Celiac Disease Treatment Market Report Size Analysis:

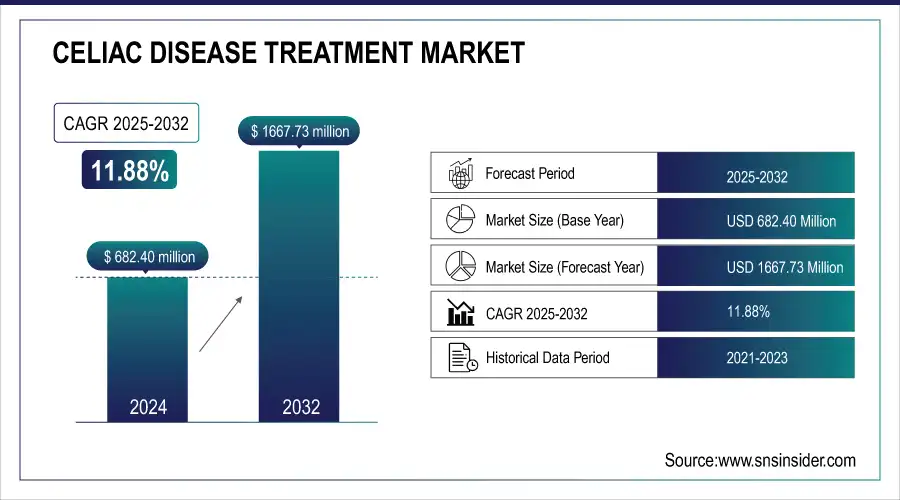

The Celiac Disease Treatment Market size was valued at USD 682.40 million in 2024 and is expected to reach USD 1667.73 million by 2032, growing at a CAGR of 11.88% over the forecast period of 2025-2032.

The celiac disease treatment market is increasing steadily, fueled by enhanced disease prevalence, better diagnostic facilities, and growing awareness of gluten intolerance. The rising use of gluten-free diets, advancements in enzyme therapies, and favorable regulatory clearances are further fueling the increasing number of treatment options. Additionally, the increasing availability of over-the-counter and prescription-based symptomatic medications further facilitates patient access. Growing markets and future clinical trials for new therapeutic drugs are poised to grow even more rapidly during the forecast period.

To Get more information on Celiac Disease Treatment Market - Request Free Sample Report

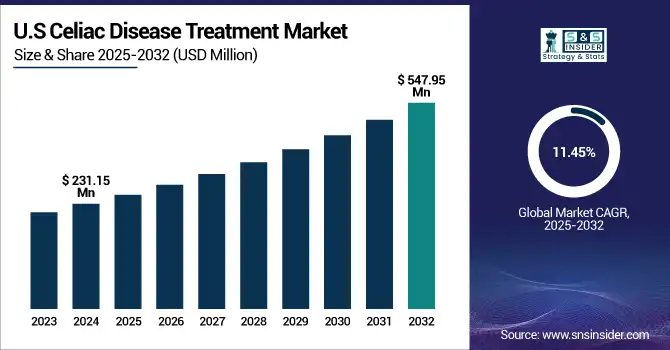

The U.S. celiac disease treatment market size was valued at USD 231.15 million in 2024 and is expected to reach USD 547.95 million by 2032, growing at a CAGR of 11.45% over the forecast period of 2025-2032. In 2024, the U.S held the largest share in the North American celiac disease treatment market due to the high incidence of the disease and extensive use of gluten-based foods. For instance, according to NIH, Experts estimate that approximately 2 million people in the United States are affected by celiac disease, and about 1% of the global population lives with the condition. The nation's advanced diagnostic facilities, strong pharmaceutical celiac disease drug companies' presence, and well-developed healthcare infrastructure also favor its position in the celiac disease drug market growth.

Celiac Disease Treatment Market Dynamics:

Drivers

-

Increasing Awareness and Early Diagnosis are Propelling the Market Growth

Increased health consciousness about celiac disease has been instrumental in the disease's early detection and management. Public awareness campaigns, health websites, and educational programs are making individuals aware of the symptoms of celiac disease, namely digestive discomfort, skin rashes, and tiredness. Consequently, individuals are approaching their health workers earlier. Timely diagnosis can manage the disease well, averting serious consequences such as malnutrition or other autoimmune diseases. As people become more aware, an increasing number of patients are being diagnosed, which drives demand for treatments and specialty gluten-free foods.

-

Rising Demand for Gluten-Free Products is Driving the Market Growth

There has been substantial growth in world demand for foods that are free from gluten, not only from those who are diagnosed with celiac disease but also from consumers who do not consume gluten due to other medical reasons, e.g., sensitivity to gluten or overall health. This increasing tendency towards gluten-free living is motivating food companies to produce more diversified gluten-free items, making them more affordable and accessible. In individuals with celiac disease, there is a necessary treatment for their condition, as the intake of gluten can cause serious symptoms and long-term health complications. As such, the increasing availability and demand for the products are hence propelling the celiac disease drug market trends, as sufferers of the disease look for safe, gluten-free options.

In March 2024, The Kraft Heinz Company (US) launched a gluten-free version of its mac 'n' cheese under the name KD Gluten Free, according to Food in Canada and confirmed through a press release. The move forms part of the company's overall shift into plant-based alternatives, which also saw the introduction of KD NotMac and Cheese.

Restraint

-

Underdiagnosis and Misdiagnosis Restrain the Market Growth

Celiac disease tends to come with symptoms that closely resemble other gastrointestinal or autoimmune illnesses, including irritable bowel syndrome (IBS), lactose intolerance, or Crohn's disease. Non-specific symptoms such as abdominal pain, bloating, fatigue, and diarrhea are given by healthcare professionals to more typical illnesses. Several patients also have atypical or no gastrointestinal symptoms ("silent celiac disease"), further complicating diagnosis. Consequently, a high proportion of cases go undiagnosed.

For Instance, Estimates from the Celiac Disease Foundation suggest that approximately 80% of individuals with celiac disease are undiagnosed in the United States alone. Underdiagnosis creates delays in treatment, lowers patient outcomes, and holds back overall market growth for celiac disease treatment, most notably in regions where fewer diagnostic resources are available.

Celiac Disease Treatment Market Segmentation Analysis:

By Treatment

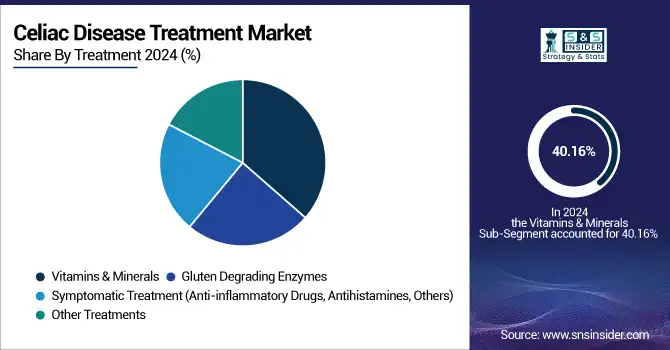

In 2024, the vitamins & minerals segment held the largest share of the celiac disease treatment market with 40.16% market share due to the high demand to address nutritional deficiencies related to the condition. Malabsorption of vital nutrients such as iron, calcium, vitamin D, and B-complex vitamins occurs in patients with celiac disease due to chronic intestinal damage. Accordingly, vitamin and mineral supplementation continues to be an integral element of management, functioning to decrease symptoms such as anemia, weakness, and bone loss, and to enhance overall patient recuperation in conjunction with a gluten-free diet.

The gluten-degrading enzymes segment is expected to witness the fastest growth in the forecast period as a result of greater innovation in enzyme-based treatments for minimizing the severity of symptoms caused by gluten. These enzymes are being developed to break down leftover gluten that is ingested accidentally, serving as an extra layer of protection for celiac patients who often struggle with following strict diets. The fast uptake and growth of this category are being propelled by patient interest in adjunctive therapies that fit into their lifestyles as well as continued clinical exploration of enzyme effectiveness.

By Distribution Channel

In 2024, the retail pharmacies segment held the largest celiac disease treatment market Share of about 58.50%, owing to its widespread availability, customer credibility, and position as a first-line channel for over-the-counter supplements such as vitamins and minerals. Retail pharmacies are where patients go for rapid access to prescribed and non-prescription therapy, nutritionals, and advice from a pharmacist. For those suffering from celiac disease, retail pharmacies quickly turned into the most favorable outlet for drug therapy, given the convenience of physically acquiring products, not to mention the opportunity to have direct communication with healthcare providers.

The online pharmacies segment will be growing at the fastest rate during the forecast period as more and more consumers turn to digital healthcare, particularly in the post-pandemic scenario. Home delivery of convenience, wider product range availability, and subscription plans for frequent supplement requirements are advantages offered to celiac patients. Growing internet penetration, mobile app usage, and insight into gluten-free and therapeutic products available on the internet are all serving to drive the high growth in this segment as a viable and effective distribution platform.

Regional Analysis:

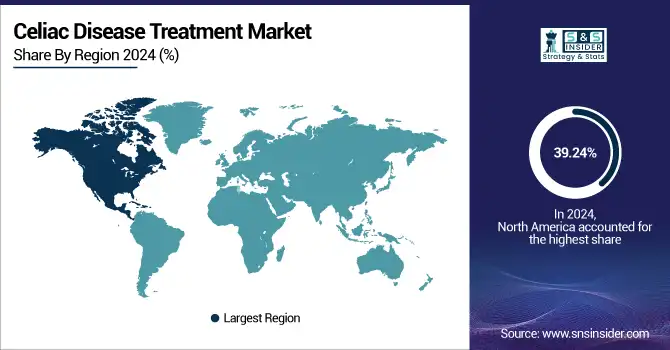

In 2024, North America dominated the celiac disease treatment market with a 39.24% market share due to the region's sophisticated healthcare infrastructure, high prevalence of the disease, and well-established treatment facilities. The U.S. is especially favored by a high rate of diagnosis, early diagnosis, and strong healthcare policies that facilitate easy access to treatment. In addition, the presence of key pharmaceutical players and a high prevalence of people with celiac disease also propels the growth of the market in North America, which is the largest regional contributor to the global market share.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific is the fastest-growing region in the global celiac disease treatment market with 12.75% CAGR, propelled by growing awareness of celiac disease, enhancing healthcare infrastructure, and increasing demand for gluten-free products. With increasing healthcare expenditures, growing access to diagnosis, and a rise in lifestyle disorders, the region is witnessing an uptrend in demand for celiac disease therapies. With developing economies in nations such as China, India, and Japan, increasing emphasis on patient education and therapy accessibility will drive quick market growth for this region.

Europe is experiencing rapid growth in the celiac disease treatment market due to increased awareness and improved access to healthcare on the continent. European countries have embraced advanced diagnostic techniques and are well-educated regarding celiac disease, leading to higher rates of diagnosis and treatment. The presence of advanced healthcare systems, high rates of gluten-free drug therapies, and growing demand for specialized treatments also contribute to the growth of the market in Europe. Moreover, continuous research and partnerships between healthcare providers and pharmaceutical firms are improving access to innovative therapies for celiac disease, driving market growth in the region.

Both the Middle East & Africa (MEA) and Latin America in 2024 showed moderate growth in the celiac disease treatment market due to growing awareness, enhancement in healthcare infrastructure, and an increase in demand for gluten-free foods.

In Latin America, Brazil and Argentina are experiencing increasing celiac disease diagnoses, facilitated by tighter regulations on gluten labeling and increased awareness of gluten-free living among consumers, driving the market growth in this region.

In the MEA region, countries such as Saudi Arabia and the UAE are stepping up efforts to improve diagnostic capacities and expand the availability of gluten-free products. These efforts are creating a more conducive climate for the development of the celiac disease treatment market.

Celiac Disease Treatment Market Key Players

Takeda Pharmaceutical Company Limited, Immunic Therapeutics, Innovate Biopharmaceuticals, BioLineRx Ltd., Amgen Inc., ZEDIRA GmbH, Novartis, Cour Pharmaceuticals, ImmunogenX, Anokion SA, Topas Therapeutics, and other players.

Recent Developments in the Celiac Disease Treatment Market

-

February 2024 – Novartis announced that the U.S. Food and Drug Administration (FDA) has approved Xolair (omalizumab) to decrease allergic reactions, including anaphylaxis, due to accidental ingestion of one or more foods. The approval is for both adult and pediatric patients 1 year of age and older with IgE-mediated food allergies.

-

November 2024 – Immunic, Inc., a biopharmaceutical company developing oral drugs for chronic inflammatory and autoimmune disorders, reported that data from its Phase 1/1b clinical trial of IMU-856 were published in The Lancet Gastroenterology & Hepatology. IMU-856 is an orally active, systemically absorbed small molecule aimed at SIRT6 (Sirtuin 6).

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 682.40 million |

| Market Size by 2032 | USD 1667.73 million |

| CAGR | CAGR of 11.88% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Treatment (Vitamins & Minerals, Gluten Degrading Enzymes, Symptomatic Treatment [Anti-inflammatory Drugs, Antihistamines, Others], Other Treatments) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Other Distribution Channels) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Takeda Pharmaceutical Company Limited, Immunic Therapeutics, Innovate Biopharmaceuticals, BioLineRx Ltd., Amgen Inc., ZEDIRA GmbH, Novartis, Cour Pharmaceuticals, ImmunogenX, Anokion SA, Topas Therapeutics, and other players. |