Life Science Analytics Market Overview:

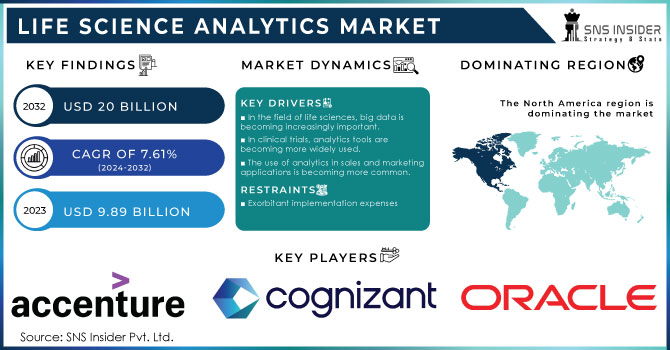

The Life Science Analytics Market was valued at USD 9.89 billion in 2023 and is projected to reach USD 20.0 billion by 2032, growing at a CAGR of 7.61% over the forecast period from 2024 to 2032.

Get More Information on Life Science Analytics Market - Request Sample Report

Descriptive and reporting analytics enable organizations to create robust databases, and prescriptive and predictive analytics are critical to forecasting trends and outcomes in a market, which pushes life science analytics market growth. This trend is driven aggressively by the engagement of more patients and a higher level of adoption of analytical solutions. The tools are fast becoming more integral to both healthcare facilities and life sciences companies as they strive toward improved clinical, operational, and financial results while keeping costs in check. Key areas, such as supply chain management, R&D, clinical trials, regulatory compliance, and pharmacovigilance, are also being changed through advanced analytics.

Increasingly, healthcare stakeholders are tapping into advanced data mining and big data analytics for strategic assessment and management of high-risk populations. Governments and insurers also resort to predictive analytics for managing claims and preventing fraud cases. Prominent partnerships, including the partnership between Moderna and IBM to optimize Moderna's vaccination program, explain the importance of analytics in healthcare well.

The chronic disease rate, growing numbers of aging populations, and heightened demands for personalized medicine are causing demands for analytical solutions aimed at catering to different needs. Life sciences organizations take into datasets from eHealth, mHealth, and EHRs in their attempt to enhance patient care with personalized treatments. Besides this, the players in the market are integrating AI-driven algorithms for the most efficient mining of health data with a view to more improved patient-specific treatment approaches. Other areas shaping up the market landscape include strategic alliances and acquisitions. Worth mentioning here is how Accenture's acquisition builds up its presence in the Middle East. Companies such as ZS and JADBio are establishing platforms that help life sciences companies improve client interaction, field performance, and clinical capabilities. The market reveals innovation when it comes to advancing analytics for digital transformation, for example, from ZAIDYN to ZSs to JADBio AutoML.

The life sciences analytics market is poised for growth and heavily relies on emerging technologies, strategic partnerships, and increasing emphasis on customized data-driven healthcare solutions.

Life Science Analytics Market Dynamics

Drivers

-

Driving Innovation in Pharma through Advanced Analytics and Strategic Partnerships Transforming Data into Therapeutic Insights

Analytics solution advances have brought a revolution in data use, where users can ease reporting and develop interactive dashboards to turn big raw data into actionable insights. As the focus of research and development in pharma and biopharma companies shifts dynamically, there is increasing demand for advanced analytics tools with unique and dynamic requirements of the industry. Technologies like cognitive computing address the big data challenge of processing and integrating large volumes of data across diverse sources and managing data in various formats, hence making them critical to any modern analytics solution. Such companies are actively investing both organically and inorganically in these sophisticated technologies to integrate them into the life cycle and operations. Recent strategic partnerships illustrate this trend. For instance, the collaboration initiated in May 2024 between TetraScience and Databricks aims at building Scientific AI for life sciences to make therapies safer, and more effective. In this regard, Trinity Life Sciences and WhizAI came together in May 2024 to combine WhizAI's conversational AI, visualization capabilities, and data management solutions by Trinity so that companies can generate AI-driven insights and share them efficiently. Such innovations and partnerships are accelerating the rate of adoption of high-performance analytics in the life sciences, providing companies with more powerful tools to transform raw data into valuable insights, driving smarter, faster decisions in pursuit of enhanced therapeutic solutions.

Restraints

-

Data Privacy Challenges and Rising Costs in Securing Patient Information in the Analytics Market

There are greater chances of unauthorized access to confidential patient data through the increasing number of shared databases between research institutions, CROs, partners, and software companies. The U.S. HITECH Act has made it mandatory to install safeguards that would secure the health records of individuals. Therefore, analytics solutions need more demand in privacy and data security. The increased usage of digital tools to handle patient data raises further questions on data confidentiality. This is one of the big challenges facing pharmaceutical companies that are working to ensure data privacy standards. There is a monetary cost, which is extremely high: according to IBM, the average cost of a mega breach rose 4.8% year over year, reaching USD 241 million in 2022. This total breached cost is gradually increasing with each year; thus, data security acts as an important barrier to the analytics market.

Life Science Analytics Market Segmentation Analysis

By Component

In 2023, the services segment held the largest market share, accounting for around 55% of the life sciences analytics market. This is because of the continuous demand for consulting, implementation, maintenance, and support services that make analytics adoption in the life sciences industry effective. With new analytic technologies being adopted by organizations, they require external expertise for smooth integration, compliance, and optimization, which makes the services segment prominent.

The growth would be fastest for the software segment with a 13% CAGR. This is because increasing amounts of advanced analytics software can process large datasets apart from doing complex analyses, which enables one to make real-time decisions in life sciences.

By Type

Predictive analytics contributed to a share of around 40% in the overall share for the year 2023. This is the leading segment since healthcare and life sciences organizations rely on forecasts and anticipation of trends, patient outcomes, and risk factors. Predictive analytics supports critical functions such as management of clinical trials, engagement of patients, and results of treatment, and hence highly valuable as organizations look at proactive approaches.

The fastest-growing type has been prescriptive analytics, with a predicted growth of 15% CAGR. Companies are seen looking for prescriptive analytics to help determine optimal decision paths, resource allocations, and treatment approaches that aid in strategic and operational improvements for life sciences.

By Application

Of all the applications, research and development (R&D) accounted for nearly 35% of the market. High demand is because analytics has a crucial role in accelerating drug discovery, designing clinical trials, and development. Analytics is increasingly being used by life sciences companies to decrease the time and cost of R&D, increasing accuracy and innovation.

Sales and marketing support emerged as the application with the highest growth rate, standing at 12% CAGR. Growth in the segment has been stimulated by greater demands for evidence-based tactics in customer interactions, focus marketing, and brand optimization which is recognized increasingly as a new edge in competition.

Life Science Analytics Market Regional Insights

North America dominated the life science analytics market in 2023. Due to high per-capita healthcare expenditure, advanced big data, artificial intelligence, and cloud computing technologies are significant contributors to this domination. Increasing demand for personalized medicine, supported by genomic data and patient-centric approaches, also underlines this region's market strength. The trend of analytics becoming necessary for research and development, sales, marketing, and supply chain optimization fuels growth further.

Quality control and regulatory compliance in the region as well as a mature health care as well as life science infrastructure play an important role in the firm adoption of digital technology across North America. A well-established competitive landscape drives the innovation of market players which leads to constant technological advancements as well as expanded service offerings from vendors across the region.

Need any customization research on Life Science Analytics Market - Enquiry Now

Key Players in the Life Science Analytics Market

-

Allscripts Healthcare LLC – Veradigm

-

Cerner Corporation – Cerner PowerChart

-

CitiusTech Inc. – BI-Clinical

-

Health Catalyst – DOS (Data Operating System)

-

Inovalon – Inovalon ONE Platform

-

McKesson Corporation – Clear Value Plus

-

Saama Technologies Inc. – Life Science Analytics Cloud (LSAC)

-

Optum Inc. – OptumIQ

-

SCIOInspire Corp. – SCIO Health Analytics

-

SAS Institute Inc. – SAS Life Science Analytic

Recent Developments

-

July 2024: Indegene partnered with Microsoft to scale generative AI adoption in life sciences, driving greater innovation and operational efficiency across the industry.

-

June 2024: SAS launched the SAS Clinical Acceleration Repository, an advanced analytics platform designed to streamline clinical trial development, accelerate regulatory submissions, control clinical research data, and integrate with various data sources.

-

June 2024: IQVIA introduced the One Home for Sites platform, a centralized dashboard that consolidates multiple systems, easing the administrative burden on research sites and enhancing clinical trial management.

-

March 2024: Cognizant teamed up with NVIDIA to utilize the BioNeMo generative AI platform, focusing on accelerating drug discovery to boost productivity and reduce development costs in the life sciences sector.

-

November 2023: Wipro and AWS launched the “Lab of the Future,” a cloud-based platform designed to streamline laboratory processes using generative AI and advanced analytics, aiming to cut costs and speed up drug development in life sciences.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 9.89 billion |

| Market Size by 2032 | US$ 20.0 billion |

| CAGR | CAGR of 7.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Type ( Reporting, Descriptive, Predictive, Prescriptive) • By Application ( Research and Development, Sales and Marketing Support, Regulatory Compliance, Supply Chain Analytics, Pharmacovigilance) • By Delivery (On-demand, On-premises) • By End-user (Medical Device, Pharmaceutical, Biotechnology, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Allscripts Healthcare LLC, Cerner Corporation, CitiusTech Inc., Health Catalyst, Inovalon, McKesson Corporation, Saama Technologies Inc., Optum Inc., SCIOInspire Corp., SAS Institute Inc. |

| Key Drivers | • Driving Forces Behind the Growth of the Enteral Feeding Devices Market Amidst an Aging Population and Rising Chronic Diseases |

| Restraints | • Data Privacy Challenges and Rising Costs in Securing Patient Information in the Analytics Market |