Calcium Supplements Market Report Scope & Overview:

Get more information on Calcium Supplements Market - Request Free Sample Report

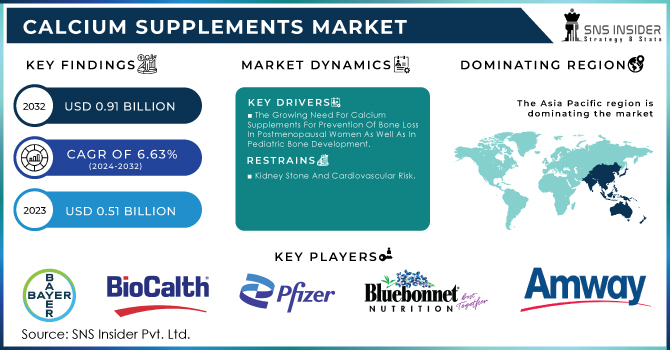

The Calcium Supplements Market Size was valued at USD 510.00 Million in 2023 and is expected to reach USD 908.83 Million by 2032, growing at a CAGR of 6.63% over the forecast period of 2024-2032.

The Calcium Supplements Market has experienced substantial growth, driven by demographic shifts such as an aging population and rising health consciousness, increasing demand for calcium supplements. Our report highlights the widespread calcium deficiency across the globe, emphasizing its role in market expansion as consumers turn to supplements for bone health. It also explores the regulatory landscape, showing how regulations ensure the safety and quality of products. The report addresses cost dynamics and price sensitivity, revealing how affordability influences purchasing decisions. Furthermore, global export and import trends are examined, providing insights into how international trade affects market development. Through these insights, our report offers a comprehensive understanding of the market’s key growth drivers.

The US Calcium Supplements Market Size was valued at USD 140.41 Million in 2023 with a market share of around 81% and growing at a significant CAGR over the forecast period of 2024-2032.

The US Calcium Supplements Market is experiencing steady growth due to rising awareness about bone health, particularly among aging populations. Organizations such as the National Osteoporosis Foundation highlight the importance of calcium in preventing bone-related diseases, fueling consumer demand. The growing trend of proactive health management, especially among older adults, has led to increased consumption of calcium supplements. Companies like GNC Holdings Inc. and Nature Made are capitalizing on this shift by offering a variety of calcium-based products tailored for different age groups. The focus on health-conscious living and preventive healthcare continues to drive the market forward.

Market Dynamics

Drivers

-

Increasing Prevalence of Bone-Related Disorders Fuels the Demand for Calcium Supplements Among the Aging Population

The growing prevalence of bone-related conditions, especially osteoporosis and osteopenia, is significantly boosting the demand for calcium supplements, particularly among the aging population in the United States and other developed regions. As individuals age, their calcium absorption decreases, leading to an increased need for supplements to maintain bone density and prevent fractures. According to the National Osteoporosis Foundation, osteoporosis affects approximately 10 million people in the United States alone, with an additional 44 million at risk. This widespread concern over bone health is driving many consumers to adopt calcium supplements as a preventive measure. Moreover, healthcare professionals recommend calcium supplementation to older adults to combat the negative effects of calcium deficiency, further propelling market growth. Additionally, the increasing awareness about the link between bone health and overall wellness continues to be a catalyst for the calcium supplements market.

Restraints

-

Lack of Consumer Education on Proper Calcium Supplementation Practices Results in Misuse and Low Efficacy

A significant restraint in the calcium supplements market is the lack of widespread consumer education on the proper use of these supplements. Many consumers are unaware of the correct dosage or timing for calcium supplementation, leading to issues such as overuse or underuse, which can reduce the overall effectiveness of the supplements. Misuse can also result in side effects such as kidney stones or gastrointestinal discomfort, further deterring individuals from using calcium supplements consistently. Despite efforts from health organizations to educate the public on calcium's role in health, many still remain uninformed about the correct approach to supplementation. As a result, consumer trust in the supplements can be negatively impacted, leading to hesitancy in adoption. Proper education is vital to ensuring that calcium supplements provide the intended health benefits, and without it, market growth may face limitations.

Opportunities

-

Growing Demand for Vegan and Plant-Based Calcium Supplements Opens New Market Segments

As the vegan and plant-based movements gain momentum globally, there is a growing demand for vegan and plant-based calcium supplements. These products are derived from alternative sources such as algae, seaweed, and other plant-based ingredients, catering to individuals who do not consume animal-derived products. This growing trend among health-conscious consumers seeking plant-based alternatives is creating new opportunities for manufacturers to innovate and expand their offerings. Companies such as Bio Island and By-health Co., Ltd. are already capitalizing on this demand by producing plant-based calcium supplements. Furthermore, as more consumers adopt vegan and vegetarian lifestyles, the market for plant-based calcium supplements is expected to continue to expand, offering new avenues for growth and diversification within the industry.

Challenge

-

Regulatory Compliance and Approval Processes Pose Significant Barriers to Market Entry

One of the major challenges in the calcium supplements market is the complex and often lengthy regulatory approval processes that manufacturers must navigate to bring new products to market. In countries like the United States, the European Union, and others, calcium supplements are subject to stringent regulations, which require manufacturers to ensure that their products meet safety, efficacy, and quality standards. This process often involves expensive clinical trials, ingredient testing, and labeling requirements, which can delay product launches and increase operational costs. Additionally, regulatory differences between regions can create barriers for companies attempting to enter international markets, particularly in regions with more rigid supplement regulations. For new entrants, complying with these regulatory requirements is often a significant challenge that can impact their ability to compete effectively.

Segmental Analysis

By Type

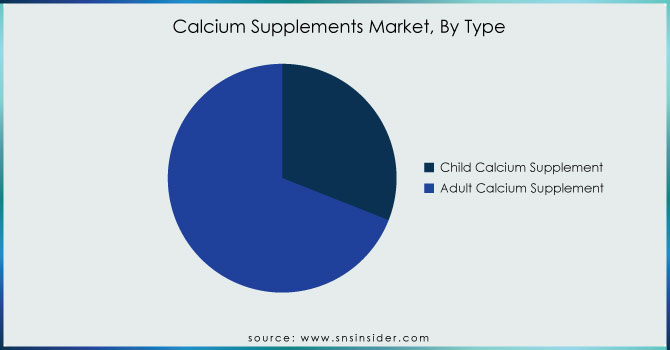

In 2023, the Adult Calcium Supplement segment was the dominant player in the Calcium Supplements Market, holding a market share of 65.3%. This dominance can be attributed to the increased focus on bone health among the aging population. According to the National Osteoporosis Foundation, osteoporosis affects millions of adults, particularly in developed countries like the United States, where calcium supplements are widely used to prevent bone density loss and fractures in older adults. Additionally, adult calcium supplementation is recommended by healthcare professionals, leading to consistent demand from this demographic. The rise in awareness about the importance of bone health and the growing prevalence of bone-related disorders further fuels the demand for adult calcium supplements. Brands like Nature Made and GNC Holdings Inc. cater specifically to adults with various calcium formulations to address these needs, highlighting the segment's growth.

By Form

The Tablet form of calcium supplements dominated the market in 2023, capturing a 60.2% market share. Tablets are the most widely accepted and convenient form of calcium supplements for consumers, with a long-standing presence in the market. Major players like Caltrate (Pfizer) and Nature Made offer various calcium tablet formulations that cater to different health needs. The dominance of tablets can be attributed to their ease of storage, affordability, and long shelf life compared to other forms like syrups or powders. Additionally, consumer preference for easy-to-consume pills and the effective dosage that tablets provide contribute to their widespread use. According to the National Institutes of Health (NIH), calcium tablets are among the most popular forms of supplementation in the United States, with consumers preferring this format for its simplicity and ease of use in daily routines. These factors reinforce tablets' position as the leading form of calcium supplements.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Analysis

In 2023, the Asia Pacific region dominated the Calcium Supplements Market, holding a market share of 34.2%. This can be attributed to the increasing health awareness, rising disposable incomes, and the growing elderly population across countries such as China, India, and Japan. The region is home to a significant portion of the world’s aging population, particularly in countries like Japan, where nearly 28% of the population is over 65 years old. The demand for calcium supplements in these countries is primarily driven by the need to address age-related bone health concerns like osteoporosis and osteopenia. The World Health Organization (WHO) has emphasized the importance of calcium for elderly populations, contributing to higher adoption of supplements. In India and China, a growing middle class is also driving the demand for health supplements, including calcium. Companies like By-health Co., Ltd. and GNC Holdings Inc. have expanded their product offerings in the region, making calcium supplements more accessible. The market is supported by government health initiatives focused on improving bone health and addressing calcium deficiencies, further solidifying the dominance of the Asia Pacific region.

On the other hand, the Europe region shows a steady growth with a significant CAGR in Calcium Supplements Market during the forecast period of 2024 to 2032. This growth is driven by an increasing aging population and rising awareness of the importance of bone health. European countries like Germany, France, and the United Kingdom have seen a steady rise in the consumption of calcium supplements, as individuals become more proactive in preventing osteoporosis and other bone diseases. The European Food Safety Authority (EFSA) has recommended adequate calcium intake for optimal bone health, further boosting market demand. Additionally, the European market is witnessing a surge in the popularity of plant-based and vegan calcium supplements, driven by dietary trends and the growing preference for plant-based products. In countries like the UK, calcium supplements are often recommended by healthcare professionals, leading to higher adoption rates. The rise in health-conscious consumers, along with increased availability of diverse calcium supplement formulations, is expected to propel the growth of this market in Europe.

Key Players

-

AandZ Pharmaceutical – (Calcium 600mg, Calcium Plus Vitamin D3)

-

Amway (Nutrilite) – (Nutrilite Calcium Magnesium Potassium, Nutrilite Calcium Plus Vitamin D3)

-

Bayer AG – (One A Day Calcium + D, Berocca Performance with Calcium)

-

BioCalth – (BioCalth Calcium, BioCalth Calcium + Vitamin D3)

-

Bio Island – (Bio Island Calcium + Vitamin D3, Bio Island Calcium)

-

Bluebonnet Nutrition – (Calcium Citrate, Calcium Magnesium Plus Zinc)

-

By-health Co., Ltd. – (Calcium Tablets, Calcium with Vitamin D3)

-

Caltrate (Pfizer) – (Caltrate 600+D3, Caltrate Bone Health)

-

Garden of Life – (Vitamin Code RAW Calcium, Garden of Life Calcium)

-

GNC Holdings Inc. – (GNC Calcium Citrate, GNC Calcium + D3)

-

GSK – (Caltrate 600+D3, Sensodyne Pronamel with Calcium)

-

Harbin Pharmaceutical Group – (Calcium Tablets, Calcium + Vitamin D)

-

High Change – (High Change Calcium Tablets, High Change Calcium with Vitamin D)

-

Kirkland Signature – (Kirkland Signature Calcium Citrate, Kirkland Signature Calcium 600mg with Vitamin D3)

-

Nature Bounty – (Nature’s Bounty Calcium 600mg with Vitamin D, Nature’s Bounty Calcium Plus)

-

Nature Made – (Nature Made Calcium 600mg with Vitamin D3, Nature Made Calcium Citrate)

-

NOW Foods – (Calcium Citrate, Calcium Magnesium Zinc)

-

Solgar – (Solgar Calcium Citrate, Solgar Calcium with Vitamin D3)

-

Shanxi Zhendong Pharmaceutical Co., Ltd. – (Shanxi Zhendong Calcium, Calcium Tablets)

-

Swisse – (Swisse Ultivite Calcium, Swisse Calcium + Vitamin D3)

Recent Developments

-

June 2024: Purovitalis, a Dutch pioneer in longevity supplements, introduced its latest innovation in slow-release Calcium-AKG tablets. Designed to enhance physical vitality and bone health, the product is formulated for sustained calcium delivery. Users report increased energy and alertness, supporting a more active and fulfilling lifestyle.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 510.00 Million |

| Market Size by 2032 | USD 908.83 Million |

| CAGR | CAGR of 6.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Child Calcium Supplement, Adult Calcium Supplement) •By Form (Syrup, Tablets, Powder) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BioCalth, Bluebonnet Nutrition, Nature's Bounty, By-health Co., Ltd., Nature Made, Shanxi Zhendong Pharmaceutical Co., Ltd., GNC Holdings Inc., High Change, AandZ Pharmaceutical, Bio Island and other key players |