Biohacking Market Report Scope & Overview:

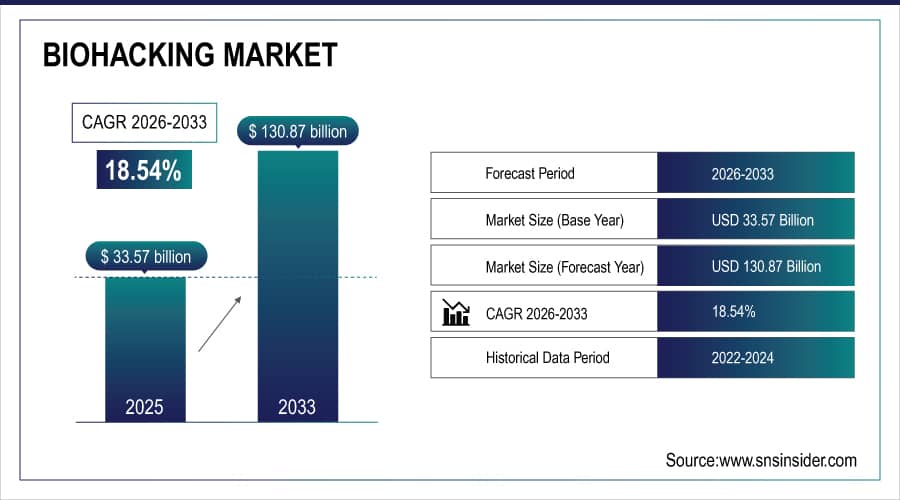

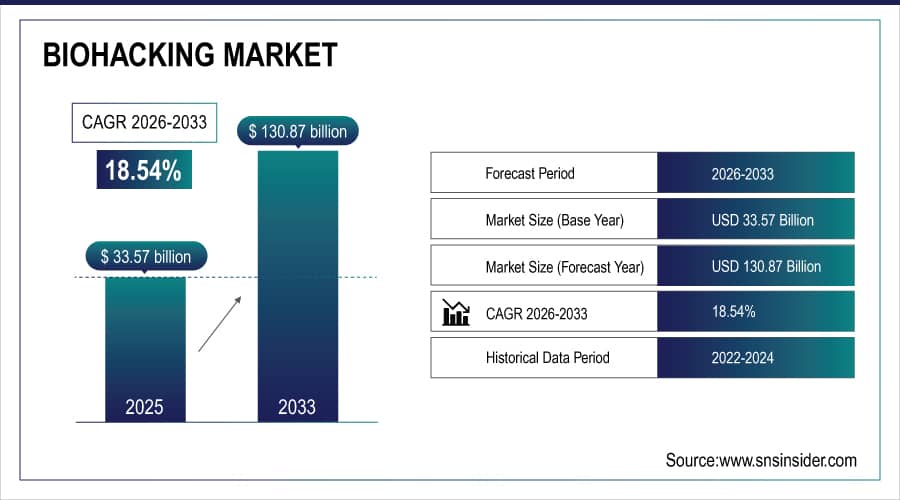

The Biohacking Market size is estimated at USD 33.57 Billion in 2025 and is expected to reach USD 130.87 Billion by 2033 and grow at a CAGR of 18.54% over the forecast period of 2026-2033.

The global biohacking market growth is driven by a rise in consumer demand for customized health optimization, fueled by developments in DIY biology kits, wearable biosensors, and nootropics. The main drivers are the desire for improved cognitive and physical performance, the emergence of quantified self-movement, and growing health consciousness. Both the consumer and professional healthcare sectors are experiencing strong growth as a result of the increased acceptance of implanted technology for continuous health monitoring and the incorporation of artificial intelligence for personalized data analytics.

For instance, in February 2025, the FDA’s clearance of a new class of over-the-counter genetic wellness kits spurred a 22% quarterly sales increase in North America, accelerating mainstream adoption of preventative health biohacking.

Biohacking Market Size and Forecast:

-

Market Size in 2025E: USD 33.57 Billion

-

Market Size by 2033: USD 130.87 Billion

-

CAGR: 18.54% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Biohacking Market - Request Free Sample Report

Biohacking Market Trends:

-

Proliferation of AI-powered wearable devices that provide real-time analytics on sleep, stress, metabolism, and cognitive function, enabling personalized lifestyle interventions.

-

Growing consumer experimentation with nootropics and smart drugs for cognitive enhancement, focus, and memory improvement, supported by online communities.

-

Rising adoption of implantable technology, such as continuous glucose monitors (CGMs) and NFC chips, for seamless health tracking and data exchange.

-

Expansion of direct-to-consumer genetic testing and microbiome analysis kits, empowering individuals with actionable insights for diet and supplement optimization.

-

Increasing collaboration between tech startups and pharmaceutical giants to develop advanced biohacking solutions for chronic disease management and prevention.

-

Utilization of blockchain technology for secure, user-owned health data management, enhancing privacy and control over personal biometric information.

-

Regulatory bodies, such as the FDA and EMA developing adaptive frameworks for low-risk wellness devices and nutraceuticals, balancing innovation with safety.

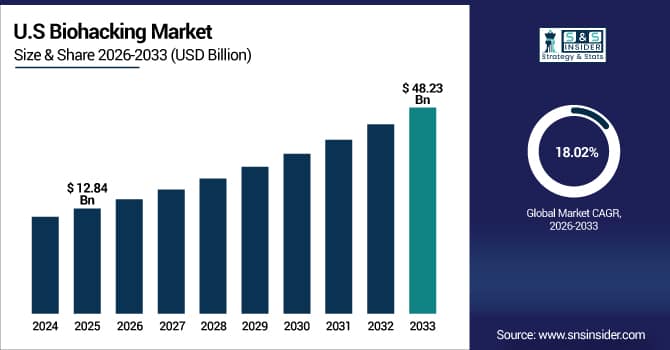

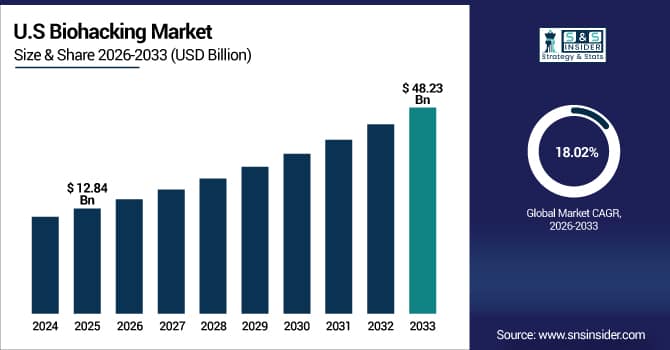

The U.S. Biohacking Market is estimated at USD 12.84 billion in 2025 and is expected to reach USD 48.23 billion by 2033, growing at a CAGR of 18.02% from 2026-2033. Due to its early adopters, high disposable income, and technology-driven healthcare culture, the United States holds the largest market share in the world. Strong venture capital investments in health-tech businesses, the broad availability of wearables and supplements, and a thriving DIY biology industry are all driving market expansion. Additionally, the U.S. is the leading regional market due to its large concentration of top IT and biotech companies and proactive regulatory procedures for digital health technologies.

Biohacking Market Growth Drivers:

The market for biohacking is primarily driven by the convergence of biotechnology, information technology, and nanotechnology, which democratizes access to cutting-edge technologies for health optimization. Consumers can now conduct comprehensive health monitoring outside of clinical settings thanks to the shrinking and cost reduction of sensors as well as robust mobile apps for data interpretation. This trend is producing substantial revenue across wearable, implantable, and consumable product segments globally, extending the addressable market from niche enthusiasts to the general wellness population.

For instance, in Q1 2025, sales of AI-integrated wearable biohacking devices in the U.S. grew by ~35% year-over-year, capturing over 28% of the total consumer health tech market share.

Biohacking Market Restraints:

The growth of the biohacking sector is significantly hampered by regulatory ambiguity and serious safety concerns. Because they lack thorough clinical validation, many consumer-grade biohacking products, particularly supplements, genetic modification kits, and implantables, operate in a regulatory gray area. Potential health hazards, product abuse, and liability concerns result from this. In particular, for sophisticated applications involving genetic engineering and unapproved smart pharmaceuticals, the lack of consistent supervision might limit market expansion, undermine customer trust, and discourage mainstream adoption.

Biohacking Market Opportunities:

There is a significant business opportunity when biohacking data streams are integrated with value-based preventative care models and telemedicine platforms. Personalized preventive care plans, early intervention, and remote patient monitoring can all be made possible by continuous biometric data from wearables and implants. Healthcare providers can move from reactive to proactive care due to this synergy, which enhances results and lowers expenses. Collaborations between biohacking businesses and healthcare systems have the potential to greatly increase market size by opening up new reimbursement channels and promoting use in clinical settings.

For instance, in March 2025, a major U.S. health insurer reported that 42% of its premium members now use at least one FDA-cleared biohacking device for chronic condition management, highlighting integration into formal care pathways.

Biohacking Market Segment Analysis:

-

By product, wearables held the largest share of around 36.21% in 2025, and the mobile apps segment is expected to register the highest growth with a CAGR of 20.12%.

-

By application, the diagnosis & treatment segment dominated the market with approximately 35.68% share in 2025, while the forensic science is expected to register the highest growth with a CAGR of 19.87%.

-

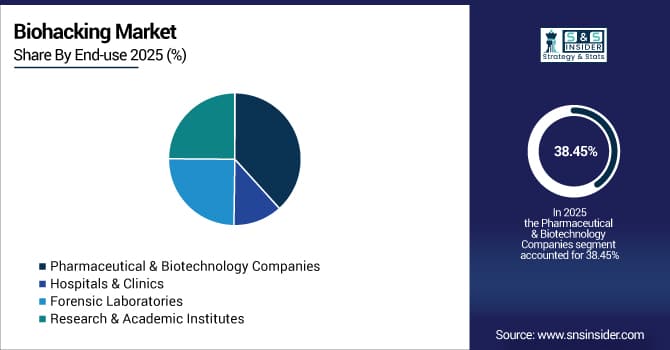

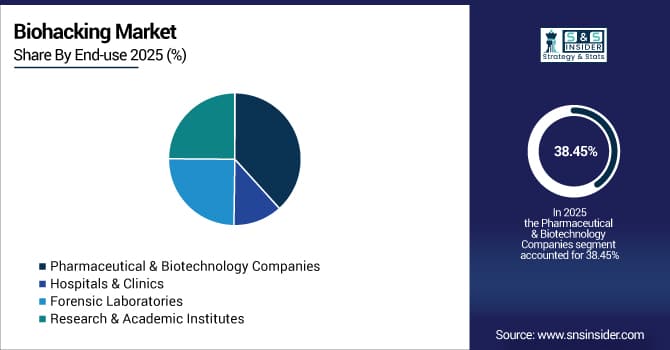

By end-use, pharmaceutical & biotechnology companies accounted for the leading share of nearly 38.45% in 2025, and research & academic institutes segment is forecasted to grow the fastest at a CAGR of 19.95%.

By Product, Wearables Lead the Market, While Mobile Apps Register Fastest Growth

The wearables segment accounted for the highest revenue share of approximately 36.21% in 2025, owing to widespread consumer adoption, real-time health monitoring capabilities, integration with smartphones, and continuous technological improvements in biosensors. Emerging trends include advanced fitness trackers, smartwatches with ECG monitoring, continuous glucose monitors, and sleep tracking devices driving market penetration.

The mobile apps segment is anticipated to achieve the highest CAGR of nearly 20.12% during the 2026–2033 period, driven by increasing smartphone penetration, demand for personalized health coaching, AI-driven recommendations, and gamification of wellness activities. Drivers include rising health consciousness, accessibility of digital health platforms, and growing integration with wearable devices for comprehensive health management.

By Application, the Diagnosis & Treatment Segment Dominates, While Forensic Science Shows Rapid Growth

The diagnosis & treatment segment held the largest revenue share of approximately 35.68% in 2025, owing to extensive use of biohacking techniques for health monitoring, disease prevention, chronic condition management, and performance optimization. Key factors driving this segment are increased consumer awareness of preventive healthcare, adoption of nootropic supplements for cognitive enhancement, and use of wearable devices for real-time health diagnostics.

The forensic science segment is predicted to grow at the strongest CAGR of approximately 19.87% during 2026–2033, driven by advanced DNA profiling techniques, portable genetic sequencing devices, and biomolecular analysis for crime investigation. Some causes include enhanced forensic technologies, government funding for law enforcement innovation, and growing applications in toxicology testing and evidence analysis.

By End-use, Pharmaceutical & Biotechnology Companies Lead, While Research & Academic Institutes Register Fastest Growth

The pharmaceutical & biotechnology companies segment accounted for the largest share of the biohacking market with about 38.45%, owing to extensive research and development activities, drug development applications, clinical trials utilizing biohacking data, and precision medicine initiatives. Reasons driving this segment include increasing investment in personalized therapies, integration of biometric data in drug efficacy studies, and partnerships with technology companies for innovative health solutions.

The research & academic institutes segment is projected to register the highest CAGR of around 19.95% during the forecast period of 2026-2033, driven by expanding research programs in synthetic biology, genetic engineering, neuroscience, and biomolecular studies. Key factors include growing government funding for biotechnology research, increasing number of biohacking laboratories in universities, and collaborative projects exploring human augmentation and longevity research.

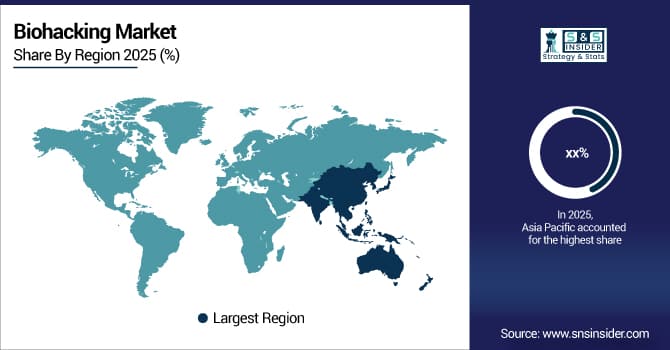

Biohacking Market Regional Highlights:

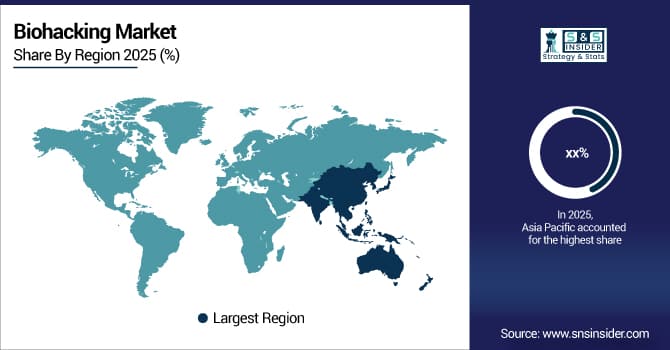

Asia Pacific Biohacking Market Insights:

With a CAGR of 19.78%, Asia Pacific is the biohacking market's fastest-growing category due to rising awareness of technological adoption, chronic illness management, preventative healthcare, and personal health optimization in emerging countries. Rapid urbanization, an increasing number of middle-class people with disposable means, and an increase in the use of wearable technology and health apps are some of the factors driving the market's expansion. Access to biohacking items has been greatly improved by e-commerce sites and digital health firms, particularly in China, India, Japan, and South Korea's cities. Growth is also being stimulated by government initiatives that support wellness programs and healthcare innovation. Growth in the Asia Pacific region is driven by more affordable CRISPR kits, genetic testing services, and nootropic supplements compared to Western markets, as well as by a growing number of tech-savvy individuals who are interested in improving their performance.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Biohacking Market Insights:

Due to the region's high rates of chronic illnesses, such as diabetes and cardiovascular conditions, sophisticated healthcare infrastructure, robust technology ecosystem, and general consumer awareness of wellness optimization, North America accounted for the largest revenue share of the biohacking market in 2025, roughly 38.26%. The widespread availability of wearable technology and smart medications, the high rates of genetic testing adoption, the significant venture capital investment in health tech businesses, and the growing popularity of do-it-yourself biology techniques are all pushing forces. Additionally, the existence of well-known tech firms like Apple and Fitbit, a strong regulatory environment that encourages innovation, and rising consumer spending on healthcare are guaranteeing market supremacy and significant profits in the global biohacking scene.

Europe Biohacking Market Insights:

Due to rising health consciousness, an aging population, a robust biotech research infrastructure, and the expanding use of personalized treatment techniques, Europe has the second-largest biohacking market after North America. Growing use of wearable health monitors, nootropic supplements, cutting-edge diagnostic technologies, supportive government policies for life sciences innovation, and a focus on preventive healthcare are all factors in the market's steady expansion in major European nations like Germany, the UK, France, and the Netherlands.

Latin America (LATAM) and Middle East & Africa (MEA) Biohacking Market Insights:

In Latin America, and Middle East & Africa, the growing incidence of lifestyle-related diseases, increase in healthcare awareness, expanding middle-class population, and improving access to technology support the biohacking market growth. The rising popularity of fitness wearables, nutritional supplements, and telehealth platforms, along with increasing digital health initiatives, will aid early adoption and market expansion. The increasing urban population and rising disposable income in these regions are continuing to encourage market growth driven by younger demographics seeking wellness solutions.

Biohacking Market Competitive Landscape:

Apple Inc. (est. 1976) is a global technology leader whose Apple Watch and HealthKit ecosystem have become foundational platforms for consumer biohacking. The company integrates advanced health sensors with privacy-focused data analytics, setting industry standards for wearable health monitoring and creating a vast ecosystem for third-party health applications.

-

In January 2025, Apple partnered with 23 leading U.S. healthcare systems to integrate anonymized Apple Watch biodata into population health studies for atrial fibrillation and metabolic syndrome, enhancing clinical research capabilities.

Fitbit, Inc. (A Google Company) (est. 2007) is a pioneer in wearable fitness technology, offering a comprehensive suite of devices and software for activity, sleep, and stress tracking. Its integration with Google's AI and cloud infrastructure enables deep health insights and personalized coaching, maintaining a stronghold in the mass-market wearables segment.

-

In March 2024, launched a next-generation sensor array capable of non-invasive monitoring of blood glucose trends and cortisol levels, positioning itself at the forefront of preventive health wearables.

Thorne HealthTech, Inc. (est. 1984) is a science-driven wellness company that bridges the gap between supplements and technology. It offers at-home health testing, personalized supplement regimens based on biomarker data, and digital tools to track outcomes, appealing to data-conscious consumers seeking evidence-based biohacking.

Biohacking Market Key Players:

Biohacking Market Report Scope:

| Market Size in 2025 |

USD 33.57 Billion |

| Market Size by 2033 |

USD 130.87 Billion |

| CAGR |

CAGR of 18.54% From 2026 to 2033 |

| Base Year |

2025 |

| Forecast Period |

2026-2033 |

| Historical Data |

2022-2024 |

| Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Product [Wearables (Wearable Neurotech, Oura Ring, Muse Headband, Others), Implants (Blood Test Implant, Circadia Implant, NFC and RFID Tags, Others), Gene Modification Kits, Smart Drugs, Supplements, Mobile Apps, Others]

• By Application [Synthetic Biology, Genetic Engineering, Forensic Science, Diagnosis & Treatment, Drug Testing]

• By End-use [Pharmaceutical & Biotechnology Companies, Hospitals & Clinics, Forensic Laboratories, Research & Academic Institutes] |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Apple Inc., Fitbit, Inc. (Google), Thorne HealthTech, Inc., Whoop, Inc., Oura Health Oy, Interaxon Inc. (Muse), HVMN, Inc. (Nootrobox), Bulletproof 360, Inc., LEVELS Health, Inc., Nutrisense, Inc., Modern Fertility (Ro), 23andMe, Inc., Ancestry.com LLC, Dexcom, Inc., Abbott Laboratories (FreeStyle Libre), BioViva Science, Inc., Grindhouse Wetware, Synbiota, Inc., The ODIN, Emotiv Inc., Ginkgo Bioworks, Inc., Zymergen, Inc., NeuroSky, Inc., LifeNome, Inc., |