Fiber Cement Market Report Scope & Overview:

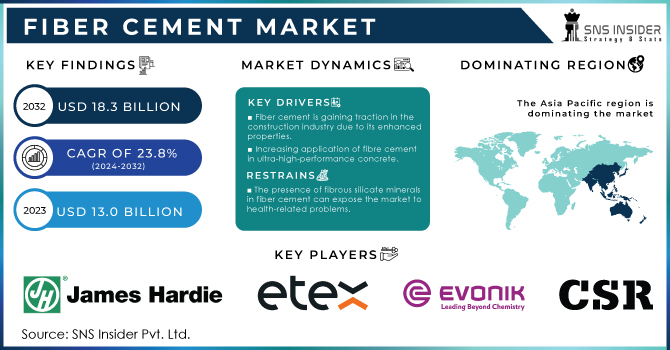

The Fiber Cement Market Size was valued at USD 17.10 Billion in 2023 and is expected to reach USD 24.87 Billion by 2032, growing at a CAGR of 4.25% over the forecast period of 2024-2032.

Get more information on Fiber Cement Market - Request Sample Report

The fiber cement market is evolving rapidly, fueled by rising construction activities and a push for sustainability. Our report reveals insights into production capacity and utilization rates, highlighting efficiency trends among manufacturers. It provides a detailed pricing trends and cost structure analysis, illustrating the effects of raw material fluctuations. The assessment of import and export data uncovers trade dynamics that shape global positioning. Innovations are explored through patent analysis, while a comprehensive supply chain and value chain analysis identifies optimization opportunities. Lastly, the impact of government policies and regulations is examined, offering a complete view of the industry's growth trajectory.

Fiber Cement Market Dynamics

Drivers

-

Increasing Demand for Sustainable and Environmentally Friendly Construction Materials Drives the Growth of the Fiber Cement Market

The rising focus on sustainability in the construction industry is a key driver for the growth of the fiber cement market. With increasing awareness about the environmental impact of traditional building materials like wood and concrete, fiber cement, known for its eco-friendly nature, has gained significant traction. Fiber cement is made using natural resources like cement, sand, and cellulose fibers, which are more sustainable compared to other construction materials. As governments and organizations push for greener building practices, there is growing demand for materials that offer durability, low maintenance, and environmental friendliness. Additionally, fiber cement products contribute to reducing carbon emissions in construction projects, which further aligns with the global shift toward sustainability. The development of green buildings, energy-efficient structures, and eco-friendly residential and commercial spaces is expected to continue driving the market forward, particularly in developed regions.

Restraints

-

High Raw Material Costs and Production Expenses Limit the Profitability of Fiber Cement Products in the Market

The cost of raw materials, including Portland cement, silica, and cellulose fibers, plays a crucial role in determining the overall production cost of fiber cement products. Volatile raw material prices can limit the profitability of manufacturers, as fluctuations in these costs can significantly impact pricing strategies. Additionally, the production process for fiber cement is complex, requiring specialized equipment and skilled labor, further adding to the overall production cost. These higher production costs, when passed on to consumers, may reduce the competitiveness of fiber cement against alternative, lower-cost construction materials, potentially limiting its widespread adoption. While fiber cement offers numerous benefits, including durability and sustainability, the price-sensitive nature of the construction industry could constrain its market share in cost-driven segments.

Opportunities

-

Rising Adoption of Eco-Friendly Construction Practices in Developing Economies Drives Demand for Fiber Cement Products

As emerging economies experience rapid urbanization and industrialization, there is a growing demand for eco-friendly and sustainable construction materials. Fiber cement products, with their environmental benefits, offer an attractive solution in these developing regions. Governments and construction companies are increasingly focusing on green building standards, which are driving the demand for sustainable materials like fiber cement. With the global push for carbon footprint reduction and sustainable development, developing countries are adopting eco-friendly construction practices, which further accelerates the adoption of fiber cement products. This trend is expected to create a significant opportunity for manufacturers to expand their presence in emerging markets, tapping into the increasing demand for environmentally conscious construction materials.

Challenge

-

Competition from Alternative Building Materials and Substitutes Impacts Fiber Cement Market Growth Potential

Fiber cement faces strong competition from alternative construction materials, such as vinyl siding, aluminum, and traditional concrete. These materials are often perceived as more cost-effective or easier to install, especially in markets where fiber cement has not yet gained widespread awareness. For instance, while fiber cement offers superior durability, fire resistance, and energy efficiency, alternative materials may offer lower upfront costs or simpler installation processes. As a result, in price-sensitive markets, consumers and contractors may opt for cheaper substitutes, limiting the growth potential of the fiber cement market. Manufacturers need to emphasize the long-term benefits of fiber cement, such as lower maintenance costs and superior performance, to overcome this challenge and gain a competitive edge in the marketplace.

Fiber Cement Market Segmental Analysis

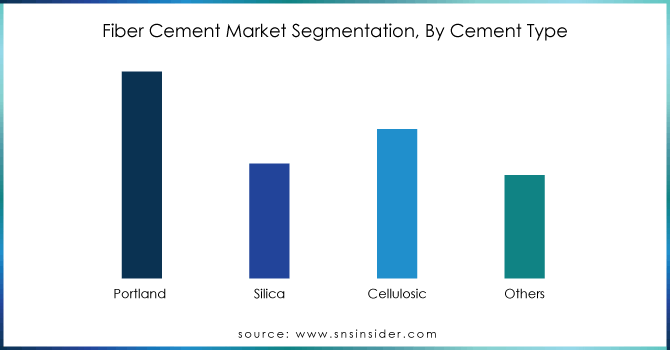

By Cement Type

In 2023, the Portland cement segment dominated the fiber cement market with a market share of 55.2%. Portland cement's dominance is primarily due to its widespread availability, cost-effectiveness, and suitability for a variety of fiber cement applications, particularly in the construction industry. It offers excellent durability, strength, and workability, which makes it a preferred choice for manufacturers. Portland-based fiber cement is commonly used in both residential and commercial projects, including siding and cladding, due to its resistance to moisture and fire. Associations like the Portland Cement Association (PCA) have played a role in supporting the widespread use of Portland cement in construction, further solidifying its dominant position in the market.

By Application

In 2023, the siding segment dominated the fiber cement market with a market share of 32.4%. Fiber cement siding is highly favored for its aesthetic appeal, durability, and low maintenance compared to traditional siding materials like wood or vinyl. The popularity of fiber cement siding has been increasing due to its ability to withstand harsh weather conditions, fire resistance, and its environmentally friendly composition. Organizations such as the National Association of Home Builders (NAHB) have recognized fiber cement's benefits, contributing to its growing use in both residential and commercial construction. This segment’s growth is also driven by government initiatives promoting energy-efficient and sustainable building materials.

By End-Use

The residential segment dominated the fiber cement market in 2023 with a market share of 48.5%. Residential construction continues to be the largest application for fiber cement products, particularly for siding, roofing, and flooring due to their durability, cost-effectiveness, and eco-friendly properties. As urbanization increases and homebuilders emphasize sustainability, fiber cement’s appeal has surged in the residential sector. Government policies aimed at promoting energy-efficient housing have further accelerated demand. For example, the U.S. Green Building Council supports the use of fiber cement in residential buildings due to its minimal environmental impact and long lifespan, reinforcing the sector's dominance.

Get Customized Report as per your Business Requirement - Request For Customized Report

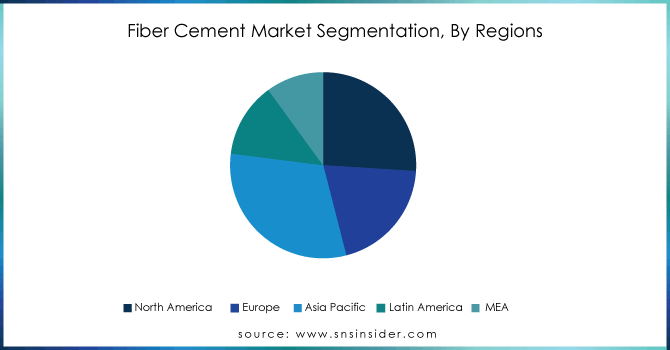

Fiber Cement Market Regional Outlook

In 2023, the Asia Pacific region dominated the natural fiber composites market with a market share of 43.2%. This dominance can be attributed to the strong manufacturing base in countries like China and India, where the adoption of sustainable materials is growing rapidly across industries such as automotive, construction, and packaging. China, for instance, is a key producer of natural fiber composites, and its government has supported the market’s growth through policies encouraging green manufacturing. Additionally, India’s strong agricultural sector provides abundant natural fibers, such as jute, hemp, and sisal, which are increasingly being used in composite materials. Countries like Japan are also leveraging these composites in automotive manufacturing for lightweight and eco-friendly solutions. The regional growth is further driven by favorable regulations and growing awareness of the environmental benefits of using natural fibers as alternatives to traditional synthetic materials.

On the other hand, the North America region emerged as the fastest-growing region in the natural fiber composites market during the forecast period, with a significant growth rate. The demand for natural fiber composites in North America is growing due to an increasing focus on sustainability, coupled with the adoption of eco-friendly solutions in various sectors, particularly automotive, construction, and consumer goods. The United States stands as the leading contributor in the region, driven by the automotive sector's need for lightweight, fuel-efficient materials. Government initiatives, such as the Renewable Energy and Energy Efficiency Program, promote the use of sustainable materials in manufacturing. Canada is also witnessing rapid growth in the use of natural fiber composites in automotive components and consumer products, bolstered by advancements in green technologies and an active push towards reducing carbon footprints in manufacturing. These factors collectively contribute to the region’s dominance in the market's future growth.

Recent Highlights

-

March 2024: Shera invested US$36 million to establish its first production hub in the Philippines. Announced by Thunnop Jumpasri, president and country head for the Philippines and Malaysia, this would represent a significant expansion in response to robust growth in the local construction sector.

-

December 2023: ETEX Group acquired BCG's fiber cement business, this strategic acquisition is aimed at boosting ETEX's revenue stream specifically within the fiber cement segment.

-

December 2023: Etex has acquired SCALAMID, this Polish company boasts a cutting-edge production line with room for growth, but the real game-changer is the technology. SCALAMID's innovative process allows direct printing of designs onto fiber cement boards, giving architects and designers exciting new creative possibilities.

Key Players

-

Beijing Hocreboard Building Materials Co. Ltd. (HBD Fiber Cement Board, HBD Calcium Silicate Board)

-

Cembrit Group A/S (Cembrit Plank, Cembrit Panel)

-

CSR Limited (Hebel PowerPanel, Cemintel Territory)

-

Etex Group (Equitone Facade Panels, Cedral Lap Siding)

-

Evonik Industries (Aerosil Fumed Silica, Dynasylan Organofunctional Silanes)

-

James Hardie Industries PLC (HardiePlank Lap Siding, HardiePanel Vertical Siding)

-

Nichiha Corporation (VintageWood Siding, Illumination Series Panels)

-

Plycem Corporation (Allura Fiber Cement Siding, Plycem Fiber Cement Trim)

-

Saint-Gobain (CertainTeed WeatherBoards, GlasRoc Sheathing)

-

The Siam Cement Public Company Limited (SCG Smartboard, SCG Smartwood)

-

Allura USA (Allura Lap Siding, Allura Panel Siding)

-

American Fiber Cement Corporation (Cembonit Cladding, Minerit HD Panels)

-

BGC Fibre Cement (Duragrid Facade System, Nuline Plus Weatherboard)

-

Everest Industries (Everest Heavy Duty Boards, Everest Designer Boards)

-

Hekim Yapi A.S. (HekimBoard Fiber Cement Board, HekimPanel Sandwich Panel)

-

Hyderabad Industries Limited (Charminar Fortune Cement Sheets, Aerocon Panels)

-

Mahaphant Fibre Cement Co. Ltd. (SHERA Board, SHERA Plank)

-

P.A.L. Chandra Builders Pvt. Ltd. (PALCO Fiber Cement Sheets, PALCO Roofing Sheets)

-

Soben International Ltd. (Soben FireProtect Board, Soben WeatherProtect Board)

-

Visaka Industries Limited (Vnext Boards, Vnext Premium Planks)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 17.10 Billion |

| Market Size by 2032 | USD 24.87 Billion |

| CAGR | CAGR of 4.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Cement Type (Portland, Silica, Cellulosic, Others) •By Application (Sliding, Roofing, Cladding, Backer Boards, Wall Partitions, Molding & Trimming, Others) •By End-Use (Residential, Commercial, Industrial and Institutional, Infrastructure) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | James Hardie Industries PLC, ETEX Group, Evonik Industries, Saint Gobain, CSR Limited, Nichiha Corporation, Cembrit Group A/S, The Siam Cement Public Company Limited, Plycem Corporation, Beijing Hocreboard Building Materials Co. Ltd. and other key players |