Insurance Telematics Market Size & Overview:

The Insurance Telematics Market size was valued at USD 4.85 billion in 2024 and is expected to grow to USD 18.7 billion by 2032 and grow at a CAGR of 18.4 % over the forecast period of 2025-2032.

The insurance telematics market has gained substantial growth due to government initiatives and rising consumer demand for usage-based insurance (UBI) models. The government bodies’ initiatives to increase the use of telematics technology and reduce road-related accidents and insurance claims contribute to the market’s growth. For instance, in 2023, the U.S. Department of Transportation announced a 15% decline in road accidents, providing telematics-based monitoring systems to be effective in reducing claims and insurance costs related to accidents.

Get more information on Insurance Telematics Market - Request Sample Report

Key Trends Shaping the Insurance Telematics Market:

-

Data-Driven Risk Assessment: Increasing adoption of telematics devices enables insurers to analyze driver behavior and vehicle data for accurate risk profiling.

-

Personalized Insurance Models: Usage-based insurance (UBI) and pay-how-you-drive programs gain traction, allowing premiums to be tailored to individual driving patterns.

-

IoT & Connected Vehicle Integration: Growing deployment of connected cars and IoT devices enhances real-time data collection and predictive analytics.

-

Regulatory Compliance Focus: Insurers adopt telematics solutions to comply with safety, privacy, and data protection regulations across regions.

-

Fleet Management & Commercial Adoption: Telematics solutions are increasingly used by commercial fleets to optimize routes, reduce costs, and improve safety.

-

Technological Advancements: AI, machine learning, and cloud platforms drive insights, automate claims processing, and enhance customer engagement.

Insurance Telematics Market Driver:

-

Growing consumer demand for personalized premiums based on driving behaviour is driving the adoption of UBI, supported by telematics devices.

-

Improved IoT connectivity and big data analytics are enabling insurers to collect and analyze real-time driving data, enhancing risk assessment accuracy.

-

Mandates and regulations in various countries are pushing for telematics systems to improve road safety and reduce accidents, increasing telematics usage.

Increased adoption of usage-based insurance in the United States is one of the main drivers of the Insurance Telematics Market. It is a new concept that is changing the traditional B2B insurance model. UBI allows customers to pay for insurance based on their actual driving behaviour. According to a recent study, almost 50% of drivers in the United States would be interested in UBI programs. These technologies appear to be most popular with millennials and Gen Z who are highly technological. Telematics devices take an active part in the introduction of UBI technologies. They record the driver’s speed, pattern of braking, mileage as well as time of day when the driver operates the vehicle. The data received permits insurance companies to assess the actual image of the driver. Currently, these technologies allow policyholders to save up to 30% of their premiums. Thus, the State Farm’s Drive Safe & Save program demonstrates possible savings on premiums based on telematics data. In this way, other companies are developing their own UBI programs with telematics involvement.

The rise of electric and connected vehicles also facilitates the growth of UBI. Moreover, the data demonstrates a significant increase in UBI insurance. Thus, according to recent statistics, UBI policies based on telematics have increased by almost 30% in North America in 2023. Finally, the proliferation of technologies that are suitable for the implementation of UBI technologies reflects the overall telematics market trends. This trend highlights the growing alignment between consumer preferences for flexible premiums and insurers' need for more precise risk management tools, fuelling the telematics market’s expansion.

Insurance Telematics Market Restraints:

-

Growing concerns over the collection and sharing of sensitive personal data are causing hesitation among some consumers to adopt telematics solutions.

-

The cost of telematics devices and their installation can be prohibitive for smaller insurance firms, limiting market growth potential.

-

Insurers face challenges in effectively managing and integrating vast amounts of telematics data into existing systems, creating operational inefficiencies.

Privacy concerns related to data collection are one of the primary constraints within the market. The increased adoption of telematics technology implies the recording of real-time driving data including speed, location, and driving habits of the insured. However, consumers become increasingly concerned with who and how their personal data might be used. The devices that provide the data often record the driving routine of the individual and receipt of such information by an unregistered party may lead to the breach of privacy. Additionally, the fact that the data is thorough implies that it can be used against the end user in ways not associated with driving or insurance. These concerns are heightened in regions with stringent data protection laws like GDPR in Europe, making it critical for insurance companies to adopt transparent and robust data privacy policies. Without adequate safeguards, privacy concerns may limit consumer willingness to adopt telematics-based insurance policies.

Insurance Telematics Market Segment Analysis:

-

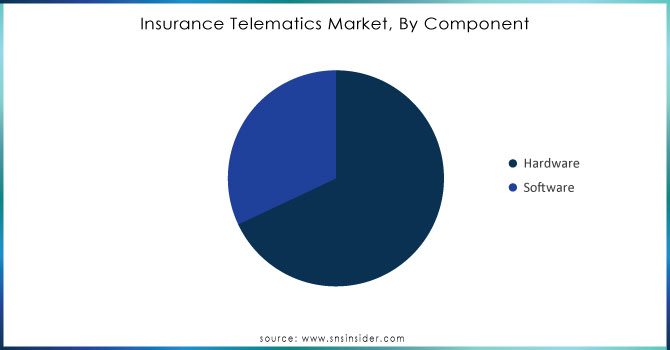

By Component, Hardware Segment Dominates Insurance Telematics Market with 68% Share in 2024

The hardware segment held the largest share 68% of the insurance telematics market in 2024, with hardware components such as telematics control units, global positioning system systems, and sensors. Several factors contributed to the dominance of hardware in the devices segment. Among these is the increasing demand for complex telematics devices that collect real-time data about driving, vehicle location, and the surrounding roads in personal and business vehicles. Moreover, the expansion of these devices in the market is driven by the emergence of advanced driver-assistance systems. Another important factor is the role of the government. For example, the European Union has imposed a mandate for hardware by passing a law for an in-vehicle telematics hardware called eCall to be deployed. The eCall telematics devices are required to alert the authorities about the crash incident automatically. Additionally, emerging markets like China and India have seen rapid growth in hardware deployment due to government-mandated safety and monitoring systems, further bolstering the market share of hardware in the insurance telematics ecosystem.

Get Customized Report as per your Business Requirement - Request For Customized Report

-

By Usage Type, Pay-How-You-Drive Usage Type Leads Insurance Telematics Market with 38% Share in 2024

Pay-How-You-Drive usage type segment led the market with a 38% market share in 2024. It is because consumers demand personalized insurance that will reward them with lower premiums for safe driving. Governments include the PHYDub models in their strategies concentrating on road safety and responsible driving. For example, in the UK, the government states that in 2024 the usage of PHYD policies by drivers caused a 25% reduction in aggressive driving and 20% less speeding. With lower amounts of aggressive driving and speeding, the number of car accidents is reduced as well as the number of concluded insurances. So, the model is beneficial for both consumers and insurers. In the U.S. Federal Insurance Office (FIO) promotes the usage of PHYD policies by suggesting that insurance companies implement the model and offering them to employ it for a more competing and customer-oriented insurance market. This has led to a 10% increase in the adoption of PHYD policies in the U.S. market in 2023, further cementing its dominant position in the insurance telematics market.

-

By Vehicle Type, Passenger Cars Drive Insurance Telematics Market Growth in 2024

In 2024, passenger cars led the Insurance Telematics Market by mode of transport, taking the highest market share. The adoption of telematics solutions among passenger cars is high because of government regulations and the rising number of individual car owners opting for UBI models. Reportedly, 85% of the new passenger cars sold in Europe had a telematics system in 2024, which was major because of the EU’s eCall regulations. In 2023, the National Highway Traffic Safety Administration estimated that 70% of the new passenger cars sold in the U.S. were equipped with integrated telematics systems because the car owners in the country desire personalized insurance products. This growing penetration of telematics in passenger vehicles has contributed to a significant increase in market share for this segment, as consumers continue to seek more cost-effective and tailored insurance solutions.

Insurance Telematics Market Regional Analysis:

-

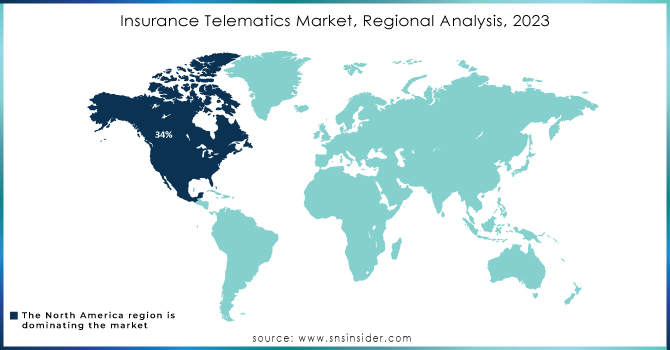

North America Insurance Telematics Market Insights

In 2024, North America dominates the Insurance Telematics Market with an estimated share of 40%, driven by widespread adoption of usage-based insurance, advanced telematics infrastructure, and strong government support for road safety initiatives. The region benefits from mature automotive markets, growing connected vehicle penetration, and supportive policies from federal agencies promoting PHYD models. These factors enable insurers to enhance risk assessment, offer personalized premiums, and improve claims management, supporting extensive deployment of telematics solutions that optimize insurance operations and consumer engagement.

-

United States Leads Insurance Telematics Market in North America

The U.S. dominates with the largest market share, supported by high vehicle telematics adoption, consumer preference for pay-how-you-drive insurance, and federal guidance from the Federal Insurance Office. Insurance providers leverage connected car data for personalized policies, risk reduction, and efficient claims processing. Advanced smartphone penetration and telematics-enabled devices accelerate market growth, while continuous innovation in UBI models and IoT-based monitoring reinforces the U.S.’s leadership position within North America.

-

Asia Pacific Insurance Telematics Market Insights

Asia Pacific is the fastest-growing region with an estimated CAGR in 2024, driven by rapid vehicle sales, government safety mandates, and increasing awareness of personalized insurance models. Rising adoption of connected vehicles, growing fleet telematics, and urbanization fuel demand for PHYD programs. Insurers and automotive companies are integrating telematics hardware and software solutions to enhance operational efficiency and risk management, accelerating market growth as consumers and businesses increasingly seek cost-effective, data-driven insurance options.

-

China Leads Insurance Telematics Market Growth in Asia Pacific

China dominates the Asia Pacific market due to large-scale connected vehicle deployment, supportive government regulations, and expanding UBI adoption. Insurance providers actively implement PHYD policies, leveraging telematics to enhance customer engagement and safety. Rapid urbanization, technological advancements in telematics devices, and high automotive sales contribute to market penetration. These factors establish China as the central driver of Asia Pacific’s insurance telematics market growth.

-

Europe Insurance Telematics Market Insights

In 2024, Europe holds a significant share in the Insurance Telematics Market, driven by regulations like the EU eCall initiative, increasing connected car adoption, and rising interest in usage-based insurance. Insurers implement telematics solutions to reduce claims, improve risk evaluation, and offer customized premiums. Continuous automotive innovation, government safety mandates, and digital infrastructure support steady regional growth.

-

Germany Dominates Europe’s Insurance Telematics Market

Germany leads the European market due to strong regulatory frameworks, high telematics penetration in vehicles, and extensive adoption of PHYD insurance models. Automotive manufacturers integrate telematics systems in new vehicles, enabling insurers to offer personalized premiums and monitor driving behavior. Supportive government policies and advanced automotive technology reinforce Germany’s leadership position within Europe.

-

Latin America and Middle East & Africa Insurance Telematics Market Insights

The Insurance Telematics Market in Latin America and MEA is witnessing steady growth, driven by increasing vehicle telematics adoption, government safety initiatives, and rising awareness of usage-based insurance. Insurance providers in these regions are expanding PHYD programs, while fleet operators leverage telematics for risk management and operational efficiency. Growing automotive sales, regulatory support, and technological integration bolster market adoption and functional versatility across these regions.

-

Regional Leaders in Latin America and MEA

Brazil leads Latin America due to expanding connected vehicle deployment, fleet telematics adoption, and government-backed road safety initiatives. In MEA, the UAE dominates, supported by smart city programs, growing insurance telematics awareness, and demand for advanced vehicle monitoring solutions, reinforcing regional market growth.

Competitive Landscape Insurance Telematics Market:

Kia Corporation

Kia Corporation, established on December 11, 1944, is South Korea's oldest automobile manufacturer. As a subsidiary of the Hyundai Motor Group, Kia specializes in producing a wide range of vehicles, including passenger cars, SUVs, and electric models. The company is committed to innovation, sustainability, and enhancing the driving experience. In the realm of insurance telematics, Kia integrates advanced in-vehicle technologies to support usage-based insurance (UBI) models, providing insurers with real-time driving data to assess risk and personalize premiums.

-

In February 2024, Kia formed a strategic alliance with LexisNexis for the extension of the Kia Connected Vehicle CIV data to U.S. auto insurers via the Telematics Exchange.

Trimble Inc.

Trimble Inc., founded in 1978 and headquartered in Westminster, Colorado, is a global technology company specializing in positioning, modeling, connectivity, and data analytics solutions. The company serves various industries, including construction, agriculture, geospatial, and transportation. Trimble's transportation solutions offer fleet management and telematics services that enable insurers to monitor driving behavior, optimize routes, and assess risk, thereby facilitating the implementation of insurance telematics programs. These capabilities help insurers develop more accurate pricing models and enhance customer engagement.

-

In March 2023, Trimble Inc. released its telematics portfolio of Mobility, offering dwell time metrics to optimize fleet management.

Insurance Telematics Market Companies:

-

Allstate Insurance

-

Progressive Insurance

-

State Farm Insurance

-

GEICO (Berkshire Hathaway)

-

AXA SA

-

Allianz SE

-

Zurich Insurance Group

-

Liberty Mutual Insurance

-

Generali Group

-

The Floow Limited

-

Octo Telematics

-

Cambridge Mobile Telematics (CMT)

-

Verisk Analytics

-

LexisNexis Risk Solutions

-

TrueMotion

-

MiX Telematics

-

Masternaut Limited

-

Sierra Wireless

-

Trimble Inc.

-

Vodafone Automotive

| Report Attributes | Details |

| Market Size in 2024 | US$ 4.85 Bn |

| Market Size by 2032 | US$ 18.7 Bn |

| CAGR | CAGR of 18.4% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software) • By Deployment (On-premises, Cloud) • By Usage Type (Pay-As-You-Drive, Pay-How-You-Drive, Manage-How-You-Drive) • By Vehicle Type (Passenger Cars, Commercial Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Allstate Insurance, Progressive Insurance, State Farm Insurance, GEICO (Berkshire Hathaway), AXA SA, Allianz SE, Zurich Insurance Group, Liberty Mutual Insurance, Generali Group, The Floow Limited, Octo Telematics, Cambridge Mobile Telematics (CMT), Verisk Analytics, LexisNexis Risk Solutions, TrueMotion, MiX Telematics, Masternaut Limited, Sierra Wireless, Trimble Inc., Vodafone Automotive |