Recovered Carbon Black Market Key Insights:

To Get More Information on Recovered Carbon Black Market - Request Sample Report

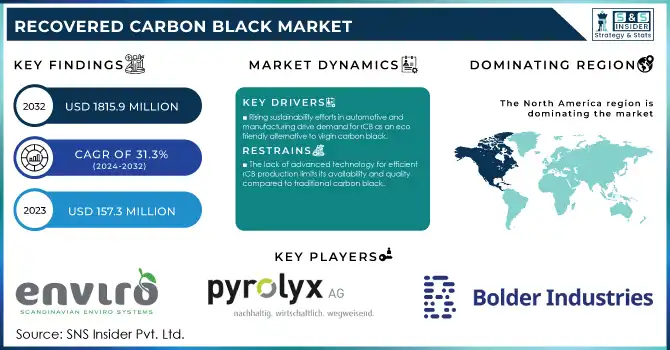

The Recovered Carbon Black Market Size was valued at USD 157.3 Million in 2023 and is expected to reach USD 1815.9 Million by 2032, growing at a CAGR of 31.3% over the forecast period 2024-2032.

The Recovered Carbon Black (rCB) market has experienced a significant boom owing to several key drivers, one of the main being a global push towards sustainability and reducing carbon footprint. As the environmental risks associated with carbon emissions and plastic pollution gain more global consciousness, many governments are enforcing strict regulations while encouraging the implementation of recycled materials such as recovered carbon black. According to a report from the U.S. Environmental Protection Agency (EPA), carbon black production contributes significantly to carbon emissions, creating a growing push towards recycling this valuable material.

In 2020 the European Union’s Circular Economy Action Plan announced plans to promote recycling and reuse of materials like carbon black for waste reduction. The ambitious targets set by countries such as the U.S., Germany, and China for reducing carbon emissions had a direct bearing on the carbon black industry, which has served to create demand for rCB. Recycled carbon black, derived from used tires and other rubber products, plays an essential role in meeting these sustainability targets. This allows the automotive and rubber industries to rely on less virgin carbon black, reducing their carbon footprints. As manufacturers look for less expensive, more sustainable substitutes, rCB is likely to see a significant increase in demand over the next few years. The government’s focus on environmental policies and sustainability initiatives is driving the demand for rCB, offering a promising future for its market.

Recovered Carbon Black Market Dynamics

Drivers

-

The increasing focus on sustainability in industries like automotive and manufacturing is pushing demand for rCB, as it serves as an eco-friendly alternative to virgin carbon black.

-

The global push towards circular economy practices, including the recycling of tires, enhances the availability and adoption of rCB in tire manufacturing and other applications.

The recovered carbon black (rCB) market is driven by, the increased environmentally friendly focus of manufacturers and consumers, there is a substantial drive for more sustainable replacements within production methods. To address this, rCB has the potential to be a viable solution, as carbon black can be reused from waste tires and thus reintroduced into the production of recycled rubber products, decreasing waste and the dependence on virgin raw materials. This provides a more carbon footprint reduction to those industries which are highly dependent on carbon black.

For instance, the tire industry is increasingly adopting rCB in response to sustainability goals. By 2024, tire manufacturers in Europe are expected to use more than 30% recycled materials in tire production, a move supported by initiatives such as the European Union's Circular Economy Action Plan. Additionally, companies like Scandinavian Enviro Systems have developed innovative technologies to recover up to 95% of carbon black from used tires, showcasing the advancements in recycling technologies. The demand for sustainable rCB is also fueled by regulatory pressures. As an example, new tire regulatory rules implemented in 2022 by the European Commission established new requirements for waste tire management, encouraging increased recycling rates and the implementation of rCB, as a unique and necessary part of the recycling loop. This shift aligns with broader sustainability trends, as industries strive for circular economy models and reduce their environmental impact.

Restraints

-

The lack of advanced technology for efficient rCB production limits its availability and quality compared to traditional carbon black.

-

Despite the environmental benefits, the cost of recovered carbon black production is often higher than that of virgin carbon black, posing a challenge to widespread adoption.

High production cost is one of the primary restraints in the recovered carbon black (rCB) market. Due to the advanced technology and chemical process taken to harvest carbon black from waste sources i.e. used tires, the production of rCB heavily relied on rCB. Such processes usually require high-energy methods like pyrolysis and grinding, making operational costs higher than the production of virgin carbon black. This naturally drives up prices and limits the adoption of rCB products, particularly by price-sensitive industries. In addition, the infrastructure to process the waste materials and to produce high-quality rCB has yet to be established in many places, increasing costs. These differences in cost are prohibitive, aiding in preventing the recovery of carbon black from competing against traditional, but less eco-friendly options such as virgin carbon black, making it difficult for it to reach widespread implementation across various markets such as automotive or manufacturing.

Recovered Carbon Black Market Segmentation Analysis

By application

Tire manufacturing has been the most dominant segment in the recovered carbon black market, holding a market share of 72% in 2023. Tires represent the largest consumer of carbon black due to its essential role in enhancing the strength, durability, and performance of rubber compounds used in tires. Consequently, the tire manufacturing sector has been the single most driving sector for rCB demand. due to the increase in the production of automobiles along with the expansion of the automotive industry in developing countries such as India and China, the need for tires has also increased, which also adds to the consumption of recovered carbon black even in the production of tires. The global tire market is expected to grow at a steady pace in the forthcoming timeframe which will propel the carbon black demand. Due to growing use by tire manufacturers due to sustainability purposes, rCB is expected to remain on the rise.

The rubber segment is also projected to grow with the highest compound annual growth rate growth rate. One major factor behind this growth is government regulations encouraging the re-utilization of materials and decreasing carbon footprints. An example of a sustainability initiative for rubber was the European Union directive on End-of-Life Vehicles (ELV) that encourages higher recycling rates for automotive waste (such as tires) and thus, promotes demand for recycled carbon black in the rubber industry. As sustainable production takes center stage, the transition that will be critical for the rubber industry during the coming years includes replacement with recovered carbon black. With continued support for promoting the recycling of tire waste and other rubber products by the government is expected to sustain significant growth in this segment.

Recovered Carbon Black Market Regional Insights

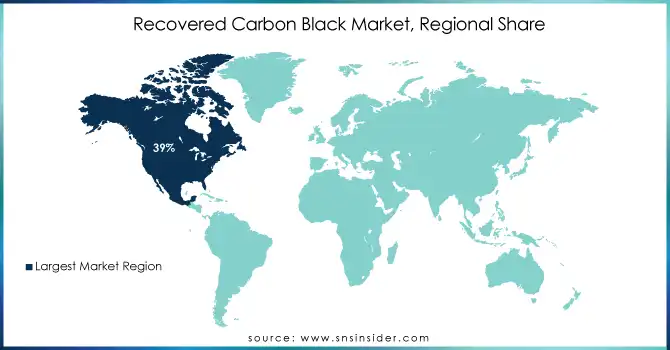

North America dominated the market, with over 39% of the global recovered carbon black market share in 2023. Promoting recycling and sustainability has been largely driven by the U.S. Federal Government policy initiatives such as the EPA sustainable materials management program. As a result of these initiatives, there has been a noticeable rise in the adoption of reclaimed carbon black across various sectors such as automotive and manufacturing. Implementation of circular economy practices, along with an increasing understanding of environmental issues, has triggered massive investments in the recovered carbon black industry in North America.

The Asia Pacific (APAC) region is projected to be the fastest-growing market for recovered carbon black, with a compound annual growth rate (CAGR) from 2024 to 2032. The rCB demand in this region is mainly triggered by the fast-growing industries such as automotive manufacturing, especially in the nations like China and India, where the automotive industry is growing at an unparalleled pace. China National Tire & Rubber Corp told the CCAG that Chinese manufacturers exceeded 300 million tires of production in 2023 alone, and as China implements more stringent environmental policies there will be increasing interest in sustainable alternatives, including recovered carbon black. Moreover, government initiatives to improve recycling and decrease carbon emissions by regulated items like the 14th Five-Year Plan of Ecological and Environmental Protection will further enhance the market of rCB. The National Action Plan on Climate Change (NAPCC) by the Indian government is also encouraging the use of environmentally friendly practices in the manufacturing sectors including the automotive sector which will boost the market growth of recovered carbon black in the region.

Do You Need any Customization Research on Recovered Carbon Black Market - Inquire Now

Key Players

Key Service Providers

-

Bolder Industries (BolderBlack, BolderInnovate)

-

Black Bear Carbon B.V. (Black Bear Carbon Black, Rubber Carbon Black)

-

Pyrolyx AG (Pyrolyx rCB, Pyrolyx Carbon Black)

-

Scandinavian Enviro Systems AB (Enviro, Ecoloop)

-

Radhe Group of Energy (Radhe Carbon Black, Radhe Pyrolysis Oil)

-

Delta-Energy Group (Delta Carbon Black, Delta Black™)

-

DVA Renewable Energy JSC (DVA rCB, DVA Black Products)

-

Alpha Carbone (Alpha Carbon Black, Alpha Tiers)

-

Integrated Resource Recovery (IRR Carbon, IRR Pyrolysis Carbon)

-

SR2O Holdings (SR2O Carbon, SR2O Pyrolyzed Carbon)

Key Users

-

Bridgestone Corporation

-

Goodyear Tire & Rubber Company

-

Michelin

-

Continental AG

-

Pirelli

-

Sumitomo Rubber Industries

-

Tire and Rubber Manufacturing Inc.

-

ExxonMobil Chemical

-

LANXESS

-

Cabot Corporation

Recent Developments

-

In February 2024, Michelin joined forces with Antin and Enviro to build the first plant dedicated to recycling end-of-life tires. The collaboration focuses on supplying used tires, recovered carbon black, and pyrolysis oil for the facility.

-

In March 2023, Enviro and Antin Infrastructure teamed up with Michelin to establish the world's first large-scale tire recycling facility. This initiative is expected to significantly boost the recovered carbon black market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 157.3 million |

| Market Size by 2032 | USD 1815.9 million |

| CAGR | CAGR of 31.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Tires, Rubber, High-Performance Coatings, Plastics, Others |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bolder Industries, Black Bear Carbon B.V., Pyrolyx AG, Scandinavian Enviro Systems AB, Radhe Group of Energy, Delta-Energy Group, DVA Renewable Energy JSC, Alpha Carbone, Integrated Resource Recovery, SR2O Holdings. |

| Key Drivers | • The increasing focus on sustainability in industries like automotive and manufacturing is pushing demand for rCB, as it serves as an eco-friendly alternative to virgin carbon black. • The global push towards circular economy practices, including the recycling of tires, enhances the availability and adoption of rCB in tire manufacturing and other applications. |

| Restraints | • The lack of advanced technology for efficient rCB production limits its availability and quality compared to traditional carbon black. • Despite the environmental benefits, the cost of recovered carbon black production is often higher than that of virgin carbon black, posing a challenge to widespread adoption. |