Thermoformed Healthcare Packaging Market Size:

The Thermoformed Healthcare Packaging Market Size was valued at USD 48.41 billion in 2023 and is projected to reach USD 94.53 billion by 2032 growing at a CAGR of 7.72% from 2024 to 2032. The global thermoformed healthcare packaging market is flourishing due to a confluence of factors. Thermoformed packaging offers a winning combination of versatility, cost-effectiveness, and eco-friendly, making it an attractive choice for healthcare product manufacturers. Additionally, the growing demand for sterile medical packaging is a major driver of the market. This is due to the increasing need for safe and effective medical devices and pharmaceuticals. Finally, the transformation of the global healthcare industry, fueled by technological advancements, demographic shifts, and evolving consumer preferences, is creating a demand for innovative packaging solutions that can ensure product safety, integrity, and efficacy. Thermoformed healthcare packaging stands out as a solution that effectively addresses these needs.

Get More Information on Thermoformed Healthcare Packaging Market - Request Sample Report

MARKET DYNAMICS

KEY DRIVERS:

-

The healthcare industry's surge is fueling a rise in demand for medical supplies

-

Busy lifestyles and the desire for effortless experiences are propelling the popularity of convenient packaging solutions

Busy lives call for grab-and-go convenience, and that includes packaging! Thermoformed packaging is a champion for convenience. It's lightweight, tough, and can be shaped to fit all sorts of products. Plus, it's budget-friendly and recyclable, making it a double win for businesses and consumers alike.

RESTRAINE:

-

Rising costs for raw materials and energy are putting pressure on manufacturers

The high cost of raw materials and energy for thermoformed packaging makes it expensive to produce, reducing profitability and forcing businesses to struggle with competitive pricing.

-

Recycling efforts are hampered by the absence of a comprehensive infrastructure system

OPPORTUNITY:

-

Designing secure packaging with sustainability in mind

-

With patient safety becoming a top priority in healthcare, thermoformed packaging emerges as a crucial asset, fortifying safety standards

Patient safety is paramount in healthcare, and thermoformed packaging is stepping up to the plate. This packaging offers a protective shield against bacteria, dust, moisture, and other threats. By keeping medical supplies safe and sterile, thermoformed packaging plays a vital role in reducing the risk of infections and complications for patients.

CHALLENGES:

-

The scarcity of qualified workers in the field is posing a challenge for many industries

The thermoformed packaging industry is struggling to find qualified workers for its specialized jobs. This lack of skilled labor is capping production output and hindering the industry's ability to meet demand.

-

Meeting strict regulations and high standards can be challenging for the market

IMPACT OF RUSSIA UKRAINE WAR

The Russia-Ukraine war is disrupting the already fragile supply chain for thermoformed healthcare packaging, causing a ripple effect that will increase costs and potentially slow down production. Sanctions on Russia, a major oil exporter, are pushing up oil prices, leading to higher costs for polypropylene and polyethylene, key materials for thermoformed packaging. Additionally, these sanctions and a reduced reliance on Russian oil could lead to shortages of some plastics, especially polypropylene. Further impacting the industry, the war is disrupting steel production and exports from Russia and Ukraine, which are major steel exporters. This could make it more difficult and expensive to create molds needed for thermoformed packaging production.

IMPACT OF ECONOMIC SLOWDOWN

The slowdown could worsen the existing labor shortage in the manufacturing sector. This could lead to production slowdowns and hinder the industry's ability to meet demand when the economy recovers. Businesses facing a slowdown might cut back on orders or cancel them altogether. This could disrupt the supply chain for raw materials and packaging, leading to shortages and price increases later when demand picks up. Companies that cut orders during the slowdown could damage their relationships with suppliers. This could put them at a disadvantage when demand returns, as they may be prioritized lower for deliveries or face higher prices. Overall, an economic slowdown could create a strain on the thermoformed healthcare packaging market by exacerbating labor shortages and disrupting the supply chain.

KEY MARKET SEGMENTS

By Packaging Type

-

Blister

-

Clamshell

-

Skin Packaging

-

Trays & Lids

-

Containers

-

Others

Blister packs are dominating the thermoformed healthcare packaging with 38% market share. They're widely used to keep medical supplies, devices, and medicine safe. These packs are popular because you can see what's inside easily, which is important for doctors and patients. They're also tamper-proof and simple to open. This clear view helps doctors quickly identify medicine and reduces medication errors for patients. Blister packs are expected to stay on top in the thermoformed healthcare packaging market for a while.

By Material

-

Polyethylene (PE)

-

Poly Vinyl Chloride (PVC)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polypropylene (PP)

-

Polystyrene (PS)

-

Others

PET packaging holds dominant position in the thermoformed healthcare packaging world. PET, or polyethylene terephthalate, is a popular type of plastic used to create thermoformed packaging through a heating and molding process. It's lightweight, transparent, and acts as a great barrier against moisture, gases, and bad smells. These features make PET perfect for packaging medical devices, medicines, and other healthcare products that need shielding from the outside world.

By Process

-

Vacuum Forming

-

Pressure Forming

-

Plug Assist Forming

-

Drape Forming

-

Cavity Forming

-

Twin Sheet Forming

Vacuum forming is top in the thermoformed healthcare packaging. This process is expected to stay ahead of the pack. Vacuum forming involves heating a plastic sheet and using a vacuum to mold it into the desired shape. This technique is perfect for making medical parts and packaging that need to fight germs or resist contamination.

By Heat Seal Coating

-

Water Based

-

Solvent Based

-

Hot Melt Based

Solvent-based coatings reign supreme in thermoformed healthcare packaging. Solvent-based coatings are used in thermoforming, a process where plastic sheets are heated and molded into specific shapes. In solvent-based thermoforming, special chemicals temporarily soften the plastic sheet before it's shaped using a mold.

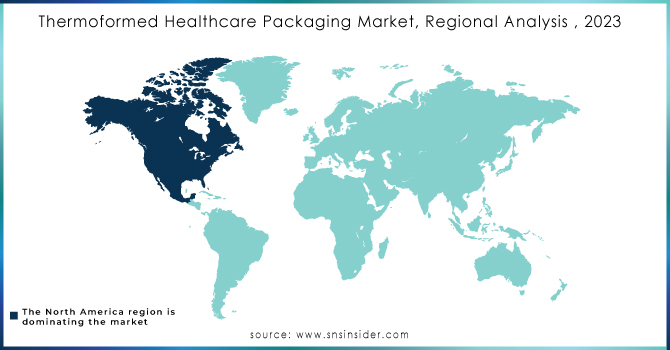

REGIONAL ANALYSIS

North America leads the thermoformed healthcare packaging market due to its advanced packaging industry and numerous producers. This trend is likely to hold as the demand for medical supplies, including those in thermoformed plastic packaging , keeps rising.

Europe's healthcare sector is seeing a rise in thermoformed packaging due to its benefits. This process creates flexible plastic packaging ideal for medical supplies. Advantages like strong protection, easy sterilization, and space-saving storage make it popular. A major driver is the growing focus on hygiene in healthcare. Thermoformed packaging acts as a barrier against contamination, keeping medical products sterile throughout their lifespan. This is vital in healthcare where preventing infections and ensuring product integrity is essential. Blister packaging is key in Asia's booming pharmaceutical market, where safety, affordability, and medication adherence are crucial. China, a top drug producer and market, is a prime target for blister pack makers.

Ask For Customized Report as per Your Business Requirement - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

·Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some of the major players in the Thermoformed Healthcare Packaging Market are Placon Corp, Sonoco Products Company, Amcor Plc, Dordan Manufacturing Company, Constantia, Plastic Ingenuity, Brentwood Industries, Inc., Prent Corporation, O. Plastics, Inc., GY Packaging and others.

RECENT DEVELOPMENTS

-

In August 2022, Amcor expanded its offerings by investing in thermoforming technology across Europe. This means Amcor can now create thermoformed trays alongside their existing selection of healthcare lidding materials and pouches.

-

In October 2021, thermoforming company Placon boosted its production capabilities and workforce by acquiring a former Sonoco packaging facility in Wilson, North Carolina. This strategic move positions Placon to meet the growing demand for their innovative packaging solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 48.41 Billion |

| Market Size by 2032 | US$ 94.53 Billion |

| CAGR | CAGR of 7.72 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Packaging Type (Blister, Clamshell, Skin Packaging, Trays & Lids, Containers, Others) • By Material (Polyethylene Terephthalate (PET), Polyethylene (PE), Poly Vinyl Chloride (PVC), Acrylonitrile Butadiene Styrene (ABS), Polypropylene (PP), Polystyrene (PS), Others) • By Process (Vacuum Forming, Pressure Forming, Plug Assist Forming, Drape Forming, Cavity Forming, Twin Sheet Forming) • By Heat Seal Coating (Water Based, Solvent Based, Hot Melt Based) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Placon Corp, Sonoco Products Company, Amcor Plc, Dordan Manufacturing Company, Constantia, Plastic Ingenuity, Brentwood Industries, Inc., Prent Corporation, O. Plastics, Inc., GY Packaging |

| Key Drivers | • The healthcare industry's surge is fueling a rise in demand for medical supplies • Busy lifestyles and the desire for effortless experiences are propelling the popularity of convenient packaging solutions |

| Restraints | • Rising costs for raw materials and energy are putting pressure on manufacturers • Recycling efforts are hampered by the absence of a comprehensive infrastructure system |