Cardiac Resynchronization Therapy Market Key Insights:

Get More Information on Cardiac Resynchronization Therapy Market - Request Sample Report

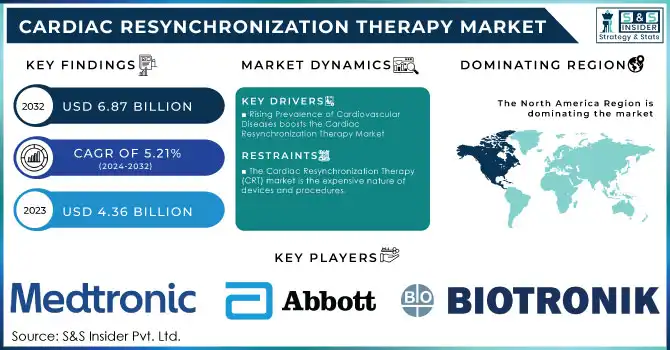

The Cardiac Resynchronization Therapy Market Size was valued at USD 4.36 Bn in 2023 and will reach $6.87 Bn by 2032, growing at a CAGR of 5.21% over the forecast period of 2024-2032.

The Cardiac Resynchronization Therapy (CRT) market is witnessing substantial growth, driven primarily by the rising prevalence of cardiovascular diseases and continuous advancements in device technology. Cardiovascular conditions, including heart failure, are a leading global health concern. According to the British Heart Foundation, in 2023, approximately 620 million people worldwide were living with heart and circulatory diseases. This growing burden can be attributed to an aging population, lifestyle changes, and increased survival rates after cardiovascular events such as heart attacks and strokes. A recent Harris Poll survey conducted in November 2023 on behalf of the American Heart Association found that over 50% of Americans are unaware that heart disease is the top cause of death in the U.S.

The prevalence of these conditions underscores the urgent need for effective treatment options like CRT devices, which have proven successful in managing heart failure and improving patient outcomes. Additionally, the growing geriatric population, particularly in developed regions, further propels the adoption of these devices due to the higher susceptibility of older adults to cardiac disorders.

Technological advancements in CRT devices have significantly enhanced their appeal and usability, further driving market expansion. These devices, including pacemakers and implantable cardioverter-defibrillators (ICDs), are equipped with advanced features that ensure precise synchronization of the heart's ventricles, improving cardiac efficiency and reducing symptoms associated with heart failure. Innovations such as extended battery life, miniaturized device sizes, and remote monitoring capabilities are key factors in enhancing the patient experience and increasing device adoption. Moreover, healthcare providers are increasingly relying on CRT devices to offer customized treatments, particularly in complex cases of heart failure. The integration of technology with healthcare services continues to elevate the market's growth trajectory, ensuring better accessibility and efficiency in managing cardiovascular diseases. This strong combination of rising demand and technological innovation positions the CRT market as a crucial contributor to the future of cardiac care.

Cardiac Resynchronization Therapy Market Dynamics

Drivers

-

Rising Prevalence of Cardiovascular Diseases boosts the Cardiac Resynchronization Therapy Market

The rise in cardiovascular diseases, such as heart failure, is a primary factor influencing the CRT market. As stated in the 2024 Heart Disease and Stroke Statistics released by the American Heart Association, heart disease has remained the primary cause of death in the United States for a century. Worldwide, more than 64 million people are impacted by heart failure, with increasing rates linked to sedentary habits, poor eating habits, and aging populations. Heart failure leads to a considerable amount of hospital admissions every year, especially in North America and Europe. In the United States, more than 1 million hospitalizations occur each year because of heart failure, underscoring the need for advanced therapies like CRT devices that enhance heart function and patient results. The increasing weight emphasizes the significance of CRT devices in minimizing disease complications and healthcare expenses.

Restraint

-

The Cardiac Resynchronization Therapy (CRT) market is the expensive nature of devices and procedures.

CRT devices, specifically CRT-Defibrillators (CRT-Ds), come with a high price tag, costing anywhere from USD30,000 to USD50,000 per unit depending on features and manufacturers. Also, the total cost can become too high for patients in low- and middle-income countries due to the implantation procedure and necessary follow-up care.

Although they are effective in treating heart failure, the cost to healthcare systems and patients can inhibit their widespread use, particularly in areas with limited insurance or reimbursement systems. In the United States, uninsured individuals may be discouraged from choosing this life-saving therapy due to the high out-of-pocket costs. Limited healthcare budgets in developing countries continue to restrict market expansion, despite the growing number of heart failure cases. The financial obstacle highlights the necessity of affordable options or improved payment policies to guarantee access.

Segmentation Analysis

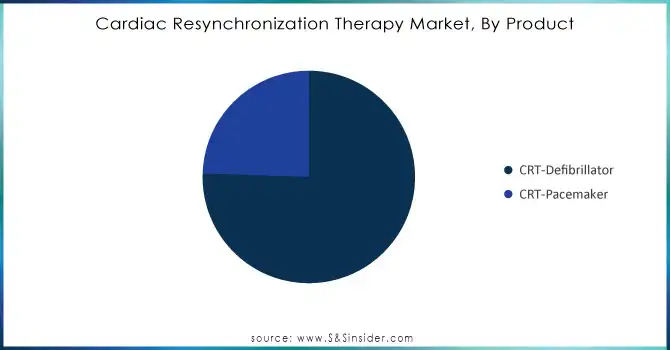

By product

CRT-Defibrillators segment made up over 75% of the market share for cardiac resynchronization therapy products in 2023. The CRT-P segment is projected to grow at a rapid pace of more than 6.0% annually in the predicted timeframe. This is due to the rise in the elderly population worldwide, the number of heart conditions, and advancements made by major market players. Moreover, an increasing number of physicians are recommending the use of CRT-P for patients with heart failure who require pacing more than defibrillation, leading to the rapid growth of CRT-P during the forecasted period.

The study in Japan revealed a rising trend in the proportion of ICDs, CRT-Ds, and CRT-Ps being implanted for the first time in patients aged 75 years and above. During ten years, scientists tallied up a total of 17,564 patients with ICD implants, 9,470 patients with CRT-D implants, and 1,087 patients with CRT-P implants.

Need Any Customization Research On Cardiac Resynchronization Therapy Market - Inquiry Now

By End Use

The hospital segment dominated the cardiac resynchronization therapy market with a leading share of roughly 55%. This is because CRT devices are heavily used in hospitals where the majority of surgeries take place. The Aster Hospital in the UAE documented the case of a 61-year-old man with severe heart failure who underwent implantation of a CRT-D due to frequent episodes of rapid and dangerous heartbeats.

The Cardiac Center segment is expected to experience the fastest growth at 7.16% because of the rise in cardiac specialty centers and the high incidence of heart conditions. Based on CDC data, approximately 6.7 million American adults had heart failure as of September 2024.

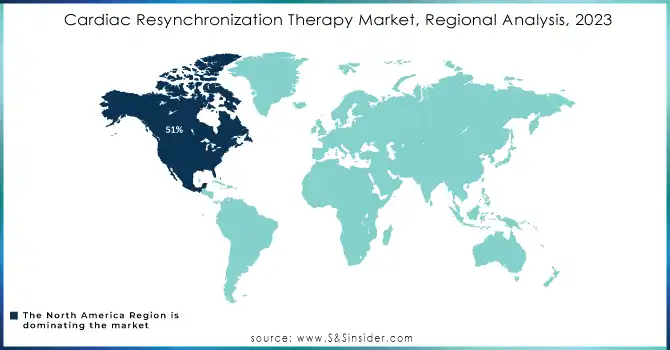

Regional Overview

North America dominated the market with a 51% market share in 2023 due to a rising elderly population and increasing regulatory approvals in the forecast period. The increase can be credited to different reasons like rising knowledge of the advantages of cardiovascular devices, elevated disposable income, and advanced healthcare facilities.

Furthermore, numerous medical device suppliers in this area are engaged in offering cardiovascular services on a global scale. These companies are concentrating on introducing innovative products with advancements like miniaturization and longer battery life, which are predicted to enhance market expansion.

The Asia-Pacific market is forecasted to experience the fastest CAGR growth throughout the forecast period. The increase in medical facilities, elderly population, improved financial conditions, strategic moves by major companies, and higher prevalence of heart conditions are the reasons for this.

Developed markets like Japan and Australia are quickly embracing the latest technological advances in these gadgets. For example, remote monitoring for cardiac implantable devices saw quick adoption in the Asia-Pacific region, specifically in CRT/CRTDs, despite higher expenses.

Key Market Players in Cardiac Resynchronization Therapy Market

-

Medtronic (Viva CRT-D, Claria MRI Quad CRT-D)

-

Boston Scientific (Resonate CRT-D, Ingenio CRT-P)

-

Abbott (Quadra Assura CRT-D, Proclaim DRG Therapy System)

-

Biotronik (Ilivia CRT-D, Evia CRT-P)

-

LivaNova PLC (Symphony CRT-P, Perceval Valve)

-

MicroPort Scientific Corporation (Rega CRT-P, Aurum CRT-D)

-

EBR Systems, Inc. (WiSE CRT System, Wireless Pacing Systems)

-

General Electric (GE) Healthcare (Vivid Echocardiography Systems, CARESCAPE Patient Monitors)

-

Siemens Healthineers (Acuson Sequoia CRT Monitoring, Artis Q.zen CRT Support Systems)

-

Koninklijke Philips N.V. (EPIQ Ultrasound Systems, IntelliVue X3 Monitor)

-

Canon Medical Systems Corporation (Aplio i900 CRT Imaging, Vantage Galan 3T MRI)

-

Hitachi, Ltd. (Arietta Diagnostic Ultrasound, AIRIS Light MRI)

-

Cook Medical (CRT Guidewires, Vascular CRT Support Catheters)

-

Sorin Group (LivaNova) (ESPRIT CRT-P, Solo Smart Valve)

-

Shree Pacetronix Ltd. (SIRO CRT-P, SYNC CRT Pacemaker)

-

Zoll Medical Corporation (LifeVest Wearable CRT Monitor, ResQCPR Systems)

-

Cardiac Science Corporation (Powerheart AED G3 CRT Monitoring, HeartStart AED)

-

Nihon Kohden Corporation (Cardiofax Systems, Remote Patient Monitors for CRT)

-

Edwards Lifesciences (Sapien Valve CRT Adjunct, CardioMEMS HF Monitoring)

-

Ecolab Inc. (Healthcare Division) (Advanced CRT Catheter Cleaning Systems, Infection Control Products for CRT Implants)

Key suppliers of Cardiac Resynchronization Therapy Market

-

Greatbatch Medical

-

Fukuda Denshi

-

Integer Holdings Corporation

-

TE Connectivity

-

Vascotube GmbH

-

Heraeus Medical Components

-

Schott AG

-

NXP Semiconductors

-

Resonetics

-

Cirtec Medical

Recent Developments

-

In July 2024, Boston Scientific's digital innovation broadens the reach of cardiac care. Boston Scientific's digital innovation is closing the distance in heart care, connecting patients from South Africa to the faraway Azores islands.

-

On July 2024, Edwards Lifesciences declared investments that demonstrate the company's strong dedication to promoting patient care via structural heart innovation, tackling significant unmet patient demands, and endorsing sustainable growth in the long run.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.36 Billion |

| Market Size by 2032 | US$ 6.87 Billion |

| CAGR | CAGR of 5.21% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (CRT-Defibrillator, CRT-Pacemaker) •By End-Use (Hospital, Cardiac Center, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Boston Scientific, Abbott, Biotronik, LivaNova PLC, MicroPort Scientific Corporation, EBR Systems, Inc., General Electric (GE) Healthcare, Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems Corporation, Hitachi, Ltd., Cook Medical, Sorin Group (LivaNova), Shree Pacetronix Ltd., Zoll Medical Corporation, Cardiac Science Corporation, Nihon Kohden Corporation, Edwards Lifesciences, Ecolab Inc. (Healthcare Division), and other players. |

| Key Drivers | • Rising Prevalence of Cardiovascular Diseases boosts the Cardiac Resynchronization Therapy Market • Technological Advancements in CRT Devices |

| Restraints | • The Cardiac Resynchronization Therapy (CRT) market is the expensive nature of devices and procedures |