Carbon Conductive Ink Market Report Scope & Overview:

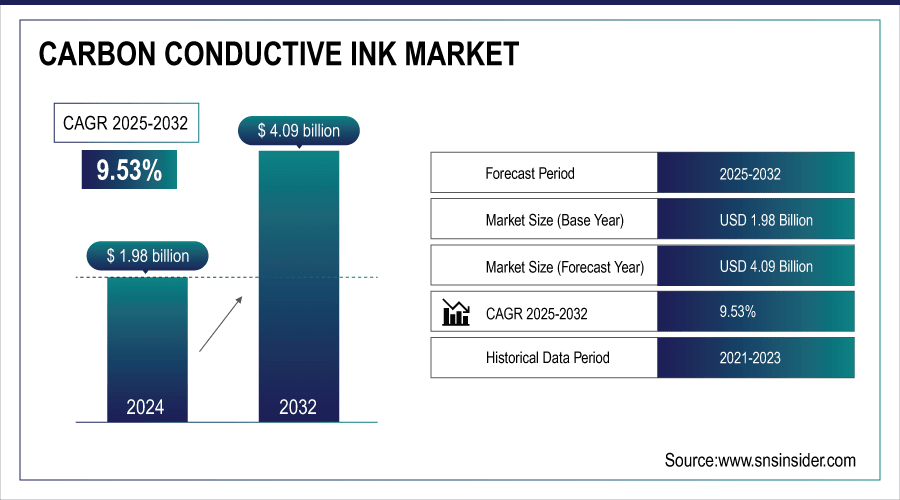

The Carbon Conductive Ink Market size was valued at USD 1.98 Billion in 2024 and is projected to reach USD 4.09 Billion by 2032, growing at a CAGR of 9.53% during 2025-2032.

The growth of the Carbon Conductive Ink Market is attributed to the increasing use of printed and flexible electronics in which lightweight, cost-efficient, and high conductivity inks are necessary. The adoption is increasing across various sectors with the proliferation of wearable devices, touchscreens, RFID tags and automotive electronics. Rising level of investment on renewable energy applications including solar cells and energy storage systems has elevated market demand. Furthermore, developments in graphene- and nanotube-based inks are paving new paths to better performance and energy utilization.

Carbon conductive inks are used in over 40% of printed sensor applications due to their chemical stability and lower cost compared to silver inks. Carbon-based conductive inks are used in ~30% of flexible wearable sensors for health monitoring (ECG, temperature, motion).

To Get More Information On Carbon Conductive Ink Market - Request Free Sample Report

Key Carbon Conductive Ink Market Trends

-

Technological advances in imaging that merge analog and digital into new possibility. This trend resonates with artistic creators and Gen Z alike, stoking demand for cameras with distinctive imaging capabilities.

-

Consumers increasingly prefer lightweight, portable devices with smartphone connectivity, film-simulation effects, and direct print functions. This drives manufacturers to design multifunctional products that align with evolving lifestyle needs.

-

Conductive inks are increasingly being integrated with wearable, automotive electronics, and touch screen for efficiency and flexibility purposes. These industries require light, durable and inexpensive materials stimulating market growth.

-

The application of conductive inks to solar cells and energy storage devices is increasing. This is in line with the worldwide trend towards sustainable energy sources with which new income sources are created.

-

Advances in graphene- and carbon nanotube-based inks can improve conductivity, efficiency, and overall device performance. These materials have great potential for high-performance applications in the electronics, imaging and renewable energy sectors.

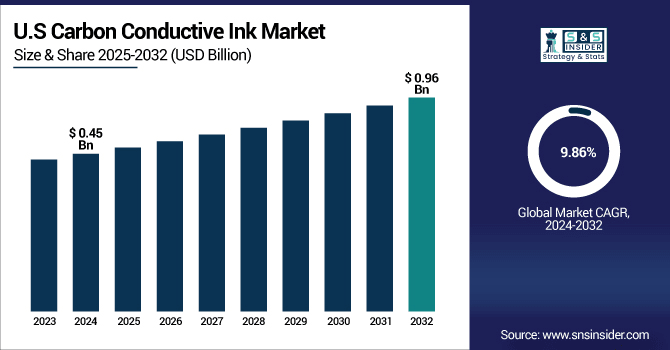

The U.S. Carbon Conductive Ink Market size was valued at USD 0.45 Billion in 2024 and is projected to reach USD 0.96 Billion by 2032, growing at a CAGR of 9.86%during 2025-2032. The growth of the carbon conductive ink market in the U.S. is attributed to the surge in the printed and flexible electronics demand from various end use industries. The increasing use of wearable health monitoring, smart textiles, and implantable medical devices is leading to a growing demand for flexible, biocompatible, and cost-effective conductive materials. Ink formulation and application techniques have been steered on into the fast lane of innovation by government and private sector investments in advanced manufacturing and next-generation electronics.

U.S. are increasingly integrating carbon conductive inks into touch sensors, heated components, and lightweight circuitry to enhance performance and reduce weight. The proliferation of IoT connected devices and smart infrastructure also fuels the need for scalable, printed electronics based on carbon inks. As top tier research institutions and companies are the first to innovate graphene, carbon nano tube-based inks, the US is leading the material renaissance.

Carbon Conductive Ink Market Growth Drivers:

-

Rising Adoption of Flexible and Printed Electronics Driving Carbon Conductive Ink Market

There is growing demand for printed and flexible electronics applications and this is driving the growth of Carbon Conductive Ink Market. Nowadays, consumers are more and more interested in light, mobile and inexpensive products, which results in the great use of conductive inks. Wearables, automotive electronics, touchscreens and other key sectors are expected to embrace such materials quickly. Increased application in renewable energy such as solar panels and energy storage is also driving the market. On going developments in graphene- and carbon-nanotube-based inks lead to improved conductivity, performance and new business opportunities.

Over 480 million wearable devices were shipped worldwide in 2023, with more than 60% of flexible sensors in fitness and medical wearables utilizing carbon-based conductive inks.

Carbon Conductive Ink Market Restraints:

-

High Costs, Material Limitations, and Regulatory Challenges Restrict Carbon Conductive Ink Market Expansion

Less availability of graphene and silver are high raw material costs are retraining the Carbon Conductive Ink Market. Scarcity of high-quality graphene and carbon nanotubes restrains its application. Technical issues such as compatibility with various substrates and printing techniques limit the versatility. Furthermore, there are a number of environmental and health regulations relevant to nanomaterials that add to the compliance requirements. All of these factors contribute to reduced market growth, notwithstanding rising demand from electronics and wind sectors.

Carbon Conductive Ink Market Opportunities:

-

Expanding Applications in Wearables, Automotive, and Renewable Energy Present Significant Opportunities in Carbon Conductive Ink Market

The Carbon Conductive Ink Market is experiencing growth primarily due to the growing demand for hybrid imaging technology, a market that fuses traditional analog appearance with advanced digital evolution. Rise in consumer demand for portable, lighter, and multifunctional devices contains smartphone connectivity, film-simulation effects, and direct print capabilities is driving the trend. This shift is driving manufacturers to broaden product portfolios to meet the demands of Gen Z and creative professionals who are looking for purpose-built tools for imaging, ultimately driving innovation and new revenue opportunities across imaging and print ecosystems.

Over 500 million wearable devices were shipped globally in 2023, with carbon conductive inks used in more than 70% of flexible health sensors for ECG, temperature, and motion monitoring.

Key Carbon Conductive Ink Market Segment Analysis

-

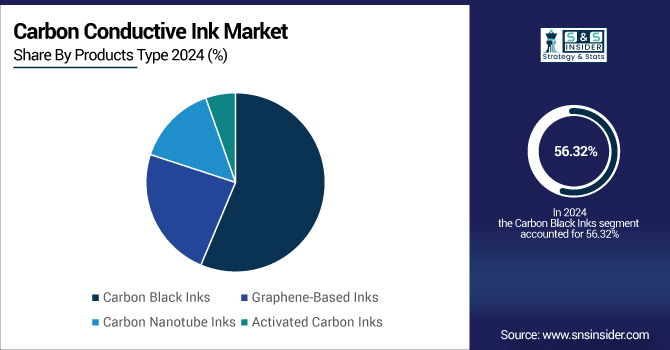

By Product Type, Carbon Black Inks led with ~ 56.32% share in 2024; Graphene-Based Inks fastest growing (CAGR 10.24%).

-

By Application, Printed Circuit Boards dominated ~34.45% in 2024; Flexible Electronics fastest growing (CAGR 10.42%).

-

By End-User, Electronics and Semiconductor led ~40.22% in 2024; Automotive fastest growing (CAGR 10.30%).

-

By Distribution Channel, Direct Sales held ~39.53% in 2024; Online Platforms fastest growing (CAGR 10.07%).

By Product Type, Carbon Black Inks Leads Market While Graphene-Based Inks Registers Fastest Growth

In 2024, the Carbon Black Inks segment dominated the Carbon Conductive Ink Market with approximately 56.32% share, driven by the silver inks, the major reason is that Carbon Black Inks are low cost, can be mass production compared to advanced nanomaterials. A key attraction of these materials is their high conductivity and compatibility for use with a range of substrates, factors conducive to widespread application. Use boomed as demand in printed electronics, sensors and touch screens was strong. Their role in renewable energy applications such as in solar cells further strengthens the market position. Graphene-Based Inks is expected to witness the fastest growth over 2025–2032, with a CAGR of 10.24%, It is lightweight and has a very compact size, and hence they are best suited for next-generation wearable, flexible electronics, and sensors. Increasing R&D spending and commercial usage in renewables and advanced electronics continue to fuel their demand.

By Application, Printed Circuit Boards Dominate While Flexible Electronics Shows Rapid Growth

In 2024, the Printed Circuit Boards segment held approximately 34.45% of the Carbon Conductive Ink Market, driven by growing usage of compact and high-performance electronics. With conductive inks, computerized design printing makes it easier for users to obtain high quality and accurate circuit, thus greatly saving the costs and reducing the faultiness of circuits. Adoption was accelerated by fast growth in consumer electronics, automotive and industrial applications. The Flexible Electronics segment is expected to grow fastest over 2025–2032 with a CAGR of 10.42%, fueled by soaring demand for lightweight, bendable, and wearable devices. Conductive inks are key to the development flexible circuits and touch sensitive systems. Growth in applications such as medical, consumer electronics & automobile drives the market momentum.

By End-User, Electronics and Semiconductor Lead While Automotive Registers Fastest Growth

In 2024, the Electronics and Semiconductor segment held approximately 40.22% of the Carbon Conductive Ink Market, driven by high demand of effective and miniaturized electronics components stimulated growth of the segment. With the help of conductive inks, we can achieve precise circuit printing and enhanced performance in semiconductors. Rise in consumer electronics, automotive, and industrial applications contributed to the supremacy of this section. The Automotive segment is projected to grow fastest over 2025–2032, with a CAGR of 10.30%, fueled the rising use of conductive inks in electric cars and advanced electronic systems in automobiles. Inks manufactured from lightweight and flexible inorganic materials with high charge storage bench-mark capabilities are used to create sensors, displays and battery components.

By Distribution Channel, Direct Sales Lead While Online Platform Grow Fastest

Direct Sales accounted for 39.53% of the Carbon Conductive Ink Market share in 2024 and is likely to experience similar trends during the forecast period, owing to better handling of manufacturer-to-consumer sales networks. Direct selling allows for more competitive pricing, quicker delivery, and tailored solutions for industrial and commercial customers. Robust demand from electronics, automotive and renewable energy sectors firmed up this segment’s market share. The Online Platform segment is anticipated to register the highest growth over 2025–2032, posting a CAGR of 10.07%, due to growing digital uptake and penetration of e-commerce. It is convenient and has a wider range, and is simple to choose conductive ink products. Growing demand from SMEs, start-ups, and global customers also boost the growth of the distribution channel.

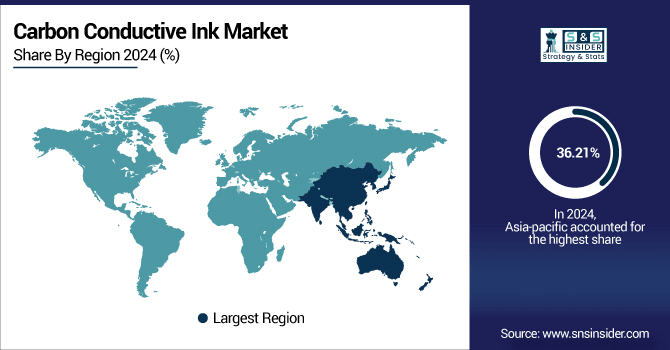

Asia-pacific Carbon Conductive Ink Market Insights

In 2024 Asia-Pacific dominated the Carbon Conductive Ink Market and accounted for 36.21% of revenue share, this leadership is due to quick industrialization and presence of potent electronics manufacturing hubs. Adoption was driven by strong demand for consumer electronics, automotive parts and renewable energy systems. Market growth was also bolstered by government-led initiatives for smart manufacturing and technology innovation. The dominance of Asia-Pacific was further supported by the existence of large regional manufacturers and R&D centers.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Carbon Conductive Ink Market Insights

China’s Carbon Conductive Ink Market is witnessing significant growth due to its robust electronics and automotive manufacturing sectors. The increasing use in flexible electronics, wearables and renewable energy applications is driving the market. Increasing improvements in graphene and carbon nanotube inks further expand market prospects and technological leadership.

North America Carbon Conductive Ink Market Insights

North America is expected to witness the fastest growth in the Carbon Conductive Ink Market over 2025-2032, with a projected CAGR of 10.01% due to the rise in the use of flexible and printed electronics in consumer electronics and automotive applications. High R&D investments and industry leaders drive innovation. Increasing usage of renewable power systems such as, solar panels and energy storage, also contributes to the market growth. The presence of government-supportive initiatives and technological advancements further endorses the market potential in the region.

U.S. Carbon Conductive Ink Market Insights

US Carbon Conductive Ink Market is currently in a creeper phase growing with a strong demand in electronics, automotive, renewable resources for now. Innovation is also being driven by the move towards flexible and printed electronics, and improved inks made from graphene or nanotubes. Robust industry background along with supportive government measures also facilitate the market growth.

Europe Carbon Conductive Ink Market Insights

In 2024, Europe emerged as a promising region in the Carbon Conductive Ink Market, due to Growing demand for automotive advanced systems, wearables and consumer electronics was largely responsible for continued strong adoption, he added. Adoption of the system was empowered by supportive government legislations and green technology incentives. Further, R&D and innovation in nanomaterial-based inks in Europe supported regional growth prospects.

Germany Carbon Conductive Ink Market Insights

Germany is also growing on account of robust automotive and electronics production spurring demand for high-grade conductive inks. The expanded use of renewable energy and flexible electronics also contribute to growth. State-of-the-art R&D projects in graphene and CNT-based inks innovating tech and market opportunities.

Latin America (LATAM) and Middle East & Africa (MEA) Carbon Conductive Ink Market Insights

The Carbon Conductive Ink Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to widespread use of consumer electronics and automotive. Increasing investment in solar, as well as the installation of energy storage systems, is driving the market growth. Growth is moderated in comparison to other regions because of the relatively immature manufacturing infrastructure and slower technology uptake. However, new applications like flexible electronics and nano materials-based inks are keeping the market growing.

Carbon Conductive Ink Market Competitive Landscape:

DuPont de Nemours, Inc. is a global leader in development of specialty materials, chemicals, and agricultural products. Its focus is on high performance conductive inks, films and coatings used in flexible electronic products for Printed Electronics sensors, wearables, smart textiles, Internet of Things, automotive and much more. The strong R&D capability and emphasis on sustainability lead to technological development and product development.

-

In August 2025, DuPont has been actively researching and developing graphene-based conductive inks. These inks offer enhanced conductivity and flexibility, making them ideal for applications in flexible electronics and wearables.

Henkel AG & Co. KGaA is a key player in the Carbon Conductive Ink Market, with a broad product portfolio of conductive inks under the LOCTITE® brand. These inks are key for a number of printed electronics technologies such as flexible circuits, sensors and heaters. Henkel offers a range of carbon inks as well that can be used in conjunction with silver inks to provide critical attributes like lubricity, anti-silver migration, and resistance control.

-

In November 2024, Henkel partnered with Covestro and Quad Industries to develop advanced medical wearables using printed electronics. This collaboration focuses on stretchable materials, enhancing the comfort and functionality of wearable healthcare devices.

Heraeus Holding GmbH, is the leading competitor in the carbon conductive ink market, and has developed numerous materials in its Heraeus Electronics division. The Company develops and manufactures Polymer Thick Film inks including particle-free silver conductive inks, for defense and consumer electronics industries. The PricElex® line from Heraeus is synonymous with high performance conductive inks formulated for optimal conductivity combined with superior adhesion and resistance properties to maximize the lifetime and reliability of electronic components.

-

In January 2024, Heraeus expanded its ink portfolio by acquiring the PriElex® electronics inks business line from Kayaku Advanced Materials, thereby strengthening its position in the thick film materials sector

Sun Chemical Corporation is a prominent supplier of conductive inks in the form of SunTronic®, offering solutions to various applications in printed electronics. The company supplies a full range of conductive materials, from silver, carbon and dielectric inks to wafer-bumping pastes, that are used in flexible circuits, sensors, and other printed electronics. The conductive inks of Sun Chemical can accommodate a variety of printing processes including screen, flexographic, and ink jet with the flexibility offered across different applications and uses. This emphasis on R&D is reflected in a commitment to produce the latest advanced materials to meet ever-changing requirements of the electronics industry.

-

In January 2024, Sun Chemical unveiled an ultra-high-resolution silver ink designed for metal-mesh-based transparent heaters and electrodes. This ink is optimized for applications requiring fine-line printing, such as capacitive touch sensors and transparent conductive films. Its formulation ensures excellent conductivity and adhesion, meeting the demands of advanced electronic devices.

Carbon Conductive Ink Market Key Players:

-

DuPont de Nemours, Inc.

-

Henkel AG & Co. KGaA

-

Heraeus Holding GmbH

-

Sun Chemical Corporation

-

Creative Materials Inc.

-

Johnson Matthey Plc

-

Vorbeck Materials Corp.

-

Poly-Ink

-

Applied Ink Solutions

-

Asahi Chemical Research Laboratory Co., Ltd.

-

Parker Hannifin Corporation

-

Nagase America Corporation

-

InkTec Co., Ltd.

-

Methode Electronics, Inc.

-

PPG Industries, Inc.

-

Dycotec Materials Ltd.

-

Cabot Corporation

-

Agfa-Gevaert Group

-

Nano Dimension Ltd.

-

Advanced Nano Products Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.98 Billion |

| Market Size by 2032 | USD 4.09 Billion |

| CAGR | CAGR of 9.53% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Carbon Black Inks, Graphene-Based Inks, Carbon Nanotube Inks, Activated Carbon Inks) • By Application (Printed Circuit Boards, Membrane Switches, Touch Screens, RFID Tags, Automotive Electronics, Flexible Electronics) • By End-User (Electronics and Semiconductor, Automotive, Healthcare, Aerospace and Defense, Consumer Goods) • By Distribution Channel (Direct Sales, Specialty Chemical Distributors, Online Platforms, Regional Dealers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | DuPont de Nemours, Inc., Henkel AG & Co. KGaA Heraeus Holding GmbH, Sun Chemical Corporation, Creative Materials Inc., Johnson Matthey Plc, Vorbeck Materials Corp., Poly-Ink, Applied Ink Solutions, Asahi Chemical Research Laboratory Co., Ltd., Parker Hannifin Corporation, Nagase America Corporation, InkTec Co., Ltd., Methode Electronics, Inc., PPG Industries, Inc., Dycotec Materials Ltd., Cabot Corporation, Agfa-Gevaert Group, Nano Dimension Ltd. and Advanced Nano Products Co., Ltd. |