Cell Freezing Media Market Report Scope & Overview:

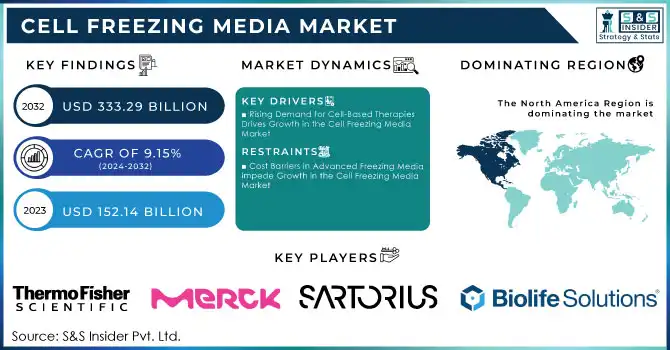

Cell Freezing Media Market was valued at USD 152.14 million in 2023 and is expected to reach USD 333.29 million by 2032, growing at a CAGR of 9.15% from 2024-2032.

The cell freezing media market is expected to grow at a fast pace, due to a rise in demand for solutions in the area of cryopreservation applied to cell-based therapies, regenerative medicine, and biopharmaceutical research. As these sectors progress, particularly in fields such as gene therapy, regenerative medicine, and cell banking, the demand for specialized freezing media formulations becomes increasingly evident. The increasing need is connected to advancements in cryoprotectants, as safer options than traditional agents such as DMSO are addressing issues with storing complex cell types. These developments are essential for the biotechnology and pharmaceutical industries, as they depend on accurate preservation methods to aid in drug development and personalized medicine.

To Get More Information on Cell Freezing Media Market - Request Sample Report

As medical and biotechnology sectors rely on preserved cells, for applications such as stem cell research, cancer treatment, and vaccine development, the need for novel and effective cell freezing media increases. This growth reflects the crucial role played by cell freezing media in offering assurance for cell viability and function, making it possible to move forward in research and therapeutic solutions. For example, the 2023 AACR Cancer Progress Report highlighted tremendous progress in cancer therapy in terms of the number of new FDA-approved therapies from August 2022 through July 2023, including molecularly targeted therapy, immunotherapy, and gene therapy. These advancements highlight the growing need for reliable cell preservation solutions like freezing media to ensure continued progress in cancer research and the development of effective treatments.

Growth opportunities in the cell freezing media market are expanding with increasing uptakes in autologous cell therapies, biobanking, and clinical studies in oncology, neurology, and immunology. Spending on oncology in the United States has been growing sharply from USD 65 billion in 2019 to USD 99 billion in 2023-all of which points towards this demand for effective cryopreservation solutions. As these industries grow, the need for more advanced freezing media is increased much, creating continuous opportunities for manufacturers to develop and expand in this market. These trends show strategic use of cryopreservation in modern medicine, promoting advances in science as well as the development of therapy.

Cell Freezing Media Market Dynamics

DRIVERS

-

Rising Demand for Cell-Based Therapies Drives Growth in the Cell Freezing Media Market

Growth in demand for cell-based treatments is the primary growth driver in the cell freezing media market. With over 100 gene, cell, and RNA therapies have been approved worldwide by June 2023, and more than 3,700 are in clinical and preclinical development. With the shift toward regenerative medicine and treatment with stem cell therapies and immunotherapies, cryopreservation technologies become quite essential. This demand is pushing the biopharmaceutical companies as well as research institutions to spend huge amounts on specialized freezing media for preserving cell viability and functionality. This promises market growth, giving room for greater innovation and competition with respect to fundamental players in this industry.

-

Development of Advanced Cryoprotectants and Freezing Media Formulations Drives Growth in Cell Freezing Media Market

The development in cryoprotectants and freezing media have significantly boosted the cell freezing media market, driven by innovations aimed at minimizing toxicity and improving cell survival post-thawing. Experimental results on oocytes and embryos, combined with mathematical modeling, show a potential 90% reduction in cryoprotectant toxicity in standard vitrification protocols. This progress allows for greater versatility, extended shelf life, and applicability in regenerative medicine and cell therapy. Emerging formulations are poised to support the preservation of more sensitive and complex cell types, expanding the possibilities in cryopreservation for advanced therapeutic applications.

RESTRAINTS

-

Cost Barriers in Advanced Freezing Media Impede Growth in the Cell Freezing Media Market

One of the key constraints in the cell freezing media market is the high development and production costs of the specialized freezing media formulation that contains advanced cryoprotectants. This would result from complex research and development, as well as the manufacturing process of developing more effective and efficient freezers. As such, products often do not reach smaller laboratories, emerging biotech companies, and those whose financial abilities are limited. These economic constraints may deter market acceptance, especially for countries whose research and development funds are limited. Thus, the potential of hindering the general market growth might be expressed through the limitation in exposure to advanced cryopreservation technologies and reduced opportunities for innovation and dispersed use.

Cell Freezing Media Market Segment Analysis

BY END-USE

The pharmaceutical and biotechnology segment was leading the cell freezing media market in 2023, with about 45% of its revenue share. This is because the sector has proved quite strong due to constant demand for cryopreservation solutions in the drug development segment, personalized therapies, and regenerative medicine. Technological and competitive advantages in preserving cell integrity have added to the market position of this sector, encouraging further investments and innovation.

The research and academic institutes segment is expected to grow the fastest CAGR of 9.91% during 2024-2032, driven by increased research initiatives in cell biology, cancer studies, and stem cell therapies. Gene therapy and regenerative medicine mark emerging trends where academic collaborations and advanced cryopreservation techniques come into play. Growth in this segment will make for a potentially more significant shift in competitive dynamics and encourage more focused investment in this expanding segment.

BY APPLICATION

In 2023, the stem cell lines segment held the largest revenue share of about 59%, and is also expected to grow at the fastest CAGR of approximately 9.73% from 2024 to 2032. The reason for this growth is that stem cells are indispensable in most studies of regenerative medicine, research on various cancers, and clinical applications; cryopreservation methods are used to ensure long-term viability. The rising demand for stem cell therapies, coupled with increasing clinical trials and advancements in personalized medicine, makes it highly necessary to have specialized freezing media. As the research expands towards various applications of stem cell-based treatments, the demand for efficient techniques of cryopreservation will increase further and drive growth in this category.

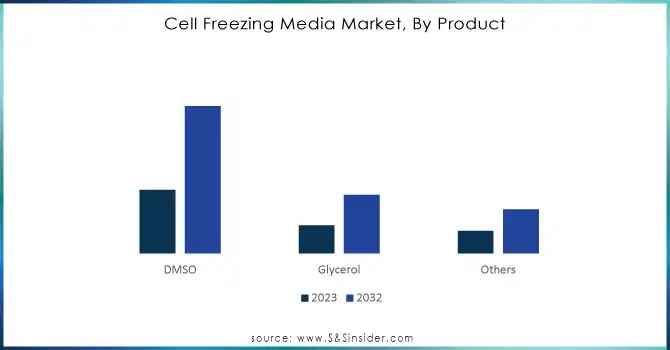

BY PRODUCT

In 2023, DMSO accounted for the largest share of the cell freezing media market at around 56% of revenue share and is also expected to grow at the fastest CAGR of 9.85% during the forecast period from 2024 to 2032. DMSO is largely used as a cryoprotectant primarily because it prevents the formation of ice crystals in frozen cells, thus preserving different types of cells such as stem cells and immune cells. Its effectiveness, low cost, and versatility in large-scale cryopreservation processes are hence preferred for both clinical and research applications. With these increased demands for cell-based therapies, regenerative medicine, and personalized medicine, DMSO's role as a key cryoprotectant is set to expand.

Do You Need any Customization Research on Cell Freezing Media Market - Enquire Now

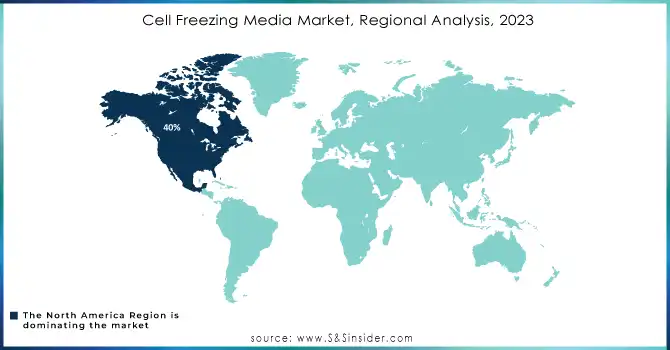

Cell Freezing Media Market Regional Outlook

North America dominated the cell freezing media market in 2023 and held around 40% revenue share. This is due to a well-developed biotechnology sector, expansive research programs, as well as rising demand in the region for cell-based therapies. Huge pharmaceutical companies and institutions continue to rely on cryopreservation technologies as they design drugs or use regenerative medicine and this continues to fuel growth within the market in North America.

The Asia Pacific is expected to grow at the fastest CAGR of about 11.03% from 2024-2032. It is a result of the fast pace of biotechnology, the rise in expenditure by governments of different countries on health infrastructure, along a surge in clinical trials and research concerning stem cells. Highly developed focus on regenerative medicine coupled with the adoption of advanced technologies across other countries such as China, Japan, and India are some of the major contributors that account for rapid market growth.

LATEST NEWS -

-

In 2024, Acorn Biolabs, focused on cell-freezing media for regenerative medicine, secured USD 8 million in Series A funding to further its innovative work in cell preservation.

-

On February 28, 2024, Capricorn Scientific and ExcellGene formed a strategic partnership to optimize processes and develop advanced products for the biotechnology sector, with a focus on enhancing cell culture and media solutions.

KEY PLAYERS

-

Thermo Fisher Scientific, Inc. (Gibco CryoMax Freezing Medium, CryoStor Cryopreservation Medium)

-

Merck KGaA (Cell Freeze Freeze Media, Sigma-Aldrich Cell Freezing Media)

-

Sartorius AG (CryoMACS Freezing Media, Sartorius Stem Cell Freezing Medium)

-

BioLife Solutions, Inc. (CryoStor CS10, CryoStor CS5)

-

Bio-Techne (R&D Systems Cell Freezing Medium, R&D Systems CryoStor Media)

-

HiMedia Laboratories (HiFreeze Cryopreservation Medium, HiMed Freezing Medium)

-

PromoCell GmbH (PromoCell Cryopreservation Medium, PromoCell Cell Freezing Medium)

-

Capricorn Scientific (Capricorn Cryo Preservation Media, Capricorn CryoComplete)

-

Cell Applications, Inc. (Cell Applications Cryopreservation Medium, CryoStor Cell Freezing Media)

-

STEMCELL Technologies (CryoStor Freezing Medium, STEMCELL Technologies Stem Cell Freezing Medium)

-

AMSBIO (CryoStor Cryopreservation Medium, AMSBIO Freezing Media)

-

Cell Systems (CryoBio Freezing Media, Cell Systems Cryopreservation Solution)

-

BPS Bioscience, Inc. (BPS CryoPreservation Medium, BPS Freezing Medium)

-

Lonza Group (Lonza Cryopreservation Medium, CryoStor Cryopreservation Medium)

-

Corning Inc. (Corning Cryopreservation Medium, Corning Cell Culture Freezing Medium)

-

GE Healthcare (HyClone Cell Freezing Medium, HyClone Cryopreservation Medium)

-

Invitrogen (Gibco CryoFreeze Freezing Medium, Gibco CryoStor Cryopreservation Solution)

-

Wako Chemicals (Wako Cryopreservation Medium, Wako Cell Freezing Media)

-

VWR International (VWR Cryopreservation Medium, VWR Cell Freezing Solution)

-

Fisher Scientific (Gibco CryoMax Freezing Medium, Gibco CryoLife Preservation Solution)

-

American Type Culture Collection (ATCC) (ATCC CryoPreservation Medium, ATCC Stem Cell Freezing Medium)

-

Acorn Biolabs (AcornCryo, AcornBioPreserve)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 152.14 million |

| Market Size by 2032 | USD 333.29 million |

| CAGR | CAGR of 9.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (DMSO, Glycerol, Others) • By Application (Stem Cell lines, Cancer Cell Lines, Others) • By End-use (Pharmaceutical and Biotechnological Companies, Research & Academic Institutes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Inc., Merck KGaA, Sartorius AG, BioLife Solutions, Inc., Bio-Techne, HiMedia Laboratories, PromoCell GmbH, Capricorn Scientific, Cell Applications, Inc., STEMCELL Technologies, AMSBIO, Cell Systems, BPS Bioscience, Inc., Lonza Group, Corning Inc., GE Healthcare, Invitrogen, Wako Chemicals, VWR International, Fisher Scientific, American Type Culture Collection, Acorn Biolabs. |

| Key Drivers | • Rising Demand for Cell-Based Therapies Drives Growth in the Cell Freezing Media Market • Development of Advanced Cryoprotectants and Freezing Media Formulations Drives Growth in Cell Freezing Media Market |

| Restraints | • Cost Barriers in Advanced Freezing Media Impede Growth in the Cell Freezing Media Market |