Car Key Chips Market Size & Trends:

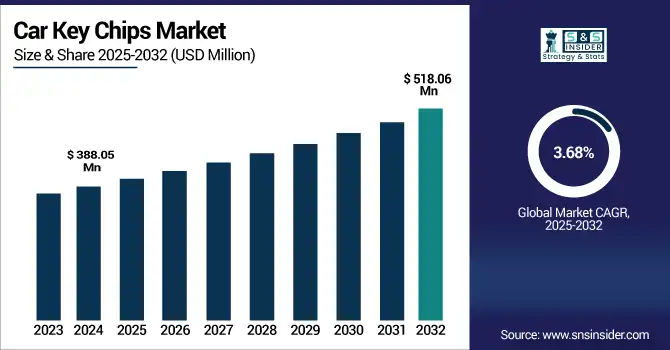

The Car Key Chips Market size was valued at USD 388.05 Million in 2024 and is projected to reach USD 518.06 Million by 2032, growing at a CAGR of 3.68% during 2025-2032.

To Get more information on Car Key Chips Market - Request Free Sample Report

The global car key chips market growth is positively influenced by the growing trend of smart and keyless entry systems, surging car manufacturing and increasing consumer preference for better automotive security and convenience. Advances in electronics design, upgrades in encryption, and the ability to build chips small enough, and to integrate with wireless standards, such as NFC and Bluetooth, have all at once changed all that. The development of electric and connected vehicles is also driving the demand for high-performance key chips with customized and remote access capabilities. With the automobile industry moving toward smarter and securer mobility solutions, the global market for car key chips will continue to witness mobility over the forecast period.

Qualcomm on Wednesday at the Snapdragon Summit 2024 introduced Snapdragon Ride and Cockpit automobile platforms, which feature sophisticated AI and security for new-generation in-vehicle experiences. Introduced in October 2024, the platforms will help in customization, automation, and connections of car key chip systems.

The U.S Car Key Chips market size was valued at USD 78.95 Million in 2024 and is projected to reach USD 101.37 Million by 2032, growing at a CAGR of 3.17% during 2025-2032.

The market growth in the U.S. is expanding due to rising consumer demand for improved vehicle security, surging smart and connected vehicles' adoption, and ongoing advancements in the automotive electronics. The strong presence of major automobile manufacturers and surging keyless entry systems' preference also make substantial contributions in the growth of the car key chips market.

Car Key Chips Market Dynamics:

Drivers:

-

Growing Demand for Secure and Interoperable Digital Car Key Technologies

Growing customer requirements for safe, convenient and compatible digital access to the car are driving the car key chips market. With the increasing popularity of digital car keys, it's more important than ever to have them work across different models and devices with absolute security. Standards and certifications that focus on building trust and greater interoperability make it possible for manufacturers to produce keyless entry solutions that are reliable and user-friendly. Attributes, such as multi-user managed access and remote key enablement are fueling adoption, propelling chip innovation and the market overall, as car makers see the need for high-level security and connectivity in smart vehicles.

NXP Semiconductors’ SN220 chip has become the first NFC digital car key solution certified by the Car Connectivity Consortium’s Digital Key Program, ensuring secure and seamless interoperability across vehicles and mobile devices. This certification is responsible in setting new standards for digital key technology in the automotive market globally.

Restraints:

-

Semiconductor Shortages and Geopolitical Tensions Disrupt Car Key Chip Supply Chain

The car key chips market faces significant challenges due to ongoing semiconductor shortages and geopolitical tensions. The disruptions have resulted in restricted supply of critical chip parts, leading to both production delays and higher production costs for automotive suppliers. The global semiconductor supply chain is susceptible to trade restrictions, export controls, and regional disputes that add to the supply uncertainties. This find leaves car manufacturers grappling to cope with increasing demand for new car key technology, impeding market growth. This supply chain uncertainty not only impacts production timing, but also results in price volatility, which impacts manufacturers and consumers. If not addressed, such factors can inhibit the growth and timely adoption of new car key chip solutions within the automotive industry.

Opportunities:

-

Expansion of NFC Access to Third-Party Apps Drives Growth in Car Key Chips Market

The opening of NFC chips in smartphones to third-party apps to enable contactless car keys, and payments and IDs, could provide great growth potential for the car key chips market. This advancement enables developers to introduce scalable, secure digital key solutions across a broad range of legacy platforms, and will facilitate innovation in vehicle access technology. With the popularity of seamless, mobile-based car key systems, the market for superior and compatible car key chips is expanding. Such development encourages carmakers and chipmakers to create products compatible with all devices, facilitating fast market expansion. Additionally, the increase of NFC availability has made it more convenient and secure for users to use digital car keys, thus boosting widespread acceptance of those technologies and stimulating fast innovation in car key chips globally.

Apple is allowing third-party apps to access its iPhone’s NFC chip with iOS 18.1, opening up contactless payments for payments, car keys, IDs and more. This step opens up NFC use for more than just Apple Pay, developers can build a variety of secure access and payments solutions.

Challenges:

-

Security Concerns and Technological Complexities Hinder Growth of Car Key Chips Market

The car key chips market faces significant challenges due to the requirement for heightened security, and technical complexity. With the proliferation of digital car keys, increasing risks such as hacking, hacking, illegal entry and other security threats have constrained consumers’ potential of this service. Besides, adding biometric authentication and seamless support for smartphones and advanced functionality leads to complex chip designs, which in turn raises the development cost and technical hurdles.

Compatibility challenges between different vehicle models and mobile platforms are the market deterrent for growth. Additionally, supply-chain disruptions and the shortage of semiconductors lead to production timeline being pushed back, affecting product launches. Collectively, these obstacles have been inhibiting chip car key technology from being widely used, preventing the technology from becoming mainstream and also stifling its development, even as demand for a secure, convenient vehicle access solution has been increasing globally.

Car Key Chips Market Segmentation Analysis:

By Type

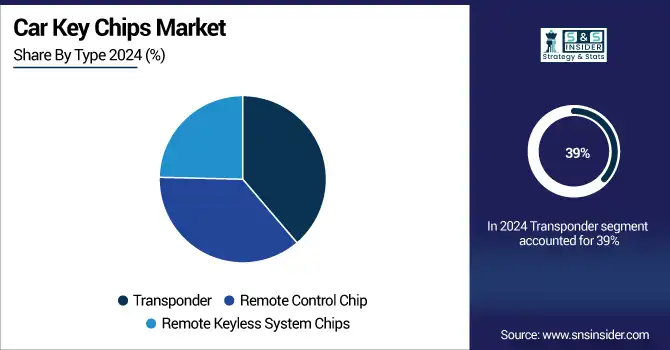

The Transponder segment held a dominant Car Key Chips Market share of around 39% in 2024, and the market for car key chips is likely to be driven by the transponder segment, as these transponders are increasingly used in keyless entry system demanding high level of security and reliability. Rising need for theft protection and car access convenience are expected to drive the growth of this market, so manufacturers and consumers are preferring the Transponder Chip Keys for safety and smooth access to vehicle.

The Remote Control Chip segment is expected to experience the fastest growth in the Car Key Chips Market over 2025-2032 with a CAGR of 5.25%, driven by increasing consumer demand for convenience and advanced keyless entry features. Suring adoption of smart vehicles and Innovations in wireless technology further propel the growth of this segment, as remote control chips allows for secure, seamless, and user-friendly vehicle control and access.

By Application:

The Commercial Cars segment held a dominant Car Key Chips Market share of approximately 59% in 2024, owing to the surging need for advanced security measures and well management of the fleet. Rising penetration of advanced keyless entry systems in commercial vehicles and stringent regulations for vehicle safety are driving the growth of this segment, making it the logical focus area for manufacturers of car key chips.

The Passenger Cars segment is expected to experience the fastest growth in the Car Key Chips Market over 2025-2032 with a CAGR of 6.17%, as consumer inclination for the convenience and safety features becomes stronger in personal vehicles. Increasing adoption of smart key systems, increase in the production of passenger cars around the world, and development of digital key technology are driving the growth of the automotive keys market in this segment.

Car Key Chips Market Regional Analysis:

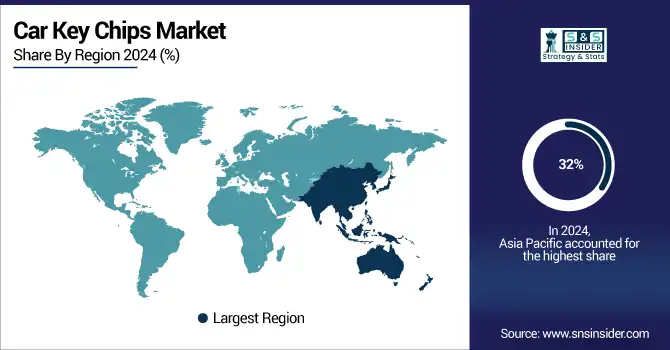

In 2024, the Asia Pacific dominated the Car Key Chips market and accounted for 32% of revenue share, and expected to be fastest growing from 2025-2032, fueled by the rapid expansion of the automotive sector and growing consumer preference for advanced vehicle security and keyless entry systems. Furthermore, the strong manufacturing infrastructure, along with continuous technological innovations in the region are projected to drive the fastest growth in the market over 2025-2032, further making it a major area of opportunity for the players in the market.

China’s dominance in the Asia Pacific Car Key Chips market is driven by its large automotive manufacturing base, rapid adoption of smart vehicle technologies, and strong government support for advanced security systems.

North America is projected to register the significant growth for CAGR of 4.17% during 2025-2032, owing to the surging demand of consumer for advanced vehicle security, escalating penetration of smart and connected car technology and continued investment on automotive R&D. Moreover, the existence of key car and chip players favours a better local market growth.

The U.S. leads the Car Key Chips market due to its advanced automotive infrastructure, high consumer demand for smart vehicle technologies, and strong presence of key semiconductor and automotive players.

In 2024, Europe emerged as a promising region in the Car Key Chips, due to the increasing number of electric and connected vehicles, stringent vehicle security regulations, and growing investments for automotive innovation. In addition, the area’s rich ecosystem of automotive manufacturing and emphasis on sustainable mobility also drives increasing needs for more advanced car key chip solutions.

LATAM and MEA is experiencing steady growth in the Car Key Chips market, owing to increasing ownership of vehicles, and the increasing focus on automotive security, and an increasing penetration of smart mobility solutions. Growing urbanization, strengthening economies and investments in Automotive Key Market infrastructure are also contributing to the development of advanced key technologies in these regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Car Key Chips Market Companies are NXP Semiconductors, Infineon Technologies AG, Texas Instruments, STMicroelectronics, Renesas, Microchip, Qualcomm, Bosch, Continental, DENSO and Others.

Recent Developments:

-

In July 2024, NXP became the first company to receive certification from the Car Connectivity Consortium for its digital car key solution, enhancing security and interoperability in smart vehicle access systems.

-

In April 2025, Texas Instruments launched a new portfolio of automotive lidar, radar, and BAW-based clock chips aimed at enhancing vehicle autonomy and safety. These innovations enable more compact, cost-effective, and reliable sensor systems for next-generation autonomous vehicles.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 388.05 Million |

| Market Size by 2032 | USD 518.06 Million |

| CAGR | CAGR of 3.68% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Transponder, Remote Control Chip, Remote Keyless System Chips) • By Application (Commercial Cars, Passenger Cars) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Car Key Chips market companies are NXP Semiconductors, Infineon Technologies AG, Texas Instruments, STMicroelectronics, Renesas, Microchip, Qualcomm, Bosch, Continental, DENSO and Others. |