Citric Acid Market Report Scope & Overview:

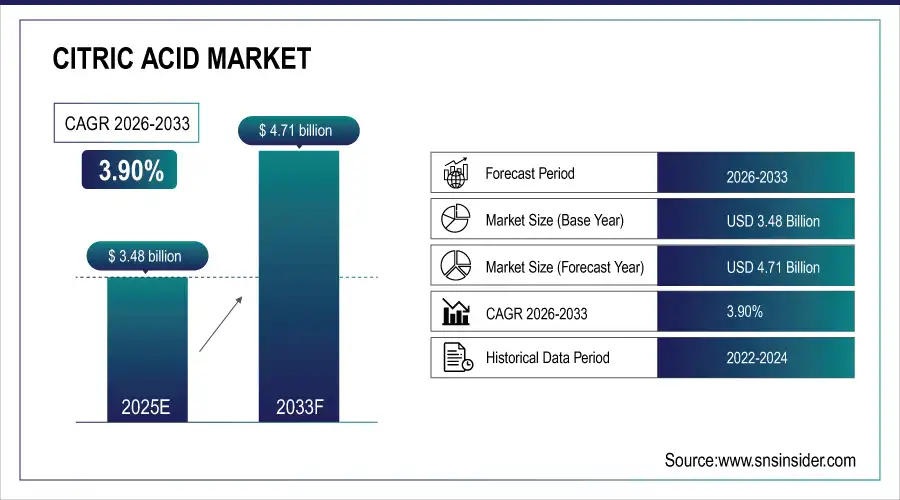

The Citric Acid Market Size was valued at USD 3.48 Billion in 2025E and is projected to reach USD 4.71 Billion by 2033, growing at a CAGR of 3.90% during the forecast period 2026–2033.

The Citric Acid Market analysis provides insights to navigate long-term market changes. Increasing demand in food & beverage, pharmaceutical, and cleaning products, expanding industrial applications, and advancements in fermentation and synthesis are driving growth for stakeholders.

Citric Acid production reached 1.2 million metric tons in 2025, driven by rising demand in food, pharmaceuticals, cosmetics, and cleaning products.

Market Size and Forecast:

-

Market Size in 2025: USD 3.48 Billion

-

Market Size by 2033: USD 4.71 Billion

-

CAGR: 3.90% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Citric Acid Market - Request Free Sample Report

Citric Acid Market Trends:

-

Rising application in food & beverages, pharmaceuticals and personal care products is a major factor propelling the Citric Acid market demand globally.

-

The development of fermentation and chemical synthesis methods is enhancing the productivity, sustainability, and cost-efficiency.

-

Growing commercial and industrial use, such as in cleaning products, water treatment, cosmetic goods are expanding market demand.

-

Increasing urbanisation, health consciousness and disposable incomes in developing countries are fuelling adoption.

-

The market is highly competitive owing to the efforts of manufacturers toward high purity grades as per regulations and quality requirements.

U.S. Citric Acid Market Insights:

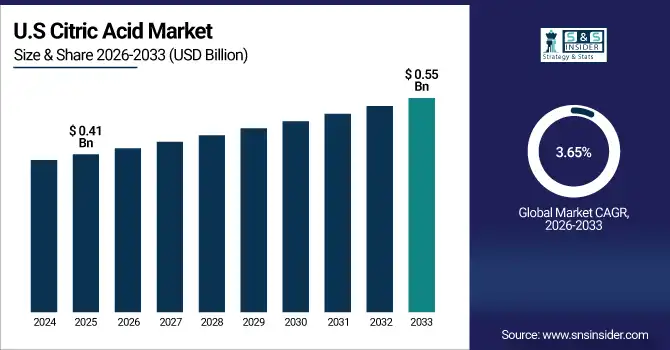

The U.S. Citric Acid Market is projected to grow from USD 0.41 Billion in 2025E to USD 0.55 Billion by 2033, at a CAGR of 3.65%. Growth is fostered by increasing food, beverage and pharmaceutical uses, growing market penetration of high purity products, technological innovations, and a mature chemical manufacturing base.

Citric Acid Market Growth Drivers:

-

Rising demand in food, pharmaceuticals, and personal care products is fueling Citric Acid market expansion globally.

Rising demand in food, pharmaceuticals, and personal care products is the primary driver of Citric Acid market growth. Growing health consciousness, urbanisation and disposable incomes are driving consumption of citric acid in beverages, processed foods, cosmetics and cleaning solutions. Rising industrial uses such as water treatment, cleaning agents are also boosting the demand for market. Manufacturers of high-purity grades and green production processes to comply with regulations and quality requirements are also driving demand.

Around 35% of Citric Acid consumption in 2025 was accounted for by food & beverages, pharmaceuticals, and personal care applications, reflecting growing demand.

Citric Acid Market Restraints:

-

Inconsistent raw material supply and strict regulatory standards are constraining large-scale Citric Acid production and distribution.

Inconsistent raw material availability and stringent regulatory standards are key factors restraining the growth of the Citric Acid market. Relying on sugarcane, corn or molasses for fermentation, also makes manufacturers vulnerable to supply changes and price highs. Strong environmental and food safety controls further exacerbate the cost of production and regulatory burden. Heavy consumption in manufacturing combined with limited access to sophisticated fermentation technologies continues to hobble small and medium-scaled producers, restricting overall market growth despite strong end-use demand.

Citric Acid Market Opportunities:

-

Growing demand for natural and clean-label ingredients presents opportunities for expanded Citric Acid applications in food and cosmetics.

Growing demand for natural and clean-label ingredients presents a significant opportunity for the Citric Acid market. Manufacturers can extend its application in foods, beverages and cosmetics due to growing concern for products with natural additives. Advances in bio-based manufacturing, sustainable fermentation processes and high-purity grades now enable companies to comply with regulatory requirements while supplying health-conscious and environmentally conscious markets, which opens doors for premium product offerings and new applications throughout the world.

Natural and clean-label Citric Acid accounted for 32% of new product formulations in 2025, driven by rising demand in food, beverages, and cosmetics.

Citric Acid Market Segmentation Analysis:

-

By Product Type, Anhydrous held the largest market share of 42.75% in 2025, while Liquid is expected to grow at the fastest CAGR of 4.12%.

-

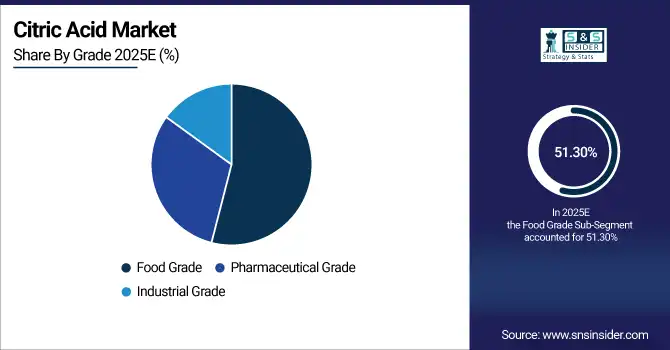

By Grade, Food Grade dominated with a 51.30% share in 2025, while Pharmaceutical Grade is projected to expand at the fastest CAGR of 4.25%.

-

By Production Process, Fermentation accounted for the highest market share of 63.50% in 2025, while Enzymatic Process is expected to record the fastest CAGR of 4.50%.

-

By Application, Food & Beverages held the largest share of 47.20% in 2025, while Cosmetics & Personal Care is projected to grow at the fastest CAGR of 4.38%.

By Product Type, Anhydrous Dominates While Liquid Expands Rapidly:

The Anhydrous segment dominated the market with its stable, long-life shelf & easy to transport nature which suits well for food, drink & industrial purpose. Its formulation compatible enables consistent performance across a broad spectrum of formulations and industries. The Liquid is the fastest growing segment, based on the rise of liquid using ready-to-drink beverages, liquid cleaning products and personal care applications. The development of packaging and handling and convenience applications is also advanced.

By Grade, Food Grade Dominates While Pharmaceutical Grade Expands Rapidly:

Food Grade segment dominated the market as it is widely used in beverages, processed food and culinary purposes coupled with regulatory approvals that guarantee safety. Its low cost and adaptability make it widely desirable. The Pharmaceutical Grade is the fastest growing segment, driven by a need for high purity formulations of supplements, drugs and nutraceuticals. High quality and health consciousness awareness, functionality ingredients enable the category to develop further.

By Production Process, Fermentation Dominates While Enzymatic Process Expands Rapidly:

The fermentation segment dominated the market as it is cost-effective, scalable, and has matured industrial infrastructure for large-scale citric acid production. Its high output and easy to use feature make it a favourite by most makers. Enzymatic Process is the fastest growing segment, driven by the need for green and sustainable manufacturing technology. Enzyme technology advancement, lower energy consumption, and cleaner products contribute to the adoption particularly in high-value applications such as pharmaceuticals and cosmetics.

By Application, Food & Beverages Dominates While Cosmetics & Personal Care Expands Rapidly:

Food & Beverages segment dominated the market owing to the citric acid that serves as a premiere ingredient used for flavoring, preservative, and acidity regulating in processed food and soft drinks and beverages. Its versatility and regulatory acceptance are contributing to its popularity. Cosmetics & Personal Care is the fastest growing segment, fueled by increasing consumer demand of natural preservatives and pH adjusters. Rising penetration in skin care, bath products and eco-friendly formulations to increase adoption on back of increasing clean-label and sustainable product awareness.

Citric Acid Market Regional Analysis:

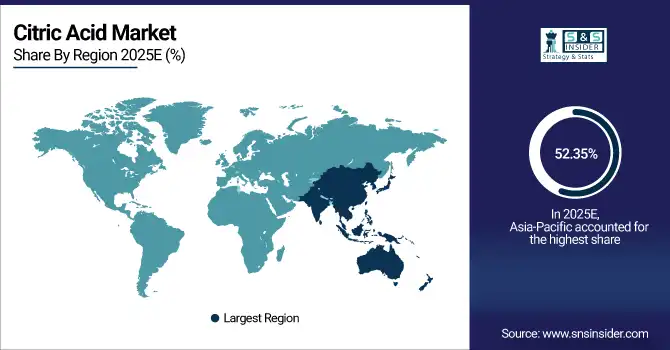

Asia-Pacific Citric Acid Market Insights:

Asia-Pacific dominated the Citric Acid market with a 52.35% share in 2025, supported by strong consumption in food & beverages, pharmaceuticals, and personal care products. Integrated fermentation and chemical production assets, large production scale, prevalent application of high-purity citric acid in specialty industries support leading position. Additionally, growing health awareness and preference toward natural ingredient and technological advancement in manufacturing processes in key countries such as China, India, Japan are anticipated to further boost its growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Citric Acid Market Insights:

China is the leader in the Citric Acid market, based on its capacity for large-scale fermentation and chemical facilities. Growth is sustained by applications in processed food, beverage and cosmetics; increasing exports to urban markets that value natural ingredients and production advancements across major provinces.

North America Citric Acid Market Insights:

The North America Citric Acid market holds a substantial share, supported by well-established chemical production facilities and steady industrial demand. Rising use in food processing, beverages and pharmaceuticals and for cleaning products contributes to growth. Tight food safety and environmental regulations are promoting the use of high purity sustainable citric acid. Rapid change in fermentation and synthesis technology, combined with innovation in applications, is transforming the competitive landscape and enabling long-term growth across the region.

U.S. Citric Acid Market Insights:

The U.S. Citric Acid Market can be used in food, beverages, pharmaceuticals and personal care applications. Prominent chemical and fermentation plants, growing inclination for high-purity, and nature counterparts, amicable insights of production processes, large-scale industrial and household application scope is likely to bolster the future market potential until 2033.

Europe Citric Acid Market Insights:

Europe is well-positioned in the citric acid market on account of its stringent regulations on food and safety, widespread uptake in beverages, processed foods, pharmaceuticals and personal care products and a mature chemical manufacturing industry. Germany, France and Italy are the key market players with high technological advances in demand for natural & high-purity ingredients, sustainability initiatives, and increasing industrial and household applications. Rising health awareness and clean label trends continue to drive regional market shares.

Germany Citric Acid Market Insights:

Germany is an important market for Citric Acid and it has a high acceptance rate of pure-priced, production-friendly products. Country's strong chemical manufacturing base, increasing consumption of natural and clean label ingredients and commitment toward environment-friendly production will be the driving growth factors for its food & beverage, pharmaceuticals and personal care applications.

Latin America Citric Acid Market Insights:

Latin America is the fastest-growing market for Citric Acid with a CAGR of 4.35%, due to growing demand from end use applications such as food & beverages, pharmaceuticals and personal care products. Growth across commercial and residential applications will be driven by expanding industrial infrastructure, increasing health consciousness, penetration of natural and high-purity citric acid, and a change in the approach to sustainable production process.

Middle East and Africa Citric Acid Market Insights:

The Middle East & Africa citric acid market is witnessing a moderate growth due to the increasing food, beverage, pharmaceutical and personal care industries. Rising demand for natural and high-purity chemicals, investments for establishing manufacturing facilities of chemical compounds and sustainable production activities surge the growth prospects in industrial and household applications.

Citric Acid Market Competitive Landscape:

Archer Daniels Midland Company (ADM), headquartered in the U.S., is a leading player in the Citric Acid market, leveraging large-scale fermentation and chemical production facilities. ADM produces citric acid for the food, beverage, and pharmaceutical industries and for use in personal care products. With such sustainable production, efficient technologies and comprehensive distribution network as support, the Company has kept and even strengthened its leading position in the market, met increasingly demand for natural product and step to the competition of citric acid.

-

In May 2025, ADM launched a new online storefront at ADMbuydirect.com, providing enhanced accessibility to its citric acid products for U.S. food producers. This streamlines the procurement process, offering detailed product information and facilitating direct purchases.

Cargill, Incorporated, based in the U.S., dominates the Citric Acid market through large-scale production, high-quality formulations, and extensive supply chains. The company emphasizes sustainability in fermentation technology, natural ingredients and clean label and high-purity citric acid for various applications. With advanced technology, environmental protection, high-quality product production, and robust market demand driving the company ahead of its rivals in the world citric acid industry to realize a competitive growth.

-

In June 2025, Cargill introduced new prototypes featuring citric acid at industry events such as IFT FIRST 2025. These prototypes include formulations for beverages and functional foods, showcasing Cargill's innovation in utilizing citric acid for enhanced flavor profiles and functional benefits.

Jungbunzlauer Suisse AG, headquartered in Switzerland, is an important producer of citric acid and special salts. The company is a market leader in high-purity, natural and bio-based citric acid for food, beverages, pharmaceuticals and personal care sectors. Focussing on sustainability in production, regulatory requirements and new technologies, Jungbunzlauer stays competitive, broadens its range of industrial applications and reinforces its position as citric acid market leader.

-

In July 2025, Jungbunzlauer launched TayaGel LA at IFT FIRST 2025. This low-acyl gellan gum is designed for plant-based and label-friendly formulations, offering suspension performance and gel strength at low usage levels. TayaGel LA reflects Jungbunzlauer's commitment to sustainable and innovative ingredient solutions.

Citric Acid Market Key Players:

Some of the Citric Acid Market Companies are:

-

Archer Daniels Midland Company (ADM)

-

Cargill, Incorporated

-

Jungbunzlauer Suisse AG

-

COFCO Biochemical Co., Ltd.

-

RZBC Group Co., Ltd.

-

Shandong Ensign Industry Co., Ltd.

-

Gadot Biochemical Industries Ltd.

-

Tate & Lyle PLC

-

TTCA Co., Ltd. (Thai Citric Acid Co., Ltd.)

-

Huangshi Xinghua Biochemical Co., Ltd.

-

Merck KGaA

-

Pfizer Inc.

-

Danisco A/S (DuPont)

-

Nacalai Tesque Inc.

-

Kenko Corporation

-

S.A. Citrique Belge N.V.

-

BBCA Group Co., Ltd.

-

Sunshine Biopharma Inc.

-

Polifar Group

-

Vivion Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.48 Billion |

| Market Size by 2033 | USD 4.71 Billion |

| CAGR | CAGR of 3.90% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Anhydrous, Monohydrate, Liquid, Others) • By Grade (Food Grade, Pharmaceutical Grade, Industrial Grade) • By Production Process (Fermentation, Chemical Synthesis, Enzymatic Process, Other Processes) • By Application (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Cleaning & Detergents, Industrial Applications, Water Treatment, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Archer Daniels Midland Company (ADM), Cargill, Incorporated, Jungbunzlauer Suisse AG, COFCO Biochemical Co., Ltd., RZBC Group Co., Ltd., Shandong Ensign Industry Co., Ltd., Gadot Biochemical Industries Ltd., Tate & Lyle PLC, TTCA Co., Ltd. (Thai Citric Acid Co., Ltd.), Huangshi Xinghua Biochemical Co., Ltd., Merck KGaA, Pfizer Inc., Danisco A/S (DuPont), Nacalai Tesque Inc., Kenko Corporation, S.A. Citrique Belge N.V., BBCA Group Co., Ltd., Sunshine Biopharma Inc., Polifar Group, Vivion Inc. |