Vapor Deposition Market Report Scope & Overview:

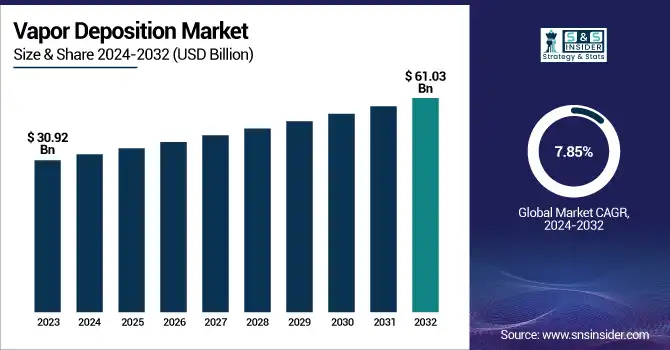

The Vapor Deposition Market Size was valued at USD 30.92 Billion in 2023 and is expected to reach USD 61.03 Billion by 2032, growing at a CAGR of 7.85% over the forecast period of 2024-2032.

To Get more information on Vapor Deposition Market - Request Free Sample Report

The Vapor Deposition market is witnessing significant growth, fueled by technological advancements and rising demand in sectors like electronics and healthcare. Our report explores the Regulatory Framework, detailing the evolving regulations that ensure industry compliance and safety. The Investment Analysis uncovers current funding trends, highlighting the areas attracting both established players and emerging companies. Additionally, the Economic Impact section examines the market’s contribution to global economies, including its role in job creation and technological progress. Lastly, our report provides insights into Quality Control Measures, shedding light on how manufacturers maintain high standards in Vapor Deposition processes. These key insights offer a comprehensive understanding of the market’s dynamics and opportunities for businesses to navigate effectively.

Vapor Deposition Market Dynamics

Drivers

-

Increased Demand for Advanced Coatings in Aerospace and Automotive Industries Accelerates Vapor Deposition Market Growth

The aerospace and automotive industries are increasingly adopting advanced coating technologies to improve the durability, corrosion resistance, and performance of components. Vapor Deposition processes, especially Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), are widely used to apply thin, high-performance coatings on parts such as turbine blades, engine components, and structural materials. These coatings provide essential benefits such as increased wear resistance, higher thermal stability, and reduced friction, making them ideal for critical applications in these industries. As the demand for lightweight, fuel-efficient, and high-performance vehicles and aircraft grows, the need for advanced coating solutions will continue to drive the adoption of Vapor Deposition technologies. Additionally, the increasing emphasis on fuel efficiency, reduced emissions, and long-term operational reliability in aerospace and automotive sectors further supports the growth of the Vapor Deposition market, as manufacturers seek materials with superior performance attributes.

Restraints

-

Environmental and Safety Concerns Associated with Precursor Materials and Waste Disposal Hinder Market Expansion

The environmental impact of Vapor Deposition processes, particularly regarding the chemicals and precursor materials used, presents a significant restraint for the market. Some materials used in Chemical Vapor Deposition and Physical Vapor Deposition, such as gases and solvents, can be hazardous to human health and the environment if not handled properly. The management of waste materials and chemical byproducts generated during the deposition process, including toxic gases and liquid effluents, requires strict regulatory compliance and advanced waste disposal technologies. These concerns add to the complexity and cost of operating Vapor Deposition systems, limiting their use in industries where sustainability is a primary focus. As regulatory pressures regarding waste management and chemical handling continue to intensify, businesses may face increasing challenges in maintaining compliance, which could hinder the widespread adoption of Vapor Deposition technologies.

Opportunities

-

Growing Demand for Flexible Electronics and Smart Devices Offers New Opportunities for Vapor Deposition Applications

As the demand for flexible electronics, including wearable devices, flexible displays, and smart textiles, continues to rise, new opportunities are emerging for Vapor Deposition technologies. These applications require thin, flexible coatings and films that maintain high performance while being lightweight and adaptable to varying shapes and sizes. Vapor Deposition techniques, such as Organic Vapor Phase Deposition and Atomic Layer Deposition, are well-suited to meet these requirements by enabling precise control over thin film deposition on flexible substrates. With the increasing use of flexible electronics in consumer electronics, healthcare, and automotive industries, Vapor Deposition offers the potential to revolutionize the design and functionality of smart devices. As the market for flexible electronics grows, Vapor Deposition technology will play a critical role in advancing product performance and expanding market reach.

Challenge

-

Maintaining Consistent Film Quality and Uniformity in Large-Scale Vapor Deposition Applications Presents Operational Challenges

One of the key challenges faced in the Vapor Deposition industry is maintaining consistent film quality and uniformity, particularly when scaling up production for large-area applications. The deposition process must be carefully controlled to ensure that thin films are evenly distributed across substrates, especially when working with complex geometries or large-scale manufacturing setups. Variations in deposition rate, substrate temperature, or precursor composition can lead to defects such as uneven thickness or poor adhesion, affecting the performance and reliability of the final product. Addressing these challenges requires ongoing improvements in process control and monitoring systems, which can increase operational complexity and cost. Ensuring high-quality results at scale remains a significant hurdle for Vapor Deposition manufacturers, especially when operating in high-demand industries such as electronics and renewable energy.

Vapor Deposition Market Segmental Analysis

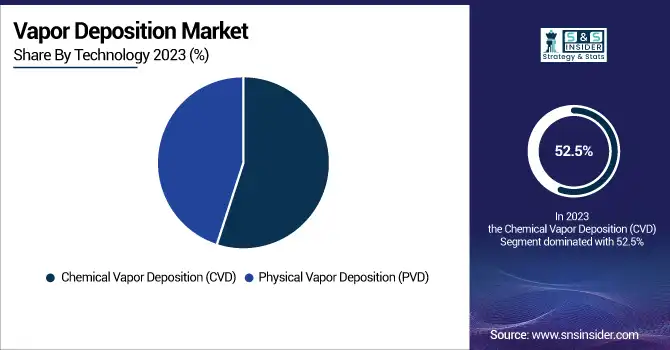

By Technology

In 2023, the Chemical Vapor Deposition segment dominated the Vapor Deposition market with an estimated market share of 52.5%. This technology's popularity stems from its ability to produce high-quality, uniform thin films, which are crucial for various applications, particularly in the semiconductor and electronics industries. For instance, organizations like the Semiconductor Industry Association (SIA) highlight that Chemical Vapor Deposition is integral to the manufacturing of advanced semiconductor devices, which require precise film thickness and composition for optimal performance. The versatility of Chemical Vapor Deposition in producing materials such as silicon carbide and gallium nitride, which are essential for high-power and high-frequency applications, further supports its dominance. Recent government initiatives aimed at boosting semiconductor manufacturing capabilities, such as the CHIPS Act in the United States, reinforce the importance of Chemical Vapor Deposition in meeting growing technological demands.

By Application

In 2023, the Cutting Tools application segment dominated the Vapor Deposition market with a market share of 23.4%. The dominance of this segment can be attributed to the increasing demand for high-performance cutting tools that require superior wear resistance and hardness. Vapor Deposition techniques, particularly Physical Vapor Deposition, are widely used to apply coatings such as titanium nitride on cutting tools, enhancing their durability and cutting efficiency. For example, the American National Standards Institute (ANSI) and the International Organization for Standardization (ISO) emphasize the critical role of advanced coatings in improving tool life and performance in manufacturing processes. As industries increasingly seek efficient and cost-effective solutions to enhance productivity, the adoption of Vapor Deposition-coated cutting tools continues to rise, solidifying this segment's position in the market.

By End-use Industry

The Electronics and Semiconductor segment dominated the Vapor Deposition market in 2023, accounting for a market share of 41.8%. This segment's leadership is driven by the relentless demand for smaller, more powerful electronic devices, which require advanced materials and manufacturing techniques. Organizations such as the Semiconductor Industry Association (SIA) report that the electronics sector is rapidly evolving, with significant investments directed towards semiconductor fabrication technologies. The integration of Chemical Vapor Deposition and Physical Vapor Deposition in the production of integrated circuits and microelectronic devices is vital for achieving the necessary performance levels in modern electronics. Additionally, government initiatives, including various funding programs to enhance domestic semiconductor production, underline the strategic importance of this segment, ensuring its continued dominance in the Vapor Deposition market.

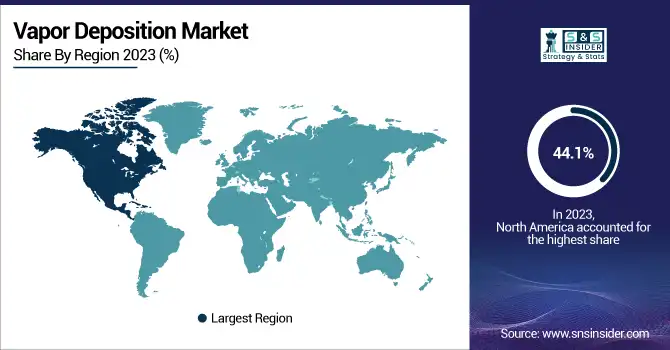

Vapor Deposition Market Regional Outlook

In 2023, North America dominated the Vapor Deposition Market with a market share of 44.1%. This dominance is primarily due to the region’s strong technological infrastructure, research and development investments, and the presence of key semiconductor manufacturers. The United States, in particular, plays a pivotal role, being home to major companies like Applied Materials and Lam Research Corporation, which are at the forefront of developing innovative Vapor Deposition technologies. Additionally, government initiatives such as the CHIPS Act, aimed at enhancing semiconductor manufacturing, have further fueled the demand for advanced deposition technologies. According to the Semiconductor Industry Association, North America's investment in semiconductor research and production technologies ensures sustained growth in the region. Canada also plays a vital role, with investments in aerospace and medical device manufacturing, where Vapor Deposition technologies are critical. This economic and industrial backing ensures that North America remains a leader in the Vapor Deposition Market.

On the other hand, the Asia Pacific region emerged as the fastest-growing in the Vapor Deposition Market, expected to experience substantial growth in the forecast period. The rapid technological advancements and manufacturing capabilities in countries like China, Japan, and South Korea contribute significantly to this growth. China, with its rapidly expanding electronics and semiconductor industries, is driving demand for Vapor Deposition technologies in manufacturing integrated circuits and microelectronic devices. Japan’s role as a major player in semiconductor equipment manufacturing and material processing technologies, particularly with companies like ULVAC, supports this market growth. South Korea's focus on advanced technology sectors, including solar energy and cutting tools, has also enhanced demand for specialized coatings produced through Vapor Deposition. The combination of favorable government policies and increased industrial demand ensures that Asia Pacific will continue to be a key region for market expansion in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

AIXTRON (AIX 2800G4, CRIUS MOCVD)

-

Applied Materials, Inc. (Endura PVD, Producer CVD)

-

ASM International N.V. (Epsilon ALD, Alpha 8 CVD)

-

IHI Corporation (High Vacuum Deposition System, Thin Film Deposition Systems)

-

Lam Research Corporation (Endura PVD, Strata PVD)

-

OC Oerlikon Management AG (Sapphire Coating Systems, Oerlikon Balzers PVD Coatings)

-

Tokyo Electron Limited (Alpha 8SE CVD, Trias PVD)

-

ULVAC, Inc. (VacuThin PVD, TurboVac CVD)

-

Veeco Instruments Inc. (TurboDisc MOCVD, DEKTAK Profilers)

-

Voestalpine AG (PVD Coatings, TiN Coatings)

-

Canon Anelva Corporation (Ion Plating Systems, High-Vacuum Coating Systems)

-

Denton Vacuum LLC (DeskVIA, Denton Discovery Sputtering System)

-

EV Group (EVG) (EVG 150 Aligner, EVG 770 PECVD)

-

Falcon Scientific, Inc. (Vacuum Evaporation Systems, Thermal Evaporators)

-

Inficon Inc. (Vapor Deposition Controllers, Thin Film Deposition Sensors)

-

Kurt J. Lesker Company (PVD Systems, Atomic Layer Deposition Systems)

-

Marel (Coating Machines, PVD Coating Equipment)

-

Oerlikon Balzers (Balzers PVD Coatings, Duracap Coating Systems)

-

SPTS Technologies (A KLA Company) (Omega PECVD, Celeris RIE)

-

Tokyo Electron Limited (Alpha 8SE CVD, Trias PVD)

| Report Attributes | Details |

| Market Size in 2023 | USD 30.92 Billion |

| Market Size by 2032 | USD 61.03 Billion |

| CAGR | CAGR of 7.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Technology (Chemical Vapor Deposition (CVD), Physical Vapor Deposition (PVD)) •By Application (Microelectronics, Cutting Tools, Medical Devices, Solar Panels, Industrial & Energy, Others) •By End-Use Industry (Electronics & Semiconductor, Automotive, Aerospace & Defense, Healthcare, Energy & Power, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Applied Materials, Inc., Lam Research Corporation, Tokyo Electron Limited, IHI Corporation, AIXTRON, OC Oerlikon Management AG, ASM International N.V., Voestalpine AG, ULVAC, Inc., Veeco Instruments Inc. and other key players |