Global Carcinoembryonic Antigen Market Overview:

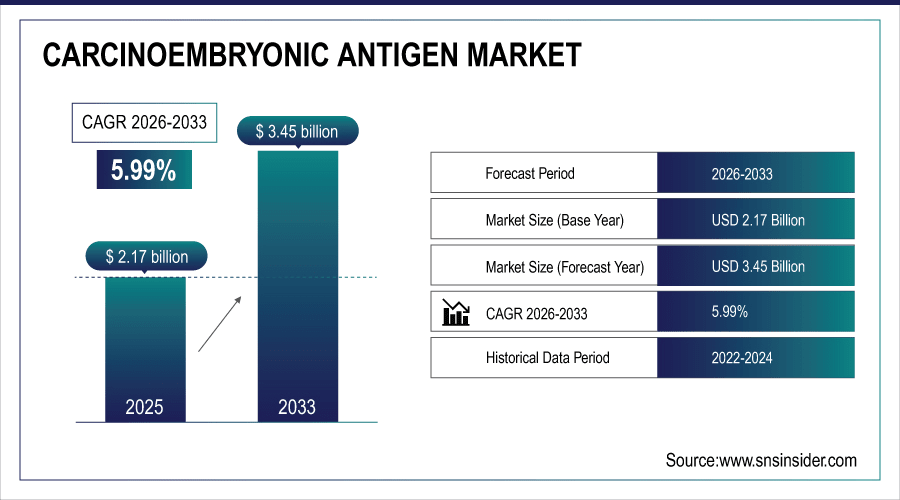

The Carcinoembryonic Antigen Market size is estimated at USD 2.17 billion in 2025 and is projected to reach USD 3.45 billion by 2033, growing at a CAGR of 5.99% during 2026-2033.

The global carcinoembryonic antigen market is growing at a dynamic pace due to the increasing prevalence of cancers, including colorectal, pancreatic, gastric, breast, and lung cancers, which are more effectively tracked by CEA tests. Furthermore, growing physician and patient awareness about the value of tumor markers, along with government and private cancer programs, leads to increased awareness of CEA testing. All of these are indicative of a healthy carcinoembryonic antigen market trend.

For instance, in September 2024, the European Cancer Organization reported that over 60% of eligible adults participated in biomarker-based screening, boosting the CEA market trend.

To Get More Information On Carcinoembryonic Antigen Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 2.17 billion

-

Market Size by 2033: USD 3.45 billion

-

CAGR: 5.99% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Carcinoembryonic Antigen Market Trends

-

Growing occurrence of cancer and high consumer awareness are the factors demanding the need for CEA testing, especially for early-stage detection, therapeutic monitoring, and cancer recurrence.

-

Recent developments in automated, more sensitive assays of CEA, including chemiluminometric immunoassays or ELISA kits, have contributed to more sensitive and rapid determination for cancer.

-

Personalized medicine and integration of CEA testing is growing, which can be applied from a treatment point of view for monitoring and tailoring of therapeutic response for CEA.

-

The rise in hospitals and diagnostic labs in developing countries is promoting the availability and uptake of CEA tests.

-

Government-sponsored screening plans and insurance compensation policies are increasing the adoption of the CEA test in developed and developing parts of the globe.

-

R&D and collaborations between industry and academia are driving the development of multi-target biomarker panels (e.g., CEA) for broader cancer screening.

-

Trends toward point-of-care and home-based testing are developing, contributing to ease of use, patient acceptance, and CEA levels in the moment.

U.S. Carcinoembryonic Antigen Market Insights

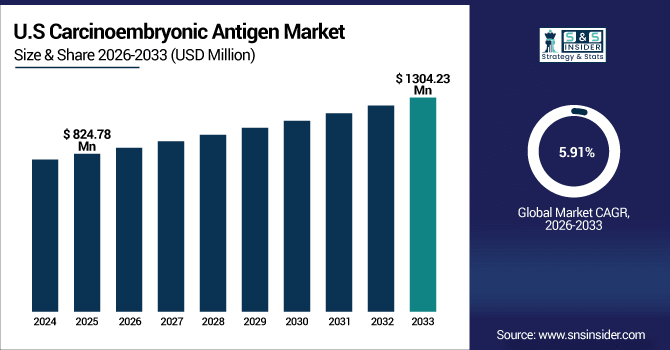

The U.S. carcinoembryonic antigen market is estimated at USD 824.78 million in 2025 and is projected to reach USD 1304.23 million by 2033, growing at a CAGR of 5.91% during 2026-2033. The U.S. is a major market for carcinoembryonic antigen, owing to the high incidence of diseases, including colorectal, lung, gastric, and pancreatic cancer, which need monitoring by CEA tests. Increasing awareness among patients & doctors regarding early detection & monitoring of therapy also fuels the market demand. These are important determinants of the carcinoembryonic antigen market analysis, and the U.S. is the largest adopter and contributor to the growth of the market.

Carcinoembryonic Antigen Market Growth Drivers:

-

Growing Awareness & Screening Programs Driving Carcinoembryonic Antigen Consumption Growth

The rising prevalence of diseases and cancer screening programs is a key driver of the global carcinoembryonic antigen market. A growing awareness among doctors and patients of the value of early cancer detection and surveillance has increased the use of CEA tests. Furthermore, public health and private testing programs, especially among high-risk groups, are increasing testing use. These changes are crucial factors that supplement the growth of the carcinoembryonic antigen industry globally.

For instance, in September 2024, the European Cancer Organization reported that over 60% of eligible adults participated in biomarker-based cancer screening programs, boosting the CEA market trend.

Market Restraints:

-

Dependence on Complementary Diagnostics Limits Market Expansion Globally

One of the significant challenges restricting the growth of the global carcinoembryonic antigen market is its reliance on adjunctive diagnostics. Elevated levels of CEA are not enough to confirm the presence of cancer, and patients usually need an imaging study or histopathology, or another kind of cancer biomarker test. This dependence restricts its independent clinical application and may impede its widespread adoption, especially in areas with limited access to sophisticated diagnostic resources.

Market Opportunities:

-

Personalized Medicine Integration Creates Growth Opportunities for the Carcinoembryonic Antigen Market

Growing adoption and increasing shift towards personalized medicine are expected to open lucrative opportunities for the globalf carcinoembryonic antigen market. CEA testing may also be incorporated into personalized oncology treatment plans to monitor response to therapy, identify disease recurrence, and refine treatment approaches for individual patients. Such an approach will drive improved clinical outcomes and require more CEA testing, paving the way for the market to expand as personalized and precision medicine take hold in cancer care globally.

For instance, in February 2025, over 70% of U.S. oncologists used biomarker-based monitoring, including CEA, to guide tailored cancer therapies, boosting the CEA market trend.

Carcinoembryonic Antigen Market Segmentation Analysis

-

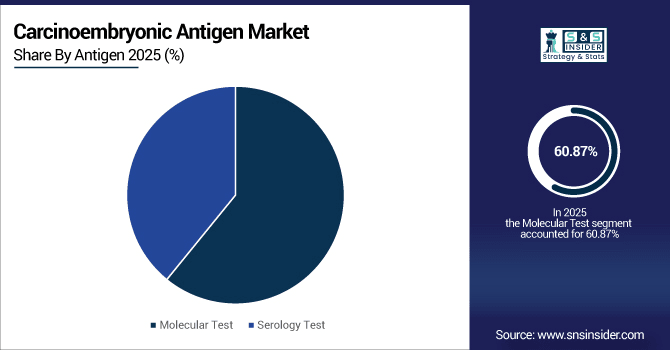

By antigen, molecular test led the market with a 60.87% share in 2025e, while serology test platforms are registering the fastest growth with a CAGR of 6.24%.

-

By type, breast cancer led the carcinoembryonic antigen market with an 18.98% share in 2025e, while colorectal cancer is the fastest-growing segment with a CAGR of 7.19%.

-

By gender, the female segment dominated the market with a 64.89% share in 2025e, whereas the male segment is expected to grow fastest with a CAGR of 6.24%.

-

By end user, hospitals held a 49.85%share in 2025e, while laboratories are growing the fastest with a CAGR of 6.60%.

By Antigen, Molecular Test Lead, While Serology Test Platforms Register Fastest Growth

The molecular test segment accounted for the highest share of revenues in the carcinoembryonic antigen market at 60.87% in the year 2025E, due to its high accuracy, sensitivity, and early cancer detection. Increasing usage of sophisticated diagnostic technologies and the need for accurate monitoring serve as a major driver. While the serology tests platforms segment is expected to achieve the fastest CAGR of approximately 6.24% during the predicted period from 2026-2033, owing to growing demand for minimally invasive, quick, and cost-effective cancer detection, and technological advancements as a major contributor.

By Type, Breast Cancer Leads the Market, While Colorectal Cancer Registers the Fastest Growth

The breast cancer segment dominated the carcinoembryonic antigen market with a revenue share of about 18.98% in 2025E, as it is one of the most common types of cancer, and the importance of early diagnosis and monitoring of treatment. Increasing prevalence and increasing awareness among patients and physicians are driving factors for the CEA and CEA-related test market. The colorectal cancer segment will grow at the highest CAGR of nearly 7.19% CAGR between 2026 and 2033, as increasing incidence rates and the value of early diagnosis and surveillance of recurrence, and factors contributing to the wider acceptance of the CEA test.

By Gender, Females Dominates While Males Shows Rapid Growth

The female segment was estimated to be the largest revenue generator with an approximate 64.89% of the total market share in 2025E, due to a higher incidence of breast and ovarian cancers with a need for CEA measurement for screening and treatment monitoring. Increasing cancer awareness amongst women is a major growth driver. For instance, the male segment is anticipated to be the fastest growing with a CAGR of around 6.24%, by 2026-2033, owing to the growing incidence of colorectal, pancreatic, and lung cancers in men, coupled with growing knowledge and early detection as a major contributor.

By End User, Hospitals Lead While Laboratories Grow Fastest

The hospitals segment accounted for the largest share of the carcinoembryonic antigen market at around 49.85%in 2025E, owing to their developed diagnostic facilities, large number of patients, and comprehensive oncology services. Increased incidence of cancer and the need for regular monitoring are one of the significant driving factors for the commercialization of the CEA test. The laboratories segment will have the highest CAGR of nearly 6.60% during 2026–2033, owing to the growing outsourcing of diagnostic tests, the proliferation of private labs, and the growing need for customized cancer monitoring, which is a major market driver.

Regional Insights

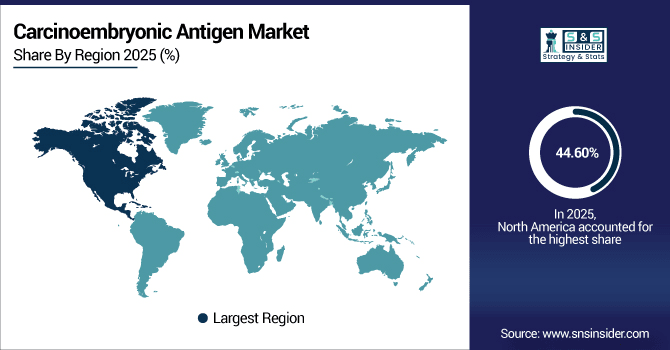

North America Carcinoembryonic Antigen Market Share Analysis

North America dominates the carcinoembryonic antigen market with a market share of 44.60% 2025E, owing to the excellent medical facilities, remarkable cancer incidence, and promoting acceptance of diagnostic tools in the region. Increased R&D focus, high availability of high-sensitivity CEA assays, and favorable reimbursement scenarios are additional factors contributing to market growth. Moreover, government-sponsored screening campaigns, expanding consumer base, and inclusion of CEA testing in personalized medicine approaches also play an important role in the growth of this market, due to which North America dominates the global carcinoembryonic antigen market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

The US holds the largest share in the North American carcinoembryonic antigen market due to developed healthcare infrastructure, high incidence of cancer, robust R&D capabilities, large number of CEA testing procedures, and positive reimbursement scenario, thereby contributing to the largest share of this regional market.

Asia-Pacific Market Outlook

Asia-Pacific is the fastest-growing region in the carcinoembryonic antigen market, registering a CAGR of 6.88 % over the forecast period, due to increasing incidences of cancer, growing healthcare infrastructure, and rising awareness regarding early detection and monitoring of treatment. The exponential increase in hospitals and diagnostic labs, oncology centers, and government-led cancer screening programmes will aid the CEA testing market. Furthermore, favorable reimbursement policies, rising private healthcare investment, and expanded availability of advanced diagnostic technologies are spurring market growth, with the Asia-Pacific as a critical emerging destination for the carcinoembryonic antigen market.

China Market Insights

China is a significant contributor to the Asia Pacific carcinoembryonic antigen market on account of growing cancer prevalence, improving healthcare infrastructure, escalating knowledge of early detection of the disease, expanding diagnostic lab networks, and government initiatives to encourage CEA test uptake.

Europe Market Insights

Europe is the second largest in the global CEA market, which is dominated by developed healthcare systems, increased incidence of cancer, and IVD and laboratory technology. Due to well-established national cancer screening programs, supportive government, high level of patient awareness, and reimbursement, routine CEA testing in clinical practice is a reality. Furthermore, with the existence of leading prevailing diagnostic players, and continued R&D activities in the field of oncology biomarker assays also play a key role in the dominance of Europe in the carcinoembryonic antigen market.

Germany Market Insights

Germany accounts for a major share of the European carcinoembryonic antigen market owing to a well-developed healthcare infrastructure, high prevalence of cancer, presence of established diagnostic laboratories, large uptake of CEA testing, and favourable government screening and reimbursement policies.

Latin America (LATAM) and Middle East & Africa (MEA) Market

The Middle East & Africa and Latin America are developing markets in the global carcinoembryonic antigen market, owing to increasing incidence of cancer, increasing awareness about early diagnosis, and improving healthcare infrastructure. Rise in the development of hospitals and diagnostic laboratories, growing government-led cancer screening programs, and increasing acceptance of high-quality CEA testing technologies are fueling market growth, thereby offering substantial opportunities to both regions in the carcinoembryonic antigen market.

Competitive Landscape:

Abbott Laboratories (founded in 1888, Abbott Park, Illinois, USA) is a global leader in healthcare with a diversified range of products in diagnostics, including immunoassays for CEA. Abbott’s CEA platforms provide lab services to help diagnose and monitor oncology cases and support detection of recurring cancers in hospitals and clinical labs globally.

-

In March 2025, Abbott launched a high-sensitivity CEA immunoassay, enabling earlier detection and more accurate monitoring of colorectal and pancreatic cancers, expanding its global diagnostic capabilities.

Roche Diagnostics (Basel, Switzerland, established in 1896) is a global leader in the delivery of advanced diagnostic and immunodiagnostic testing, including the Elecsys CEA test. Roche’s automated systems for cancer biomarker testing provide reliable and accurate results that give confidence when deciding on a treatment plan or drug course, helping to transform cancer care globally.

-

In December 2024, Roche partnered with European academic oncology centers for clinical validation of next-generation CEA multiplex panels, supporting advanced cancer diagnostics and personalized treatment approaches.

Siemens Healthineers, established in 1847 that provides full product lines across the diagnostic spectrum that include platforms for immunoassays and platform use in CEA test analysis. Siemens Healthineers’ technology for precise cancer diagnosis and therapy monitoring has been widely used in hospitals and laboratories, which is driving better patient care and the growth of the global CEA market.

-

In October 2024, Siemens partnered with hospitals in the Asia-Pacific to implement automated CEA testing workflows, improving early detection, therapy monitoring, and patient outcomes in the region.

Carcinoembryonic Antigen Market Companies:

-

Thermo Fisher Scientific

-

Beckman Coulter

-

Sysmex Corporation

-

F. Hoffmann-La Roche Ltd.

-

Hologic, Inc.

-

Ortho Clinical Diagnostics

-

NovaTec Immundiagnostica GmbH

-

Siemens AG

-

Diasorin S.p.A.

-

Bio-Rad Laboratories

-

Epitope Diagnostics

-

Abbexa Ltd.

-

Immuno-Biological Laboratories

-

Inova Diagnostics

-

Kalron International

-

Euro Diagnostica AB.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.17 Billion |

| Market Size by 2033 | USD 3.45 Billion |

| CAGR | CAGR of 5.99 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Colorectal Cancer, Pancreatic Cancer, Ovarian Cancer, Breast Cancer, Thyroid Cancer, Others) • By Gender (Male, Female) • By Antigen (Molecular Test, Serology Test) • By End User (Hospitals, Laboratories, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |