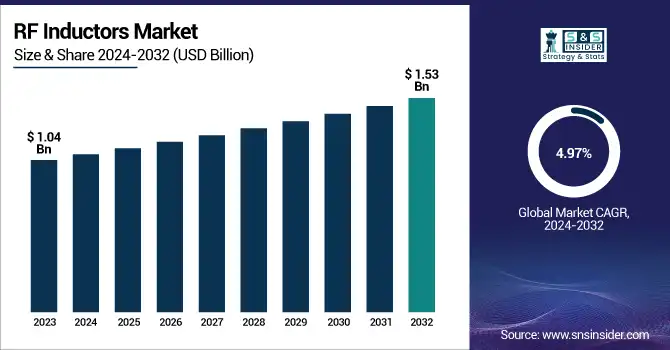

RF Inductors Market Size & Growth:

The RF Inductors Market Size was valued at USD 1.04 billion in 2024 and is expected to reach USD 1.53 billion by 2032, at a CAGR of 4.97% from 2025-2032.The Global Market is segmented by type, application, and region in addition to a market dynamics section with drivers, restraints, opportunities, and challenges. The market is expected to grow due to increasing applications of compact high frequency devices in smartphones, automotive electronics, and wireless communication systems. RF Inductors Market analysis highlights evolving trends and technical advancements globally. The swift deployment of 5G, EV growth spurt, and miniatures trends boost the adoption and enhancement of the innovation, especially through key regions including Asia Pacific and North America making it a long-term industry size growth engine.

To Get more information on RF Inductors Market- Request Free Sample Report

For instance, over 60% of global mobile network subscriptions are 5G-enabled, requiring advanced RF front-end components including inductors.

The U.S. RF Inductors Market size was USD 0.21 billion in 2024 and is expected to reach USD 0.30 billion by 2032, growing at a CAGR of 4.61% over the forecast period of 2025–2032.

The U.S. is leading the market due to rapidly increasing adoption of 5G networks, advanced automotive electronics, and booming IoT applications. Supportive domestic demand has been bolstered by the huge investments in wireless infrastructure and continuous innovation in consumer electronics design by leading U.S. firms. The U.S. is poised to support the further ascendancy of the overall market, with high-performance RF inductors proliferating through key sectors, including telecom, defense, and automotive.

For instance, electronics make up nearly 40% of a vehicle’s value in the U.S., much of which involves RF-based communication and control systems.

RF Inductors Market Dynamics:

Key Drivers:

-

Rapid 5G Deployment and Rising Demand for Compact High-Frequency Components in Wireless Communications are Boosting Market Expansion Across Industries

The global demand for RF inductors to support higher frequency and low-loss performance in 5G infrastructure rollouts is a powerful engine stimulating the growth of the market. These elements are essential for RF front-end modules for smartphones, base stations, and connected devices. With increasing data rates and lower latency requirements, RF inductors are essential to maintain proper signal filtering and impedance matching. As mobile networks transition to millimeter-wave frequencies, small, high-Q inductors become more important for telecom and consumer electronics, leading to higher adoption of this segment. This is driving ongoing innovation from component suppliers to satisfy performance and size requirements.

For instance, modern 5G smartphones integrate over 50 RF filters and inductors to support multiple frequency bands and carrier aggregation.

Restraints:

-

Miniaturization Limits in RF Inductors Constrain their Efficiency, Power Handling, and Performance in Next-Generation Compact Device Architectures

Due to the downsizing of end-user devices, such as smartphones and wearables, RF inductors must also downsize, which is approaching the limit of the current materials and design capabilities. Nevertheless, miniaturization could result in low inductance values, high losses, and unsatisfactory thermal stability. High-speed, high-frequency applications suffer from these trade-offs in performance. To increase speed, manufacturers usually need to mount wider wheels, but that can impact Q-factor and current, not to mention wide, strong wheels cost more and take up useful frame space. This challenge limits deploying in those ultra-compact designs, where both tight space constraints and power efficiency are of utmost significance, which further slows down the pace towards product integration.

Opportunities:

-

Growing Adoption of IoT Devices and Smart Wearables Creates a Strong Opportunity for RF Inductors in Ultra-Compact and Battery-Efficient Designs

The growth of IoT and smart wearables from fitness trackers to connected home systems is providing new opportunities for RF inductors. These devices are largely dependent on efficient wireless communication and high-compact circuit. RF inductors enable signal filtering, impedance matching and EMI suppression in Bluetooth, Zigbee, and Wi-Fi modules deployed in compact form factors. RF Inductors Market growth is fueled by rising wireless device integration. Market expansion into health tech, agriculture, and industrial monitoring has brought demand for tailored low-profile inductors that support high-frequency applications with low power consumption, an opportunity to which manufacturers are quickly responding.

For instance, over 80% of consumer IoT devices use either Bluetooth Low Energy, Zigbee, or Wi-Fi, which require precise RF inductors for signal integrity.

Challenges:

-

Supply Chain Fragility and Geographic Concentration of Component Manufacturing Pose Risks to Continuity and Scalability in Global RF Inductor Production

RF inductor manufacturing takes place almost entirely in East Asia, primarily Japan, South Korea, and China. Such geographical concentration creates exposure to natural disasters, geopolitics and logistics disruptions that have been visible in recent global events. Furthermore, the extreme specificity of processes and material dependencies makes it hard to pivot production quickly. These vulnerabilities pose a formidable challenge to manufacturers striving to guarantee continuously available supply while simultaneously addressing global demand spikes and ensuring conformance to stringent quality standards, all while design cycles are shrinking and demand is to be catered to across industries.

RF Inductors Market Segmentation Analysis:

By Type

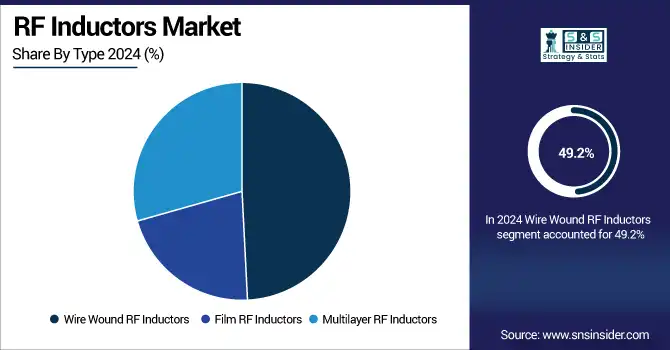

In 2024, Wire Wound RF Inductors accounted for the highest revenue share by 49.2%, attributable to its high current handling capacity, high Q-factor, and strength in power dominant applications. These are commonly used magnetics in automotive electronics, power amplifiers, and RF filters due to their stable performance under thermal and electrical stress. RF Inductors Market trends show rising preference for high-Q components. Examples include high-reliability wire wound inductors for industrial and telecom applications where companies, such as Coilcraft continue to lead. The robustness and wide range of operation make them ideal for high performance circuits in various industries.

Multilayer RF Inductors are expected to grow with the fastest CAGR of 5.52% during the forecast period 2024-2032 owing to increasing demand for small size and surface mountable devices which will be used in smartphones, wearables, and IoT devices. Operating on the principles of ceramic substrates and integrated structure, these inductors provide high performance in a smaller size. Murata Manufacturing, of multilayer inductors, provides advanced solutions with ultra-complex miniaturization suitable for small devices. For instance, they are being manufactured cost-efficiently at a mass scale and are effective and efficient over high frequency regions, enabling their commercial usage in consumer electronics and mobile applications.

By Application

Mobile Phone accounted for the largest RF Inductors Market share of 31.6% in 2024 due to the international smartphone consumption and fast 5G integration. RF inductors are key building blocks of RF front-end modules where they are playing a major role to maintain the signal integrity and also spectrum efficiency. This booming demand has driven major manufacturers, such as Samsung Electronics to introduce new multi-band mobile platforms with advanced inductive components that serve essential needs. The increasing sophistication of antennas and advances in mobile SoC technology only reinforce the entrenched position of mobile applications in the market.

The automotive segment will grow at the fastest CAGR of 6.04% over the period of 2024 to 2032 spearheaded by the increasing adoption of electric vehicles and autonomous systems driving the segment growth. RF inductors are critical components used in radar, EV powertrains, infotainment units, and wireless connectivity modules. For instance, TDK Corporation is also innovating automotive-oriented inductors that would offer high-temperature and EMI protection. With V2X communication, extended ADAS, and electric drivetrains taking significant root in the automotive domain, the demand for reliability and high-frequency inductors have drastically increased.

RF Inductors Market Regional Overview:

North America is one of the prominent shareholders within the RF Inductors Market owing to well-developed 5G deployment, greater demand for automotive electronics, and IoT in use. Particularly the U.S. with its well-established tech infrastructure and the presence of industry giants in the region. The market in the region is also expected to be propelled by burgeoning telecom and defense industries, along with the retention of EV gains in the region, thereby providing the market a sustained growth momentum in the next few years across U.S., Canada and Mexico.

-

The U.S. dominates the North American RF Inductors industry due to its advanced telecommunications infrastructure, strong presence of leading semiconductor companies, and high demand from defense, automotive, and consumer electronics sectors, supported by continuous innovation and high R&D investment.

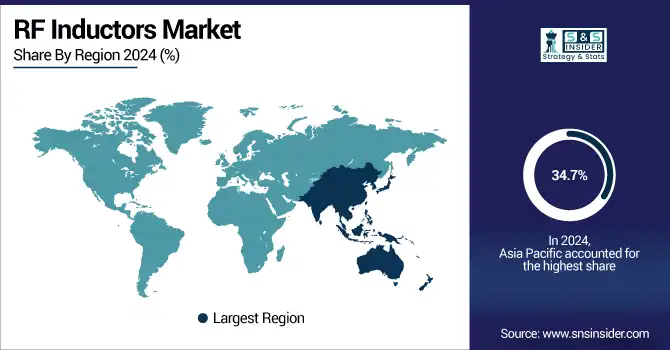

In 2024, Asia Pacific led the RF Inductors Market with the highest revenue share of 34.7%, due to its major contribution to consumer electronics and telecom manufacturing. The presence of major OEMs and semiconductor fabs in countries including China, South Korea and Japan make for high adoption rates for inductors on a large scale. The highest CAGR of 5.78% over the period of 2024-2032 is expected for this region, owing to swift rollout of 5G, increasing electric vehicles manufacturing, and growing investment in telecom infrastructure and smart devices. Government initiatives coupled with increasing R&D activity that supports emerging markets, such as India and Southeast Asia, also remain as key drivers for Asia Pacific to maintain its market leading position.

-

China leads the Asia Pacific RF Inductors Market owing to its massive electronics manufacturing base, rapid 5G network rollout, strong domestic demand for smartphones and EVs, and government-driven support for local semiconductor and electronic component production.

Europe accounts for a significant proportion in the RF Inductors Market as the region have an advanced automotive industry and growing number of 5G infrastructure coupled with booming industrial automation. Countries, such as Germany and France are ahead in terms of EVs and smart mobility innovation. Moreover, the integration of RF inductors into numerous applications is prompted by regulatory surveillance concerning electromagnetic interference (EMI) compliance and energy efficiency.

-

Germany dominates the European RF Inductors Market due to its strong automotive electronics sector, advanced manufacturing infrastructure, and leadership in EV and industrial automation. High demand from OEMs and continuous innovation in RF technologies support its top position in the region.

UAE captures the largest share in the Middle East & Africa RF Inductors Market owing to rapid deployment of 5G technology in the region, growing investments in smart city projects and increasing usage of IoT products across various industrial sectors. Brazil leads the Latin American space owing to its emerging automotive and consumer electronics industry, which, in turn, is being fueled by digital transformation initiatives and rising investments in wireless communication infrastructure.

Get Customized Report as per Your Business Requirement - Enquiry Now

RF Inductors Companies are:

Major Key Players in RF Inductors Market are Murata Manufacturing Co., Ltd., TDK Corporation, Taiyo Yuden Co., Ltd., Coilcraft, Inc., Vishay Intertechnology, Inc., Chilisin Electronics Corp., Würth Elektronik GmbH & Co. KG, Panasonic Corporation, Samsung Electro-Mechanics, Laird Technologies, Bourns, Inc., AVX Corporation , Delta Electronics, Inc., Yageo Corporation, Johanson Technology, Inc., Frontier Electronics Corp., Pulse Electronics, ICE Components, Inc., Sumida Corporation, and Token Electronics Industry Co., Ltd and others.

Recent Developments:

-

In May 2025, Murata launched the ultra-compact LQP01HV_02 series (0.25 × 0.125 mm), targeting high-frequency applications such as automotive PoC and RF front-end modules.

-

In November 2024, TDK unveiled its MLJ1005‑G multilayer inductors for automotive Power‑over‑Coax systems in November 2024, followed by the high-current ADL4532VK wire‑wound series in February 2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.04 Billion |

| Market Size by 2032 | USD 1.53 Billion |

| CAGR | CAGR of 4.97% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Wire Wound RF Inductors, Film RF Inductors and Multilayer RF Inductors) • By Application (Mobile Phone, Consumer Electronics, Automotive, Communication Systems and Others |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Murata Manufacturing Co., Ltd., TDK Corporation, Taiyo Yuden Co., Ltd., Coilcraft, Inc., Vishay Intertechnology, Inc., Chilisin Electronics Corp., Würth Elektronik GmbH & Co. KG, Panasonic Corporation, Samsung Electro-Mechanics, Laird Technologies, Bourns, Inc., AVX Corporation , Delta Electronics, Inc., Yageo Corporation, Johanson Technology, Inc., Frontier Electronics Corp., Pulse Electronics, ICE Components, Inc., Sumida Corporation and Token Electronics Industry Co., Ltd. |