investments in R&D have resulted in the presence of advanced rubber processing solutions, which are being made available by the rubber processing chemicals companies being made available.

Middle East & Africa and Latin America Rubber Processing Chemicals Market Insights

The Rubber Processing Chemicals Market in the Middle East & Africa and Latin America is witnessing steady growth, driven by expanding automotive, construction, and industrial sectors. Rising demand for high-performance rubber products, coupled with government initiatives supporting industrialization and infrastructure development, is boosting adoption. Increasing investments in manufacturing facilities and growing awareness of advanced chemical additives for enhanced durability, elasticity, and processing efficiency are further accelerating market expansion in these regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Rubber Processing Chemicals Market Competitive Landscape:

LANXESS AG Overview:

LANXESS AG is a leading specialty chemicals company headquartered in Germany, focusing on high-performance chemical products and additives for diverse industries, including automotive, construction, and rubber processing. The company specializes in producing innovative solutions such as polymer additives, high-performance plastics, and advanced intermediates. With a strong commitment to sustainability and technological advancement, LANXESS leverages research and development to deliver high-quality, efficient, and environmentally friendly chemical solutions that meet evolving global industrial demands.

-

In October 2023, LANXESS introduced new bio-based vulcanizing agents from plant oils. These agents are designed to enhance sustainability by reducing dependence on petrochemicals, addressing the growing demand for eco-friendly solutions in the rubber market.

Arkema S.A. Overview:

Arkema S.A., a French multinational specialty chemicals and advanced materials company, develops innovative chemical solutions for industries such as construction, automotive, electronics, and rubber processing. The company focuses on high-performance polymers, adhesives, coatings, and additives, with an emphasis on sustainability, efficiency, and technological innovation. Arkema combines global expertise with local operations to deliver products that improve performance, safety, and durability across a wide range of industrial applications.

-

In September 2023, Arkema cooperated with a major research institute to develop AI-driven predictive maintenance systems for rubber parts. This initiative aims to enhance performance and prevent failures by maximizing product durability and extending the lifespan of rubber components.

Key Players:

-

Eastman Chemical Company

-

Solvay S.A.

-

Arkema S.A.

-

BASF SE

-

Akzo Nobel N.V.

-

China Petroleum & Chemical Corporation (Sinopec)

-

Emerald Performance Materials LLC

-

Behn Meyer Group

-

Hexpol AB

-

Lanxess Rubber Additives

-

RTP Company

-

Cabot Corporation

-

Wacker Chemie AG

-

ChemChina

-

Nocil Ltd.

-

Lubrizol Corporation

-

Omnova Solutions Inc.

-

Flexsys Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.14 Billion |

| Market Size by 2032 | USD 8.89 Billion |

| CAGR | CAGR of 4.72% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Anti-degradants, Accelerators, Flame Retardants, Processing Aid/Promoters, Others) •By Application (Tire, Non-Tire) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Lanxess AG, Eastman Chemical Company, Solvay S.A., Arkema S.A., BASF SE, Akzo Nobel N.V., China Petroleum & Chemical Corporation (Sinopec), Sumitomo Chemical Co., Ltd., Emerald Performance Materials LLC, Behn Meyer Group. |