Cellulosic Fire Protection Intumescent Coatings Market Report Scope & Overview:

Get More Information on Cellulosic Fire Protection Intumescent Coatings Market - Request Sample Report

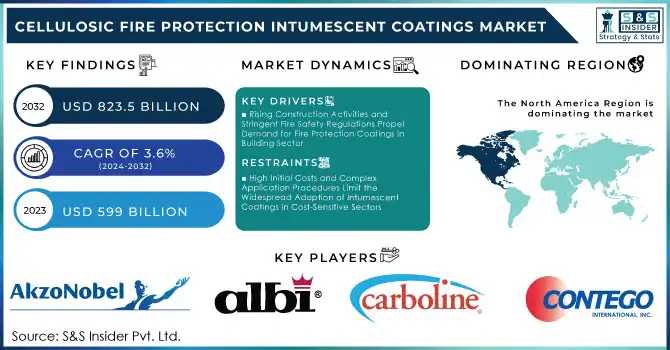

The Cellulosic Fire Protection Intumescent Coatings Market Size was valued at USD 599 billion in 2023 and is projected to reach USD 823.5 billion by 2032, growing at a (CAGR) of 3.6% over the forecast period from 2024 to 2032.

The Cellulosic Fire Protection Intumescent Coatings Market has been experiencing steady advancements due to the increasing demand for fire safety in buildings and infrastructure. The key drivers of market growth include stricter fire safety regulations, the rising awareness of fire hazards, and the need for cost-effective and efficient fireproofing solutions. This market is seeing continuous product innovations to enhance performance, reduce application times, and improve sustainability. Intumescent coatings are widely used in construction, oil and gas, and smart transportation sectors due to their ability to expand when exposed to heat, providing insulation and protecting structures from fire damage. The use of water-based and solvent-based formulations has also surged as industries strive to meet both safety and environmental standards. For example, Sherwin-Williams introduced a new cellulosic fireproofing coating in May 2021, designed to deliver improved efficiencies in application. This coating offers better coverage and faster drying times, helping to reduce labor costs while improving fire protection performance, thus meeting the increasing demand for efficient fireproofing solutions in construction.

In recent developments, Jotun launched the SteelMaster 1200HPE in April 2022, a high-performance intumescent coating designed to provide enhanced fire protection for structural steel. This coating was developed to withstand high temperatures and is suitable for use in industries that require significant fire protection, such as the oil and gas sector. Additionally, in June 2022, Hempel introduced the Hempafire XTR 100, an innovative solution for hydrocarbon passive fire protection. This product offers up to three hours of fire protection, making it suitable for high-risk applications in industrial settings. The Hempafire XTR 100 was formulated to meet the rigorous standards of the offshore oil and gas industry, ensuring reliable performance in the event of a fire. These examples highlight how Sherwin-Williams, Jotun, and Hempel are continuously innovating to develop advanced, reliable, and cost-efficient intumescent coatings to meet the growing demand for fire safety in various sectors. Furthermore, the ongoing developments in intumescent coatings, such as those from PPG Industries in February 2023, which provide up to three hours of fire protection, further demonstrate the market’s commitment to providing superior fire safety solutions.

Cellulosic Fire Protection Intumescent Coatings Market Dynamics:

Drivers:

-

Rising Construction Activities and Stringent Fire Safety Regulations Propel Demand for Fire Protection Coatings in Building Sector

The growing global construction industry, driven by urbanization and infrastructural developments, has significantly increased the demand for fire protection solutions. With stringent fire safety regulations and standards being enforced in many countries, the use of fire-resistant materials, including cellulosic fire protection intumescent coatings, is becoming essential. These coatings are used extensively in residential, commercial, and industrial buildings to prevent fire-related damage. Governments around the world are setting higher standards for fireproofing materials, which, in turn, drives the demand for more efficient, durable, and cost-effective fire protection solutions. For instance, jurisdictions in Europe and North America require the use of intumescent coatings for building safety. This growing focus on fire safety in construction ensures consistent growth for the cellulosic fire protection coatings market.

-

Increased Awareness of Fire Hazards and Protection Measures Drives Market for Intumescent Coatings in Industrial Applications

-

Technological Advancements in Intumescent Coatings Improve Performance and Expand Market Reach

-

Growing Demand for Fire Protection in Offshore Oil and Gas Industry Drives Intumescent Coatings Market

-

Shift Toward Sustainable and Low-Environmental Impact Coatings Drives Demand for Water-Based Intumescent Coatings

Restraint:

-

High Initial Costs and Complex Application Procedures Limit the Widespread Adoption of Intumescent Coatings in Cost-Sensitive Sectors

Opportunity:

-

Growing Focus on Retrofitting Fire Protection Solutions for Existing Buildings Creates New Market Opportunities

The increasing need to retrofit older buildings with modern fire protection systems presents a promising opportunity for the cellulosic fire protection intumescent coatings market. As older buildings and structures may not meet current fire safety standards, there is a growing trend to upgrade and improve fireproofing measures. Intumescent coatings, which are easy to apply on existing structures without requiring major changes, are ideal for such retrofitting projects. This trend is especially prevalent in aging urban infrastructures and historical buildings, where preserving the aesthetic value of the structure while ensuring fire safety is essential.

-

Expansion of Building and Infrastructure Projects in Emerging Economies Drives Demand for Fire Protection Coatings

-

Advancements in Green Building Certifications and Regulations Drive the Need for Environmentally Friendly Fire Protection Coatings

The growing emphasis on green building standards and environmental sustainability has created an opportunity for the cellulosic fire protection coatings market, particularly water-based and low-VOC products. With the rise of green building certifications such as LEED, BREEAM, and others, many construction projects require fire protection solutions that meet eco-friendly criteria. This shift toward sustainable construction practices is encouraging the development and adoption of intumescent coatings that comply with these standards. The increasing emphasis on environmental protection in the construction sector opens up a lucrative opportunity for manufacturers to supply eco-friendly fire protection coatings.

| End-Use Industry | Specifics/Applications | Examples/Use Cases |

|---|---|---|

| Construction | Intumescent coatings are extensively used in protecting structural steel and other building materials. | Fireproofing of steel beams and columns in commercial and residential buildings. |

| Oil and Gas | Fire protection coatings are applied in refineries, offshore platforms, and storage tanks. | Protection of piping systems, storage tanks, and offshore rigs from fire hazards. |

| Power Generation | Used in power plants, including nuclear, thermal, and renewable energy plants to protect equipment. | Fireproofing of transformers, switchgear, and control panels in power plants. |

| Transportation | Coatings are used in protecting infrastructure such as tunnels, railway stations, and vehicles. | Fireproofing of trains, buses, and tunnel walls. |

| Marine & Offshore | Intumescent coatings are essential in ensuring fire protection for ships and offshore platforms. | Application on ship hulls, offshore rigs, and maritime structures for fire safety. |

Cellulosic Fire Protection Intumescent Coatings Market Segmentation Overview

By Material Type

Acrylic-based coatings dominated the Cellulosic Fire Protection Intumescent Coatings Market in 2023, with a market share of 45%. Acrylic-based intumescent coatings are known for their excellent adhesion properties, versatility, and durability. These coatings offer reliable fire resistance and are widely used in both commercial and industrial sectors. Their ability to provide long-lasting protection while being cost-effective has made them a top choice, especially in the construction and infrastructure sectors where cost efficiency and performance are essential.

By Application

Structural Steel Protection dominated the Cellulosic Fire Protection Intumescent Coatings market in 2023 with a market share of 50%. Structural steel protection is crucial in the construction industry, where steel is widely used in building frameworks and needs fire resistance. Intumescent coatings are ideal for steel structures as they form an insulating char layer when exposed to heat, protecting the steel from fire damage. The rising demand for fire-safe buildings and infrastructure has made structural steel protection the dominant application segment, with widespread adoption in commercial, residential, and industrial buildings.

By End Use

The Construction sector dominated the Cellulosic Fire Protection Intumescent Coatings market in 2023, with a market share of 55%. The construction industry, driven by urbanization and infrastructural expansion, represents the largest demand for fire protection solutions. As fire safety regulations become stricter and buildings grow taller and more complex, the need for reliable fireproofing systems, including cellulosic fire protection coatings, has increased. The sector's growing focus on fire prevention and safety in residential, commercial, and public buildings continues to drive the demand for these coatings, making construction the leading end-use industry.

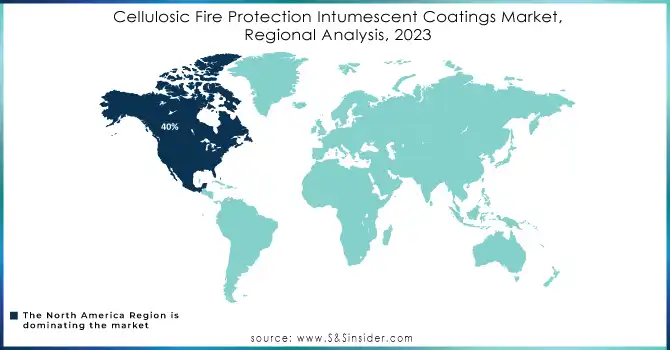

Cellulosic Fire Protection Intumescent Coatings Market Regional Analysis

In 2023, the North American region dominated the Cellulosic Fire Protection Intumescent Coatings Market, with a market share of approximately 40%. North America’s dominance can be attributed to stringent fire safety regulations, particularly in the U.S. and Canada, which require high-performance fire protection coatings for various industries such as construction, oil and gas, and power generation. The U.S. is a key contributor, driven by its robust infrastructure sector, with ongoing projects in both commercial and residential buildings emphasizing fire safety. For example, in 2023, U.S. government regulations mandated fireproof coatings on large-scale construction projects in cities like New York and California. Additionally, the increasing focus on sustainable construction materials has fueled the demand for water-borne and eco-friendly fire protection coatings. Canada, with its rigorous building codes, also plays a vital role in North America’s market share. Major cities such as Toronto and Vancouver have incorporated these advanced fireproofing solutions in their skyline development and industrial facilities. The presence of leading companies like Sherwin-Williams and PPG Industries in the region further solidifies North America's dominant position in the market.

Moreover, the Asia Pacific is expected to grow as the fastest-growing region in the Cellulosic Fire Protection Intumescent Coatings Market from 2024-2032. This growth is primarily driven by the rapid urbanization and construction boom in countries like China, India, and Southeast Asian nations, where industrial expansion and residential growth are surging. In China, the government’s focus on safety standards and the increasing number of high-rise buildings has heightened the demand for fire protection solutions. For instance, cities like Shanghai and Beijing are seeing a rise in the number of skyscrapers that require advanced fire protection coatings for structural integrity. Similarly, India’s thriving infrastructure sector, backed by both private and public sector investments, has led to a growing adoption of fireproof coatings. The push for safety regulations in the power generation and oil and gas industries in countries like India and Indonesia further accelerates the demand for these coatings. The region's CAGR is also boosted by the expansion of industrial facilities in Southeast Asia, especially in countries like Thailand and Malaysia, where increasing construction projects in the oil and gas sector demand durable fire-resistant solutions. This surge in construction, coupled with a growing emphasis on fire safety regulations, positions the Asia Pacific region as the fastest-growing market.

Need Any Customization Research On Cellulosic Fire Protection Intumescent Coatings Market - Inquiry Now

Key Players in Cellulosic Fire Protection Intumescent Coatings Market

-

Akzo Nobel N.V (Interchar 1120, Chartek 7)

-

Albi (Albi Clad, Albi 2000)

-

Carboline (Carbomastic 15, Chartek 1709)

-

Contego International Inc. (Contego Fire Protection Coatings, Contego 5600)

-

Hempel A/S (Hempel Fire Shield, Hempel Intumescent Coating)

-

Isolatek International (Promat, Isolatek Type 330)

-

Jotun (Jotachar JF750, Jotun Steelmaster 1200WF)

-

No-Burn Inc. (No-Burn Plus, No-Burn XTRA)

-

Nullifire (Nullifire SC802, Nullifire S707)

-

PPG Industries (Sigmashield 850, PPG HiTemp 1020)

-

Protective Coatings (Protex, Endura-Cote)

-

The Sherwin-Williams Company (Sherwin-Williams Firetex FX2000, Firetex FX5102)

-

3M Company (3M Fire Barrier, 3M Wrap & Firestop Coating)

-

BASF SE (BASF Fire Protection Coatings, MasterEmaco)

-

Bühler Group (Bühler Fire Protection Coating, Bühler Intumescent Coating)

-

Crown Paints (Crown Fire Protection Coatings, Crown Shield)

-

FireFree (FireFree 88, FireFree 40)

-

Hesse Lignal GmbH (Hesse Fire Protection Coating, Lignal Firestop)

-

Jotun Powder Coatings (Jotun Firetex, Jotun Thermoguard)

-

NCP Coatings (NCP Fireproof Coating, NCP FlameGuard)

Recent Developments

-

February 2024: No-Burn Inc., a leader in fire protection solutions, proudly launched its new line of intumescent coatings. The series, which includes No-Burn Plus, No-Burn Plus XD, and No-Burn Plus ThB, offers robust fire protection across various applications.

-

December 2023: Hempel, a prominent industry player, introduced HEET Dynamic, a cutting-edge software solution. This innovative tool enhances the efficiency and accuracy of intumescent coating estimations for steel sections, simplifying the process for structural engineers and estimators.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 599.0 Billion |

| Market Size by 2032 | US$ 823.5 Billion |

| CAGR | CAGR of 3.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Solvent-borne, Water-borne) • By Material Type (Acrylic, Epoxy, Alky, Vinyl Acetate-Ethylene, Others) • By Application (Structural Steel Protection, Wood Protection, Electrical Cables Protection, HVAC System Protection, Others) • By End Use Industry (Construction, Oil and Gas, Power Generation, Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Akzo Nobel N.V, Jotun, Contego International Inc., Hempel A/S, No-Burn Inc., Nullifire, The Sherwin-Williams Company, Carboline, Albi , Protective Coatings, Isolatek International, PPG Industries and other key players |

| Key Drivers | • Increased Awareness of Fire Hazards and Protection Measures Drives Market for Intumescent Coatings in Industrial Applications •Technological Advancements in Intumescent Coatings Improve Performance and Expand Market Reach |

| RESTRAINTS | • High Initial Costs and Complex Application Procedures Limit the Widespread Adoption of Intumescent Coatings in Cost-Sensitive Sectors |