Functional Service Providers (FSP) Market Report Scope & Overview:

Get more information on Functional Service Providers (FSP) Market - Request Sample Report

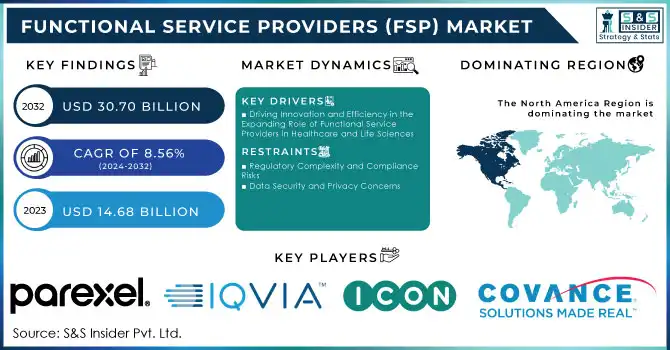

The Functional Service Providers (FSP) Market Size was valued at USD 14.68 billion in 2023 and is expected to reach USD 30.70 billion by 2032 and grow at a CAGR of 8.56% over the forecast period 2024-2032.

The Functional Service Provider (FSP) market is expanding rapidly, driven by several key factors related to the evolving demands of the global clinical trials industry. One of the major reasons for the market's growth is the increasing complexity and scope of clinical research. As pharmaceutical and biotech companies face the challenges of managing larger, more intricate trials—often across multiple regions—they are turning to FSPs to streamline their operations. FSPs provide access to specialized expertise in areas such as clinical monitoring, data management, regulatory affairs, and pharmacovigilance without the need for companies to expand their in-house teams.

Cost reduction remains another significant factor contributing to the market's growth. The rising costs of clinical trials, which account for a substantial portion of drug development budgets, have prompted companies to seek more cost-effective solutions. The FSP model offers a flexible, scalable approach, allowing companies to outsource only the specific services they need. This helps optimize resources and manage clinical trials more efficiently. By engaging FSPs, companies can avoid the significant overhead of hiring, training, and retaining full-time staff for every function across a trial.

Moreover, the global expansion of clinical trials, particularly in emerging markets, is fueling the demand for FSPs. These regions offer a wealth of qualified talent at a fraction of the cost compared to more established markets. This enables FSPs to deliver high-quality services across global trials while maintaining cost efficiency. Companies can tap into the growing pool of expertise in regions such as Asia and Eastern Europe, making it easier to recruit patients and meet regulatory requirements in diverse geographies. The shift toward more specialized and personalized therapies, such as cell and gene therapies, is also creating additional demand for FSPs. The increasing complexity of these therapies requires deep domain expertise, which FSPs can offer by focusing on niche areas of clinical development. In line with these trends, technological advancements, such as the launch of Fujitsu’s new cloud-based platform in March 2023, are supporting the digital transformation of the medical industry. Fujitsu’s platform enables secure collection and utilization of health-related data, enhancing clinical trials’ efficiency and further driving demand for specialized services in data management and digital health solutions.

Overall, the FSP market's growth is being driven by the increasing complexity of clinical trials, the need for cost-effective solutions, the global expansion of clinical research, and the demand for specialized services in emerging therapies. This multifaceted demand positions FSPs as a key player in optimizing clinical trials and accelerating drug development timelines.

Market Dynamics

Drivers

-

Driving Innovation and Efficiency in the Expanding Role of Functional Service Providers in Healthcare and Life Sciences

The Functional Service Providers (FSP) market is expanding rapidly due to several critical drivers, particularly in the healthcare and life sciences industries. One of the key factors is the increasing demand for outsourcing specialized functions. Companies across sectors, including pharmaceuticals and biotechnology, are turning to FSPs to streamline operations, reduce costs, and focus on their core competencies. This trend allows organizations to bypass the challenges of recruiting and training in-house experts for niche areas like regulatory affairs, clinical trial management, and data analytics, significantly improving operational efficiency.

Another key driver is the flexibility and scalability offered by FSPs. As clinical trials and research projects often require varying levels of resources, FSPs provide a modular approach, enabling clients to adjust services as needed without the long-term commitment or complexity of full-service outsourcing. This scalability helps companies optimize their resource use, reduce operational burdens, and ensure that their trials meet deadlines and scientific benchmarks.

Additionally, the growing integration of advanced technologies—such as artificial intelligence, machine learning, and blockchain is transforming clinical trials and research management. AI-driven data analysis speeds up decision-making and enhances trial designs, while blockchain ensures data integrity, enhancing trust and compliance in clinical studies. The use of these technologies enables FSPs to deliver higher-quality outcomes in shorter timeframes, further boosting their attractiveness in the competitive research environment. Overall, these factors position the FSP market as a critical enabler of innovation and efficiency in clinical research and pharmaceutical development.

Restraints

-

Regulatory Complexity and Compliance Risks

-

Data Security and Privacy Concerns

Key Segmentation

By Type

The Clinical Monitoring segment held the largest share of the FSP market in 2023, contributing around 26.4% of the overall market. Its dominance stems from its critical role in ensuring compliance with regulatory standards and managing trial integrity. The rising complexity of clinical trials, including multi-center studies and adaptive trial designs, has made expert oversight indispensable. FSPs specializing in this area provide trained professionals to perform both onsite and remote monitoring, ensuring efficient trial execution and high data accuracy.

Data Management is projected to be the fastest-growing segment over the forecast period. The segment's growth is fueled by the increasing complexity and volume of clinical trial data, requiring sophisticated systems for data collection, storage, and compliance. As regulations around data privacy and security tighten globally, sponsors are turning to FSPs for robust data management solutions that ensure integrity, accuracy, and regulatory adherence. This trend aligns with the increasing reliance on advanced analytics and real-time data processing technologies in clinical trials.

By Stage

The Clinical Development stage accounted for the largest share of the market in 2023. This dominance is attributed to significant R&D investments by pharmaceutical and biotechnology companies, aiming to expedite drug discovery and development. FSPs play a pivotal role in managing clinical trial workflows, helping organizations maintain compliance and accelerate timelines during this critical stage.

Clinical Development is also anticipated to be the fastest-growing stage over the forecast period. This growth is driven by increasing biopharma investments in innovative treatments, such as cell and gene therapies. Additionally, the integration of advanced tools like AI and machine learning to optimize trial design and execution further propels the demand for specialized FSP services during this stage.

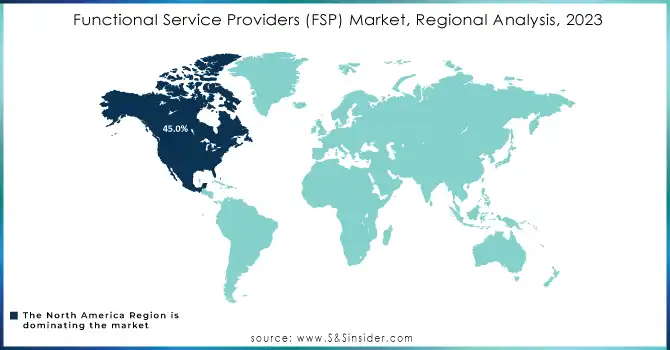

Regional Analysis

North America dominated the market, accounting for approximately 45.0% of the global share in 2023. This leadership stems from a robust pharmaceutical and biotech industry, extensive investment in R&D, and the presence of major players like Covance, IQVIA, and PAREXEL. The region benefits from advanced regulatory frameworks that emphasize compliance and quality, driving demand for specialized FSP services. Moreover, the adoption of innovative solutions like AI and data analytics enhances trial efficiency and supports growth in this region.

Europe ranked as the second-largest region in 2023. A strong focus on regulatory compliance, patient safety, and a thriving pharmaceutical sector propels demand for FSPs. Countries like Germany, the UK, and France contribute significantly through investments in clinical research and advanced trial methodologies. The region’s increasing adoption of patient-centric approaches and integration of digital tools further positions Europe as a key market

Asia-Pacific is anticipated to be the fastest-growing region over the forecast period. The growth is driven by expanding healthcare infrastructure, cost-effectiveness, and rising clinical trial activities in countries like China, India, and South Korea. The region’s diverse patient demographics and increasing investments in healthcare R&D attract local and international FSPs. Advanced technologies, including cloud-based solutions and mobile health platforms, are increasingly utilized to streamline trial processes, enhancing Asia-Pacific's appeal.

Need any customization research on Functional Service Providers (FSP) Market - Enquiry Now

Key Players

-

IQVIA – IQVIA Vigilance Platform, Clinical Data Analytics Solutions

-

Parexel International Corporation – Clinical Trial Management Solutions, Data Analysis Tools

-

ICON plc – Clinical Development Optimization Services, Data Management Platforms

-

PRA Health Sciences – Patient-Centric Clinical Trial Management, Biostatistics

-

Covance Inc. (Labcorp) – Clinical Trial Management, Toxicology Testing Solutions

-

Charles River Laboratories International Inc. – Early-Stage Development Services, Preclinical Testing

-

Syneos Health – Data and Insights Solutions, Late-Stage Clinical Services

-

Pharmaceutical Product Development LLC (PPD) – Clinical Development, Real-World Evidence Services

-

Medpace Holdings Inc. – Full-Service Clinical Trial Management, Pharmacovigilance

-

Wuxi AppTec – Integrated R&D Services, Safety Assessment Platforms

-

Accenture – Life Sciences Cloud, Pharmacovigilance Analytics

-

Cognizant – Clinical Data Management, Regulatory Affairs Solutions

-

Quanticate – Biostatistics, Data Management Services

-

BioPoint Inc. – Clinical Monitoring, Regulatory Consulting

Recent Developments

In January 2023, Premier Research, a leading clinical research organization (CRO), partnered with Centogene N.V., a global expert in genetic diagnostics, to strengthen support for rare disease clinical trials. The collaboration focuses on streamlining critical aspects of trial processes, including patient identification, stratification, recruitment, and enrollment. By leveraging Centogene's expertise in genetic diagnostics alongside Premier Research’s clinical trial capabilities, the partnership aims to enhance study success rates and accelerate drug development for rare diseases.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 14.68 billion |

| Market Size by 2032 | US$ 30.70 billion |

| CAGR | CAGR of 8.56% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Clinical Monitoring, Medical Writing, Data Management, Pharmacovigilance, Biostatistics, Programming, Study Design, Others) •By Stage (Clinical Development, Post Approval) •By Application (Biopharma Companies, Biotech Companies, Medical Devices Companies, Research Centers and Academic Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IQVIA, Parexel International Corporation, ICON plc, PRA Health Sciences, Covance Inc. (Labcorp), Charles River Laboratories International Inc., Syneos Health, Pharmaceutical Product Development LLC (PPD), Medpace Holdings Inc., Wuxi AppTec, Accenture, Cognizant, Quanticate, BioPoint Inc |

| Key Drivers | • Driving Innovation and Efficiency in the Expanding Role of Functional Service Providers in Healthcare and Life Sciences |

| Restraints | •Regulatory Complexity and Compliance Risks • Data Security and Privacy Concerns |