Cladding Systems Market Report Scope & Overview:

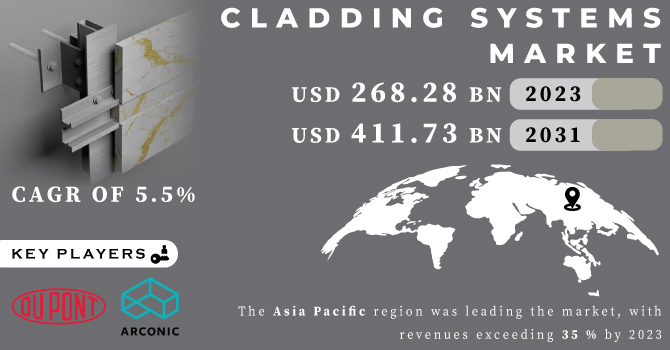

The Cladding Systems Market size was USD 268.28 billion in 2023 and is expected to Reach USD 411.73 billion by 2031 and grow at a CAGR of 5.5% over the forecast period of 2024-2031.

Key market trends include increasing emphasis on sustainable and eco-friendly materials along with increased demand for energy efficient solutions. Technological and material advances are driving innovation, which leads to the development of highly functional coatings, lightweight composites as well as digital integration designs. However, challenges persist, including fire safety concerns and the need to adhere to strict building codes and regulations. In addition, considerations of cost, maintenance requirements, and installation complexity influence decision making by manufacturers and buyers.

Get More Information on Cladding Systems Market - Request Sample Report

Urbanization and the rapidly changing architectural landscape are continuing to shape the coating systems market. The demand for aesthetic design, as well as solutions that can withstand different climatic conditions, is driving the market. As industry responds to changing consumer expectations and environmental requirements, the coating systems market remains a dynamic arena that intersects with creativity, sustainability and compliance. throughout the construction industry.

MARKET DYNAMICS

KEY DRIVERS:

-

Growing urbanization and infrastructure growth

The rise in construction activity is due to rapidly growing urbanization and infrastructure development around the world. Cladding systems play a vital role in creating functional and visually appealing urban spaces.

-

The main driver of the construction industry is durability of cladding wall systems.

RESTRAIN:

-

High installation cost and maintenance cost

In order to retain its appearance and performance, certain cladding materials have to be maintained regularly. The longer-term cost of a building may be affected by high maintenance needs. Installation of specific types of cladding systems may take an excessive amount of time and labour to do, resulting in longer project deadlines and potential cost overruns.

OPPORTUNITY:

-

Advancements in Innovative Materials and Technology

Advances in materials sciences and technologies offer a means of developing new coating materials that are not just visually attractive, but also energy efficient, lighter and more environmentally sound.

-

A constant demand for walling solutions arises from rapid urbanization and the need to build new infrastructure.

CHALLENGES:

-

High cost of maintenance and repairing

In order to maintain the look and performance of some cladding materials, regular maintenance is required. Building owners may find it difficult to balance the aesthetics of their buildings with ongoing maintenance needs.

IMPACT OF RUSSIAN UKRAINE WAR

The war created instability in the global economy, reducing the need for coating systems. The war in Ukraine is having a significant impact on the global coating systems market. Steel prices surged, putting pressure on paint system costs. War also disrupts supply chains, making it more difficult and costly to bring coating systems to market

In the United States, steel prices have increased by more than 20% since the beginning of the war. This has pushed up the prices of coating systems, making them harder to buy for some businesses and homeowners. In Europe, the war disrupted Ukraine's steel supplies. This makes it more difficult and expensive to bring coating systems to market. In Asia, war has sown instability in the global economy. This has reduced the need for cladding systems as companies and owners are reluctant to invest in new projects.

Russia and Ukraine are major exporters of steel, which is an important component in coating systems. The war disrupted steel production and exports from these countries, driving up steel prices and coating systems.

War also disrupted global supply chains, making coating systems more difficult and costly to bring to market.

IMPACT OF ONGOING RECESSION

Due to the fact that businesses and consumers are less inclined to invest in new construction projects during a recession, the global economic downturn is expected to have a negative impact on the cladding systems market. As there is still an ongoing demand for Cladding Systems in the rehabilitation and maintenance of existing buildings, it is expected that the market will remain resilient.

According to the National Association of Homebuilders, housing starts fell by 17.6 % for June 2022, which was the biggest drop since April 2020. In the United States, this decrease will probably have an adverse impact on demand for Cladding Systems. A number of challenges, such as the fire at Grenfell Tower and its cost to repair it, exist in the United Kingdom's cladding systems market. The government said it would set up a $5 billion fund aimed at helping with the remediation, but there was no clear indication what proportion of this funding will be available for cladding systems. The market could be reduced by as much as 5% in 2023, according to some analysts.

KEY MARKET SEGMENTS

By Material

-

Wood

-

Ceramic

-

Vinyl

-

Metal

-

Brick & Stone

By Component

-

Windows

-

Roof Light

-

Doors

-

Vent

-

Wall

-

Others

By Application

-

Residential

-

Non-Residential

REGIONAL ANALYSIS

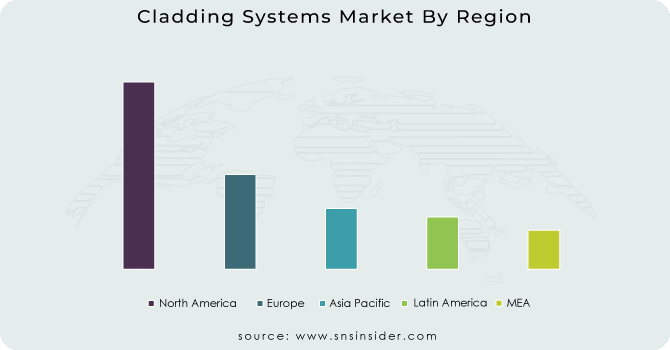

The Asia Pacific region was leading the market, with revenues exceeding 35 % by 2023, as a result of an increase in household income, rapid urbanisation and population growth coupled with more construction activity in emerging economies such as China, India and Japan.

In view of growing demand from the real estate sector and government initiatives aimed at reinforcing social infrastructure in the United States and Canada, North America's Cladding Systems Market is expected to increase significantly over the forecast period. In addition, the promotion of market growth is facilitated by increasing awareness about the advantages of weather protection in buildings.

As a consequence of an increase in commercial construction activity, it is expected that the demand for cladding systems across Europe will grow over the forecast period. Demand for product is also expected to grow over the forecast period, as more buildings use cladding in order to achieve an enhanced appearance of a building.

The construction sector in the Middle East and Africa is expected to show a revival of growth during the forecast period due to factors such as an increase in investment, increased oil production and better weather conditions which are anticipated to drive demand for cladding.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Cladding Systems market are Dow Du Pont, Arconic, James Hardie Industries PLC, Saint Gobain SA, Tata Steel Limited, Etex Group, Westlake Chemical, Everest Industries Limited, SIKA, Nichiha Corporation and other players.

Dow Du Pont, Arconic-Company Financial Analysis

RECENT DEVELOPMENT

-

Gebrik Modular, which will provide the ideal solution for the modular housing market was put into operation on January 2023 by Brick facades specialists Aquaria Cladding.

-

Metalwerks increasing their presence in the New York City construction market. New partnership with Green Building Products to supply tri-state area with high-quality metal cladding.

| Report Attributes | Details |

| Market Size in 2023 | US$ 268.28 Bn |

| Market Size by 2031 | US$ 411.73 Bn |

| CAGR | CAGR of 5.5 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Wood, Ceramic, Vinyl, Metal, Fibre Cement, Brick & Stone) • by Component (Windows, Roof Light, Doors, Vent, Wall, Others) • by Application (Residential, Non-Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Cladding Systems market are Dow Du Pont, Arconic, James Hardie Industries PLC, Saint Gobain SA, Tata Steel Limited, Etex Group, Westlake Chemical, Everest Industries Limited, SIKA, Nichiha Corporation |

| Key Drivers | • Growing urbanization and infrastructure growth • The main driver of the construction industry is durability of cladding wall systems. |

| Market Challenges | • High cost of maintenance and repairing |