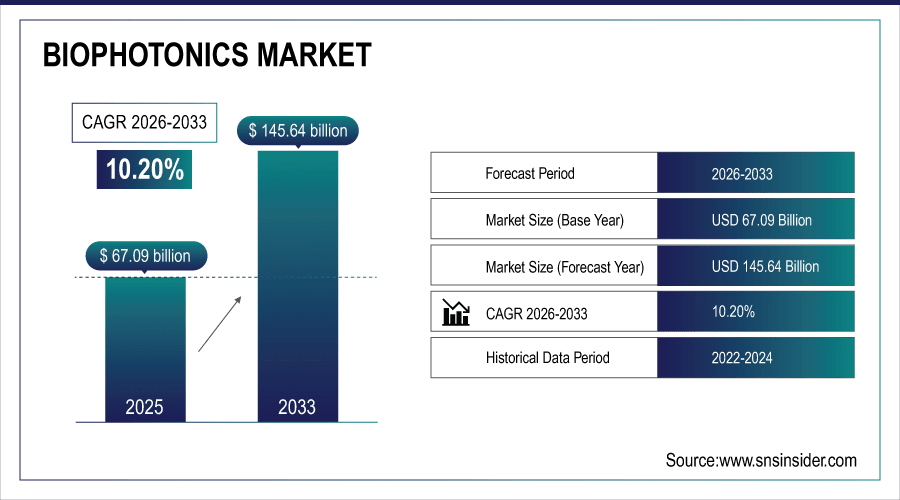

Biophotonics Market Size & Growth:

The Biophotonics Market size was valued at USD 67.09 Billion in 2025E and is projected to reach USD 145.64 Billion by 2033, growing at a CAGR of 10.20% during 2026-2033.

The Biophotonics Market is expanding due to rising demand for advanced diagnostic and imaging technologies in healthcare. Increasing prevalence of chronic diseases is driving adoption of biophotonics for early and accurate detection. Technological innovations, such as minimally invasive imaging and laser-based therapies, are enhancing treatment outcomes. Growing investment in R&D and government support for photonics research further fuel market growth. Additionally, its applications across life sciences, medical diagnostics, and biotechnology strengthen its long-term potential.

Minimally invasive biophotonic procedures reduce hospital stays by 30–50% and cut complication rates by ~40% vs. traditional surgery.

To Get More Information On Biophotonics Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 67.09 Billion

-

Market Size by 2033: USD 145.64 Billion

-

CAGR: 10.20% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Biophotonics Market Trends

-

Biophotonics adoption accelerates as healthcare shifts toward precision medicine, enabling early disease detection and personalized treatments.

-

Rising demand for biophotonic-enabled minimally invasive diagnostic and therapeutic procedures improves patient outcomes and clinical efficiency.

-

Continuous global R&D investments enhance imaging, spectroscopy, and laser technologies, driving higher accuracy, affordability, and reliability.

-

Biophotonics adoption grows in agriculture, biotechnology, and environmental sciences, diversifying applications beyond traditional medical and clinical domains.

-

Supportive policies, photonics research funding, and integration with digital healthcare platforms boost biophotonics adoption and scalability worldwide.

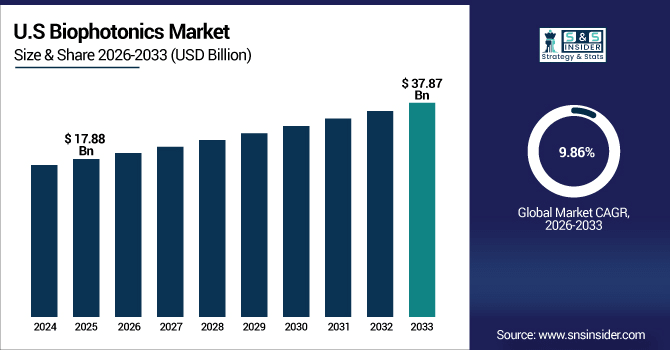

The U.S. Biophotonics Market size was valued at USD 17.88 Billion in 2025E and is projected to reach USD 37.87 Billion by 2033, growing at a CAGR of 9.86% during 2026-2033.

Biophotonics Market growth is driven by strong adoption of advanced imaging and diagnostic technologies in healthcare. The high prevalence of chronic diseases like cancer and cardiovascular disorders boosts demand for non-invasive solutions. Significant investments in R&D by both public and private sectors enhance innovation and commercialization. The country’s robust healthcare infrastructure supports rapid integration of biophotonics in clinical and research applications. Growing focus on personalized medicine and precision diagnostics further accelerates adoption. Additionally, collaborations between universities, biotech firms, and medical device companies strengthen the U.S. market position.

Biophotonics Market Growth Drivers:

-

Rising demand for non-invasive diagnostics and imaging technologies fuels rapid growth in biophotonics solutions.

The increasing prevalence of chronic diseases is driving the adoption of biophotonics in healthcare diagnostics, while growing awareness about precision medicine is enhancing the need for advanced imaging and detection technologies. Continuous R&D investments are improving the performance, accuracy, and affordability of biophotonic tools. At the same time, integration of biophotonics in personalized medicine and clinical applications is accelerating market penetration, with strong government support for photonics research further strengthening long-term market growth.

Point-of-care biophotonic devices (e.g., smartphone-based fluorescence readers) projected to grow 42% in 2024, especially in emerging markets.

Biophotonics Market Restraints:

-

High cost of biophotonics devices and complex regulatory approvals restrict widespread adoption globally.

The advanced technology and precision of biophotonics equipment result in higher procurement and maintenance costs, while limited affordability in developing regions restricts adoption despite strong healthcare needs. Additionally, complex approval processes for medical devices slow commercialization timelines, and the shortage of skilled professionals creates operational challenges in handling advanced instruments. Together, these factors collectively hinder the faster expansion of the biophotonics market.

Biophotonics Market Opportunities:

-

Expanding applications in personalized medicine and life sciences create significant growth avenues for biophotonics.

Biophotonics enables early disease detection and targeted treatment, supporting the global shift toward precision healthcare. Advancements in minimally invasive procedures are expanding its applications in diagnostics and therapeutics, while rising R&D investments drive innovation in imaging, spectroscopy, and laser technologies. Beyond healthcare, adoption in agriculture and biotechnology is opening new non-medical applications, and smart healthcare initiatives coupled with growing digital integration are further enhancing future opportunities for the biophotonics market.

In biotech, biophotonics drives >40% of high-throughput screening systems for drug discovery — market value of $6.2B in 2024.

Biophotonics Market Segment Analysis

-

By Product: In 2025E, lasers are projected to lead the biophotonics market with 40.21% share, while imaging systems will be the fastest growing segment with a CAGR of 10.76%.

-

By Application: Biological sensing & process applications are expected to dominate the market with a 39.21% share in 2025E, whereas live cell imaging will grow at the fastest pace, recording a CAGR of 10.91%.

-

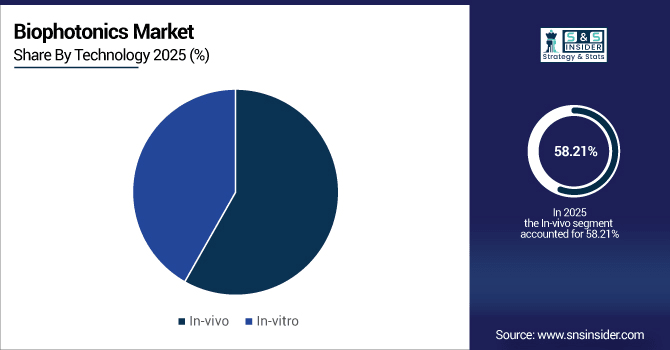

By Technology: In 2025E, in-vivo technology will account for the majority share at 58.21%, while in-vitro technology is anticipated to grow the fastest with a CAGR of 10.49%.

-

By End-User: Medical diagnostics are forecasted to hold the largest share of 55.27% in 2025E, while medical therapeutics will register the fastest growth with a CAGR of 10.70%.

By Technology, In-vivo Lead While In-vitro Registers Fastest Growth

In-vivo technology dominates the biophotonics market with a significant 58.21% share in 2025E, driven by its ability to provide real-time, non-invasive monitoring inside living organisms. Its applications span diagnostics, therapeutic guidance, and advanced imaging techniques. In contrast, in-vitro technology is emerging as the fastest-growing segment, projected to record a CAGR of 10.49%. This is fueled by its adoption in laboratory-based analysis and research settings. The balance of dominance and rapid growth showcases the complementary role of both technologies in healthcare and research.

By Products, Lasers Leads Market While Imaging Systems Registers Fastest Growth

In 2025E, lasers lead the biophotonics market, holding the largest share of 40.21%, owing to their widespread use in imaging, diagnostics, and therapeutic applications. Their precision and efficiency make them indispensable across healthcare and life sciences. On the other hand, imaging systems are witnessing the fastest momentum in the market. With an expected CAGR of 10.76%, these systems are gaining traction due to advances in high-resolution imaging and real-time monitoring. This growth highlights the shift toward more accurate and non-invasive diagnostic techniques.

By Application, Biological sensing & process Dominate While Live Cell Imaging Shows Rapid Growth

In 2025 by biological sensing & process is dominated applications, contributing 39.21% share, largely because of their critical role in disease detection, biosensing, and cellular analysis. The increasing prevalence of chronic and infectious diseases further boosts demand in this segment. Live cell imaging, however, is the standout in terms of growth. With a rapid CAGR of 10.91%, it is expanding quickly due to its importance in drug discovery and cell biology research. This demonstrates the growing reliance on advanced imaging in biomedical studies.

By End-User, Medical Diagnostics Lead While Medical Therapeutics Grow Fastest

Medical diagnostics hold the largest share of 55.27% in 2025E, reflecting the rising use of biophotonics in early disease detection, imaging, and personalized medicine. The growing burden of chronic illnesses and demand for accurate diagnostics have cemented this segment’s leadership. At the same time, medical therapeutics is positioned as the fastest-growing end-user category. With a projected CAGR of 10.70%, it benefits from the growing adoption of photonic-based treatment methods such as laser therapies. Together, these end-user dynamics highlight biophotonics’ role in both prevention and treatment.

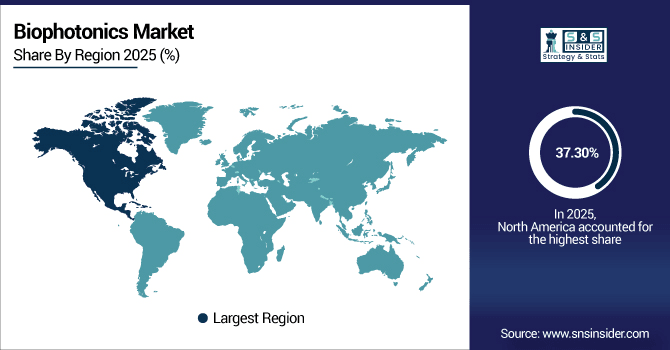

North America Biophotonics Market Insights

In 2025E North America dominated the Biophotonics Market and accounted for 37.30% of revenue share, this leadership is due to technological leadership and advanced infrastructure. High R&D spending and government support drive continuous innovation. Adoption in precision medicine and personalized healthcare is robust. Presence of major industry players accelerates commercialization of new technologies. Strong academic research institutions further enhance market growth.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Biophotonics Market Insights

The U.S. dominates the North American biophotonics market. Strong healthcare infrastructure and funding drive adoption of advanced imaging. Widespread use in oncology, neurology, and ophthalmology boosts demand. A high concentration of biophotonics companies encourages innovation and product launches. Regulatory frameworks support safe commercialization and clinical integration.

Asia-pacific Biophotonics Market Insights

Asia-pacific is expected to witness the fastest growth in the Biophotonics Market over 2026-2033, with a projected CAGR of 10.85% due to expanding healthcare infrastructure and government investments. Rising demand for advanced diagnostics and imaging supports market penetration. Increasing focus on precision medicine and life sciences research boosts adoption. Growing biotechnology and pharmaceutical sectors also contribute significantly. Strong participation from countries like Japan, India, and South Korea accelerates regional growth.

China Biophotonics Market Insights

China holds a central position in the Asia-Pacific biophotonics market. Rapid urbanization and population growth increase healthcare demand. Government support for innovation and R&D in medical devices fuels market development. Adoption of biophotonic solutions in cancer detection and chronic disease management is rising.

Europe Biophotonics Market Insights

In 2025, Europe’s biophotonics market benefits from supportive regulations and rising demand for minimally invasive diagnostics. Countries across the region are investing in healthcare modernization. Academic and clinical research collaborations enhance biophotonics applications. Integration into precision medicine initiatives supports market penetration. Growing awareness about advanced diagnostics strengthens adoption.

Germany Biophotonics Market Insights

Germany leads the European biophotonics landscape. Its advanced healthcare infrastructure supports high adoption levels. Strong presence of medical device manufacturers fuels innovation. Significant investments in research and clinical trials expand applications.

Latin America (LATAM) and Middle East & Africa (MEA) Biophotonics Market Insights

The Biophotonics Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the improving healthcare infrastructure supports gradual adoption. Rising awareness of early diagnostics encourages uptake of biophotonic tools. Cost-effective solutions attract demand in resource-constrained regions. Government and private sector collaborations are opening new opportunities.

Biophotonics Market Competitive Landscape:

Hamamatsu Photonics is a global leader in photonics technology, offering advanced imaging, spectroscopy, and light detection solutions. The company plays a crucial role in biophotonics with its high-sensitivity sensors and imaging systems. Its innovations support applications in cancer detection, neurology, and life sciences research. Continuous R&D investments strengthen its position in healthcare and diagnostics.

-

In August 2025, Hamamatsu Photonics was selected for Japan’s NEDO project to advance quantum computing industrialization, developing ultra-high-speed and high-sensitivity cameras, and spatial light modulators.

Olympus Corporation is a key player in medical imaging and biophotonics technologies. The company provides endoscopes, microscopes, and imaging systems widely used in diagnostics and minimally invasive procedures. Its biophotonics solutions are central to precision medicine and early disease detection. Strong global presence and clinical partnerships drive its market growth.

-

In July 2025, Olympus entered a strategic partnership with Revival Healthcare Capital, co-founding Swan EndoSurgical with an initial investment of at least USD 65 million to develop endoluminal robotic systems for minimally invasive gastrointestinal procedures.

Affymetrix, now part of Thermo Fisher Scientific, is recognized for its expertise in genomics and molecular diagnostics. Its biophotonics-enabled microarray and imaging platforms support research in personalized medicine and biotechnology. The company focuses on improving diagnostic accuracy and life sciences research efficiency. Integration with Thermo Fisher’s portfolio enhances its global impact.

-

In June 2025, Thermo Fisher Scientific launched a new Microarray Pharmacogenomics Research Programme at the European Society of Human Genetics (ESHG) conference. This initiative aims to advance the understanding of genetic variations influencing drug response, thereby supporting the development of personalized therapeutic strategies.

Zeiss is a leader in optical systems and biophotonics applications, particularly in microscopy and medical imaging. Its advanced imaging platforms enable breakthroughs in cell biology, oncology, and neurology research. The company invests heavily in innovation for high-resolution and 3D imaging solutions. Strong collaborations with academic and clinical institutions expand its influence in healthcare.

-

In April 2025, Zeiss introduced the AI-powered ZEISS Research Data Platform for ophthalmic research, enabling seamless integration of clinical and research data to accelerate discoveries.

Key Biophotonics Companies are:

-

Olympus Corporation

-

Affymetrix (Thermo Fisher Scientific)

-

Zeiss

-

Zecotek Photonics Inc.

-

BD (Becton, Dickinson, and Company)

-

Lumenis Ltd.

-

Bio-Rad Laboratories, Inc.

-

Shimadzu Corporation

-

Carl Zeiss AG

-

Danaher Corporation

-

Thermo Fisher Scientific Inc.

-

Oxford Instruments plc

-

IPG Photonics Corporation

-

Nikon Corporation

-

Canon Inc.

-

Bruker Corporation

-

LUMICKS

-

Thorlabs, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 67.09 Billion |

| Market Size by 2033 | USD 145.64 Billion |

| CAGR | CAGR of 10.20% From 2026 to 2033 |

| Base Year | 2024 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Products (Imaging Systems, Lasers, Fiber Optics, Others) • By Application (Biological sensing & process, Live Cell Imaging, Optical Sensing & Detection, Photosynthesis Evaluation, and others) • By Technology (In-vivo and In-vitro) • By End-Use (Medical Therapeutics, Medical Diagnostics, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Hamamatsu Photonics, Olympus Corporation, Affymetrix (Thermo Fisher Scientific), Zeiss, Zecotek Photonics Inc., BD (Becton, Dickinson, and Company), PerkinElmer Inc., Lumenis Ltd., Bio-Rad Laboratories, Inc., Shimadzu Corporation, Carl Zeiss AG, Danaher Corporation, Thermo Fisher Scientific Inc., Oxford Instruments plc, IPG Photonics Corporation, Nikon Corporation, Canon Inc., Bruker Corporation, LUMICKS, Thorlabs, Inc. |