Carrageenan Market Analysis & Overview:

The Carrageenan Market size was USD 975.20 Million in 2024 and is expected to reach USD 1477.60 Million by 2032 and grow at a CAGR of 6.12% over the forecast period of 2025-2032.

The growing consumer influence for natural and clean-label ingredients is the key driver for the global carrageenan market. Today's consumers tend to be more health-conscious and look for food made from natural and minimally processed ingredients that contribute to their health and wellness goals. Carrageenan, a natural, plant-based ingredient from red seaweed, perfectly meets this demand. It does so as of its capacity to act as a stabilizer, thickener, and a gelling agent when no synthetic additives are required. It is gaining the favor of many manufacturers making all efforts to meet the clean-label standards.

For instance, the U.S. Food and Drug Administration (FDA) has updated the criteria for foods labeled as "healthy," limiting added sugars, saturated fats, and sodium to ensure alignment with dietary recommendations.

Get E-PDF Sample Report on Carrageenan Market - Request Sample Report

Key Carrageenan Market Trends

-

Rising demand for clean-label and plant-based ingredients

-

Growth in functional foods and nutraceuticals

-

Expansion in the pharmaceutical and personal care sectors

-

Sustainability and ethical sourcing focus

-

Innovation in processed food formulations

-

Regulatory scrutiny and safety debates

Carrageenan Market Growth Drivers

-

Growing Use of Carrageenan in Dairy and Processed Meat Products Fuels Market Growth

One of the major driving factors of the market is the rising usage of carrageenan in dairy products and processed meat products. Carrageenan Market Trends highlight its widespread use in dairy products, where it is added as a stabilizer and thickener in chocolate milk, cream, yogurt, and other dairy desserts. The ingredient allows the product texture to be more stable, avoids the separation of ingredients, and increases the overall shelf life. In processed meat products, carrageenan is used to improve water binding, juiciness, and firm texture. Its water-binding and gelling properties make it highly valuable in items such as sausages, hams, and deli meats.

The increasing use of carrageenan in these applications is aligned with the accelerating demand for convenience foods and high-quality products, which continues to drive demand in the market. Furthermore, the expressive natural and clean-label nature of carrageenan supports changing consumer preferences, further enhancing its adoption in food formulations.

In April 2022, Bang & Bonsomer, based in Finland, acquired all shares of Eurogum A/S (Denmark) and Eurogum Polska Sp Zoo (Poland). Eurogum specializes in the production of carrageenan and alginate for the food industry.

Carrageenan Market Restraints

-

Price Volatility of Seaweed May Hamper the Market Growth

Price fluctuation of seaweed is one of the crucial restraining factors for global Carrageenan Market growth. As carrageenan is sourced from red seaweed, any variations in the supply and price of seaweed automatically impact the production costs of carrageenan. Weather conditions, natural disasters, and over-harvesting all create uncertainty around seaweed supply. Furthermore, the price volatility can be raised by variations in seaweed farming practices and the quantity harvested in specific regions. This volatility in raw material costs may lead to increased production expenses for carrageenan, affecting the overall Carrageenan Market analysis by contributing to higher product prices. Manufacturers might have to absorb these costs, reducing profit margins, or pass them on to consumers, potentially decreasing demand for carrageenan-based products especially in price-sensitive or low-margin markets

Carrageenan Market Segmentation Analysis:

By Product Type

The Kappa segment held the largest market share around 65% in 2023. It is owing to significant application across the food and beverage industry coupled with high demand. Kappa carrageenan is prized for its gelling ability and is commonly used in several products including dairy desserts, puddings, and jams. In meat products, it is also used to provide texture and help bind water. The excellent gel strength of kappa carrageenan makes it the first choice of many manufacturers when formulating for consistency. This property of forming stable gels with low concentrations and being compatible with other ingredients has led to its leading position in the market. At the same time, its status as a natural and clean-label product meets increased consumer interest in health-promoting minimally processed foods. All these factors contribute to the largest market share of kappa carrageenan, thus establishing it as a leading variant of the market of carrageenan.

By Processing Technology

The semi-refined carrageenan segment held the largest market share, around 48%, in 2023. This is owing to its low price and wide application scope. Carrageenan companies looking to satisfy consumer demand for natural, clean-label products have increasingly turned to semi-refined carrageenan, which is less processed than fully refined carrageenan and thus retains more of its natural components. This type of carrageenan is frequently found in dairy, non-dairy drinks, and processed meats, where it acts as a thickener, stabilizer, and gelling agent. It displays excellent gelling properties and texture at a lower cost compared to fully refined carrageenan, making it ideal for industries with tighter budgets. Moreover, the shifting preference toward natural ingredients in food products continues to propel demand for semi-refined carrageenan, which is viewed by many as an eco-friendlier and more natural alternative factor driving innovation among carrageenan companies

By Function

Thickening agents held the largest market share, around 35%, in 2023. This is due to their significant functional contribution to a variety of industrial applications, especially in food and beverage. A key factor driving carrageenan market growth is its widespread use as a common thickener, owing to its ability to enhance a product's viscosity without altering the taste or appearance of liquid-based products. In the food industry, its value is particularly evident in sauces, soups, dairy products, and beverages, where achieving the right texture and consistency is crucial. The gelation and smooth, creamy textural properties of carrageenan make it attractive for numerous applications, including dairy desserts, non-dairy beverages, and plant-based alternatives. Its versatility and efficiency at low concentrations also contribute to its appeal as a cost-effective option for manufacturers.

By Application

Food & Beverage held the largest market share around 65% in 2023. It is used in food and beverage products, carrageenan effectively functions as a thickener, gelling agent, stabilizer, and emulsifier. Frequently used in ice cream, yogurt, and dairy-based goods, it improves a product's texture, keeps ingredients from separating, and enhances shelf life. In processed meats, plant-based substitutes, sauces, soups, and drinks for example, carrageenan is an important texturizing agent that functions to improve body and mouthfeel. Carrageenan is a natural ingredient derived from seaweed and is best suited to meet these consumer demands for clean-label, natural ingredients. Due to its high-quality texture and economic value, it has become a favored food manufacturing option.

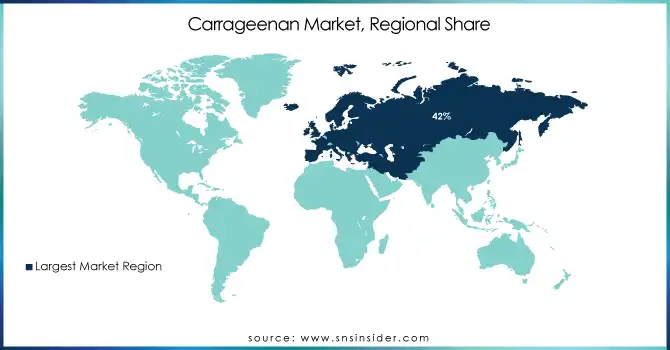

Carrageenan Market Regional Outlook

Europe Carrageenan Market Insights

Europe held the largest market share around 42% in 2024. This is due to increased consumption of high functionality in food and beverage industries, pharmaceutical, and cosmetic products in the region, owing to the clean-label and natural product trend. In the European market, carrageenan, a gelling, thickening, and stabilizing agent, is one of the most widely used ingredients in the food and beverage industry, made with a well-established, modern industry in place, covering retail products including dairy, meat, sauces and plant-based foods.

In addition, Europe sets very high regulatory standards, so the increasing emphasis on natural and safe ingredients has led to a rise in the Carrageenan Market share as it becomes a preferred food additive. Its market position is also bolstered by the regional growth of plant-based food that requires carrageenan for texture and consistency. Apart from food applications, it is also used in pharmaceuticals and personal care products across Europe, further enhancing its revenue-generation potential. Consequently, the regional market is expected to grow, owing to the increasing preference of manufacturers in Europe for carrageenan (a renewable and biodegradable product), as consumers are highly aware of sustainability.

Asia Pacific Carrageenan Market Insights

Asia Pacific will be leading the global carrageenan market in 2024 on account of large-scale seaweed production across its countries, such as the Philippines, Indonesia, and China, which are key raw material suppliers. Growing applications from the food & beverage industry, including dairy, confectionery, and meat, are expected to drive growth, with increasing acceptance in pharmaceutical and personal care applications also offering opportunities. Low-cost manufacturing cost structure and significant investments in processing capacity are the key factors that propel Asia Pacific into a global player in terms of carrageenan production and export.

North America Carrageenan Market Insights

The North American market will grow steadily through 2024 due to increasing consumption of clean-label, plant-based, and natural food additives. The U.S. is the largest user the seaweed on a large scale for processed food and dairy alternatives, and in beverages to gel and stabilize products. Rigorous food safety standards and consumer demand for organic and non-genetically modified organism (GMO) ingredients are driving food and personal care manufacturing to a broader product offering, thereby driving the adoption of carrageenan in food and personal care applications.

Latin America (LATAM) Carrageenan Market Insights

Promising Market for Carrageenan in LATAM From 2019-2024 The LATAM carrageenan market is witnessing demand, due to the growth in this region is favored by a rise in demand in the food processing, dairy, and confectionery industries. Brazil and Mexico, which have high consumption of processed food and an increasing interest in plant-derived additives, are the two leading markets, driving adoption. Besides, shore-based investments in seaweed farming and processing by the locals would enhance the significance of the region in the international carrageenan supply chain.

Middle East & Africa (MEA) Carrageenan Market Insights

The MEA Carrageenan market has been witnessing moderate growth currently. The demand for carrageenan-based products is largely emerging from the food & beverage industry, particularly in dairy, confectionery, and halal-certified food products. Countries such as Saudi Arabia, UAE, and South Africa are inclining their preference towards carrageenan as a stabilizer and thickening agent in processed and packaged food, the popularity of which is escalating. Furthermore, the booming pharmaceutical industry and cosmetics industry along with increasing consumer focus towards natural additives, is also boosting the carrageenan demand in the region.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Competitive Landscape for Carrageenan Market

-

DuPont

DuPont is a global science and innovation leader, providing specialty ingredients, materials, and sustainable solutions across industries, including food, beverages, and healthcare.-

In 2023, DuPont expanded its range of natural and clean-label ingredients, introducing new bio-based solutions derived from sustainable sources. This expansion included carrageenan as a key component in its clean-label offerings, targeting the growing demand from the food and beverage sector.

-

-

Ingredion

Ingredion is a leading global provider of ingredient solutions for the food, beverage, and industrial markets, with a focus on clean-label, plant-based, and functional formulations.-

In 2022, Ingredion launched its Clearblend line of carrageenan products designed for plant-based food applications. The launch aimed to address the rising demand for vegan and vegetarian alternatives by offering carrageenan solutions that enhance texture and mouthfeel in dairy alternatives and other plant-based foods.

-

Carrageenan Market Companies are:

- DuPont (Genencare, Cholecalciferol)

- Ingredion Incorporated (Clearblend, Viscosity Control)

- Ashland (Keltrol, Polysaccharides)

- CP Kelco U.S., Inc. (Gellan Gum, Keltrol)

- Cargill, Inc. (Stabilizer, Texturizing Agent)

- Ceamsa (Kappa, Iota Carrageenan)

- W Hydrocolloids, Inc. (LBG, Seaweed Extracts)

- Gelymar (CarraLact VPD, CarraLact VFL)

- Caldic B.V. (Gellan Gum, Alginate)

- Ina Food Industry Co. Ltd. (Carrageenan Powder, Gel)

- PT. Gumindo Perkasa Industries (Semi-Refined Carrageenan, Refined Carrageenan)

- TBK Manufacturing Corporation (TBK-20, TBK-25)

- FMC Corporation (Alginate, Agar)

- Marinochem (Marin Carrageenan, Seaweed Extracts)

- Eurogum (Carrageenan, Seaweed Derivatives)

- TIC Gums (Ticaloid, Ticaloid Ultra)

- Gum Technology Corporation (Xanthan Gum, Guar Gum)

- Neogalen (Natural Gels, Gelatin)

- Hongmao (Kappa Carrageenan, Iota Carrageenan)

- Seaweed Solutions (Seaweed Gel, Hydrosol Carrageenan)

| Report Attributes | Details |

| Market Size in 2024 | US$ 975.20 Mn |

| Market Size by 2032 | US$ 1477.60 Mn |

| CAGR | CAGR of 6.12% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Processing Technology (Alcohol Precipitation, Gel Press, and Semi-refined) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | DuPont, Ingredion Incorporated, Ashland, CP Kelco U.S., Inc., Cargill, Inc., Ceamsa, W Hydrocolloids, Inc., Gelymar, Caldic B.V., Ina Food Industry Co. Ltd., PT. Gumindo Perkasa Industries, TBK Manufacturing Corporation, and other |