Bottled Water Market Report Scope & Overview:

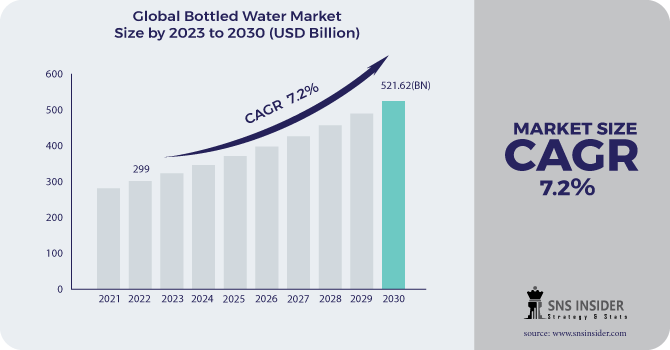

Bottled Water Market Size was valued at USD 299 billion in 2022 and is expected to reach USD 521.62 billion by 2030, and grow at a CAGR of 7.2% over the forecast period 2023-2030.

Water is a fundamental and crucial part of all types of life on the planet, particularly for people. Water represents very nearly the vast majority of the human body. Filtered water is the water that is drunk exclusively to drink and comes in bundled in a container. The worldwide filtered water market is anticipated to notice a huge development because of the rising interest in something similar. The comfort of conveying filtered water is assessed to assume a significant part in the development of the market in the years to come.

The fundamental wellspring of beginning for filtered water is the regular supplies, like lakes, streams, lakes, and other such wellsprings of water. In any case, the greater part of the water coming from the normal water bodies is contaminated and contains different dissolving pollutants, infections, synthetic compounds, and microbiological microscopic organisms. Filtered water is a sanitized type of water from these normal sources and is a substitute to the drinking water arrangement, because of its powerful and trustworthy strategies of decontamination. The virtue of filtered water is anticipated to empower the development of the worldwide filtered water market in the years to come.

Market Dynamics:

Driving Factors:

-

Expanding inclination for supplement invigorated water is moving attributable to the rising significance of wellbeing and health among customers. The interest has been expanding among explorers and working experts and for in-house utilization.

-

Items with marks, for example, antacid, electrolyte-rich, sustained, jazzed water, and strengthened with extra hydrogen or oxygen have been acquiring fame.

Restraining Factors:

-

Expansion in endeavors to lessen the ecological contamination brought about by the ill-advised removal of plastic water bottles

Opportunities:

-

Rising mindfulness in regards to sound refreshments because of admittance to data and disappointment with quality drinking refreshments

-

Expansion in mindfulness about waterborne sicknesses, for example, jungle fever, typhoid, the runs, food contamination, and others have flooded the interest for filtered water.

Challenges:

-

Unfortunate transportation framework, low passage hindrances, hardships in memorability and once in a while danger from the climate defenders and social extremists against the utilization of filtered water.

Impact of Covid-19:

Broad limitations forced by states overall to battle COVID-19 made calculated difficulties for the filtered water industry. It has been multiple and a half year since the underlying worldwide episode of COVID-19. As per the International Bottled Water Association (IBWA), filtered water organizations have supported their creative limits in 2020 to take special care of the flood popular for filtered water. This incorporates expanding packaging limit, getting additional creation and bundling materials, and counseling retailers to decide their interest.

Product type:

The filtered section held the biggest income share and is supposed to keep up with its lead over the gauge period. Sicknesses like looseness of the bowels, the runs, and typhoid are generally caused because of debased particles in running water, in this manner shoppers are searching for water-saving choices and organizations are resolving similar issues. The shining section is projected to enroll the quickest development rate. The developing inclination of shoppers for the shimmering class as a sound option for sweet beverages, for example, cola to chop down sugar content levels is driving the section.

Distribution Channel:

The off-exchange portion held the biggest income portion of. The portion incorporates all retail outlets, for example, hypermarkets, grocery stores, corner shops, little business sectors, and conventional stores. The on-exchange channel is expected to enroll the quickest CAGR. The section incorporates outlets like eateries, bistros, clubs, lodgings, and parlors. Developing wellbeing and cleanliness concerns, combined with the rising COVID-19 cases, have provoked customers to purchase bundled water rather than ordinary choices at such places.

Key Market Segmentation:

By Product type:

-

Spring Water

-

Purified Water

-

Mineral Water

-

Sparkling Water

-

Others

By Distribution Channel:

-

Off-trade

-

On-trade

.png)

Regional Analysis:

-

North America

-

The USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

In developed economies, like the United and Canada, functional water is constantly becoming a major commercial and popular beverage category, as it is an appealing option for health-conscious consumers. Hence, this is augmenting the bottled water market. Bottled water has remained the most profitable section of the beverage consumption market according to International Bottled Water Association (IBWA). Hence, this is augmenting the bottled water market. Major manufacturers and marketers in the country have started to position functional water as an alternative to carbonated drinks and fruit juices. Through product description, modern and interactive labeling and backing from respected brands and organizing programs and seminars, the players are claiming that functional water is an enriched product that is not just for hydration but also can function as a functional beverage.

Key Players:

Danone, Hangzhou Wahaha Group CO, Ltd., Icelandic Glacial, Nestlé, Niagara Bottling, LLC., Nongfu Spring., Norland International, PepsiCo, The Coca-Cola Company, and VOSS of Norway AS.

Danone-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 299 Billion |

| Market Size by 2030 | US$ 521.62 Billion |

| CAGR | CAGR 7.2% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Type (Still Bottled Water, Carbonated Bottled Water, Flavored Bottled Water, Functional Bottled Water) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, +D11UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Danone, Hangzhou Wahaha Group CO, Ltd., Icelandic Glacial, Nestlé, Niagara Bottling, LLC., Nongfu Spring., Norland International, PepsiCo, The Coca-Cola Company, and VOSS of Norway AS. |

| Key Drivers | •Items with marks, for example, antacid, electrolyte-rich, sustained, jazzed water, and strengthened with extra hydrogen or oxygen have been acquiring fame. |

| Market Opportunities | •Rising mindfulness in regards to sound refreshments because of admittance to data and disappointment with quality drinking refreshments |