Spring Water Market Report Scope & Overview:

Get More Information on Spring Water Market - Request Sample Report

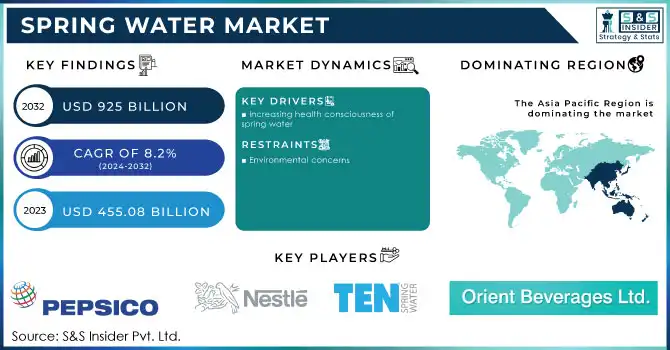

The Spring Water Market size was USD 455.08 billion in 2023 and is expected to Reach USD 925 billion by 2032 and grow at a CAGR of 8.2% over the forecast period of 2024-2032.

Spring water is water that flows naturally from the ground from an underground aquifer. It is typically collected from natural springs, although it can also be bottled and sold in retail establishments. Because it is naturally filtered by the ground, spring water is generally considered to be healthier than other types of water, such as tap water or refined water.

Based on Packaging, Spring water is dominated by bottled springs, however, canned springs are gaining ground due to convenience and sustainability. In accordance with the International Bottled Water Association, bottled water will account for around 92.5% of total sales in the United States in 2022.

The supermarkets/hypermarkets distribution channel is expected to grow most rapidly. Supermarkets and hypermarkets provide a wide range of consumer goods and food and beverage products, along with convenience and substantial savings. It operates at convenient times and at an easily accessible location. It has a wide customer base and generates consistent revenue for market participants.

MARKET DYNAMICS

KEY DRIVERS

-

Increasing health consciousness of spring water

Consumers are becoming more conscious of the necessity of hydration and are seeking healthier beverage options. Because it is free of calories, sugar, and artificial chemicals, spring water is seen as a healthier option than other beverages such as sugary drinks and sodas. Furthermore, spring water is considered to include important elements that are good for your health, such as calcium, magnesium, and potassium. These minerals are essential for bone health, muscle function, and overall well-being. Spring water is becoming increasingly popular among consumers as a result of these supposed health benefits. This is fueling the spring water market's rise, which is projected to continue in the future years.

RESTRAIN

-

Environmental concerns

The generation of plastic garbage is among the main worries. Spring water is often sold in plastic bottles that end up in landfills or harm the environment. According to a World Wildlife Fund survey, over 1 million plastic bottles are purchased every minute, with only 9% recycled. Another issue to be concerned about is the exploitation of spring water. Spring water is obtained from subsurface aquifers, which are natural water reserves. Excessive spring water extraction can deplete aquifers and harm ecosystems. Furthermore, spring water companies are frequently required to carry their products over large distances to market. This mode of transportation may emit greenhouse gases and contribute to climate change.

-

Government regulations

OPPORTUNITY

-

Development of new products

Springwater firms are constantly inventing to create new goods that fit consumers' evolving needs. Some spring water firms are also offering flavored spring water, such as lemon, cucumber, and mint. These flavored spring waters are popular with customers looking for a pleasant and healthy alternative to sugary drinks. Other spring water firms are now producing nutrient-enriched spring water, such as electrolytes and vitamins. These nutrient-enhanced spring waters are popular among athletes and consumers trying to improve their hydration and nutrition levels. The creation of new goods is driving growth in the spring water market since it meets consumers' changing wants.

-

Investment in sustainable practices

CHALLENGES

-

High Cost of Spring Water Bottle

A spring water bottle is significantly more expensive than tap water. On average, spring bottled water costs 9.47 dollars per gallon, while the same amount of tap water costs 0.005 dollars. As a result, bottled water might be 2,000 times more expensive than tap water. In addition, many consumers dislike the taste, odor, and color of spring water. When the costs of production, distribution, and promotion for each spring bottle are considered, the total costs are substantial. Many bottled water facilities in springs sell purified consumption of water from the same water source as local water utilities.

IMPACT OF RUSSIA-UKRAINE WAR

The war between Russia and Ukraine is having an enormous impact on the spring water business. According to the International Bottled Water Association, 85% of spring water producers have reported an increase in production costs since the start of the war. Furthermore, 65% of businesses have reported interrupted supply networks. In other markets, the war has also reduced demand for spring water. since the beginning of the war, sales of spring water have dropped by 20% globally. Since the commencement of the war, the price of bottled water has risen by 10%.

IMPACT OF ONGOING RECESSION

During a recession, Spring water is frequently considered to be an expensive product, and consumers are prone to reduce their expenditure on expensive products. Tap water is a far cheaper option than spring water then customers are more likely to convert to tap water to save money. Some consumers are concerned about bottled water's environmental impact, and they may be more likely to convert to tap water during a recession to lessen their environmental impact. This has led to the Ukrainian bottled water market is anticipated to contract by 20% by 2023.

MARKET SEGMENTATION

By Packaging

-

Bottled

-

Canned

By Distribution Channel

-

Supermarkets/Hypermarkets

-

Speciality Stores

-

Online Sales

-

Others

REGIONAL ANALYSIS

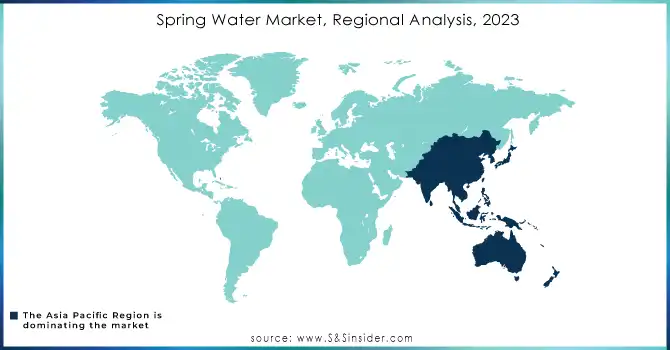

The Asia Pacific region is the largest market for spring water, with a 6.5% CAGR during the forecast period. The region's market growth can be ascribed to the region's vast population, rising income levels, and changing lifestyles of consumers. Furthermore, rising awareness of the health benefits of drinking spring water is propelling the market in this region forward.

The North American region is predicted to be the market for spring water, with a 5.9% CAGR during the forecast period. The growing health consciousness among consumers, as well as increased awareness about the benefits of drinking spring water, can be associated with the market's expansion in this region. the demand for spring water is high among athletes, sports persons, and consumers willing to have healthy lifestyles.

Europe accounted for 29.8% of the market share for spring water in 2022. The region's high share may be attributed mostly to the highest demand for natural spring water in Germany and France, which contributed 13.5% and 23.1% of the market volume share, respectively. Because of the increasing number of health-conscious customers and the increased use of bottled beverages, Europe leads the spring water market.

Need Any Customization Research On Spring Water Market- Inquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Spring Water Market are KYIQ MOUNTAIN, Orient Beverages Pvt. Ltd., Ten Spring Water, CG Roxane LLC, Nestle S.A., PepsiCo, Berrington Water, Primo Water Corporation, Bluetriton Brands, Bisleri, Himalayas ONTOP., Danone, Tata Consumer Products Limited, and other key players.

RECENT DEVELOPMENTS

In February 2023, Primo Water Corporation, a major North American and European supplier of sustainable drinking water solutions, announced the acquisition of another spring water source in Garland County, Arkansas, near to its existing Mountain Valley spring.

In May 2023, KYIQ MOUNTAIN is proud to introduce its high-quality 100% Natural Spring Water, sourced directly from the magnificent Yukon Mountains. KYIQ MOUNTAIN takes pleasure in using a natural mineral spring to provide unique mineral water that fulfills the highest purity and flavor standards.

In October 2023, Bisleri will expand its manufacturing and distribution networks. Bisleri is also expanding its offers into carbonated soft drinks, premiumization with the brand Vedica Himalayan Spring Water, and an innovative approach to its backbone of the packaged drinking water industry.

| Report Attributes | Details |

| Market Size in 2023 | US$ 455.08 Billion |

| Market Size by 2032 | US$ 925 Billion |

| CAGR | CAGR of 8.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Packaging (Bottled, Canned) • By Distribution Channel (Supermarkets/Hypermarkets, Speciality Stores, Online Sales, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | KYIQ MOUNTAIN, Orient Beverages Pvt. Ltd., Ten Spring Water, CG Roxane LLC, Nestle S.A., PepsiCo, Berrington Water, Primo Water Corporation, Bluetriton Brands, Bisleri, Himalayas ONTOP., Danone, Tata Consumer Products Limited |

| Key Drivers | • Increasing health consciousness of spring water |

| Market Challenges | • High Cost of Spring Water Bottle |