Cinema Camera Market Report Scope & Overview:

Get More Information on Cinema Camera Market - Request Sample Report

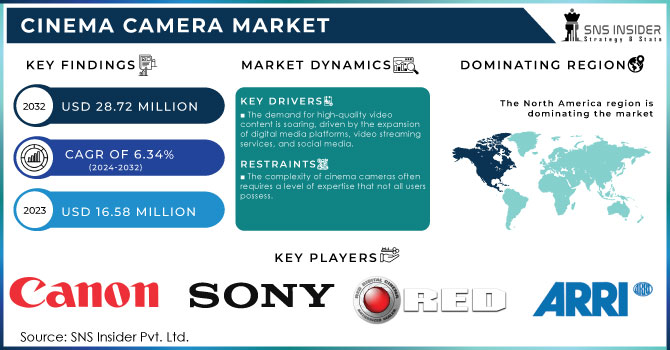

The Cinema Camera Market Size was valued at USD 16.58 Million in 2023 and is expected to reach USD 28.72 Million by 2032, growing at a CAGR of 6.34% over the forecast period 2024-2032.

The cinema camera market has experienced significant growth, driven by advances in digital imaging technology, evolving consumer demands, and the rising popularity of high-quality visual content creation. With the rise of platforms like Netflix, Amazon Prime, and YouTube, there is an increased need for high-quality video content, pushing both amateur and professional filmmakers to adopt advanced cinema cameras. The global streaming landscape has evolved into a dynamic ecosystem where Video on Demand (VOD) and Over-the-Top (OTT) platforms, e-learning sites, and social media giants compete fervently for viewer engagement across diverse content genres and devices. Leading the charge are prominent players like Netflix, boasting 269.6 million subscribers worldwide and renowned for its extensive library of original content. Amazon Prime Video, embedded within Amazon Prime's membership, follows closely with around 220 million subscribers, leveraging its robust catalog. Disney+ has captured 150.2 million subscribers, capitalizing on its vast legacy content and franchises like Star Wars and Marvel. HBO Max offers over 10,000 hours of content, featuring hits like "Succession" and "Euphoria," while Hulu excels with 68,000 hours of programming including live TV and reality shows.

In the realm of e-learning, platforms like Coursera lead with 84 million users, focusing on technology and business courses, while Udemy offers over 200,000 courses and sees significant growth in IT certification and business content. Khan Academy remains popular for K-12 education and SAT prep, contributing to its substantial mobile traffic. Social media platforms like YouTube, with 2 billion monthly users, dominate with gaming, music, and educational content, while TikTok garners over 850 minutes of monthly usage per user, primarily accessed through smartphones. These platforms have set new standards for picture quality, making cinema cameras essential tools for creating content that meets industry requirements. The cinema camera market benefits from trends in streaming platforms, e-learning growth, and social media content creation.

| Film | Country | Year | Camera phone |

|

New Love Meetings |

Italy |

2005 |

Nokia N90 |

|

Why Didn't Anybody Tell Me It Would Become This Bad in Afghanistan |

Netherlands |

2007 |

Samsung Sharp 902 and 903 |

|

SMS Sugar Man |

South Africa |

2008 |

Sony Ericsson W900i |

|

Veenavaadanam |

India |

2008 |

Nokia N70 |

|

Jalachhayam |

India |

2010 |

Nokia N95 |

|

Night Fishing |

South Korea |

2011 |

iPhone 4 |

|

A Cell Phone Movie |

Bosnia |

2011 |

LG Viewty |

|

Unsane |

United States |

2018 |

iPhone 7 Plus |

|

High Flying Bird |

United States |

2019 |

iPhone 8 |

|

Ghost |

United Kingdom |

2020 |

iPhone 8 |

|

I WeirDo |

Taiwan |

2020 |

iPhone XS Max |

|

Pondicherry |

India |

2022 |

iPhone X |

|

Very Nice Day |

Canada |

2022 |

Google Pixel 2 |

|

Banger |

Czech Republic |

2022 |

iPhone 12 Pro Max |

|

28 Years Later |

United Kingdom |

2025 |

iPhone 15 Pro Max |

Cinema Camera Market Dynamics

Drivers

-

The demand for high-quality video content is soaring, driven by the expansion of digital media platforms, video streaming services, and social media.

As viewers become more familiar with high-quality content, filmmakers, video producers, and content creators are putting more money into advanced cinema cameras to satisfy these demands. The rise of services such as Netflix, Amazon Prime, and YouTube has sparked a strong demand for top-notch movies and TV shows. Filmmakers are currently obligated to create cinematic experiences that connect with viewers, challenging the limits of conventional filmmaking methods. Top-notch video content not only draws in viewers but also enables brands and companies to better convey their messages. In a competitive market, businesses rely on high-definition (HD) and 4K videos to make a strong first impression and differentiate themselves. Consequently, there is a notable rise in the need for cinema cameras capable of capturing breathtaking visuals and providing high-quality images. Furthermore, technological progress has made it possible to create cinema cameras that offer enhanced capabilities like improved low-light performance, increased frame rates, and better dynamic range. These characteristics enable filmmakers to explore different storytelling methods, resulting in fresh storylines and engaging visuals.

-

Virtual production techniques are transforming the way films and television shows are created, integrating digital elements into live-action filming.

The utilization of LED walls, live rendering, and virtual reality (VR) technologies allows filmmakers to craft immersive environments that enrich storytelling. Cinema cameras are essential in this process, recording top-notch footage that can easily blend with virtual elements. Virtual production is being embraced by big film studios and production houses, as filmmakers look for new ways to improve visual storytelling and decrease production expenses and time. Advanced features in cinema cameras, like high-resolution sensors and real-time tracking capabilities, are crucial for achieving desired outcomes in virtual production settings. With the increasing need for virtual production, manufacturers are concentrating on creating cameras specifically designed for this changing environment. The incorporation of AR and MR technologies enhances filmmakers' options, opening up fresh avenues for storytelling and engaging with audiences.

Restraints

-

The complexity of cinema cameras often requires a level of expertise that not all users possess.

Even though cameras have become easier to use thanks to technological progress, many aspiring filmmakers still struggle to effectively utilize all of the available features. This restriction could impede the market, as potential purchasers might be discouraged by the steep learning curve of professional cinema cameras. Therefore, certain users might choose simpler alternatives, decreasing the potential market for advanced camera systems. To tackle this issue, manufacturers need to commit to providing educational resources and support systems to assist users in getting comfortable with the technology. Not doing this may hinder the widespread use of cinema cameras, especially for novice filmmakers.

Cinema Camera Market Segmentation Overview

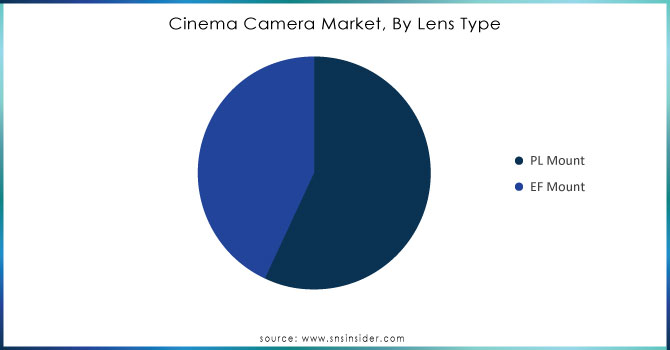

By Lens Type

PL (Positive Lock) mount lenses led the market in 2023 with over 56% market share, because they are commonly used in top-quality professional filmmaking and cinema production. Filmmakers prefer them because they work well with different professional cinema cameras, such as those made by ARRI, RED, and Sony. PL mount lenses are favored by rental houses because of their ability to be used with various camera systems, allowing for flexibility in a variety of production setups. ARRI's ALEXA LF and RED's V-RAPTOR XL are frequently used with PL mount lenses, giving filmmakers enhanced image quality and control.

The EF (electro-focus) mount lenses are projected to experience a rapid growth rate during 2024-2032, first created by Canon, in the cinema camera market because of their versatility and accessibility. EF mount lenses are frequently utilized in professional and semi-professional filmmaking, attracting independent filmmakers, content creators, and videographers. EF mount lenses are favored because they can be used with a wide range of cinema and DSLR cameras, including Canon's EOS C500 Mark II and Blackmagic's URSA Mini Pro.

Do You Need any Customization Research on Cinema Camera Market - Enquire Now

By Video Resolution

The Full HD (1080) resolution dominated the market in 2023 with a 65% market share, as it offers a good blend of quality and affordability. Full HD cameras are still widely used for broadcasting, independent filmmaking, and online video content. Their reduced storage and processing needs in comparison to 4K/8K make them suitable for mid-level productions and individuals on a limited budget. Panasonic, Blackmagic Design, and Sony are among the companies that manufacture Full HD cinema cameras for various purposes such as news reporting, documentaries, and educational videos.

The 4K/8K resolution segment is to become the fastest-growing with the highest CAGR during 2024-2032. These cameras offer impressive visuals ideal for theatrical releases, commercial productions, and high-end streaming platforms like Netflix, with 4K giving four times the resolution of Full HD and 8K offering even more detail. Advanced display technologies, including 8K televisions and immersive digital projectors, are backing the adoption of 4K/8K. Top camera brands such as RED Digital Cinema, Sony, and Canon are introducing cameras that support 8K resolution, appealing to filmmakers in search of high-quality footage and accuracy.

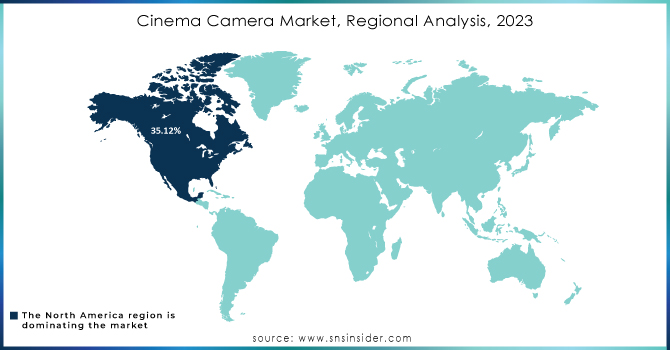

Cinema Camera Market Regional Analysis

North America held a market share of 35.12% in 2023 and led the market, due to advanced film production industries and the widespread use of cutting-edge cinematography technologies. Major Hollywood studios in the area heavily invest in advanced cinema cameras to improve the quality of visual effects and overall production in the region. Major companies such as ARRI, RED Digital Cinema, and Canon are well-established in North America and offer cameras tailored to the varied requirements of the film sector. Moreover, the increasing popularity of indie filmmaking and streaming services such as Netflix and Amazon Prime have led to a rise in the need for top-notch digital cinema cameras.

APAC is anticipated to have the fastest CAGR during 2024-2032, due to an increase in film production and the growth of digital platforms. Nations such as China, India, and South Korea are experiencing a rise in investments in film production and content creation, which is driving the need for more advanced cinema cameras. The rise in popularity of local streaming platforms like Tencent Video, iQIYI, and Disney+ Hotstar has created a need for high-quality filming gear to satisfy the increasing audience standards. Sony and Panasonic, both headquartered in APAC, are essential in providing cinema cameras for local productions and media outlets.

Key Players in Cinema Camera Market

The major key players in the Cinema Camera Market are:

-

Canon Inc (EOS C300 Mark III, EOS C700 FF)

-

Sony Group Corporation (FX6, Venice 2)

-

RED Digital Cinema, LLC (RED KOMODO 6K, RED V-RAPTOR 8K)

-

Blackmagic Design (URSA Mini Pro 12K, Pocket Cinema Camera 6K Pro)

-

ARRI (Alexa Mini LF, AMIRA)

-

Panasonic Corporation (Lumix S1H, VariCam LT)

-

Nikon Corporation (Z9, Z8)

-

Z CAM (E2-F6, E2-S6)

-

Sigma Corporation (fp L, fp)

-

Fujifilm (X-H2S, GFX100)

-

Kinefinity (MAVO Edge 8K, MAVO LF)

-

JVCKENWOOD Corporation (GY-HC500, GY-HC900)

-

RED Komodo (Komodo 6K, DSMC2 Helium 8K S35)

-

Ikegami (UHK-X700, HDK-99)

-

Sharp Corporation (8K Video Camera, 8C-B60A)

-

GoPro Inc. (HERO12 Black, MAX)

-

DJI (Ronin 4D, Osmo Action 4)

-

Leica Camera AG (Leica SL2-S, Leica Q2)

-

Phase One (XF IQ4 150MP Camera System, XT Camera System)

-

Hasselblad (X2D 100C, H6D-100c)

Suppliers for Raw Materials/Components to Cinema Camera Manufacturers:

-

Sony Semiconductor Solutions

-

ON Semiconductor

-

OmniVision Technologies

-

Samsung Electronics

-

STMicroelectronics

-

TE Connectivity

-

Texas Instruments

-

Panasonic Electronic Components

-

Corning Incorporated

-

NXP Semiconductors

Recent Development

-

February 2024: Pentax’s Film Camera Project is moving on to the next stage of its development. The camera is expected to be a fixed-lens, hand-winding, compact model that is now actively in development and out of the research stage.

-

April 2024: Sony debuted a new high-end 4K 60p pan-tilt-zoom (PTZ) camera model with an integrated lens, the BRC-AM7. Incorporating PTZ Auto Framing technology, which uses AI technology for advanced recognition, the camera facilitates accurate and natural automatic tracking of moving subjects.

-

June 2024: B&H announced the Panasonic Lumix GH7, a Micro Four Thirds camera featuring improved Phase Hybrid Autofocus, Active Internal Stabilization, and ProRes RAW recording in a compact body built for rigorous shooting conditions. A 32-bit capable audio expansion unit is also available.

| Report Attributes | Details |

| Market Size in 2023 | USD 305.10 Million |

| Market Size by 2032 | USD 519.26 Million |

| CAGR | CAGR of 6.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type (CMOS, Full Frame, Dual Pixel, Super 35mm, Charged-Coupled Device (CCD)) • By Lens Type (PL Mount, EF Mount) • By Video Resolution (4K/8K Resolution, Full HD Resolution (1080)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Canon Inc., Sony Corporation, RED Digital Cinema, Blackmagic Design, ARRI, Panasonic Corporation, Nikon Corporation, Z CAM, Sigma Corporation, Fujifilm, Kinefinity, JVC, RED Komodo, Ikegami, Sharp Corporation, GoPro Inc., DJI, Leica Camera AG, Phase One, Hasselblad |

| Key Drivers | • The demand for high-quality video content is soaring, driven by the expansion of digital media platforms, streaming services, and social media. • Virtual production techniques are transforming the way films and television shows are created, integrating digital elements into live-action filming. |

| RESTRAINTS | • The complexity of cinema cameras often requires a level of expertise that not all users possess. |