Biostimulants Market Report Scope & Overview:

Get E-PDF Sample Report on Biostimulants Market - Request Sample Report

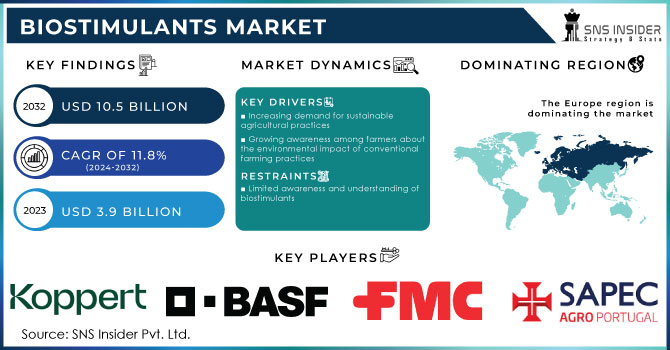

The Biostimulants Market Size was valued at USD 3.9 billion in 2023, and is expected to reach USD 10.5 billion by 2032, and grow at a CAGR of 11.8% over the forecast period 2024-2032.

Rising demand from sustainable agriculture and the need for better crop productivity drive the market. Biostimulants can be natural or synthetic in origin and are applied to plants for their growth with enhanced stress tolerance. It is the biotech innovation, clean environment, and organic farming practices that propel the sector, and hence firms invest heavily in R&D to come up with novel and effective formulations. In April 2024, BASF introduced a new line of advanced biostimulants under the brand Optimax, which help crops optimally absorb the available nutrients and increase stress tolerance. These have been formulated with the best available biotechnology today to meet contemporary problems in agriculture. The launch of Optimax speaks of a more general tendency in the field of developing high-performance solutions capable of sustainable agriculture through greater yield.

In June 2024, Syngenta once again went one step ahead with the introduction of its new biostimulant, GrowBoost, in the market, which uses advanced microbial technology to improve plant growth and resilience. Product expansion is in a bid to answer the growing demand for biostimulants among the farming community. GrowBoost indeed is a remarkable addition to the company's portfolio at a time when biostimulants are much in line with the market trend of adopting latest technologies for enhancing crop performance and sustainability.

Among other important developments in the biostimulant industry during the month of March 2024 has been the acquisition of Plant Health Technologies by Valagro. Such acquisition should boost the position of Valagro in the marketplace in this very marketplace and further broaden the product offering. Strategic moves of industries in these very segments define the competitive nature of the very marketplace at present, with managing increasing importance of consolidating resources behind research activity, along with product innovation in the sector of biostimulants.

The new EU regulation, which entered into force in May 2024, shall help harmonize the application of biostimulants and ensure their safe and effective application, which should be able to bear the sustainability of the environment. Another major driver of demand for such biostimulants is increasing consumer awareness about sustainable agricultural practices, whereby farmers are seeking effective solutions for crop management with less dependence on chemical fertilizers. This growing consciousness and regulation encourage the competitive landscape and innovation stimulated into the biostimulant market.

Market Dynamics:

Drivers:

-

Increasing demand for sustainable agricultural practices

The biostimulants market has seen a fast growth, which is founded on increased demand in sustainable agriculture. This has actually been a rather very important change in view with regard to the kind of environmental care modern agriculture can exercise and the productivity attained. The consumers and producers, therefore, are looking at sustainable solutions toward the conservation of the environment with long-term effects of the use of chemical inputs that will assist in minimizing the negative ecological footprints and enhancing yield. Example In February 2024, Koppert Biological Systems introduced a new range of biostimulants to boost soil health and foster sustainable agriculture. The products in this line incorporate a mixture of natural micro-organisms and improved soil fertility that gives plants a better resilience as demand for environmentally friendly inputs in agriculture continues to peak. For example, in July 2024, Italy-based biostimulant manufacturer Biolchim S.p.A. unveiled the mix of the new biostimulants that the company has developed in order to reduce the dependency on artificial fertilizers. Their new formulation will have organic extracts, which boosts the growth of plants and soil quality, keeping the general trend nowadays in sustainable agriculture. These constitute concrete examples of a more general trend: new biostimulants being developed and marketed as part of overall solutions for enabling sustainable agriculture. Attention to the reduction of chemical inputs, improvement in soil health, and biodiversity enhancement serves to be a trend in biostimulants, falling in with the requirement increases of agriculture-friendly, environmentally friendly farming solutions.

-

Growing awareness among farmers about the environmental impact of conventional farming practices

Awareness is increasing among the farming community on the effect of conventional farming into environmental depletion. As such, it is essentially changing the outlook of the biostimulants market, as the agriculturalists are looking for more and more alternatives that cause reduced ecological harm while increasing crop productivity. The growing concern for the environment is also swelling the tides; they are on the verge of shifting from the traditional, chemical-intensive methods of farming to sustainable and environmentally healthy solutions. As an example, Arysta LifeScience, an international agricultural company, launched its advanced product in the biostimulant segment, EcoGrow, in March 2024, continuing to ensure its operations are environmentally friendly by reducing the use of chemical fertilizers and pesticides. The new product to be launched is expected to use natural compounds and useful microorganisms to revitalize plant and soil health in a sector that is continuously demanding ecologically sound agricultural practices. The second important innovation was a novel class of biostimulant designed by the Japanese world leader in agricultural company, Ishihara Sangyo Kaisha, Ltd. NatureBoost, released in August 2024, is intended to enhance plants' resilience to a broad spectrum of environmental stresses. This product mirrors a wider trend of gradually less harming modes of farming being practiced by farmers, considering that conventional farming leads to such negative consequences as soil degradation and water contamination. Biostimulant technology developments directly respond to the raising awareness of environmental issues that farmers have today; it is a critical trend where agriculture puts itself in a line of accelerated alignment with more sustainable and environmentally conscious practices.

Restraints:

-

Limited awareness and understanding of biostimulants

One major restrain is the limited awareness and understanding regarding biostimulants, whereby many farmers and professionals associated with this industry are still not aware of the benefits accruable from the use of these products or even proper applications. Lack of knowledge is going to hamper its widescale adoption and effective use. For example, in June 2024, AgroTech Innovations, a biostimulant manufacturer, could not corner any sizeable market due to most farmers still remaining unaware of the advantages that its new product, BioMax, would give to them for better yields and greater tolerance of bad climatic conditions. For example, in July 2024, GreenHarvest Ltd., a biostimulant producer, had not yet managed to set up a firm base in North America because farmers were uninformed or unaware of how a biostimulant such as its GrowElite could properly complement traditional farming. These examples illustrate that low awareness and education about biostimulants can be one bottleneck to market growth and innovation diffusion in farming practices.

Opportunities:

-

Increasing demand for organic food presents a significant opportunity for the biostimulant market

The rising demand for organic food opens up a huge opportunity for the biostimulant market, since such products fully agree with the tenets of organic agriculture by improving plant health and productivity without resorting to synthetic chemicals. While consumers increasingly buy organic produce for health reasons and environmental sustainability, farmers seek ways to answer the demand in accordance with organic farming standards. For example, in April 2024, BioAg, an Australian biostimulant producer, came up with EcoBoost Organic, a biostimulant uniquely formulated to pass the stringent tests for organic farming. The product was developed with crop yield and soil health in mind, without compromising on compliance requirements enshrined within organic certification standards that open up the growing organic market. Similarly, Natural Solutions Corp. introduced GreenHarvest Organic in September 2024, a blend of natural ingredients that improves plant growth and tolerance without affecting its organic character. The launch of these products underlines the broader industry trend: biostimulant companies are increasingly putting a stronger and stronger emphasis on organic-compatible solutions in view of the fast-growing consumer demand for organic food. Not only will this shift open new market segments for manufacturers of biostimulants, but it will also shift their products to match the changing expectations within the agricultural sector.

Challenges:

-

Lack of standardized regulations governing the use and labelling of biostimulant products

The absence of a harmonized regulatory framework for use and labelling acts as a big headache within the market, as this leaves uncertainty and irregularity with respect to efficacy and safety. On that note, in January 2024, TerraGrow Solutions, a biostimulant manufacturer, was having problems marketing a new product called GrowSmart due to the existence of a different regional regulation that did not give any clear guidance with respect to labelling. This regulatory ambiguity makes the product-approval process cumbersome and leaves consumers and farmers confused about the advantages and correct use of biostimulants. For instance, variable standards across nations are causing problems with product certification and problems associated with market entry; AgriNexus Inc. has been going through some turbulence regarding the rollout of EcoFertile in August 2024. These examples clearly illustrate how the absence of standardization in legislation and labelling works against the development of markets and the confidence that consumers have in these products.

KEY MARKET SEGMENTS

The seaweed extract segment dominated and accounted for a market share of 40% in the biostimulants market during 2023. This can be attributed to the well-established efficacy and wide spectrum of applications across a variety of crops. Seaweed extracts find widespread acceptance due to the realization that they are an entirely natural, growth-enhancing medium that provides health and tolerance to stress in plants. For instance, Kelp Blue, one of the key manufacturers in this space, announced immense success with its product KelpMax, based on seaweed extracts that will boost crop yields and strength. On the other hand, Alginate Industries reported increasing adoption of their SeaGrow range, thereby re-reinforcing the leadership position of this segment. Their growing popularity might be a result of the fact that seaweed extracts are organic, effective, and there is a growing popular demand for natural and sustainable agricultural solutions.

By Crop Type

Fruits and vegetables dominated the biostimulants market in 2023, with a volume share of around 45%. This may be attributed mainly to the value and intensive rearing of fruits and vegetables that drives the needs for enhancements in crop performance and quality. For instance, strong sales of their biostimulant product VeggieBoost, specifically formulated to improve the growth and yield of vegetables, were reported by AgroTech Innovations. On the other hand, FruitGrow Solutions fared well with their FruitMax biostimulant, designed to improve fruit quality and resistance. It focuses on this segment because of the growing demand for biostimulants that can address specific requirements of high-value crops, ensuring better yield and quality in the competitive fresh produce market.

By Formulation

In 2023, the liquid formulation segment dominated the market with an estimated share of about 60%. Liquid biostimulants are very popular due to easy application and quick uptake by plants, which further enhances their action in a wide spectrum of agricultural practices. For example, BioAgri Solutions declared that it received very good results from its AquaGrow liquid biostimulant, foliarly applied and rapidly taken up by crops. On the other hand, LiquidBoost by GreenLife Technologies did quite well as a liquid concentrated formula designed to effectively deliver nutrients and promoters of plant growth directly into the root system. Some of the reasons that place liquid formulations at the top are multipurpose application and effectiveness, making them very famous among farmers and other agricultural professionals.

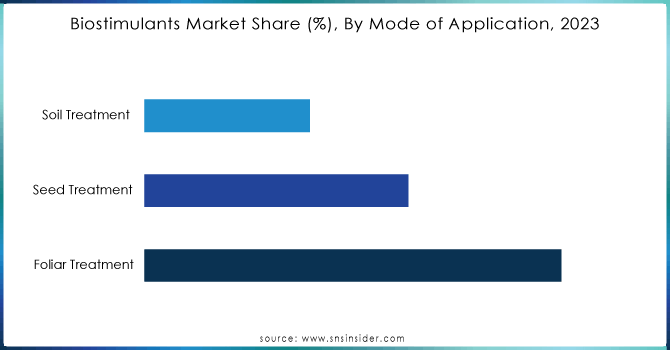

By Mode of Application

The foliar treatment segment dominated the biostimulants market in 2023 and captured a market share of about 55%. This is because foliar treatments are preferred, owing to their instant action and ease of application, as this method allows one to deliver the biostimulants directly onto the leaves of the plants, where it is quickly absorbed and elicits efficient growth responses. For instance, AgroMax Solutions reported brisk sales of its LeafBoost foliar biostimulant, a solution applied to the foliage to enhance health and productivity in plants. Likewise, PlantNourish Inc. gained great success in the market with FoliarGrow, designed to deliver key nutrients and enhancers of growth right into the foliage of plants. One reason could be that foliar treatments can provide quick results on the target growth stages of plants, hence very popular among growers.

Get Customized Report as per your Business Requirement - Request For Customized Report

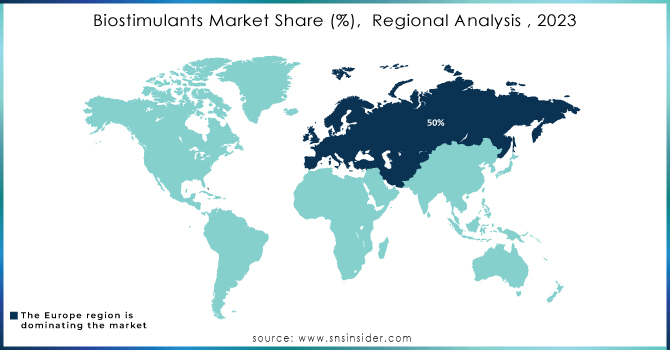

Regional Analysis

Europe dominated the biostimulant market with a share of approximately 50% in 2023. Better agricultural practice, strong regulatory framework, and increasing awareness towards sustainable farming are major factors behind this. For instance, European countries have been major adopters of biostimulant technologies—this, to a large extent, has been catalyzed by stringent regulations in the field of environment and a really high level of awareness about sustainable agriculture. For example, innovative biostimulant products from European-based companies such as BASF and Syngenta drive the market toward addressing local agricultural needs in the region. Optimization from BASF and GrowBoost from Syngenta were also warmly welcomed due to their efficacy and EU compliance. In addition, the supportive policy and funding of the European Union for research and development in agricultural sustainability added to the boost of growth in the market of the region. The blend of regulatory support, innovation, and readiness of the market has cemented the leading position of Europe in the global biostimulants market.

Moreover, in 2023, Asia-Pacific emerged as the fastest-growing region in the biostimulants market with an estimated market share of about 20%. Major drivers that emerged as the reasons behind such rapid growth in the region include the rising agricultural sector, adoption of modern farming practices, and demand for sustainable agricultural solutions to meet the large and diverse population. China National Chemical Corporation (ChemChina) showed strong biostimulant product sales growth for its subsidiary GrowMax Asia, designed to improve crop performance not only in China but also in other surrounding countries. Similarly, Indian-based UPL Limited saw a very strong market demand and growth for its BioGro series developed to cater to the rising demand for biostimulants in Indian agriculture. This quick market expansion and consequent increase in share of this region also owe to the budging agribusinesses and government initiatives of supporting agricultural innovation.

Key Players

The major key players are BASF SE, Koppert B.V., Sapec Agro S.A., FMC Corporation, Isagro Group, Biolchim S.P.A., Novozymes A/S, Platform Specialty Products Corporation, Valagro SpA, Italpollina SAP, Biostadt India Limited, UPL Limited, Koppert, and other key players mentioned in the final report.

Recent Developments

-

May 2024: The Government of India notified the Fertiliser, Inorganic, Organic or Mixed, Control, Third Amendment Order, 2024, whereby biostimulants were squarely brought within its ambit and controlled regime to ensure their quality and safety.

-

April 2024: UPM Biochemicals launched its new line of biochemical, bio-based plant stimulants under the brand name UPM Solargo and entered into the agrochemicals market with a more sustainable alternative to products based on fossil raw materials.

-

September 2023: Agrematch and ICL partnered to apply Artificial Intelligence in the discovery of new biostimulants that would optimize agriculture. This cooperation will try to leverage the capabilities of AI in finding compounds that improve the yield of crops, their health, and durability.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.9 Bn |

| Market Size by 2032 | US$ 10.5 Bn |

| CAGR | CAGR of 11.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Active Ingredients (Seaweed Extract, Acid Based, Humic Substances, Microbial, and Others) • By Crop Type (Fruits & Vegetables, Row Crops & Cereals, Oilseeds & Pulses, Turf & Ornamentals, and Others) • By Formulation (Dry and Liquid) • By Mode of Application (Foliar Treatment, Seed Treatment, and Soil Treatment) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | BASF SE, Koppert B.V., Sapec Agro S.A., FMC Corporation, Isagro Group, Biolchim S.P.A., Novozymes A/S, Platform Specialty Products Corporation, Valagro SpA, Italpollina SAP, Biostadt India Limited, UPL Limited, Koppert |

| Key Drivers | • Increasing demand for sustainable agricultural practices • Growing awareness among farmers about the environmental impact of conventional farming practices |

| Market Restraints | • Limited awareness and understanding of biostimulants |