Cardiac Safety Services Market Report Scope & Overview:

Get more information on Cardiac Safety Services Market - Request Free Sample Report

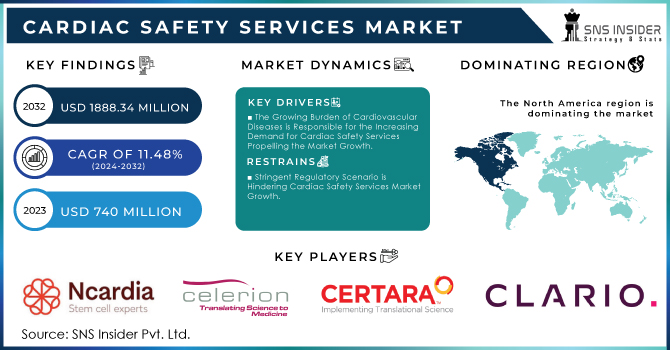

The Cardiac Safety Services Market Size was valued at USD 740 Million in 2023 and is expected to reach USD 1,888.34 Million by 2032 and grow at a CAGR of 11.48% over the forecast period 2024-2032. Growth in the cardiac safety services market is mainly received from % several key factors, which include various government statistics. In the first place, there is an increase in the incidence of cardiovascular diseases. CVDs are the number one cause of death globally: more people die annually from CVDs than from any other cause; an estimated 17.9 million percent, account for three-quarters of all deaths due to non-communicable diseases as per the World Health Organization. This distressing figure illustrates the necessity for comprehensive cardiac safety solutions that both clinical trials, as well as everyday healthcare, can utilize to keep track of and tackle risks at an early stage.

Moreover, the increase in clinical trials (especially those conducted by pharmaceutical and biopharmaceutical organizations) further boosts the cardiological safety services market. As of 2023, more than 420,000 clinical trials have been registered across the world and this number is increasing at a constant rate by the National Institutes of Health. The rising trend underscores the emerging demand for thorough cardiac safety evaluations to ensure patient centricity as well as compliance with regulatory norms. The enforcement of government regulations and some guidelines also influences the growth of this market sector. the drug approval process by regulatory agencies such as The USFDA or the European Medicines Agency requires comprehensive cardiac safety evaluation of drugs. The demand for these services is driven by a need to perform extensive cardiac safety testing by the FDA's guidance on the evaluation of the proarrhythmic potential of drugs.

Besides technological progress, the development of artificial intelligence in cardiac safety services extends its power to higher levels. Growth initiatives taken by the government to accelerate the words AI in healthcare are fuelling these trends such as the digital health innovation plan from the FDA, which prescribed modern cardiac monitoring technologies manufacturing and implementation. To conclude the demand for cardiac safety services market is driven by the increasing incidence of cardiovascular disorders, a rise in the number of clinical trials, stringent regulations, and technological advancements. This is further highlighted by government statistics and regulations that are focused on the improved patient safety and operations-based compliance required as a result of changes in healthcare.

MARKET DYNAMICS:

KEY DRIVERS:

-

The Growing Burden of Cardiovascular Diseases is Responsible for the Increasing Demand for Cardiac Safety Services Propelling the Market Growth.

-

Increased Focus on Developing Personalized Medicines is Boosting the Cardiac Safety Services Market Growth.

RESTRAINTS:

-

Stringent Regulatory Scenario is Hindering Cardiac Safety Services Market Growth.

-

High Cost of Cardiac Safety Evaluation Can Limit the Growth of Cardiac Safety Services.

OPPORTUNITY:

-

An increase in Biologics & biosimilar development is Offering a Lucrative Growth Opportunity for Cardiac Safety Services Procedures.

-

Growth in the Analysis and Development Investment in Pharma are Responsible for the Market Growth During Upcoming Years.

KEY MARKET SEGMENTATION:

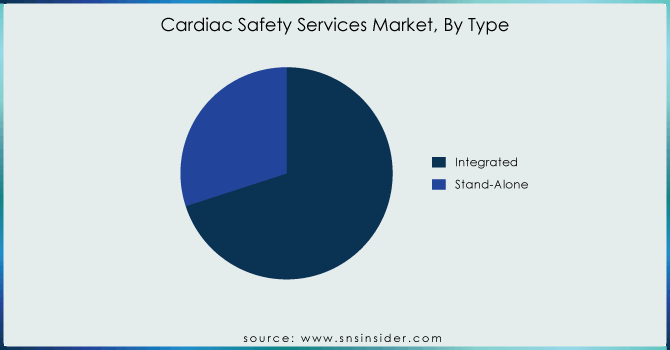

By Type

Integrated services held 70% as of the end of 2023. These are some of the primary reasons why integrated take-not-home services have been so successful. Data Integration: Firstly, integrated services combine all kinds of data to provide comprehensive integration and make sure that you have a consolidated whole dataset with everything related. By combining it with the data, integration will greatly enhance the quality of those data and help eliminate discrepancies/errors that often arise when you work on separate datasets. Further, integrated services support bio/pharma to execute clinical trials (which are pivotal through the pharmaceutical/biopharmaceutical ICO cycle) in improved and shorter lifecycle increments. These services speed up the process of clinical trials by simplifying data management and deployment procedures while saving costs. In the fast-moving world of drug development, rapid results are vital - meaning this efficiency is worth its weight in gold.

In addition, an integrated view of patient data by way of the comprehensive services saves us from missing out on what may be considered minor yet extremely important observations that could potentially influence cardiac safety handling during feature duration. This end-to-end process protects all data from trial design to final results thereby enhancing the reliability quotient of clinical outcomes as well as assuring compliance by making sure that detailed safety information is reliable and truly comprehensive. Hence, integrated services are the most sought-after option by a majority of players to streamline their cardiac safety monitoring attempts for serve as one of the leading producers in the cardiac safety solutions market.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End-User

The Pharmaceutical and biopharmaceutical companies dominated the cardiac safety services market in 2023 with 45% of revenue. The companies undertake a plethora of clinical trials to manufacture new drugs and therapies. Every trial must include the stringent cardiac safety evaluations required for patient protection and regulatory compliance. As a result, there has been significant demand for cardiac safety services among these organizations. Additionally, companies working in the area of pharmaceutical and biopharmaceutical generally maintain a substantial resource pool for cardiac safety. This comes with expert teams, state-of-the-art tech, and advanced infrastructure for quick turnarounds in terms of efficient & effective cardiac safety monitoring. The accessibility of these assets empowers the share for different organizations to deal with heart well-being in contrast with other end-clients.

Regulatory compliance is another major factor that helps these incumbent magnates maintain their position. Both the FDA and EMA require comprehensive evaluations of drugs for cardiac safety as part of the drug approval process. However, a failure to comply with this strict law may lead to delays or rejection of drug approvals, amounting to large sums. Pharmaceutical & biopharma companies spend significantly on cardiac safety services to avoid such significant risks and ensure regulatory compliance. Moreover, rising patient safety awareness in these companies will continue to fuel the adoption of cardiac safety solutions that are comprehensive and seamlessly integrated. Patient safety is paramount throughout the clinical trial process and integrated cardiac safety services take a global, customized approach to monitoring and evaluating cardiac risk. This emphasis on patient safety not only leads to more successful trial results but also makes these companies recognized as pioneers in safe and reliable drug development.

REGIONAL ANALYSIS:

North America holds 44% in 2023 due to an increasing geriatric population and higher incidence rate for cardiovascular diseases. There were nearly 805,000 estimated heart attacks in the United States each year (605,000 new or first and 200,000 recurrent events) as of October 2020 according to updated information last published by the CDC. In addition, a growing geriatric population in the area is also anticipated to grow cardiovascular diseases hence adopting cardiac safety services. For example, published figures from StatsCan in July 2022 estimate that there are now approximately 7,330,605 Canadians who are aged 65 and this corresponds with a share of 20 percent of the entire population.

Moreover, significant contributions by the top regional market players are also likely to drive an increase in the revenue of the industry. For example, ERT and Bioclinica merged under the banner of UIW Clario in November 2021. The deal brings together Bioclinica's clinical trial imaging, eClinical software, and drug safety solutions with ERT's expertise in electronic Clinical Outcome Assessments (eCOA), cardiac safety, and respiratory health.

KEY PLAYERS:

The key market players include Ncardia AG, Celerion, Certara, Clario, Richmond Pharmacology, Koninklijke Philips N.V.(BioTelemetry), Laboratory Corporation of America Holdings, Medpace, Biotrial, PhysioStim & other players.

RECENT DEVELOPMENTS

-

In August 2022, FIFPRO and IDOVEN company were involved in a partnership to improve player health prevention from sudden cardiac arrest or any other heart risks.

-

In MAY 2022, Novocardia announced the launch of an edge program that has incorporated individualized health coaching paired with remote patient monitoring for heart failure patients aimed at enhancing their quality of life and reducing hospitalization rate.

| Report Attributes | Details |

| Market Size in 2023 |

US$ 740 Million |

| Market Size by 2032 |

US$ 1,888.34 Million |

| CAGR |

CAGR of 11.48% From 2024 to 2032 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Data |

2020-2022 |

| Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

•By Type (Integrated & Stand-alone) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Ncardia AG, Celerion, Certara, Clario, Richmond Pharmacology, Koninklijke Philips N.V.(BioTelemetry), Laboratory Corporation of America Holdings, Medpace, Biotrial, PhysioStim & other players |

| Key Drivers |

•The Growing Burden of Cardiovascular Diseases is Responsible for the Increasing Demand for Cardiac Safety Services Propelling the Market Growth. |

| RESTRAINTS |

•Stringent Regulatory Scenario is Hindering Cardiac Safety Services Market Growth. |