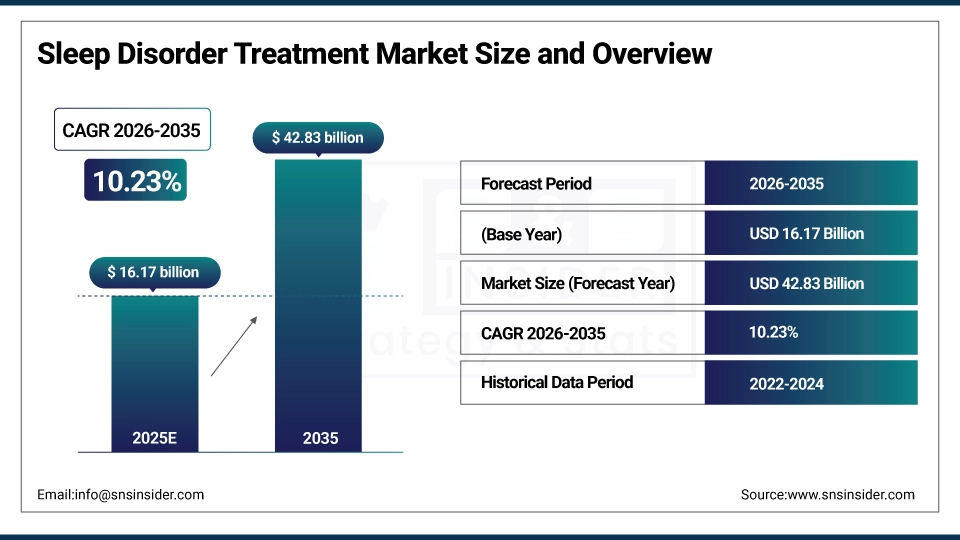

Sleep Disorder Treatment Market Size & Overview:

The Sleep Disorder Treatment Market size is estimated at USD 16.17 billion in 2025 and is expected to reach USD 42.83 billion by 2035, growing at a CAGR of 10.23% over the forecast period of 2026-2035.

The global sleep disorder treatment market trend is a growing demand for pharmacological therapies such as hypnotics, sedatives, and wakefulness-promoting agents as the growth of the market is driven by increasing prevalence of sleep-related disorders, rising awareness about sleep health consequences, and growing adoption of cognitive behavioral therapy for insomnia. This trend is also driven by a growing adoption of prescription sleep medications and the growing focus on personalized sleep medicine as healthcare providers become more focused on improving patient sleep quality and are more willing to invest in novel treatment modalities, resulting in growth in the domestic and international market for drug-based and non-drug-based sleep disorder interventions.

For instance, in March 2024, growing awareness and improved diagnostic capabilities drove a 24% increase in sleep disorder treatment prescriptions for healthcare systems in North America, boosting patient access to therapeutic interventions and sleep health management.

Sleep Disorder Treatment Market Size and Forecast:

-

Market Size in 2025E: USD 16.17 billion

-

Market Size by 2035: USD 42.83 billion

-

CAGR: 10.23% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Get more information on Sleep Disorder Treatment Market - Request Free Sample Report

Sleep Disorder Treatment Market Trends

-

Sleep disorder treatment solutions are being adopted because patients demand effective management of insomnia symptoms, sleep apnea complications, and daytime sleepiness reduction.

-

Customized therapeutic approaches based on sleep disorder subtypes, patient age groups, and comorbidity profiles to improve treatment outcomes.

-

The development of dual orexin receptor antagonists, novel melatonin receptor agonists, and digital therapeutics to improve the sleep quality and reduce medication dependency.

-

Combination therapies, behavioral sleep medicine interventions, and remote sleep monitoring are all available to ensure continuous patient care and treatment adherence.

-

Increased demand for controlled-release formulations, wearable sleep trackers and telemedicine-based sleep consultations to help treatment accessibility and patient compliance.

-

Collaboration between pharmaceutical companies, sleep medicine specialists and medical device manufacturers to develop integrated treatment solutions and improve clinical guidelines.

-

FDA, EMA and national regulatory authorities promoting standards for sleep medication safety, controlled substance scheduling, therapeutic efficacy requirements, and patient education materials.

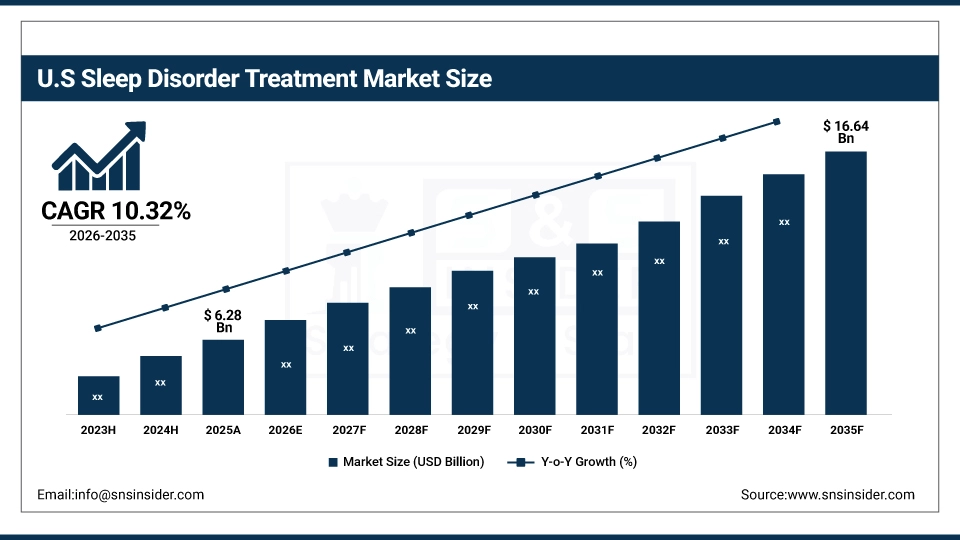

The U.S. Sleep Disorder Treatment Market is estimated at USD 6.28 billion in 2025 and is expected to reach USD 16.64 billion by 2035, growing at a CAGR of 10.32% from 2026-2035. The United States represents the largest market for sleep disorder treatment, primarily driven by the high prevalence of chronic insomnia, widespread sleep apnea diagnosis, and well-developed sleep medicine infrastructure. Healthcare insurance coverage, high levels of prescription medication utilization and increased provider awareness regarding sleep health importance help to drive growth in the market. Also, the U.S. is the largest regional market in the world, due to the regulatory approval pathways and swift adoption of novel orexin antagonists and next-generation hypnotic agents.

Sleep Disorder Treatment Market Growth Drivers:

-

Rising Prevalence of Sleep Disorders and Lifestyle-Related Sleep Problems are Driving the Sleep Disorder Treatment Market Growth

Rising prevalence of sleep disorders and lifestyle-related sleep problems take the center

stage as a growth driver for the sleep disorder treatment market share, and are driven by the increasing incidence of stress-induced insomnia, shift work sleep disorder, and technology-related circadian disruptions for increased treatment-seeking behavior and pharmaceutical intervention demand. These solutions for chronic sleep deprivation management and sleep quality improvement are driving the base of the market, the penetration of prescription medication & behavioral therapy markets, and adding to the overall market share globally.

For instance, in June 2024, novel orexin antagonists and extended-release hypnotics accounted for ~58% of the total global sleep medication prescriptions, reflecting growing physician preference and expanding market share.

Sleep Disorder Treatment Market Restraints:

-

Medication Side Effects and Dependency Concerns are Hampering the Sleep Disorder Treatment Market Growth

Medication side effects & dependency concerns of sleep disorder treatments also restrict the sleep disorder treatment market growth, as a large number of patients who are prescribed hypnotics experience adverse effects including morning drowsiness, cognitive impairment, or develop tolerance requiring dose escalation. This might lead to treatment discontinuation, limited long-term adherence, and reduced patient satisfaction with pharmacological interventions. As a result, treatment outcomes suffer, and market growth is stunted in regions where concerns about benzodiazepine dependency are prevalent and alternative therapies are preferred.

Sleep Disorder Treatment Market Opportunities:

-

Digital Therapeutics and AI-Powered Sleep Solutions Drive Future Growth Opportunities for the Sleep Disorder Treatment Market

The opportunity in the digital therapeutics and AI-powered sleep solutions in sleep disorder treatment market is in the form of app-based cognitive behavioral therapy for insomnia, wearable sleep optimization devices, and personalized sleep coaching platforms. These solutions provide for non-pharmacological intervention options, individualized treatment recommendations, and continuous sleep pattern monitoring. Through enhanced treatment accessibility, reduced medication dependency, and improved long-term outcomes, particularly in areas with growing health technology adoption, these innovations may improve patient quality of life, decrease healthcare costs, and expand the market.

For instance, in April 2024, the American Academy of Sleep Medicine reported that 71% of sleep disorder patients expressed interest in digital therapeutic options, highlighting rising consumer demand and increasing opportunity for technology-enabled treatment solutions.

Sleep Disorder Treatment Market Segment Analysis

-

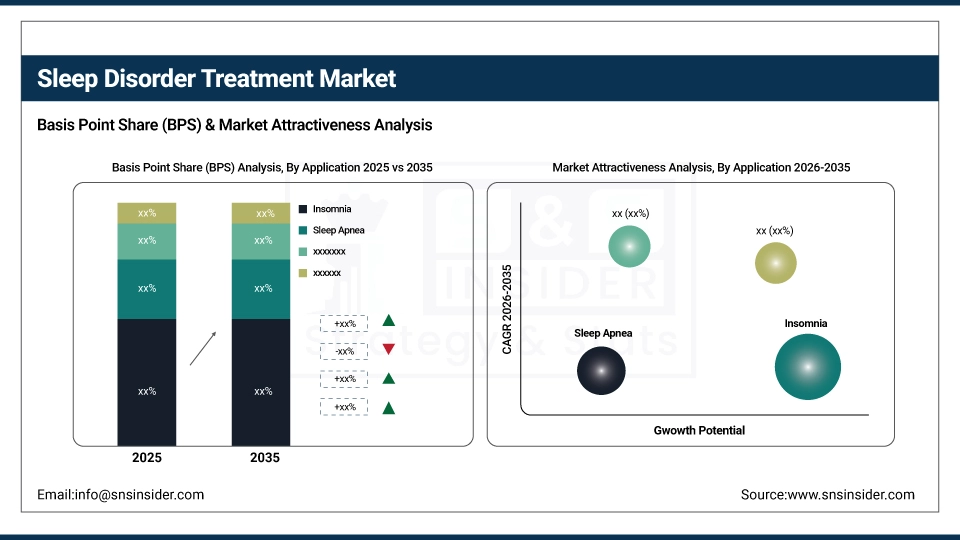

By drug type, nonbenzodiazepines held the largest share of around 36.82% in 2025E, and the orexin antagonists segment is expected to register the highest growth with a CAGR of 12.47%.

-

By application, insomnia dominated the market with approximately 44.56% share in 2025E, while sleep apnea is expected to register the highest growth with a CAGR of 11.34%.

By Drug Type, Nonbenzodiazepines Lead the Market, While Orexin Antagonists Register Fastest Growth

The nonbenzodiazepines segment accounted for the highest revenue share of approximately 36.82% in 2025, owing to favorable safety profile compared to traditional benzodiazepines, lower abuse potential, and widespread physician prescribing habits for short-term insomnia management. Emerging trends, including increasing patient preference for Z-drugs and regulatory support for controlled hypnotic use. In comparison, the orexin antagonists segment is anticipated to achieve the highest CAGR of nearly 12.47% during the 2026–2035 period, driven by the novel mechanism of action targeting sleep-wake regulation, reduced dependency risk, and growing FDA approvals for dual orexin receptor antagonists. Drivers include rising adoption among chronic insomnia patients, the preference for non-sedating sleep medications with minimal next-day impairment.

By Application, Insomnia dominates, while Sleep Apnea Segment Shows Rapid Growth

By 2025, the insomnia segment contributed the largest revenue share of 44.56% due to high global prevalence rates, extensive pharmaceutical treatment options and well-established clinical management protocols. Growing recognition of chronic insomnia as a serious health condition coupled with insurance reimbursement availability, patients are increasingly seeking medical intervention for persistent sleep difficulties. The sleep apnea segment is projected to grow at the highest CAGR of about 11.34% between 2026 and 2035 due to the growing need for combination therapies including pharmacological agents alongside CPAP devices and increasing diagnosis rates through home sleep testing expansion. Some of the reasons include better awareness of cardiovascular complications associated with untreated sleep apnea, emerging pharmacological options for obstructive sleep apnea, and healthcare systems' preference for comprehensive treatment approaches addressing both sleep fragmentation and daytime symptoms.

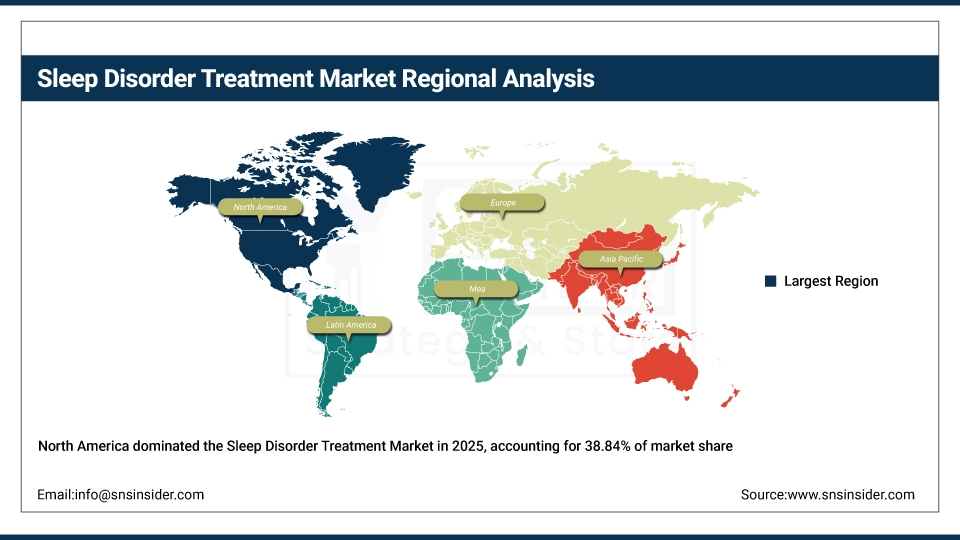

Sleep Disorder Treatment Market Regional Highlights:

North America Sleep Disorder Treatment Market Insights:

North America held the largest revenue share of over 38.84% in 2025 of the sleep disorder treatment market due to an established sleep medicine specialty infrastructure, comprehensive insurance coverage for sleep disorder treatments, and increased patient awareness regarding the health consequences of untreated sleep problems. Drivers include ubiquitous use of prescription sleep medications, an advanced pharmaceutical research environment, growing direct-to-consumer advertising for sleep treatments and greater acceptance of pharmacological interventions stemming from busy lifestyles and work-related stress. At the same time, various clinical practice guidelines, American Academy of Sleep Medicine recommendations and enormous investments in novel drug development from pharmaceutical companies are anchoring sleep disorder treatment medications and services in the market, and ensuring multibillion dollar revenues around the world.

Need any customization research on Sleep Disorder Treatment Market - Enquiry Now

Asia Pacific Sleep Disorder Treatment Market Insights:

Asia Pacific is the fastest-growing segment in the sleep disorder treatment market with a CAGR of 11.76%, as the awareness about sleep health importance, urbanization-driven lifestyle changes, and increasing healthcare infrastructure development in emerging economies is growing. Factors including rapid expansion of sleep clinics, rising middle-class population with health insurance access, and growing acceptance of Western sleep medicine practices are stimulating the market growth. Pharmaceutical market liberalization and telemedicine expansion have been instrumental in improving treatment accessibility, especially in densely populated urban centers. Government health initiatives and occupational health regulations also help in advancing sleep disorder recognition and treatment-seeking behavior. Increase in demand in Asia Pacific region owing to rising healthcare spending against historical levels and growing affordability and accessibility of generic sleep medications.

Europe Sleep Disorder Treatment Market Insights:

The sleep disorder treatment market in Europe is the second-dominating region after North America on account of an increase in the adoption of evidence-based sleep medicine protocols, robust pharmaceutical regulatory frameworks including EMA approval processes, and increasing public health campaigns addressing sleep deprivation consequences. Rising implementation of national sleep health strategies, advanced neuropsychiatric care integration, favorable reimbursement policies for sleep medications, and cross-border pharmaceutical harmonization are also contributing to the sustained growth of the market in leading European countries.

Latin America (LATAM) and Middle East & Africa (MEA) Sleep Disorder Treatment Market Insights:

In Latin America, and Middle East & Africa, the growing healthcare system modernization and increase in pharmaceutical market expansion with sleep medicine awareness campaigns support the sleep disorder treatment market growth. The rising availability of affordable generic medications and multilingual patient education resources, along with international pharmaceutical company presence, will aid treatment access and prescription rates. The increasing urban lifestyle adoption and improving diagnostic capabilities in these regions are continuing to encourage market growth.

Sleep Disorder Treatment Market Competitive Landscape:

Merck & Co., Inc. (est. 1891) is a leading global pharmaceutical company that focuses on research-driven medications for sleep disorders and neurological conditions. It uses its extensive drug development expertise and clinical trial capabilities to produce innovative orexin antagonist therapies with proven efficacy in insomnia treatment.

-

In February 2025, it expanded its sleep disorder treatment portfolio with enhanced formulations of suvorexant and next-generation orexin receptor modulators, aiming to improve treatment outcomes and reduce morning residual effects across diverse patient populations.

Eisai Co., Ltd. (est. 1941) is a well-known global pharmaceutical company focused on neurology therapeutics, sleep-wake disorder medications, and patient-centered drug development. It invests in novel hypnotic agents and insomnia management solutions with the hopes of revolutionizing sleep medicine with effective, well-tolerated, and scientifically validated treatment options.

-

In May 2024, launched an enhanced sleep disorder treatment campaign featuring lemborexant expanded indications and patient education initiatives across global markets, enhancing treatment awareness, medication access, and clinical adoption among sleep medicine specialists.

Idorsia Pharmaceuticals Ltd. (est. 2017) is a leading biopharmaceutical company in the fields of central nervous system disorders, sleep medicine innovation, and precision therapeutics. The company's sleep disorder treatment product portfolio focuses on dual orexin receptor antagonists and next-generation insomnia medications, and features a strong commitment to clinical evidence generation and continuous pharmaceutical innovation to complement the strong market presence in both primary care and specialty sleep medicine settings.

-

In September 2024, introduced advanced sleep disorder treatment data for daridorexant demonstrating improved sleep maintenance and patient-reported outcomes, strengthening clinical evidence base and expanding adoption among prescribing physicians globally.

Sleep Disorder Treatment Market Key Players:

-

Merck & Co., Inc.

-

Eisai Co., Ltd.

-

Idorsia Pharmaceuticals Ltd.

-

Takeda Pharmaceutical Company Limited

-

Jazz Pharmaceuticals plc

-

Pfizer Inc.

-

Sanofi S.A.

-

Vanda Pharmaceuticals Inc.

-

Teva Pharmaceutical Industries Ltd.

-

Mylan N.V. (Viatris Inc.)

-

Purdue Pharma L.P.

-

Mallinckrodt Pharmaceuticals

-

Harmony Biosciences

-

Avadel Pharmaceuticals plc

-

Neurocrine Biosciences, Inc.

-

Pernix Therapeutics Holdings, Inc.

-

Actelion Pharmaceuticals Ltd. (Johnson & Johnson)

-

Boehringer Ingelheim International GmbH

-

Sunovion Pharmaceuticals Inc.

-

Arena Pharmaceuticals (Pfizer)

-

Somaxon Pharmaceuticals

-

Heron Therapeutics, Inc.

-

Axsome Therapeutics, Inc.

-

Sage Therapeutics, Inc.

-

Celon Pharma S.A.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 16.17 Billion |

| Market Size by 2035 | USD 42.83 Billion |

| CAGR | CAGR of 10.23% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Type (Benzodiazepines, Nonbenzodiazepines, Antidepressants, Orexin Antagonists, Melatonin Antagonists, Other Drug Types) • By Application (Insomnia, Sleep Apnea, Narcolepsy, Circadian Disorders, Other Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Merck & Co., Inc.; Eisai Co., Ltd.; Idorsia Pharmaceuticals Ltd.; Takeda Pharmaceutical Company Limited; Jazz Pharmaceuticals plc; Pfizer Inc.; Sanofi S.A.; Vanda Pharmaceuticals Inc.; Teva Pharmaceutical Industries Ltd.; Mylan N.V. (Viatris Inc.); Purdue Pharma L.P.; Mallinckrodt Pharmaceuticals; Harmony Biosciences; Avadel Pharmaceuticals plc; Neurocrine Biosciences, Inc.; Pernix Therapeutics Holdings, Inc.; Actelion Pharmaceuticals Ltd. (Johnson & Johnson); Boehringer Ingelheim International GmbH; Sunovion Pharmaceuticals Inc.; Arena Pharmaceuticals (Pfizer); Somaxon Pharmaceuticals; Heron Therapeutics, Inc.; Axsome Therapeutics, Inc.; Sage Therapeutics, Inc.; Celon Pharma S.A. |