Black Mass Recycling Market Size & Trends:

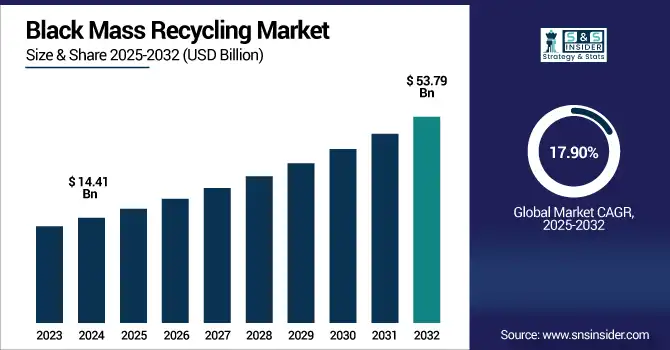

The Black Mass Recycling Market size was valued at USD 14.41 Billion in 2024 and is projected to reach USD 53.79 Billion by 2032, growing at a CAGR of 17.90% during 2025-2032. The Black Mass Recycling market is experiencing rapid growth, driven by the growing demand for sustainable and circular solutions in the battery market. The pace of electric vehicle (EV) adoption and battery production is steadily increasing and consequently volumes of decommissioned batteries and manufacturing scrap are rising, necessitating effective recycling solutions. Black mass, composed of valuable metals including lithium, cobalt, nickel, and manganese, has emerged as a critical feedstock for recovering and recycling these materials back into the battery supply chain.

To Get more information on Black Mass Recycling Market - Request Free Sample Report

Increasing technological advancements in shredding and extraction processes, favorable regulations in countries in Europe and more will drive the market growth. The black mass recycling market is witnessing strong growth as industries increasingly focus on reducing reliance on virgin raw materials and embracing circular economy practices. This black mass recycling market trend is driven by the need to recover valuable metals from spent batteries while aligning with global decarbonization targets, promoting sustainability and lowering environmental impact.

The U.K. miners Technology Minerals and Recyclus have commenced black mass export to Europe, with the former delivering 111 tonnes in accordance with an offtake agreement with Glencore. Commercial milestone underscores its industrial lithium-ion battery recycling capacity and its function to bolster Europe's critical metals supply chain.

The U.S Black Mass Recycling Market size was valued at USD 2.58 Billion in 2024 and is projected to reach USD 10.09 Billion by 2032, growing at a CAGR of 18.59% during 2025-2032. The Black Mass Recycling Market growth is driven by the increasing demand for electric vehicles, the mounting amount of end-of-life batteries, and the government initiatives that support battery recycling. An increasing market for a number of critical metals including lithium, cobalt, and nickel is driving the black mass recovery.

Black Mass Recycling Market Dynamics:

Drivers:

-

Urban Battery Waste Surge Fuels Demand for On-Site Black Mass Recycling Solutions

There is a substantial increase in demand for portable and efficient black mass recycling solutions due to the rising volume of lithium-ion battery waste in urban settings. The growing number of electric and electronic devices in cities results in an increasing number of non-EV batteries in circulation, which poses significant challenges in terms of the safe collection, transport, and processing of discarded devices and their batteries. The increasing landfill problem is forcing the development and mass production of micro recycling plants that can be implemented right in your city powered by artificial intelligence. This capability allows for sorting, shredding, and extraction of metals such as lithium, cobalt, and nickel directly on-site, avoiding additional logistical needs and environmental risk. Local processing of battery waste increases sustainability, reduces time taken for material recovery

Achelous Pure Metals, a Hong Kong startup, has devised a mobile lithium-ion battery waste recycling plant that uses artificial intelligence and can be sent to cities. The nanotech robotic-based separation solution for black mass is now being aimed to replicate through Southeast Asia.

Restraints:

-

Limited Infrastructure and Complex Processing Techniques Hinder Black Mass Recycling Market Expansion

The absence of a strong infrastructure or standardized processing systems able to deal with various battery chemistries is one of the major hindrances for the black mass recycling market. However, recycling is a hazardous process that needs flammable electrolytes and toxic gases to be handled in special workshops, with high safety protocols, which many countries lack the incentive to develop or the means to build. The composition of the batteries also varies, from lithium iron phosphate (LFP) to nickel-manganese-cobalt (NMC), which makes material recovery difficult, as the metal-containing units are hard to be extracted from the waste battery, they are also very expensive to be recovered. The investment and the large-scale adoption are restrained by the limited public awareness around the technology and the regulatory inconsistencies. It is now experiencing a slowdown in market penetration, and creating the closed-loop battery-recycling ecosystem that would depend on heavy recycling.

Opportunities:

-

Growing OEM Partnerships Drive Expansion Opportunities in Black Mass Recycling

The increasing collaboration between battery manufacturers and automakers is creating significant growth opportunities in the black mass recycling market. With the rapid scale-up in electric vehicle (EV) production, the amount of battery scrap generated is increasing quickly, and can be readily recycled and reused through partnerships. In addition, partnership between OEMs and recyclers pave the way for closed-loop systems that not only secure the supply of critical materials including lithium, cobalt, and nickel, but also reduce reliance on imported raw materials. These partnerships also assist sustainability strategy, regulatory compliance, and cost efficiency. Emerging OEM-catalyzed recycling infrastructure, especially in North America and Europe, provides an attractive backdrop for the market to pursue faster growth & innovation in black mass recovery methods.

LG Energy Solution and Toyota Tsusho on Thursday opened a joint venture in the U.S., albeit one quite new that is dedicated to recycling EV batteries: Green Metals Battery Innovations LLC, The North Carolina facility will be designed to reclaim black mass from 13,500 tons of scarp per year by 2026.

Challenges:

-

Technical Complexities and Regulatory Gaps Challenge Scalable Growth in Black Mass Recycling Market

The black mass recycling market faces several key challenges that hinder its scalable and efficient growth. One major hurdle is the technical complexity of handling diverse battery chemistries, which require customized processes for effective metal recovery. Extracting high-purity lithium, cobalt, and nickel from black mass involves advanced technologies, often leading to high operational costs and energy consumption. Additionally, inconsistent battery designs and the presence of hazardous components including electrolytes and adhesives increase safety risks during dismantling and shredding. Regulatory fragmentation across regions further complicates cross-border recycling efforts, creating uncertainties for investment and operations. Limited standardization, lack of recycling infrastructure, and insufficient awareness among consumers and manufacturers continue to slow down market development and circular adoption.

Black Mass Recycling Market Segmentation Analysis:

By Battery Type

The Lithium-Ion Batteries segment held a dominant black mass recycling market share of around 76% in 2024, owing to the widespread use of lithium-ion batteries in electric vehicles, consumer electronics and energy storage systems. Due to their precious metal contents of lithium, cobalt and nickel, they are also cheap to recycle as well. With the continued adoption of EVs, the amounts of battery production scrap and end-of-life batteries are expected to increase, which will drive the demand for lithium-ion battery recycling solutions with high-throughput.

The Nickel-Based Batteries segment is expected to experience the fastest growth in black mass recycling market over 2025-2032 with a CAGR of 20.36%, owing to high energy density of nickel-rich chemistries, including NMC and NCA, in EVs, and rising efforts to recover valuable nickel content through effective recycling processes.

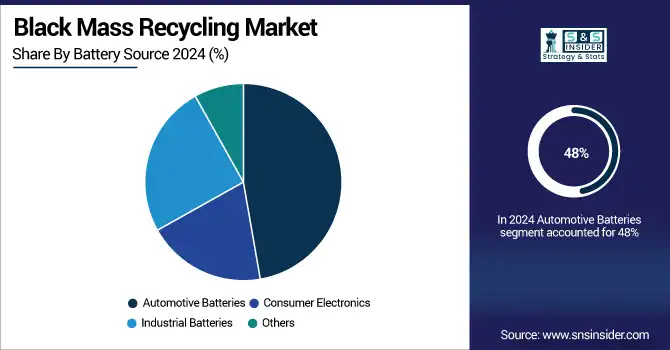

By Battery Source

In 2024, the Automotive Batteries segment held a dominant 48% share of the black mass recycling market, due to the increasing adoption of electric vehicles (EVs) and hybrid vehicles globally. The record-high EV manufacture and accretion of end-of-life automotive batteries has led to a more mass of recoverable battery materials, ordering the need for black mass recovery and recycling.

The Consumer Electronics segment is expected to experience the fastest growth in black mass recycling market over 2025-2032 with a CAGR of 23.82%. The rise is driven by the proliferation of smartphones, laptops, tablets, and wearable devices that use lithium-ion batteries and are being disposed of. The increasing volume of e-waste and the demand for sustainable metal recovery are substantial factors contributing to the rapid growth of this segment.

By Recovered Metals

In 2024, the Nickel segment held a dominant 36% share of the black mass recycling market as Nickel's high energy density and performance advantages make it paramount to the production of EV batteries. There is a growing demand for the recovery of nickel from recycled batteries to lessen the dependence on primary mining, thereby securing the nickel supply.

The Cobalt segment is expected to experience the fastest growth in black mass recycling market over 2025-2032 with a CAGR of 24.36%. This growth is driven by cobalt’s high economic value, limited global reserves, and its critical role in enhancing battery stability and performance. Growing supply chain concerns and ethical sourcing issues are accelerating efforts to recover cobalt through advanced recycling processes.

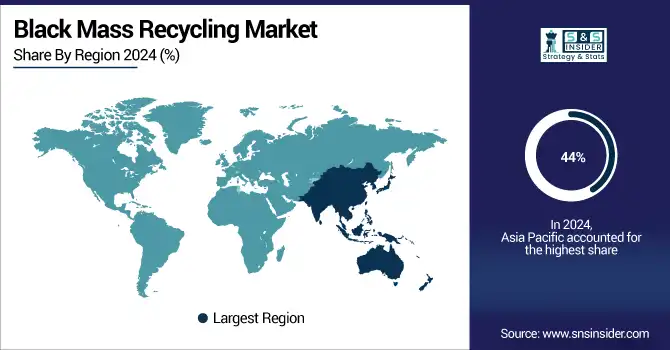

Black Mass Recycling Market Regional Outlook:

In 2024, Asia Pacific dominated the black mass recycling market and accounted for 44% of revenue share, due to strong electric vehicle production base, rising battery-manufacturing capacity in line with rapid growth of said industry and supportive governmental policies across countries in the region. Countries including China, Japan, and South Korea have an advanced pointing toward the global acceptance of battery technology and well-established recycling infrastructure creating a conducive environment for the recovery of black mass and other circular economy aspects.

North America is expected to witness the fastest growth in the black mass recycling market over 2025-2032, with a projected CAGR of 19.74%, mainly due to growing electric vehicle demand, rising investments in battery manufacturing, and continuous government support for domestic recycling. On the front of energy and EVs, a further driver of market expansion is the requisite supply chain resilience along with less reliance on imported critical metals.

In 2024, Europe emerged as a key growth region in the black mass recycling market, driven by the rapid expansion of the electric vehicle fleet and the growing network of gigafactories, along with a strong regional focus on circular economy principles. Recognizing the market’s potential, European governments have actively promoted the sector through supportive policies and substantial investments in research and development.

LATAM and MEA are experiencing steady growth in the black mass recycling market, driven by increasing e-Waste volume, adoption of electric vehicles, and awareness of resource recovery. In these emerging regions, governmental support for sustainable solutions and infrastructure investment for recycling is slowly but surely developing the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Black Mass Recycling Companies are Anglo American, Aqua Metals, BASF, Boliden, Epiroc, Fortum, Glencore, Heraeus Holding, Redwood Materials, Tenova, Umicore, Li-Cycle, and others.

Recent Developments:

-

In May 2025, Li-Cycle filed for bankruptcy after halting its New York recycling hub, with Glencore bidding USD 40 million for its assets, underscoring the financial and operational hurdles in North America's emerging battery recycling sector.

-

In July 2025, BASF has started commercial operations of its black mass recycling plant in Germany, capable of processing 15,000 tons of lithium-ion battery waste annually. The facility recovers lithium, nickel, cobalt, and manganese, supporting a circular supply chain for cathode active materials in Europe.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 14.41 Billion |

| Market Size by 2032 | USD 53.79 Billion |

| CAGR | CAGR of 17.90% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Battery Type(Lithium-Ion Batteries and Nickel-Based Batteries) • By Battery Source(Automotive Batteries, Consumer Electronics, Industrial Batteries and Others) • By Recovered Metals (Nickel, Cobalt, Lithium, Copper and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Black Mass Recycling Market companies are Anglo American, Aqua Metals, BASF, Boliden, Epiroc, Fortum, Glencore, Heraeus Holding, Redwood Materials, Tenova, Umicore, Li-Cycle.and Others. |