Clinical Decision Support Systems Market Overview and Scope

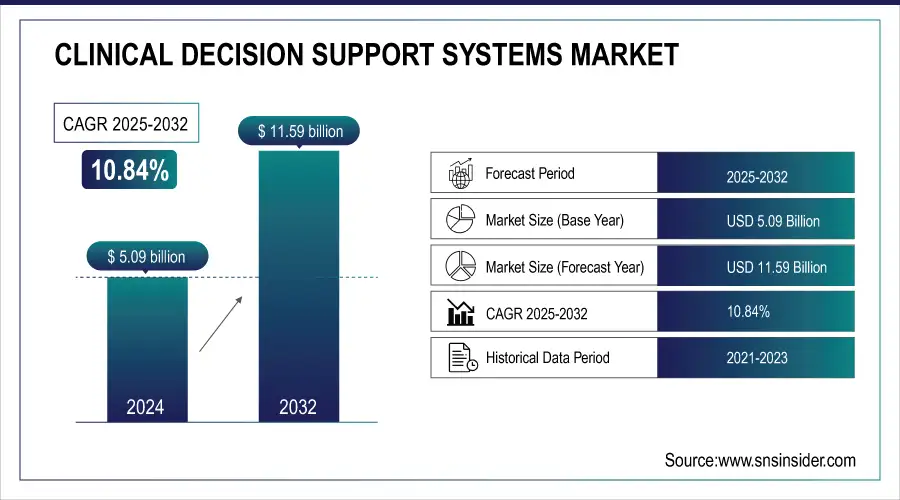

The Clinical Decision Support Systems Market was valued at USD 5.09 billion in 2024 and is expected to reach USD 11.59 billion by 2032, growing at a CAGR of 10.84% from 2025-2032.

Gt more information on Clinical Decision Support Systems Market - Request Sample Report

Clinical Decision Support Systems Market Size and Forecast

-

Market Size in 2024: USD 5.09 billion

-

Market Size by 2032: USD 11.59 billion

-

CAGR (2025–2032): 10.84%

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

The Clinical Decision Support System (CDSS) market is rapidly expanding, driven by widespread Electronic Health Record (EHR) adoption, with over 96% of U.S. hospitals and 78% of physicians using EHRs. Government initiatives worldwide, from the U.S.’s ONC promoting interoperability to Europe’s eHealth framework, further support HCIT adoption. CDSS enhances diagnosis, treatment planning, and patient outcomes while reducing prescription errors, readmissions, and healthcare costs. High-growth opportunities exist in APAC, particularly India and China, due to government-backed hospital digitization and rising healthcare expenditure. Integration with AI and personalized medicine promises more efficient, patient-centric healthcare, fueling long-term market growth.

Clinical Decision Support Systems Market Trends

-

Growing demand for improved patient outcomes and evidence-based care is driving CDSS adoption.

-

Integration with EHRs, AI, and predictive analytics is enhancing diagnostic accuracy and treatment planning.

-

Increasing focus on reducing medical errors and optimizing clinical workflows is boosting market growth.

-

Cloud-based and mobile-enabled solutions are enabling real-time access and remote decision support.

-

Rising prevalence of chronic diseases is expanding the need for advanced clinical decision tools.

-

Regulatory support and healthcare IT initiatives are encouraging adoption across hospitals and clinics.

-

Collaborations between software vendors, healthcare providers, and research institutions are accelerating innovation.

Market Growth Drivers

-

AI And Machine Learning Advancements And Personalized Medicine Boom With Growing Hospital Adoption

Clinical Decision Support Systems (CDSS) landscape is converging due to Artificial Intelligence (AI), and machine learning helping pave the way for unprecedented changes in how data interoperates within healthcare. These technologies are the next evolution in functionality allowing our breakthrough CDSS, analyzing vast data sections artificial intelligence enables us to see subtler trends and patterns not visible by a human eye. This in-turn gives them the ability to predict future health trajectory and advise on best treatment strategies. Machine learning algorithms are better at predicting patient mortality rates in the intensive care unit (ICU) more than traditional methods, says a Nature paper.

Using patient-specific information about history of disease or even a specific genetic profile, CDSS may be able to create optimal treatment plans for patients. This individualized pathway may vastly improve the therapeutic outcomes and lower side effects by limiting potential toxicological implications during drug administration. For example, a company called Praxis Precision Medicine uses an AI-powered CDSS to assess the genetic signature of a patient, and recommend potential individualized cancer therapies.

Market Restraints

-

Significant Barriers to Clinical Decision Support System Adoption Due to Cloud Security Concerns and the Growing Influence of Social Media on Healthcare Information Reliability

While AI-driven machine learning is accelerating CDSS adoption, data security in cloud-based systems remains a major concern, potentially limiting broader implementation. Healthcare organizations face risks such as breaches, unauthorized access, and regulatory compliance challenges, causing hesitation in fully deploying cloud CDSS solutions. Simultaneously, the expanding role of social media introduces information overload, where unreliable or conflicting external content can undermine clinical decision-making and reduce confidence in CDSS outputs. Addressing these challenges requires robust security measures, strict compliance, and careful management of external information sources to ensure reliable system effectiveness.

Clinical Decision Support Systems Market Segmentation Analysis

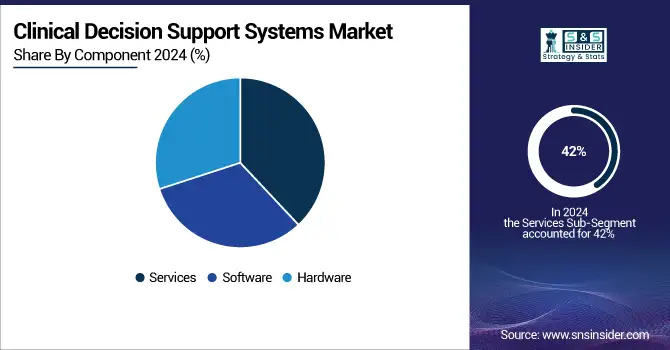

By Component, Services dominated while Software is expected to grow fastest

By component, Services is the largest segment with 42% market share in 2023 they dominate due to services ensure effectiveness of the CDSS. The company provides implementation, training, support, customization and consulting – the gamut of services to maximize a healthcare organization's recommendation engine investment. Services enable the smooth operation of the system with technical support and offer user training that enhances clinical decision at point.

Software will be anticipated to be the fastest growing segment as a result of the CDSS software being integrated with EHR and CPOE systems. It enables personalized decision support — software can be used to interpret patient data from EHRs and give tailored recommendations. The rise of platforms such as Elsevier Health's ClinicalKey AI in Feb 2024 is a case on point. An AI tool leveraging medical content for point-of-care, real-time support. Services are key today but the future lies with software that includes AI and integration capabilities as components of a CDSS.

By Product, Standalone CDSS Leads, while Integrated EHR-CDSS is projected to grow fastest

Clinical Decision Support Systems market (CDSS) remains the largest market type with revenues accounting for over 30% of the total market in 2023. Standalone systems like these are widespread in use due to their low cost, simplicity and capability of operating without real-patient patient data (which could easily be shared by human subjects) which makes it perfect as test beds. Yet the direction for CDSS is towards that of integrated systems embedding in EHR. This segment is anticipated to grow at the highest rate as a result of rising acceptance of EHRs in multi-specialty hospitals.

The integrate EHR with CDSS is the fastest growing which could easily be drawn insights from: due to direct accessing rights made possible by an association between alliance and licensing, it was feasible for CDSS integrated directly working alongside patient database accesses is shared; as a consequence, clinical workflows were automated. Because of these integrated systems, secondly, patient data available within the EHR can be used to help guide and make more informed clinical decisions. In the end, recent government proposals to encourage sharing EHR data for CDSS evaluation additionally endorse this combined movement. This standardization and the potential to build new CDSS functionalities inside EHRs suggest a future where integrated EHR-CDSS will be extremely widely available.

By Application, Drug Allergy Alerts led while Clinical Guidelines segment is expected to grow fastest

Drug Allergy Alerts is the dominating segment in the CDSS application clinical decision support systems market that accounted for over 25% of revenue share in 2023 and this trend is likely to continue till forecast period. This supremacy is by all means from their utmost ascendency in the descant of medication errors and adverse drug reactions (ADRs). CDSS lowering alerts can be personalized for individual patient profiles & an allergy addendum used to grade how immediate and actionable the alert is in relation to a given case. Providers can customize alert thresholds to maximize their efficacy. The prevalence of drug allergies continues to increase, for example causing 10% of the US population to be allergic penicillin according to CDC, which is a major driver for adoption CDSS in general and specifically within the Drug Allergy Alert Segment.

Nevertheless, the future of clinical decision support systems market applications could be in relation to clinical guidelines is the segment which will grow fastest. In the article cited, clinical decision support systems (CDS) stood out as advice just in time for diagnosis and treatment decisions at point of care. These systems are more than just alerts; they perform actions, predict future problems and provide recommendations to healthcare professionals as well as patients. The main purpose of CDS is to narrow down the clinical decision-making steps, which leads to higher quality healthcare that improves patient outcomes. According to the American Medical Informatics Association (AMIA), CDS helps both providers and anyone else involved in healthcare make better decisions.

By Delivery Mode, On-Premise CDSS held the largest share while Cloud-Based CDSS is projected to grow fastest

On-premise CDSS is the largest segment on the basis of delivery mode with 42% market share in 2023 because it was built for customization, allowing healthcare organizations to utilize new tools while navigating through more established system. On-premise fits best for larger facilities and multi-specialty hospitals as they have more control over the patient data, hence prefer to keep it on-site. But the cloud is becoming a viable alternative. By Deployments, Cloud-Based CDSS is poised to hold the fastest-growing market owing to its cost-effectiveness and scalability. Second, it is accessible — healthcare practitioners can access the knowledge easily online with any device and anywhere. Cloud providers have stringent data security controls, and these could rival even those of web-based systems. Although on-premise provides customization and control the cloud's cost, availability, and potential security improvements are a dangerous provision for future clinical decision support systems market superiority.

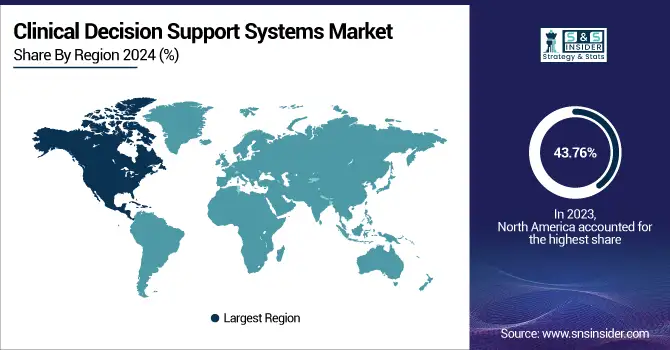

Clinical Decision Support Systems Market Regional Analysis

North America CDSS Market

North America is expected to hold the largest revenue share in 2023 at 43.76%. This dominance is upheld with an increased requirement for sophisticated healthcare IT, emphasis on quality care delivery and ever-changing technological developments that improve CDSS capabilities. The EBSCO Dyna Innovation Center which is to be placed at the heart of Dubai will also support CDSS adoption in the region.

Need any customization research on Clinical Decision Support Systems Market - Enquiry Now

U.S. CDSS Market

The US commands a larger share of the clinical decision support systems market within North America because EHRs are utilized more widely here than in any other country. Continued progress is being made in the US, with 78% of physician and 96% of hospital users using certified EHRs by 2021.

Asia Pacific CDSS Market

Asia Pacific in the near-term as its growth rate eclipses that of those powerhouse regions. This spike is attributed to the strong collaboration between healthcare provider, technology player and research institute. In addition, technological advancements and increasing healthcare needs are expected to provide an impetus for growth in the Asia Pacific clinical decision support systems market due to government funding combined with the rising awareness of CDSS benefits.

Europe CDSS Market

Europe as a managed clinical decision support systems market to hold profound position this stability is driven by established CDSS incumbents, growing interest in the technology from healthcare providers and increasingly hospitable regulations coming to light like a European Commission's recent endorsement of clinical decision-support.

Middle East & Africa and Latin America CDSS Market

The Middle East & Africa and Latin America are emerging markets for Clinical Decision Support Systems, driven by rising healthcare digitization, increasing government investment in healthcare infrastructure, and growing awareness of patient safety and treatment efficiency. Adoption is still in early stages, but initiatives promoting EHR integration and advanced technologies are expected to accelerate CDSS market growth in these regions.

CDSS Market Competitive Landscape

Oracle

Oracle is a key player in the Clinical Decision Support Systems market, leveraging AI-powered solutions integrated with EHRs to enhance clinical decision-making. Its innovations include deep-learning CDSS for early skin cancer detection, enabling rapid and affordable screening, and AI agents that interpret lab results, patient interactions, and treatment plans to streamline workflows and improve patient outcomes.

-

December 2023: Oracle’s AI-powered EHR-integrated CDSS prototype for skin cancer detection via deep learning analyzes skin-cell images for early diagnosis, enabling rapid, affordable, and user-friendly screening.

-

April 2025: Oracle introduces AI agents in healthcare that interpret lab results, conversations, and treatment plans collaboratively to enhance decision-making workflows.

IBM

IBM is a major contributor to the Clinical Decision Support Systems market, focusing on AI-driven solutions that enhance clinical development and patient care. In 2024, IBM Japan and FBRI launched an AI-embedded platform using generative AI and real-world medical data to optimize clinical trials and drug discovery. In 2025, IBM partnered with Roche to introduce the Accu-Chek SmartGuide Predict app, an AI-enabled CDSS providing real-time glucose forecasting, hypoglycemia alerts, and night-time risk predictions for diabetes management.

-

September 2024: IBM Japan and FBRI launch an AI-embedded clinical development platform using generative AI and real-world medical data to streamline clinical trial processes and drug discovery.

-

June 2025: IBM and Roche unveil the Accu-Chek SmartGuide Predict app an AI-enabled CDSS assisting diabetes management via real-time glucose forecasting, hypoglycemia warnings, and night-time risk predictions.

Microsoft

Microsoft is advancing the Clinical Decision Support Systems market through its AI and cloud-based healthcare solutions. By integrating Azure cloud services with AI-powered analytics, Microsoft enables hospitals and clinics to leverage real-time patient data for improved diagnosis, treatment planning, and workflow efficiency. Its solutions support interoperability with EHR systems, predictive analytics, and personalized care, helping healthcare providers enhance patient outcomes while optimizing operational efficiency and reducing costs.

-

On June 30, 2025, Microsoft introduced an AI diagnostic orchestrator that outperformed unaided clinicians, achieving 80% success in complex cases by combining multiple AI platforms to guide tests and diagnoses, marking a step toward medical superintelligence.

Key Players in the Clinical Decision Support Systems Market

-

McKesson Corporation

-

Siemens Healthineers GmbH

-

Wolters Kluwer

-

Allscripts Healthcare

-

Agfa-Gevaert Group

-

Athenahealth, Inc.

-

NextGen Healthcare Inc.

-

Aidoc

-

Navina

-

Tebra

-

Medidata Solutions

-

Corti

-

DreaMed Diabetes

-

Bingli

-

SOAP, Inc.

-

Included Health

-

Accolade

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.09 Billion |

| Market Size by 2032 | USD 11.59 Billion |

| CAGR | CAGR of 10.84% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Standalone CDSS, Integrated E.H.R. with CDSS, Integrated CPOE with CDSS, Integrated CDSS with CPOE & E.H.R.) • By Application type (Clinical Reminders, Drug-drug Interactions, Clinical Guidelines, Drug Allergy Alerts, Drug Dosing Support, Others) • By Delivery Type (Cloud-based Systems, Web-based Systems, On-premise Systems) • By Component type (Software, Hardware, Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Oracle, Koninklijke Philips, McKesson Corporation, Siemens Healthineers GmbH, Wolters Kluwer, Allscripts Healthcare, Agfa-Gevaert Group, Athenahealth, Inc., NextGen Healthcare Inc., Aidoc, Navina, Tebra, Medidata Solutions, Corti, DreaMed Diabetes, Bingli, SOAP, Inc., Included Health, Accolade |