Women’s Health Devices Market Size Analysis:

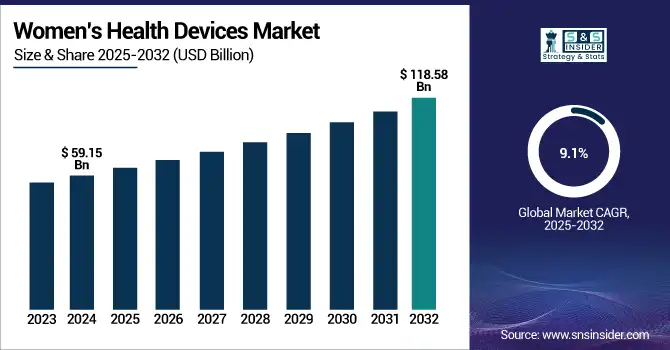

The Women’s Health Devices Market size was valued at USD 59.15 billion in 2024 and is expected to reach USD 118.58 billion by 2032, growing at a CAGR of 9.1% over the forecast period of 2025-2032.

To Get more information on Women’s Health Devices Market - Request Free Sample Report

Driven by rising awareness of women’s health issues and aggressive government policies, the women's health devices market is seeing robust growth.

Reflecting a strategic push to address conditions including breast cancer, pelvic disorders, and reproductive health issues, the U.S. government allocated approximately USD 500 million in 2024 through NIH and ARPA-H to improve women's health research and invention.

Driven by sophisticated healthcare infrastructure and regulatory backing, including improved HIPAA laws safeguarding reproductive health data, the U.S. women's health devices market held a significant share, with a value of USD 22.01 billion in 2024 and it’s expected to reach USD 43.74 billion by 2032 with a CAGR of 8.98% during the forecast period. Adoption of wearable devices for women's health, digital health for women, and maternal health solutions is driven worldwide by growing geriatric female populations and rising healthcare expenditure. Policies supporting telehealth and data privacy are changing the regulatory scene in women's healthcare, further accelerating women’s health devices market growth and innovation in women's health devices market trends.

The female health devices market includes a broad range of women's healthcare devices meant for pelvic health, breast health, reproductive health, and gynecological diagnosis. Government agencies all around have raised money and given women's wellness technology and femtech developments top priority regulatory focus. For instance, the 2022 Health of Women Program Strategic Plan of the U.S. FDA supports the development and approval of female-specific medical technology, therefore encouraging market expansion. Demand for hormonal health monitoring and endometriosis diagnosis stems from growing knowledge of women's health as well as from the aging female population. Including wearable devices and telemedicine, digital health for women is increasing access to maternal health solutions and fertility monitoring devices, therefore addressing unmet needs in both developed and developing markets.

Women’s Health Devices Market Dynamics

Driver

-

Increasing Awareness and Health Education Among Women Significantly Boosts Adoption of Women’s Health Devices

Increasing acceptance as well as health awareness among women is one of the major factors boosting the demand for women's health devices worldwide. The increasing government initiatives, as well as outreach by the private sector regarding reproductive health, menstrual hygiene, pregnancy care, and chronic conditions such as osteoporosis and breast cancer, are major factors driving the women's health devices market in India. An example of a governmental initiative on enhancing woman health using better diagnostic and therapeutic options is the Health of Women Program Strategic Plan released by the U. S. FDA in 2022.

The growth of mobile health platforms and telemedicine services has also enabled women to take more control over their health and well-being, resulting in a wider adoption of wearable health devices, diagnostic kits, and smart menstrual products. The reduction of social taboos around gynecological health further encourages women to seek timely medical interventions. Improving awareness not only helps in timely diagnosis and better management of the disease but also aids in the acceptance of emerging female-centric health technologies. The exceptionality of this trend is buoyed by the enhancement of global healthcare infrastructure and increasing female population demographics, both of which broaden the scope of the global women's health devices market among varied socio-economic and geographic strata.

Restraints

-

High Cost and Regulatory Complexity Limit Accessibility and Growth of Women’s Health Devices Market

In developing countries, the cost of women's health devices is too high as well, and regulatory environments in these countries also create high barriers to market growth and accessibility. The high prices of these advanced medical devices for diagnostics and treatment are due to the expensive materials and high-end technology involved in the manufacturing of these devices, something that many women just cannot afford. Restricted insurance reimbursement and variable telehealth policies further limit access to these devices, especially in low-income and rural areas. Two of the biggest barriers are regulatory challenges since FemTech products fall under different categories and regulations depending on the region, which leads to slow approval processes and delayed access to the market. It usually takes 3 to 7 years to get FDA approval for new medical devices, which directly means that time-to-market increases and development costs rise.

Data privacy laws are also evolving, which pushes companies to bear the burden of increased operational compliance, be it through increased enforcement of HIPAA regarding reproductive health data or compliance with state-specific laws, such as the California Privacy Rights Act. Social stigma makes discussions about these issues difficult for market penetration. These financial, regulatory, and social barriers all contribute to a lag in the adoption of innovative solutions and facilitate the limited scope of women's health tech devices, impeding the overall women’s health devices market growth.

Women’s Health Devices Market Segmentation Analysis

By Application

In 2024, the cancers & other chronic diseases segment held a leading position in the women’s health devices market with a share of around 35%, because of the high prevalence of breast cancer, ovarian cancer, and cervical cancer. As per the statistics of the American Cancer Society, breast cancer affects 1 in 8 U. S. women, which has resulted in the demand for advanced breast health devices such as molecular diagnostics and imaging tools. Innovation in cancer diagnostics and therapeutics has also been propelled by government initiatives such as greater funding for female cancer research initiated by the U.S. National Cancer Institute. As a key example, the launch of the cobas PIK3CA Mutation Test in 2021 by F. Hoffmann-La Roche Ltd shows how next-generation diagnostics promote tailored therapeutic approaches.

Factors such as the increasing prevalence of urinary incontinence and pelvic floor disorders, especially in the aging female population, will contribute to making the pelvic & uterine healthcare segment grow at a strong rate. According to the American Urological Association, roughly 1 in 2 U.S. women over 20 has experienced urinary incontinence, causing a need for pelvic health device such as electrical stimulators and vaginal pessaries. Through research grants and public health campaigns, government health agencies zeroed in on pelvic health, facilitating national uptake of wearable devices for women’s health, which allow remote monitoring of pelvic conditions. Ongoing awareness and destigmatization of pelvic disorders are further fueling the growth of the market.

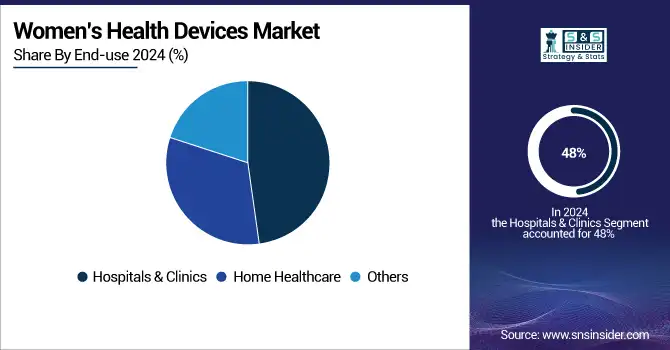

By End-Use

In 2024, the women's health devices market was led by hospitals & clinics with the largest revenue share of 48%. This is largely due to the linkage between complex diagnostics and the treatment of cancers and gynecological disorders in clinics. The adoption of advanced female health devices market technologies such as gynecological diagnostic devices and breast health devices, is being supported by government reimbursement policies and healthcare infrastructure investments, as stated, thereby significantly supporting the growth of the female health devices market. For example, Unified Women’s Healthcare’s acquisition of Gennev in October 2022 expanded clinical menopause management services, illustrating strategic clinical growth.

For instance, home care is expected to be the fastest-growing segment, as more patients prefer convenience and advances in wearable devices for women’s health. The ability to monitor devices related to reproductive health remotely, including pregnancy and ovulation testing devices, is made possible by 2025 through government telehealth policies. Digital health for women has steadily taken off, with fertility monitoring devices that connect to your smartphone and hormonal health monitoring tools to help women assess, track, and manage their health proactively at home. This trend is consistent with the changing regulatory environments that promote telemedicine and the development of medical technology for female conditions outside traditional clinical environments.

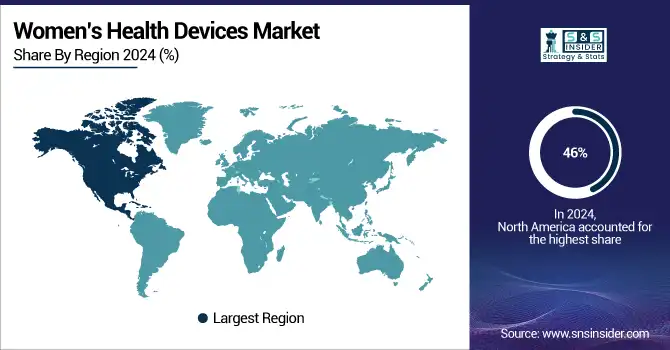

Regional Insights

North America accounts for the largest women’s health devices market share 46% in 2024. The U.S. women’s health devices market alone accounted for approximately 37.2% share of the global women’s health devices market in 2023 and will continue to be one of the key drivers for this leadership. North America holds the largest women’s health devices market share based on the presence of developed healthcare systems, extensive spending, and significant government backing for women-specific medical technology and women’s wellness technology. The most ideal ground for innovating and taking up next-generation reproductive health devices, breast health devices, and pelvic health devices has opened due to government initiatives such as increasing funding for women's health research through NIH and ARPA-H, and regulatory frameworks such as strengthening HIPAA data protections for reproductive health data. Also, a high occurrence of chronic diseases & power in the region leads to an increase in the number of various female-related problems related to gynecological diagnostic devices, which in turn is highly affecting the demand for gynecological diagnostic devices along with the developing need for wearable devices. in the region.

Europe accounts for a significant revenue share of the global women's health devices market, which is supported by favourable government initiatives, reimbursement policies & healthcare infrastructure investment. These three countries (Germany, the UK, and France) play a pivotal role in the women's health devices market, which is characterized by a diverse range of diagnostic, therapeutic, and monitoring devices for women's health issues such as reproductive health disorders, bone disorders (osteoporosis), and cancers. In the European market are also seeing the increasing adoption of digital health for women and femtech innovations, which cover hormonal health monitoring, endometriosis diagnostics, and more. Access to maternal health tools and fertility tracking instruments has been improved due to government initiatives on telemedicine and women’s wellbeing technologies.

Asia-Pacific is anticipated to be the fastest-growing market for women's health devices over the forecast period due to a rise in healthcare expenditure as well as the high prevalence of female-specific health conditions, along with a growing healthcare infrastructure in countries such as China, India, Japan, and South Korea. The growth is attributed to increasing awareness towards reproductive health, supportive government initiatives towards preventive diagnosis, and speedy advancements in wearable and artificial intelligence-based diagnostics. The adoption of Telemedicine and the rise of mobile health platforms have facilitated the accessibility of female health-centered devices, especially in remote or underserved areas. Also, due to the increase in disposable incomes along with the surprising entity of the geriatric female population, it is further driving the market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Women’s Health Devices Market Key Players

The key Women’s Health Devices Companies are GE Healthcare Technologies Inc., Abbott Laboratories, Hologic, Inc., Allengers Medical, Garmin Ltd., Alphabet Inc., Organon & Co., Koninklijke Philips N.V., Samsung Electronics Co., Ltd., Caldera Medical, OMRON Corporation, Carestream Health, Mankind Pharma Limited, and others.

Recent Developments in the Women’s Health Devices Market

-

In February 2024, Hologic, Inc. launched the first digital cytology system using advanced volumetric imaging, which the FDA cleared to detect pre-cancerous and cervical cancer cells in the U.S. employing its Genius Digital Diagnostics System. This achievement fortified the company as a leader in the competitive landscape.

-

In Jan 2024, U.S. Dept of Health and Human Services will bolster HIPAA enforcement on reproductive health data protection, changing the regulatory landscape in women's healthcare and prompting a slew of companies to bolster the data security of their digital health women's applications

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 59.15 Billion |

| Market Size by 2032 | USD 118.58 Billion |

| CAGR | CAGR of 9.1% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Cancers & Other Chronic Diseases, Pelvic & Uterine Healthcare, General Health & Wellness, Reproductive Health, Pregnancy & Nursing Care, and Others) • By End-user (Home Healthcare, Hospitals & Clinics, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | GE Healthcare Technologies Inc., Abbott Laboratories, Hologic, Inc., Allengers Medical, Garmin Ltd., Alphabet Inc., Organon & Co., Koninklijke Philips N.V., Samsung Electronics Co., Ltd., Caldera Medical, OMRON Corporation, Carestream Health, Mankind Pharma Limited, and others |