Pharmaceutical Sterility Testing Market Size & Overview:

Get more information on Pharmaceutical Sterility Testing Market - Request Sample Report

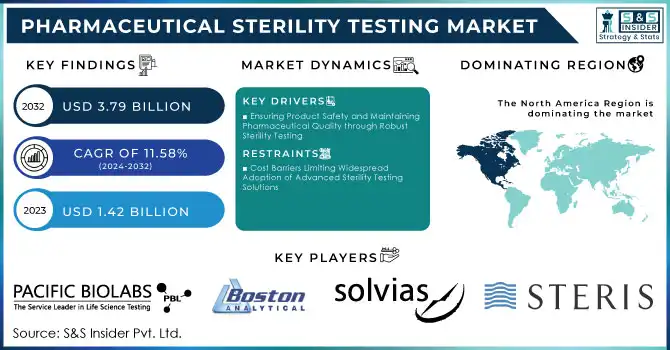

Pharmaceutical Sterility Testing Market was valued at USD 1.42 billion in 2023 and is expected to reach USD 3.79 billion by 2032, growing at a CAGR of 11.58% from 2024-2032.

The pharmaceutical sterility testing market is expected to exhibit significant growth with a rise in demand for safe and effective pharmaceutical products. The stringent regulations imposed by health authorities such as the FDA and EMA have made pharmaceutical companies ensure that their products remain sterile and safe for patients. Increasing levels of infectious diseases and a pharmaceutical manufacturing industry expanding at an unbelievable rate will continue to propel the demand for sterility testing services. Furthermore, advancement in testing technology, such as automated methods and rapid sterility testing, is expected to spur growth in this market.

The higher growth potential of biopharmaceuticals, such as biologics and gene therapies, is an opening for fast growth in the sterility testing market. With biologics, which require highly sensitive testing to ensure they are free from microbial contamination, ensuring their safety is crucial for the health and well-being of the patient. As the trend for personalized medicine and advanced biologic therapies continues on an upward trajectory, there will be a commensurate increase in sterility testing that calls for precision and reliability. With further growth in this sector, R&D investment in new testing solutions and technologies for these needs is expected to continue to intensify.

The pharmaceutical sterility testing market will expand with the progression of regulation and the rising importance of quality control in pharmaceutical production. The importance of achieving and maintaining sterility at every stage of the manufacturing process, from raw materials to finished products, has placed a huge demand on testing solutions. With increasing biological drugs in the market and emerging therapies that require high sterility controls, the market has huge future potential. Pharmaceutical manufacturing activities are witnessing an increasing trend, and advanced sterility testing of production processes will create further long-term opportunities for established players and new entrants in the market.

Pharmaceutical Sterility Testing Market Dynamics

DRIVERS

-

Ensuring Product Safety and Maintaining Pharmaceutical Quality through Robust Sterility Testing

The pharmaceutical sterility testing market addresses the critical need to ensure that injectable drugs, vaccines, and implantable devices do not harbor any microbial contamination that could cause severe patient infections or complications. Testing during the production and packaging processes must be stringent to uphold the optimum levels of product safety. Continuous monitoring thus allows for the maintenance of quality, integrity, and efficacy of pharmaceutical products in support of public health expectations and regulatory requirements. Improved sterility assurance contributes to reducing the risk of contamination directly and maintains a higher level of confidence in pharmaceutical products.

-

Revolutionizing Sterility Testing with Rapid Detection and Automation Innovations

Sterility testing is advancing due to innovations in testing methods, moving away from conventional techniques such as direct inoculation and membrane filtration toward quicker, more effective strategies. Rapid microbial detection methods, such as PCR testing and ATP bioluminescence, are becoming more prominent due to their capacity to greatly shorten testing durations. Moreover, advancements in automation and real-time monitoring are improving the accuracy and effectiveness of sterility testing, reducing human mistakes. These advancements are enhancing throughput and guaranteeing quicker, more dependable outcomes. The growing need for faster and more precise sterility assurance is a primary market catalyst.

RESTRAINTS

-

Cost Barriers Limiting Widespread Adoption of Advanced Sterility Testing Solutions

The high cost related to the implementation of rapid microbial detection techniques and automated sterility testing systems represents a major obstacle to market expansion. These technologies typically require a substantial initial investment and ongoing maintenance costs, making them less accessible to smaller pharmaceutical companies or those situated in regions with limited infrastructure. Consequently, the extensive adoption of these innovative testing solutions is limited, especially within budget-conscious companies. The cost of implementing these innovations might restrict their accessibility, hindering widespread market adoption.

Pharmaceutical Sterility Testing Market Segment Analysis

BY TYPE

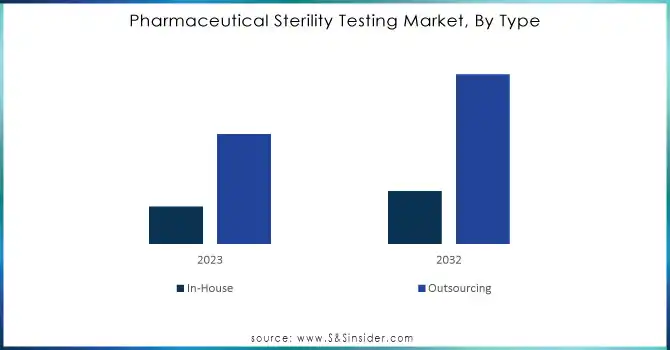

Outsourcing dominated the pharmaceutical sterility testing market in 2023, with the highest share of revenue about 59% with third-party contract research organizations (CROs) and contract manufacturing organizations (CMOs) due to their repute for cost-effectiveness and specialized expertise. Companies prefer outsourcing by reducing the cost of operations, accessing high-specialized testing facilities, and also streamlining the supply chain.

In-house sterility testing is projected to increase at the fastest CAGR of 12.47% during the period from 2024 to 2032, as more companies invest in internal testing capabilities for better quality control, to meet arising regulatory requirements better, and to shorten time-to-market for new drug products. These developments are spurred by advances in the domain of automation and AI, thus making in-house testing much more viable and efficient for most companies.

Need any customization research on Pharmaceutical Sterility Testing Market - Enquiry Now

BY PRODUCT TYPE

Kits and reagents proved to be the largest revenue-generating product type in pharmaceutical sterility testing during 2023, holding a share of above 59%, as it is considered a fundamental product to carry out proper sterility testing. Its products are extensively used in every testing method, which leads to the resulting outcome along with strict regulatory compliance.

The services segment is expected to experience the fastest CAGR of 13.26% from 2024-2032 due to the increasing demand for pharmaceutical companies outsourcing testing services. Service providers decrease pharmaceutical companies' expenses, increase efficiency, and allow pharmaceutical companies access to cutting-edge testing technologies while sparing them the heavy upfront investments in equipment. This trend toward outsourcing sterility testing services will continue to be driven significantly by further scaling up of the industry in the next few years, keeping the focus on a larger production size with stringent quality standards.

BY END USE

In 2023, pharmaceutical companies dominated the pharmaceutical sterility testing market, contributing approximately 43% of the overall revenue. This supremacy is linked to their production of substantial quantities of sterile medications, including injectables and biologics, which undergo strict testing before market release. These firms must comply with stringent regulatory requirements for safety and quality, driving the increasing demand for efficient sterility testing solutions.

The compounding pharmacies are expected to grow at the highest CAGR of 13.47% from 2024 to 2032, considering that the growing demand for individualized medications and customized sterile formulations accelerates. Compounding pharmacies are becoming more invested in sterility testing as tailored treatments increase, particularly in treatment areas such as oncology and hormone therapy.

Pharmaceutical Sterility Testing Market Regional Outlook

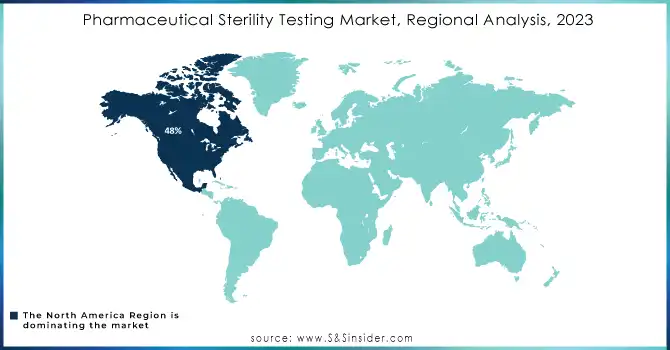

North America held about 48% of market revenue in 2023 due to the region hosting a well-established pharmaceutical industry and having strict regulatory standards. Hosting some of the top pharmaceutical companies, with a focus on advanced drug development, biologics, and injectables, creates tremendous demand for sterility testing services. In addition, the FDA and other similar regulatory authorities have strict regulations on sterility testing, which supports the majority share in this market region.

The Asia Pacific region is anticipated to experience the highest CAGR of 14.58% throughout the forecast period from 2024 to 2032, fueled by swift advancements in pharmaceutical production and rising investments in healthcare facilities. Elements like the increasing need for generic medications and biologics, combined with the expanding count of Contract Manufacturing Organizations (CMOs) in China and India, are fueling this growth. The Asia Pacific's rise as a central location for drug production will boost market growth, leading to a greater need for dependable and effective sterility testing solutions that comply with international quality standards.

LATEST NEWS-

-

In 2024, Sartorius launched the Sterisart Universal | Gen 4 sterility testing pump, offering advanced features like real-time data sharing and secure electronic documentation to enhance pharmaceutical testing workflows

-

STERIS introduced Verafit Sterilization Bags and Covers in March 2024, designed to support EU GMP Annex 1 compliance and reduce contamination risks in pharmaceutical sterilization processes

KEY PLAYERS

-

Pacific Biolabs (Bioburden Testing, Sterility Testing Services)

-

Steris Plc (Sterility Assurance Products, Rapid Microbial Testing Solutions)

-

Boston Analytical (Bioburden Testing, Sterility Testing Services)

-

Sotera Health Company (Nelson Labs) (Sterility Testing, Bioburden Testing)

-

Sartorius Ag (Sterility Testing Equipment, Filtration Systems for Sterile Applications)

-

Solvias Ag (Sterility Testing Services, Microbial Testing Solutions)

-

SGS SA (Sterility Testing Services, Bioburden Testing Solutions)

-

Labcorp (Sterility Testing, Microbial Limits Testing)

-

Pace Analytical (Microbial Testing, Sterility Testing Services)

-

Charles River Laboratories (Sterility Testing, Bioburden Testing)

-

Thermo Fisher Scientific, Inc. (Sterility Testing Equipment, Microbial Identification Systems)

-

Rapid Micro Biosystems, Inc. (Automated Microbial Detection System, Rapid Sterility Testing Solutions)

-

Almac Group (Sterility Testing, Microbial Testing Services)

-

Labor LS SE & Co. KG (Sterility Testing, Microbial Contamination Testing)

-

BioMerieux (Sterility Testing Solutions, Microbial Identification Systems)

-

Lonza Group (Sterility Testing Services, Bioburden Testing)

-

WuXi AppTec (Sterility Testing Services, Bioburden Testing Solutions)

-

Merck KGaA (Sterility Testing Reagents, Rapid Microbial Detection Systems)

-

Eurofins Scientific (Sterility Testing, Bioburden Testing Services)

-

Pall Corporation (Sterilizing Filtration Systems, Sterility Testing Solutions)

-

MilliporeSigma (Sterility Testing Kits, Microbial Testing Services)

-

Viral Inactivation Technologies (Sterility Testing, Viral Clearance Services)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.42 Billion |

| Market Size by 2032 | USD 3.79 Billion |

| CAGR | CAGR of 11.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (In-House, Outsourcing) • By Product Type (Kits & Reagents, Instruments, Services) • By End-use (Compounding Pharmacies, Medical Device Companies, Pharmaceutical Companies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pacific Biolabs, Steris Plc, Boston Analytical, Sotera Health Company (Nelson Labs), Sartorius Ag, Solvias Ag, SGS SA, Labcorp, Pace Analytical, Charles River Laboratories, Thermo Fisher Scientific, Inc., Rapid Micro Biosystems, Inc., Almac Group, Labor LS SE & Co. KG, BioMerieux, Lonza Group, WuXi AppTec, Merck KGaA, Eurofins Scientific, Pall Corporation, MilliporeSigma, Viral Inactivation Technologies |

| Key Drivers | • Ensuring Product Safety and Maintaining Pharmaceutical Quality through Robust Sterility Testing • Revolutionizing Sterility Testing with Rapid Detection and Automation Innovations |

| RESTRAINTS | • Cost Barriers Limiting Widespread Adoption of Advanced Sterility Testing Solutions |