Bioresorbable Polymers Market Report Scope & Overview:

Get more information on Bioresorbable Polymers Market - Request Sample Report

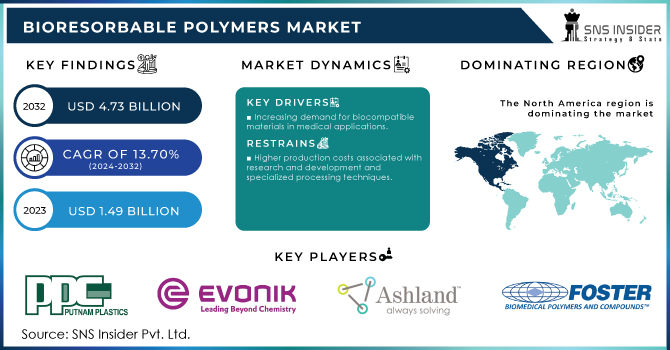

The Bioresorbable Polymers Market Size was valued at USD 1.49 billion in 2023 and is expected to reach USD 4.73 billion by 2032 and grow at a CAGR of 13.70% over the forecast period 2024-2032.

The bioresorbable polymers market is experiencing significant growth, driven by advancements in medical technology and an increasing preference for materials that naturally decompose within the body, eliminating the need for surgical removal. These polymers are extensively utilized in orthopedic devices and drug delivery systems, offering benefits such as reduced post-surgical complications and enhanced patient compliance. Key factors propelling market dynamics include technological innovations, rising healthcare expenditures, and growing demand for minimally invasive procedures. Strategic investments and developments from leading companies further support the industry's expansion.

In August 2024, Ashland completed the second expansion of its pharmaceutical injectables manufacturing and R&D lab at the National Science Park in Mullingar, Ireland. This enhancement significantly increased Ashland's capabilities in delivering innovative bioresorbable polymer chemistry to meet rising market demand. The project, supported by the Irish Government through IDA Ireland, underscores Ashland's commitment to advancing bioresorbable polymers for improved pharmaceuticals, medical devices, and tissue engineering solutions. In February 2020, Evonik announced the development of the world's first bioresorbable polymer in powder form suitable for high-resolution 3D printing of implantable medical devices using Selective Laser Sintering (SLS) technology. This innovation enabled the production of customized, patient-specific implants with enhanced precision and functionality. Such developments by industry leaders highlight the dynamic nature of the bioresorbable polymers market and its pivotal role in the evolution of medical treatments and devices.

Bioresorbable Polymers Market Dynamics:

Drivers:

-

Increasing Applications of Bioresorbable Polymers in Medical Devices Propel Market Expansion

Bioresorbable polymers are gaining traction in the medical device sector due to their unique properties, including biocompatibility and biodegradability. These materials are widely used in sutures, stents, drug delivery systems, and scaffolds for tissue engineering. As healthcare professionals seek alternatives to traditional materials, which can lead to complications and the need for additional surgeries, the adoption of bioresorbable polymers is becoming more prominent. The growing aging population and the rise in chronic diseases are also contributing to this trend, as there is an increasing demand for minimally invasive surgical techniques and materials that do not require removal after their intended purpose is fulfilled. This expansion in medical applications is expected to drive significant growth in the bioresorbable polymers market over the coming years.

-

Growing Awareness of Environmental Sustainability Fuels Interest in Bioresorbable Polymers

-

Rising Investment in Research and Development for Bioresorbable Polymers Sparks Market Opportunities

Increased investment in research and development (R&D) is playing a crucial role in advancing the bioresorbable polymers market. Governments, private investors, and academic institutions are allocating significant resources to explore new applications, improve existing materials, and develop novel formulations that enhance performance characteristics. This influx of funding is facilitating collaborations among various stakeholders, including researchers, manufacturers, and healthcare professionals, to accelerate the development of innovative bioresorbable products. The focus on R&D not only leads to the discovery of new applications across different sectors but also strengthens the overall market by addressing challenges related to material properties, such as strength, degradation rates, and compatibility with biological tissues. As a result, the bioresorbable polymers market is likely to experience substantial growth fueled by ongoing advancements and innovation.

Restraint:

-

Limited Awareness and Understanding of Bioresorbable Polymers Among End-Users Hinders Market Growth

Despite the numerous advantages of bioresorbable polymers, a significant barrier to their widespread adoption is the limited awareness and understanding among potential end-users. Many manufacturers and healthcare professionals may not be fully informed about the benefits and applications of these materials, which can lead to reluctance to transition from conventional options. This lack of knowledge can result in slower acceptance rates and the perpetuation of traditional materials that may not offer the same environmental and health benefits. Additionally, misunderstandings regarding the performance, safety, and regulatory compliance of bioresorbable polymers can deter potential users from integrating them into their products or practices. As education and awareness initiatives are essential for promoting the benefits of bioresorbable polymers, the industry must address this restraint to unlock the market's full potential.

Opportunity:

-

Growing Demand for Targeted Drug Delivery Systems Opens New Avenues for Bioresorbable Polymers

The healthcare sector's shift toward personalized medicine and targeted drug delivery systems is creating new avenues for bioresorbable polymers. These materials are particularly well-suited for applications in controlled drug release, where they can provide sustained therapeutic effects while minimizing side effects. By enabling precise delivery of medications to specific sites within the body, bioresorbable polymers can enhance the efficacy of treatments and improve patient outcomes. As researchers and pharmaceutical companies explore innovative drug delivery methods, the demand for bioresorbable polymers is expected to rise, leading to new product development and market expansion opportunities in this area.

-

Increased Focus on Biodegradable Packaging Solutions Drives Interest in Bioresorbable Polymers

The global movement toward sustainability has intensified interest in biodegradable packaging solutions, with bioresorbable polymers emerging as a promising alternative to traditional plastic packaging. As consumers demand environmentally friendly packaging options, manufacturers are exploring the potential of bioresorbable materials to meet this need. This trend is particularly pronounced in sectors such as food and pharmaceuticals, where the focus on reducing plastic waste is paramount. Companies that invest in developing bioresorbable packaging solutions can capitalize on this growing market demand, fostering innovation and sustainability while addressing environmental concerns. The bioresorbable polymers market is likely to benefit significantly from this focus on biodegradable packaging, opening new growth opportunities for manufacturers.

Supply Chain and Raw Material Sourcing for Bioresorbable Polymers Market

|

Aspect |

Description |

|---|---|

|

Raw Material Sources |

Bioresorbable polymers are primarily sourced from natural, renewable materials such as polylactic acid (PLA), polyglycolic acid (PGA), and polycaprolactone (PCL). |

|

Supplier Network |

The supply chain includes suppliers of biopolymer raw materials, such as agricultural producers for PLA and PCL, and petrochemical companies for monomers. |

|

Sustainability in Sourcing |

Emphasis on sourcing materials from sustainable, renewable sources is increasing to meet environmental standards and reduce carbon footprints. |

|

Regional Supply Chain Differences |

Regions like North America and Europe are leading in biopolymer production, with strong supply chains in place, while emerging markets face raw material shortages. |

|

Logistical Challenges |

The bioresorbable polymer supply chain faces challenges such as transportation delays, high costs of raw material imports, and fluctuating prices of feedstocks. |

The supply chain for bioresorbable polymers is intricate, with raw materials primarily sourced from renewable resources such as plant-based sugars and polyesters. Key raw materials include PLA, PCL, and PGA, which are produced by both agricultural and petrochemical suppliers. Sustainability is a growing focus in the industry, as manufacturers aim to reduce their environmental impact by sourcing materials responsibly. However, supply chains can vary by region, with North America and Europe having well-established networks, while emerging markets often experience shortages and logistical challenges. Issues such as raw material price volatility and transportation disruptions further complicate the smooth flow of bioresorbable polymer production.

Key Market Segments

By Type

In 2023, Polylactic Acid (PLA) dominated the bioresorbable polymers market with a market share of approximately 45%. Among the subsegments, Poly (L-lactic) acid (PLLA) dominated with a market share of around 25%. PLA's widespread application in the medical field, particularly for sutures, drug delivery devices, and scaffolds, contributes significantly to its dominance. Its excellent biocompatibility and biodegradability make it a preferred choice for various medical applications. For instance, PLLA is often used in the development of biodegradable sutures and implants that gradually dissolve in the body, thus eliminating the need for surgical removal. The increasing demand for minimally invasive procedures and the focus on sustainability further bolster the PLA segment's growth, highlighting its importance in the evolving landscape of bioresorbable polymers.

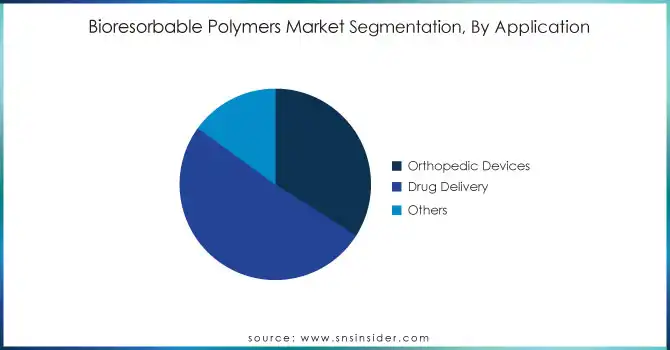

By Application

In 2023, the Drug Delivery application segment dominated the bioresorbable polymers market with a market share of around 50%. Within this segment, the parenteral drug delivery subsegment dominated with a market share of approximately 30%. The growing focus on targeted and controlled drug delivery systems is driving the demand for bioresorbable polymers, as they can provide sustained release of medications while minimizing side effects. For example, bioresorbable polymer-based nanoparticles are increasingly utilized for delivering chemotherapeutic agents directly to tumors, enhancing therapeutic efficacy and reducing systemic toxicity. The rise in chronic diseases and the need for effective drug delivery methods are expected to propel the growth of the drug delivery segment, further solidifying its position in the bioresorbable polymers market.

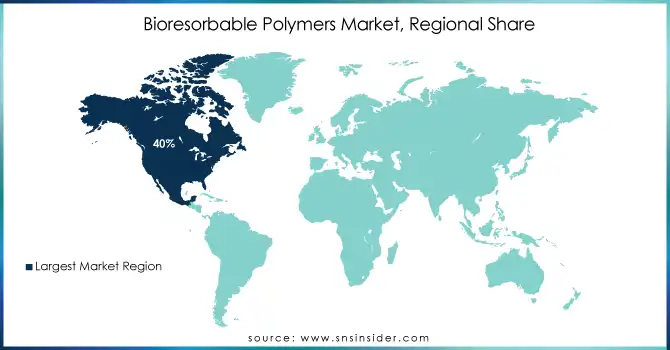

Bioresorbable Polymers Market Regional Analysis

In 2023, North America dominated the bioresorbable polymers market with a market share of approximately 40%. The region's leadership can be attributed to advanced healthcare infrastructure, strong research and development activities, and increasing healthcare spending. The United States, in particular, accounted for the largest share due to its leading position in medical device manufacturing and the increasing demand for minimally invasive surgeries. For example, the widespread adoption of bioresorbable sutures and drug delivery systems in the U.S. has driven market growth. Companies like Medtronic and Baxter International are investing heavily in R&D to develop innovative products using bioresorbable polymers. The increasing preference for eco-friendly, biodegradable medical devices and the growing elderly population in North America further contribute to the dominance of this region. Additionally, the region benefits from a supportive regulatory environment, particularly through the FDA, which accelerates the approval process for new bioresorbable polymer-based products, making it a favorable market for innovation.

Moreover, In 2023, the Asia-Pacific (APAC) region emerged as the fastest-growing region in the bioresorbable polymers market with a CAGR of 8.5%. This rapid growth can be attributed to several factors, including the increasing healthcare needs in developing countries, the rising demand for sustainable medical solutions, and the growing trend of medical tourism. Countries like China and India are driving market expansion due to the increasing healthcare investments and their large populations, which present a significant demand for affordable medical solutions. For instance, China is one of the largest markets for bioresorbable polymers due to the increasing use of biodegradable sutures in surgeries. India, with its expanding healthcare sector and rising awareness about eco-friendly medical devices, is also contributing to the growth of this market. The government's initiatives to promote medical device manufacturing, combined with the growing middle-class population and increasing healthcare expenditures, are expected to sustain this growth. Moreover, advancements in the medical technology sector and increasing access to high-quality healthcare services are further bolstering the adoption of bioresorbable polymers in the region, making it a key market for future investments.

Get Customized Report as per your Business Requirement - Request For Customized Report

Recent Developments

-

August 2024: Ashland expanded its Viatel bioresorbable polymers lab in Mullingar, Ireland, with support from IDA Ireland. This facility will enhance the production of bioresorbable polymers for medical devices and pharmaceuticals, meeting the growing demand for sustainable medical solutions.

-

April 2024: Evonik expanded its RESOMER powder biomaterial facility in Germany, incorporating solvent-free micronization technology. This upgrade allows the production of customized medical powders, catering to implants and esthetic applications.

Key Players:

-

Ashland (Viatel bioresorbable polymers, RESOMER)

-

Corbion NV (PURASORB PL, PURASORB PDL)

-

DURECT Corporation (RESOMER PDLG, DURAVEC)

-

Evonik Industries AG (RESOMER polymers, VESTAKEEP PEEK)

-

Foster Corporation (BioFLEX, BioDUR)

-

Groupe PCAS (PCAS Bioresorbable Polymers, PCAS Biomaterials)

-

KLS Martin (BioResorb scaffold material, Biodegradable plates and screws)

-

Koninklijke DSM N.V (Synova, DSM Resomer)

-

Merck KGaA (Millipore Biofilter, BioResorb)

-

Poly-Med Inc. (PGA-based sutures, BioSYN)

-

Putnam Plastics (PGA-based tubing, Resilon polymers)

-

REVA Medical, Inc. (RevaBio, RevaCore)

-

Teijin Limited (Teijin Pharma bioresorbable polymer, Resilon)

-

Zhejiang Hisun Biomaterials Co., Ltd. (PLGA polymers, PGA resins)

-

Medtronic (Absorb bioresorbable scaffold, MEDSORB)

-

Abbott Laboratories (Absorb bioresorbable vascular scaffold, Bioresorb)

-

Biotronik (Bioabsorbable scaffold, PROBIO polymer)

-

Integra LifeSciences (Integra biocompatible tissue scaffolds, Integra dermal regeneration template)

-

Jinan Daigang Biomaterials Co., Ltd. (PCL biomaterials, PLGA polymers)

-

Solvay (Solef bioresorbable polymers, Solvay Biopolymer)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.49 Billion |

| Market Size by 2032 | US$ 4.73 Billion |

| CAGR | CAGR of 13.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Polylactic Acid (PLA), [Poly (l-lactic) acid (PLLA), Poly-d,l-lactic acid (PDLLA)], Polysaccharides, Proteins, Polyglycolic Acid (PGA), Poly (Lactic-Co-Glycolic Acid) (PLGA), Polycaprolactone (PCL), Others) •By Application (Orthopedic Devices [Trauma, Knee, Sports injury, Hip, Spine, Others], Drug Delivery [Oral, Parenteral, Others], Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Putnam Plastics, Evonik Industries AG, Ashland, DURECT CORPORATION, REVA Medical, Inc., Poly-Med Inc., Merck KGaA, KLS Martin, Corbion NV, Koninklijke DSM N.V, Foster Corporation., Groupe PCAS and other key players |

| Key Drivers | •Growing Awareness of Environmental Sustainability Fuels Interest in Bioresorbable Polymers •Rising Investment in Research and Development for Bioresorbable Polymers Sparks Market Opportunities |

| Restraints | •Limited Awareness and Understanding of Bioresorbable Polymers Among End-Users Hinders Market Growth |