Acetaldehyde Market Report Scope & Overview:

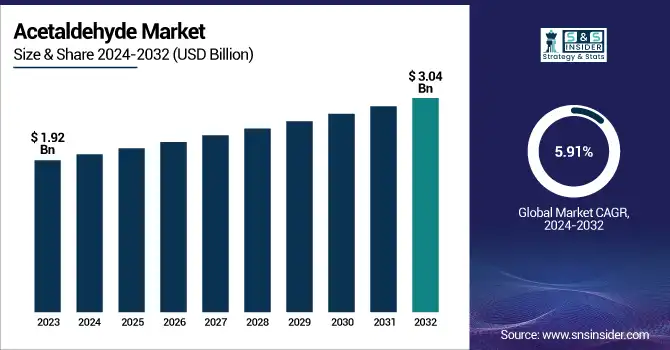

The Acetaldehyde Market size was USD 1.92 Billion in 2023 and is expected to reach USD 3.04 Billion by 2032 and grow at a CAGR of 5.91 % over the forecast period of 2024-2032. The report provides a comprehensive analysis of production capacity and utilization across key countries, highlighting the dominance of major manufacturing processes. It covers feedstock price trends for ethanol, ethylene, and methanol, along with cost fluctuations by region. The report examines regulatory and environmental compliance, assessing emission norms and sustainability policies impacting the industry. Innovation trends in bio-based acetaldehyde and R&D advancements for new applications are explored. Additionally, it provides insights into market adoption by end-use industries, including chemicals, food & beverage, and pharmaceuticals. Sustainability initiatives, carbon footprint reduction, and circular economy efforts by major manufacturers are also analyzed.

To Get more information on Acetaldehyde Market - Request Free Sample Report

Acetaldehyde Market Dynamics

Drivers

-

Growing consumption of chemicals & derivatives which drives market growth.

Increased usage of chemicals and derivatives is one of the major factors complementing the acetaldehyde market growth. 6 The substantial global production of acetaldehyde has made it an important intermediate for the manufacture of acetic acid, pyridine, pentaerythritol, and peracetic acid, which are mainly used as plastics, pharmaceuticals, agrochemicals, and coatings. Acetaldehyde consumption is stimulated by the growing demand for acetic acid, which is largely used in the production of vinyl acetate monomer (VAM) which is widely utilized in adhesives, paints, and textiles. The development of pyridine derivatives, in turn, is important for the pharmaceutical and agricultural industries, which boosts market growth. With the increase in industrialization, and scaling up of chemical production across the globe, acetaldehyde is increasingly used as a building block chemical, thereby pushing the growth of the global market.

Restraint

-

High production and transportation costs which may hamper the market growth.

These high production and transportation costs represent a key restraint to growth in the acetaldehyde market. As a result, the existing processes for acetaldehyde synthesis include energy-intensive processes needing large capital and operating costs, like ethanol oxidation, ethylene oxidation, and methanol hydroformylation. Rising prices of ethanol and methanol used as feedstock contribute to production costs while also feeding the volatility of feedstock prices, increasing production costs. Transportation is a second significant restraint owing to the need for a regulated and careful handling of acetaldehyde as it is hazardous with a high flammability potential requiring special packages for transportation. Transporting hazardous chemical materials involves very strict safety regulations, which increase the cost of processing the logistics and distribution internationally. All these factors cumulatively limit the market growth and make it tough for smaller manufacturers to maintain operational costs while competing at low prices.

Opportunity

-

Growth in water treatment applications creates an opportunity in the market.

One of the booming opportunities for the acetaldehyde market is the growing requirement for water treatment applications. Acetaldehyde is broadly employed for manufacturing polyacrylamides and peracetic acid, a principal water treatment chemical used by municipal and industrial water purification. As the threat of water contamination, severe climate regulations, and the greater need for sustainable water management grow, the demand for water treatment has never been larger. Moreover, the rapid industrialization and urbanization in developing regions, particularly Asia-Pacific, is also accelerating the growth of waste-water treatment plants in these regions, which is expected to create significant demand for commercial acetaldehyde-based chemicals. With rising investments from government and industry in advanced water treatment technologies, acetaldehyde is likely to see higher penetration within this industry

Challenges

-

Declining demand in certain end-use industries may challenge the market growth.

The slowdown of demand in some end-use industries presents a major challenge for the acetaldehyde market and limits its growth. Acetaldehyde's toxic nature is raising health concerns and hampering its adoption, restricting its usage space across industries like food & beverage, pharmaceuticals, plastics, etc. Food sector, as stricter audits on food preservatives will limit additives holding acetaldehyde characteristics and in the pharmaceutical industry, the growing adoption of safer pharmaceutical excipients for drug formulations. Moreover, the transition to bio-based and sustainable chemicals in the plastics and coatings industry is pushing manufacturers to analyze non-hazardous alternatives. The decreasing demand along with stringent environmental policies is making the market expansion difficult especially for the key players who are investing in sustainable production processes and potential substitution applications.

Acetaldehyde Market Segmentation Analysis

By Process

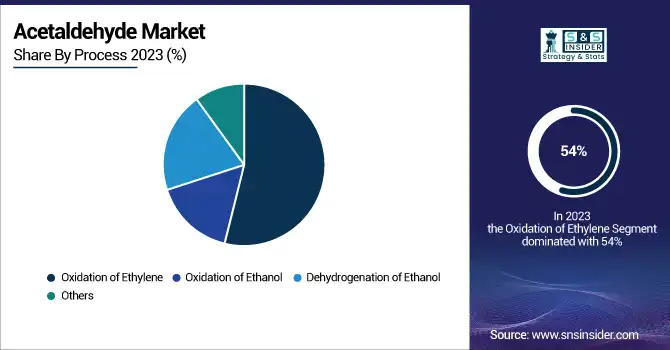

Oxidation of Ethylene held the largest market share around 54% in 2023. It is owing to a very efficient and cost-effective route for the production of acetaldehyde and a prevalent route for industrial production. This method can yield lower percentages of a low-purity product since it is synthesized through the catalytic oxidation of ethylene with palladium or copper catalysts but is preferred as it has been identified to have a lower cost compared to production methods e.g. ethanol dehydrogenation or hydroformylation of methanol. Ethylene is also a cheap and abundant feedstock, especially in the Asia-Pacific and North America, where it is largely produced and accessible due to its bulk petrochemical industries.

By Application

Food & Beverages held the largest market share around 34% in 2023. Acetaldehyde is widely used in the industrial sector for the preservation of food items such as vinegar, fruit & vegetable juices, and dairy products as well as to boost the shelf-life by providing a better taste profile. It is also an important intermediate in the production of food additives like acetic acid and pentaerythritol, which are both widely used in food processing. Also, there has been a rise in demand for processed and packaged foodstuff due to the increasing pace of life preferably in Asia-Pacific and North America, which is further fueling the growth of the diacetyl market. Yet, despite this dominance, rising regulatory inspection on food safety and possible health risks may negatively influence this remnant's growth in the future.

Acetaldehyde Market Regional Outlook

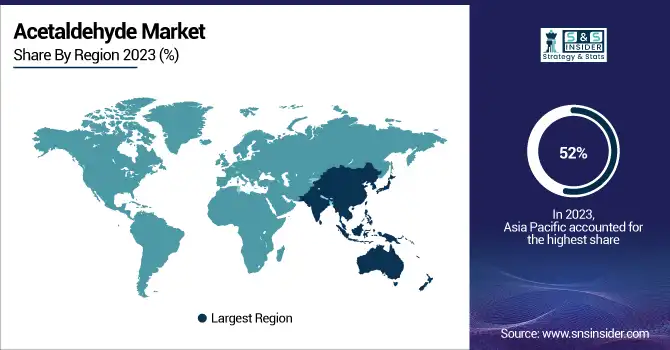

Asia Pacific held the largest market share around 52% in 2023. This is owing to its industrial-based economy, high consumption of end-use industries, and availability of raw materials. Established food & beverage, chemical & pharmaceutical industries in countries like China, India, and Japan, have led to high consumption of acetaldehyde. There are many acetaldehyde production Plants in the region as well, taking advantage of the easy accessibility of ethanol, ethylene, and methanol as feed available resources for the Plants. Additionally, the growing demand from China and India in paints & coatings, and plastics across a diverse range of applications, adds to the demand for ground calcium carbonate. Additionally, lower environmental standards than in North America and Europe have aided in ongoing creation. Asia-Pacific remains the unmatched leader in the ranks of the global market aided by increasing urbanization, rising disposable incomes, and the need for processed foods.

North America held a significant market share in 2023. Its wide use in the chemical industry followed by pharmaceutical and food & beverage industries in the North American region which acts as major demand generating producing regions. Acetaldehyde is used as an intermediate in the production of various others such as acetic acid, pyridine derivatives, and peracetic acid, and this creates a high demand for the chemical across the world from various application sectors thus leading to key manufacturers significantly present in the region. Furthermore, the rise of high-performance coatings, synthetic resins, and plastics in the automotive and construction industries further drives the market demand. In addition, stringent environmental laws and regulations have resulted in innovations in the bio-based production of acetaldehyde. Despite flaky regulations, it still holds a considerable market due to the advanced R&D capabilities of the region, robust supply chain networks, and increasing demand for value-added food & beverages in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Eastman Chemical Company

-

Sumitomo Chemical Co., Ltd.

-

Sekab

-

Lonza

-

LCY Chemical

-

Jubilant Ingrevia Limited

-

Ashok Alco-chem Limited

-

Merck KGaA

-

Showa Denko K.K.

-

Perstorp

-

Jinyimeng Group

-

Shandong Hongda

-

Hubei Yihua

-

Sanmu

-

Nanjing Redsun

-

Anhui Jinhe Industrial

-

Jiangsu Kailin Ruiyang Chemical

Recent Development:

-

In April 2024, Arkema enhanced its sustainable product portfolio at the American Coatings Show 2024. The company introduced various eco-friendly solutions, emphasizing sustainability. This initiative aligns with Arkema’s commitment to greener innovations in the coatings industry.

-

In April 2024, Eastman partnered with deSter to tackle single-use plastic waste in the airline industry. The collaboration focused on sustainable solutions, with Eastman’s Tritan Renew material playing a key role. This initiative aims to promote eco-friendly alternatives in aviation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD1.92 Billion |

| Market Size by 2032 | USD 3.04 Billion |

| CAGR | CAGR of 5.91 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Process (Oxidation of Ethylene, Oxidation of Ethanol, Dehydrogenation of Ethanol, Others) •By Application (Food & Beverage, Paints & Coatings, Plastics & Synthetic Rubber, Pharmaceuticals, Chemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Evonik Industries AG, Infineum International Limited, The Lubrizol Corporation, Clariant AG, Afton Chemical Corporation, Baker Hughes, Bell Performance, Inc., Chevron Oronite Company LLC, Dorf Ketal, Innospec Inc., TotalEnergies SE, HollyFrontier Corporation, Nalco Water (an Ecolab company), Tianhe Chemicals, Cestoil Chemical Inc., Exxon Mobil Corporation, Ecolab Inc., Croda International Plc, Schlumberger Limited |