Bromelain Market Report Scope & Overview:

The Bromelain Market Size was valued at USD 27.6 Million in 2023. It is expected to grow to USD 50.4 Million by 2032 and grow at a CAGR of 6.9% over the forecast period of 2024-2032.

Get More Information on Bromelain Market - Request Sample Report

The dietary supplements industry is expanding rapidly, fueled by growing health and wellness awareness among consumers. Among these, bromelain has become a leading component and is impactful due to its healing effects. This naturally occurring enzyme, which comes from pineapples, is commonly included in several digestive health supplements and used to decrease inflammation as well as detoxification supplements to aid recovery following injuries or surgical procedures. Bromelain is especially useful in these areas because of its ability to digest proteins. With growing interest in the search for alternatives to drugs, the use of bromelain as a dietary supplement continues its popularity rise. The increasing demand is not only stressing the multi-use of bromelain but also indicates a greater tendency towards holistic and natural dietary supplements in the market.

A survey conducted by the National Institutes of Health (NIH) indicated that around 76% of U.S. adults reported taking dietary supplements, with many citing reasons such as improving overall health and addressing specific health concerns.

Bromelain is gaining traction in the food industry, particularly within the meat and seafood sectors, due to its exceptional natural tenderizing properties. Being a protein-digesting enzyme extracted from pineapples, bromelain works as an incredible component to be added in the marination stage. Their enzymatic action tenderizes tougher cuts of meat and improves flavor and texture resulting in a more desirable product for the consumer. In the meat processing industry, this powerful natural enzyme has caught the attention of food manufacturers looking to produce better quality products by avoiding any artificial additives or the use of chemicals. They are positioning bromelain according to the growing consumer demand for natural/clean-label products and plant-based–based ingredients. Bromelain's position in the food industry is likely to grow as more consumers seek out ingredients that are higher quality and more natural, providing meat and seafood producers with advanced solutions to meet these evolving market demands.

According to the U.S. Department of Agriculture (USDA), the total value of the U.S. meat and poultry industry reached approximately USD 224 billion in 2022, with projections indicating a continued increase as the industry adapts to consumer preferences for quality and natural ingredients.

Bromelain Market Dynamics

Drivers

-

The trend towards natural and organic products drives the market growth.

The increasing affinity towards natural and organic products is still a major factor responsible for the growth of the bromelain market, which aligns with the global transformation in consumer tastes to health-friendly buying. With people learning more about health and wellness, consumers are more careful about the ingredients that they choose to take in their food and supplement intake. Almost all want products that eschew synthetic additives, preservatives, and chemicals in favor of natural human nature. Bromelain, a natural enzyme obtained from pineapples fits this bill very well, thus making it suitable for dietary supplements and food processing. Sodium alginate is known as a clean-label ingredient, making it highly appealing to health-conscious consumers who are focusing on transparency in the purchasing decision process. Furthermore, the demand for bromelain is expected to grow due to the increasing penetration of health and wellness ingredients with retailers and manufacturers expanding their themselves on natural & organic offers according help consumer demands. Such a trend will lead to the further expansion of the market but also promote innovative product formulations utilizing natural products such as bromelain.

Moreover, a survey conducted by the Organic Trade Association found that 82% of U.S. families now purchase organic products, highlighting a significant shift toward natural ingredients in food and supplements.

Restraint

-

Competition from alternative issues may hamper the market growth.

One of the prominent factors that is expected to restrain growth of the bromelain market during the forecast period is competition from alternative products, as both dietary supplements and food additive segments are flooded with numerous substitute alternatives. Many synthetic enzymes-natural alternatives, like papain from papayas, or other tenderizers-are common and generally more familiar to the consumer. These alternatives may be promoted to the public as being just as effective or even more digested for specific uses compared to bromelain, and might therefore lead people away from using bromelain. Moreover, the aggressive marketing of these competing products and its touted benefits attract more consumers and further share of the market. This would result in fewer consumers and manufacturers inclined to use it, as bromelain may simply not have a distinguishable value proposition in a crowded marketplace. Such aggressive competition affects sales and induces bromelain producers to spend more on marketing and product invention, thus raising high operating expenses.

Bromelain Market Segmentation Analysis

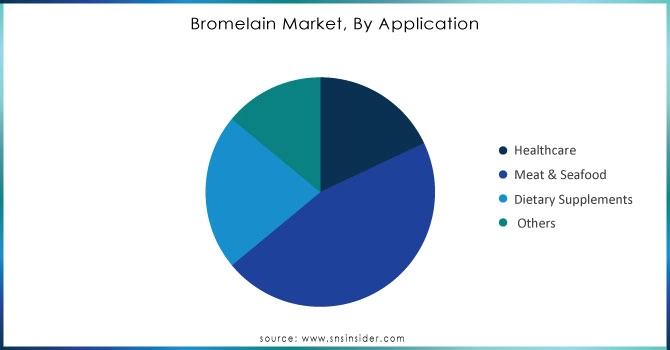

By Application

Meat and Seafood held the largest market share around 46% in 2023. This is due to the ability of bromelain to act as a natural tenderizer and flavor enhancer. It breaks down the structure of the protein, it is especially useful for marinading: tougher cuts of meat become tender and easier to eat. This enzymatic action not only renders meat and seafood products with a better texture but also helps to enhance their flavor profile making them more consumer-appealing. Furthermore, one of the factors for bromelain being adopted by food processors in their formulations is that consumers demand high-quality meat as well as seafood products and they tend to prefer good taste coupled with texture. Along with the growing food service industry and increasing consumer demand for gourmet and specialty meat products, this trend contributes to the overall dominance of the meat and seafood category in the bromelain market which will continue to be a significant area of application for this enzyme.

|

Application Segment |

Market Share |

|---|---|

|

Meat & Seafood |

Largest Share |

|

Healthcare |

Growing Share |

|

Dietary Supplements |

Steady Growth |

|

Others |

Moderate Share |

Need Any Customization Research On Bromelain Market - Inquiry Now

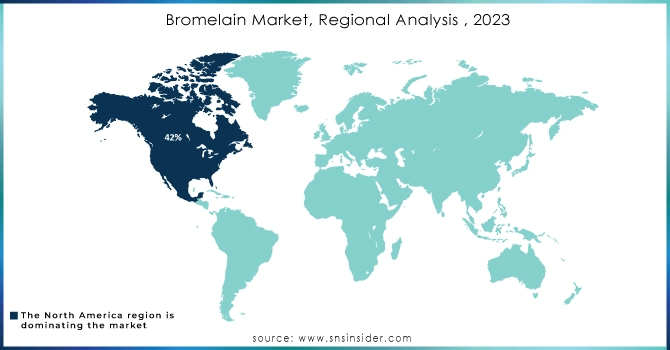

Bromelain Market Regional Outlook

North America region held the highest market share around 42% in 2023. It is owing to a well-established dietary supplements industry and growing consumer awareness about health benefits, coupled with a strong food processing range. Consumers in the region are shifting toward natural ingredients due to increasing focus on health and wellness. A brisk appetite for health-related products, including bromelain: almost 77 American adults used dietary supplements in 2022 (Council for Responsible Nutrition).

In addition, the U.S. dietary supplementation is valued at an estimated USD 54.5 billion in 2022 according to the Nutritional Business Journal and this boom gravitates further prospects for bromelain as a natural enzyme to be applied in numerous formulations. Moreover, bromelain is also a food additive approved by the U. S. Food and Drug Administration (FDA) which indicates its easier use in the food industry. North America dominates the bromelain market due to these factors, coupled with a strong regulatory setup and comprehensive research validating the health benefits of bromelain.

Key Players

-

Hong Mao Biochemicals Co., Ltd. (Bromelain Powder)

-

ENZYBEL GROUP (ENZYBEL Bromelain)

-

Great Food Group of Companies (Bromelain Extract)

-

Advanced Enzyme Technologies (Bromelain Enzymes)

-

Guangxi Nanning Javely Biological Products Co. Ltd. (Javely Bromelain)

-

Nanning Pangbo Biological Engineering Co., Ltd. (Pangbo Bromelain)

-

Nanning Doing Higher Bio-Tech Co., Ltd. (Bromelain Enzyme)

-

Changsha Natureway Co., Ltd. (Natureway Bromelain)

-

Biozym Gesellschaft für Enzymtechnologie mbH (Biozym Bromelain)

-

URSAPHARM Arzneimittel GmbH (Ursapharm Bromelain)

-

NutraBlast (NutraBlast Bromelain)

-

Bromelain Pharma (Bromelain Capsules)

-

Huangpu Quanzhou Biochemical Co., Ltd. (QZ Bromelain)

-

Bromelain Solutions LLC (Bromelain 500mg)

-

Aumgene Biosciences (Aumgene Bromelain)

-

Biosera (Bromelain Solution)

-

Creative Enzymes (Creative Bromelain)

-

Yiduoli Biotechnology Co., Ltd. (Yiduoli Bromelain)

-

Shaanxi Huike Botanical Development Co., Ltd. (Huike Bromelain)

-

Sunrise Nutrachem Group (Sunrise Bromelain)

Recent Development:

-

In 2023, Enzybel Group expanded its enzyme production facilities in Belgium to enhance its production capacity for natural enzymes like bromelain. The expansion aims to meet the rising global demand for high-quality, sustainable bromelain for food and pharmaceutical applications.

-

In 2023, Advanced Enzyme Technologies expanded its product portfolio by launching an enhanced bromelain enzyme variant with improved stability and efficiency for use in meat processing and dietary supplements. The company’s focus on innovation aligns with the rising demand for natural enzymes in the food and healthcare sectors.

-

In 2023, Guangxi Nanning Javely invested in research to enhance bromelain extraction processes. This development aims to improve the enzyme’s potency and expand its application in various industries, including pharmaceuticals and cosmetics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 27.6 Million |

| Market Size by 2032 | US$ 50.4 Million |

| CAGR | CAGR of 6.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Healthcare, Meat & Seafood, Dietary Supplements, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hong Mao Biochemicals Co., Ltd., ENZYBEL GROUP, Great Food Group of Companies, Advanced Enzyme Technologies, Guangxi Nanning Javely Biological Products Co. Ltd., Nanning Pangbo Biological Engineering Co., Ltd., Nanning Doing Higher Bio-Tech Co., Ltd., Changsha Natureway Co., Ltd., Biozym Gesellschaft für Enzymtechnologie mbH, URSAPHARM Arzneimittel GmbH, NutraBlast, Bromelain Pharma, Huangpu Quanzhou Biochemical Co., Ltd., Bromelain Solutions LLC, Aumgene Biosciences, Biosera, Creative Enzymes, Yiduoli Biotechnology Co., Ltd., Shaanxi Huike Botanical Development Co., Ltd., Sunrise Nutrachem Group, and Others |

| Key Drivers | •The trend towards natural and organic products drives the market growth. |

| Restraints | •Competition from alternative issues may hamper the market growth. |