Aminophenol Market Analysis & Overview:

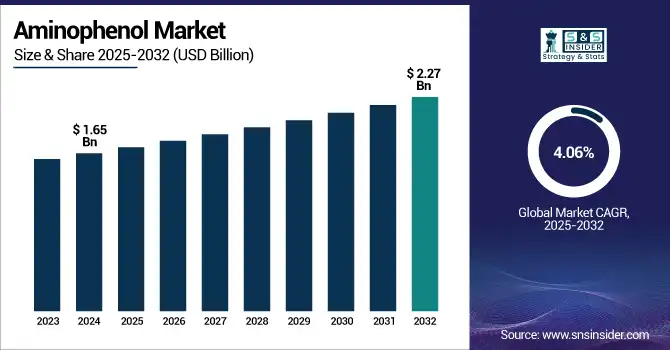

The Aminophenol Market size was valued at USD 1.65 billion in 2024 and is expected to reach USD 2.27 billion by 2032, growing at a CAGR of 4.06% over the forecast period of 2025-2032. Aminophenol market analysis indicates that the expanding use of chemical intermediates across diverse industries is a major factor driving market growth. The growth of the aminophenol market is attributed to the increasing application of chemical intermediates in various sectors. Chemical intermediates like aminophenol are important precursors for many chemicals, including those for pharmaceuticals, agrochemicals, and dyes. With the booming need for these chemicals in healthcare, personal care, and manufacturing, among others., high-quality Aminophenol is now required. Aminophenol is an essential ingredient in the pharmaceutical industry for making paracetamol, which is the most commonly used painkiller drug on the market.

To Get more information on Aminophenol Market - Request Free Sample Report

The U.S. Environmental Protection Agency (EPA) has issued significant new use rules (SNURs) under the Toxic Substances Control Act (TSCA) for several chemical substances, possibly aminophenol compounds.

Moreover, the U.S. Food and Drug Administration (FDA) conducts quality surveillance testing for drugs, including acetaminophen, to ensure product safety and efficacy. For instance, acetaminophen products have undergone identification, assay, dissolution, and impurity testing as part of the FDA's Drug Quality Sampling and Testing Program.

Aminophenol Market Dynamics:

Drivers:

-

Growing Use in Cosmetics and Personal Care Drive the Market Growth

Cosmetics and personal care products account for a sizable portion of the aminophenol derivatives market, and their rising use in these areas will accelerate market expansion. Aminophenol is a hair dye precursor for a colorant, which create a color that is deep and long-lived, and is also used as an ingredient in formulating hair dyes. Rising cases of global demand for hair care, and other cosmetic products across the globe, especially in the developing markets, will positively forge the high demand for potential cosmetic ingredients so as aminophenol is one of the high-potential effective cosmetic ingredients poised to lead aminophenol market growth.

For instance, Beauty and Business S.p.A. patented a composition for hair coloring that does not contain MAP, aromatic amine compounds used for oxidative dyes of hair. The new formula combines methoxymethyl-p-phenylenediamine, hydroxyethyl-3,4-methylenedioxyaniline, and 5-amino-6-chloro-o-cresol to achieve both stable and semi-permanent levels of hair color without the use of MAP.

Additionally, L'Oréal formulates compositions for changing the color of keratin fibers comprising ortho-aminophenols as 2-aminophenol and/or 2-amino-5-methylphenol. These innovations are designed to deliver stable and efficient hair colour results, indicative of constant evolution within hair dye technology.

Restraints:

-

Regulatory Challenges May Hamper Market Growth

The aminophenol market is restrained due to regulatory challenges. Due to the use of aminophenol in pharmaceuticals, cosmetics, and chemicals, it is regulated by regulations that govern the production, application, and handling of the same. In the pharmaceutical sector, the use of aminophenol in the synthesis of pain relievers, such as paracetamol is strictly regulated by health authorities, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These agencies set high standards regarding quality and require testing processes to make sure the public is getting safe and high-quality products. Cosmetics, such as hair dyes and colorants, are also regulated, for instance, hair dyes & colorants with aminophenol are under safety regulations from governmental authorities, such as the U.S. FDA and the European Commission.

Opportunities:

-

Increasing Demand for Advanced Pharmaceuticals Create Opportunities for Market Growth

The growing need for technological pharmaceutical solutions provides the major potential drive for the aminophenol market growth. Aminophenol is a primary raw material for paracetamol (acetaminophen), which is among the most commonly used analgesics and antipyretics globally. With the rising global population due to the increase of senior citizens, also with the increase in various chronic diseases including arthritis, diabetes, and cardiovascular diseases, and with the increasing level of the pain management, the population is requiring better ways to manage pain to manage more health problems.

Besides, the aminophenol market trends of self-medication has also increased the use of over-the-counter drugs, such as paracetamol. The increasing requirement for pain relief medicine straight fuels the creation of aminophenol within pharmaceutical production.

For instance, in 2023, BASF announced a USD 250 million investment in expanding its production capacity for PAP at the Ludwigshafen site. The move extends the capacity necessary to meet increasing global paracetamol demand with a continuous supply of high-performing intermediates for pharma applications.

Aminophenol Market Segmentation Analysis:

By Type

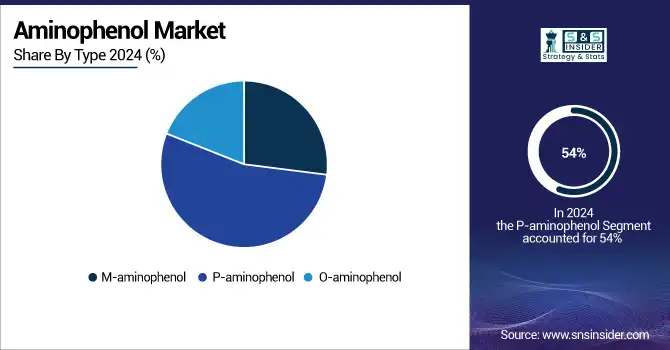

P-aminophenol held the largest market share, around 54%, in 2024. Due to its high demand in the pharmaceutical industry. This compound has high purity and efficiency and is best suited for large-scale drug manufacturing. Moreover, since P-aminophenol synthesis is a proven, economical, and scalable process, it would provide leverage for producing P-aminophenol consistently to cater to the rising global pharmaceutical demand.

M-aminophenol held a significant market share and was the fastest-growing segment in the forecast period. The segment’s growth is driven by its wide application in the chemical, dye & pharmaceutical industry. The contribution of m-aminophenol is mainly toward the synthesis of dyes, hair colors, and for use as an intermediate in the manufacture of several specialty chemicals, unlike its para-isomer.

By Application

Dye intermediate segment held the largest market share, around 47%, in 2024. The segment’s expansion is owing to the common use of various derivatives of aminophenol for dyes and pigments for textiles, cosmetics, and industrial applications. Such that, Aminophenols, especially m-aminophenol and p-aminophenol, are one of the most important intermediates for the synthesis of azo dyes and hair dyes due to their good fastness, stability, and applicability in processes.

Synthesis precursors held a significant market share. It is due to the compound being a key building block in the production of different compound structures, the addition of Aminophenol in the market segment of Synthesis Precursors contributed a noteworthy share to the overall global market of aminophenol. Aminophenol has found various usages as a synthesis precursor for active pharmaceutical ingredients (API), agrochemicals, antioxidants, and specialty chemicals.

By End-Use Industries

The pharmaceutical industry held the largest market share, around 46%, in 2024. The growth is driven by the high demand for aminophenol, especially p-aminophenol, and para-aminophenol in the production of paracetamol (acetaminophen), one of the most requested OTC (over-the-counter) analgesics and antipyretics globally. The consumption of paracetamol and related drugs has risen due to the increasing requirement for effective and economical medications when factors such as growing healthcare awareness, an aging global population, and the growing number of chronic conditions are taken into account.

The chemical industry held a significant market share. The growth is driven by the large and diversifiable uses of aminophenol as an intermediate in the manufacturing of a wide variety of industrial and specialty chemicals. The presence of both amino and hydroxyl functional groups in aminophenol gives it reactivity a wide range of organic synthesis, providing an important intermediate for the preparation of antioxidants, stabilizers, corrosion inhibitors, and resins.

Aminophenol Market Regional Outlook:

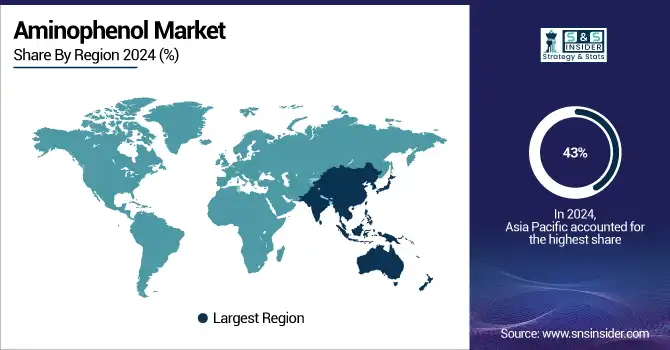

Asia Pacific held the largest market share, approximately 43%, in 2024 due to the region's strong industrial base, increased pharmaceutical production, and rising demand from some important end-use sectors such as chemicals, dyes, and personal care. China and India are important locations for pharmaceutical manufacturing and chemical processing due to a combination of cheap labor, government-favorable policies, and domestic consumption growth. These countries are also key paracetamol producers, which in turn, greatly increases regional consumption.

For instance, in March 2024, Jilin City announced the initiation of a 10,000-ton/year para-aminophenol project, aiming to bolster the production capacity of active pharmaceutical ingredients (APIs). This development underscores China's commitment to enhancing its pharmaceutical manufacturing capabilities.

North America held a significant aminophenol market share and growing region in the forecast period. It is due to due to a well-established pharmaceutical industry with high demand for over-the-counter drugs and continuous developments in chemical manufacturing. Aminophenol is used in huge amounts in the United States due to an increase in consumption as the key raw material for the manufacture of paracetamol (acetaminophen), one of the most widely used pain relievers and fever reducers. The global growth of the aminophenol market can be directly attributed to the high demand for these medications owing to an aging population and the rising incidence of chronic conditions.

The U.S. market size was valued at USD 0.30 billion in 2024 and is expected to reach USD 0.46 billion by 2032, growing at a CAGR of 5.53% during the forecast period 2025-2032. It is because the country has a well-developed pharmaceutical industry and manufacturing capabilities, along with a huge demand for pain relief medications. The U.S. is initially the top paracetamol (acetaminophen) consumer, and the main synthetic route of paracetamol (acetaminophen) is the use of aminophenol as the main raw material. Aminophenol demand within the country is further propelled by the widespread usage of paracetamol in the treatment of pain and fever, along with the rising prevalence of chronic ailments like arthritis, cardiovascular diseases, and diabetes.

Europe held a significant market share in 2024. It is due to aminophenol being an important raw material used for production of paracetamol (acetaminophen), which is a widely used painkiller, and the region consists of a well-established base of pharma companies that are solely dependent on it. The growing aging population in several European countries, along with wide spread of chronic diseases, such as arthritis, cardiovascular diseases, has led to continued demand for pain management medicines, thus accentuating aminophenol consumption.

According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), Europe accounted for 22.7% of global pharmaceutical sales in 2023, underscoring its substantial role in the global pharmaceutical market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

In the report, the Aminophenols companies include LyondellBasell Industries, Mitsui Chemicals, SABIC, Eastman Chemical Company, Honeywell International Inc., Lonza Group, Seiko Chemical Co., Ltd., Deepak Nitrite Ltd., Alfa Aesar, and Jay Organics Pvt. Ltd.

Recent Development:

-

In March 2023, Iran established a production line for an acetaminophen precursor, 4-aminophenol, at Kimiyagaran Company, Markazi Province. That is a major progress towards autonomy on this class of essential pharmaceutical intermediates.

-

In October 2023, Evonik Industries developed a new, greener, and more cost-effective process for the production of para-aminophenol with environmental friendliness as a target. This innovation signifies progressive developments for greener chemical manufacturing practices in the industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.65 Billion |

| Market Size by 2032 | USD 2.27 Billion |

| CAGR | CAGR of 4.06% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (M-aminophenol, P-aminophenol, O-aminophenol) •By Application (Synthesis Precursors, Dye Intermediate, Fluorescent Stabilizers, Others) •By End Use Industries (Pharmaceutical, Chemical, Cosmetic, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | LyondellBasell Industries, Mitsui Chemicals, SABIC, Eastman Chemical Company, Honeywell International Inc., Lonza Group, Seiko Chemical Co., Ltd., Deepak Nitrite Ltd., Alfa Aesar, Jay Organics Pvt. Ltd. |