Life Science Tools Market Size Analysis

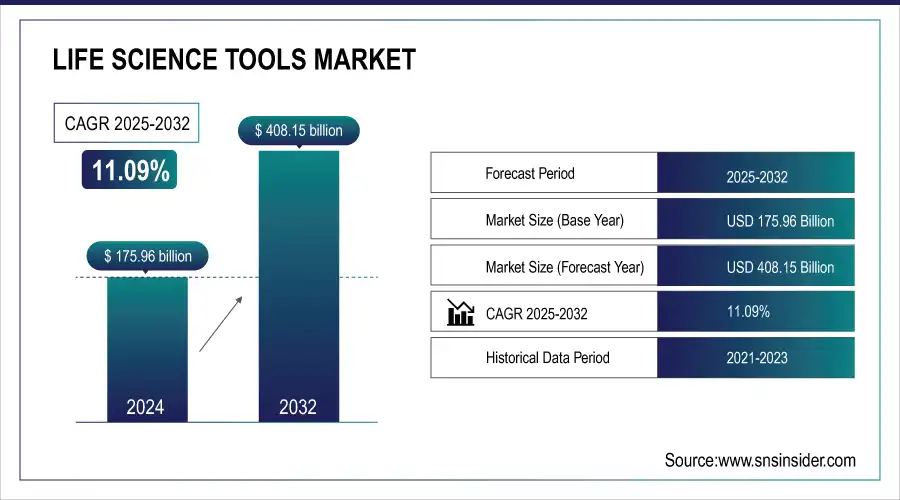

The Life Science Tools Market size was estimated at USD 175.96 billion in 2025E and is expected to reach USD 408.15 billion by 2033 with a growing CAGR of 11.09% during the forecast period of 2026-2033.

The life science tools market is experiencing rapid growth, driven by technological advancements and increasing demand for innovative solutions in diagnostics, drug development, and genomics. Key factors propelling this expansion include the integration of artificial intelligence (AI), automation in laboratories, and advancements in genomic technologies. AI and machine learning have become integral in drug discovery, particularly in protein design and the analysis of vast datasets. AI-powered platforms now enable faster and more accurate protein structure predictions, significantly enhancing drug development efforts and enabling more targeted therapeutic solutions.

Market Size and Forecast:

-

Market Size in 2025E USD 175.96 Billion

-

Market Size by 2033 USD 408.15 Billion

-

CAGR of 11.09% From 2026 to 2033

-

Base Year 2025

-

Forecast Period 2026-2033

-

Historical Data 2022-2024

Get More Information on Life Science Tools Market - Request Sample Report

Moreover, AI applications in genomics, such as sequencing and data analysis, have streamlined research and improved the efficiency of genomic discoveries. For example, DeepMind’s AlphaFold AI system has revolutionized protein structure prediction, a crucial aspect of drug discovery. This system can now predict the 3D structures of proteins with remarkable accuracy, accelerating drug design and providing critical insights into diseases like cancer and Alzheimer’s. The AI-powered tool is helping researchers overcome one of biology's biggest challenges, drastically reducing the time and cost of drug development.

In addition, the adoption of cloud computing and big data analytics has become widespread in life science research. These technologies enable real-time data sharing and collaboration across global research networks, accelerating decision-making in drug development and clinical trials. AI-driven cloud platforms are allowing researchers to analyze large datasets faster and uncover insights more effectively, which is crucial in fields like drug discovery and genomics. For example, the use of cloud-based AI platforms allows for the analysis of millions of genetic sequences in record time, fostering rapid discoveries and aiding in precision medicine initiatives.

The U.S. Life Science Tools market size was valued at an estimated USD 68.50 billion in 2025 and is projected to reach USD 160.40 billion by 2033, growing at a CAGR of 10.71% over the forecast period 2026–2033. Market growth is driven by strong investments in biomedical research, rising demand for advanced analytical instruments, reagents, and consumables, and the expanding focus on drug discovery, genomics, proteomics, and personalized medicine. Increasing adoption of automation, high-throughput screening technologies, and digital laboratory solutions is accelerating market expansion. Additionally, robust funding from government agencies, academic institutions, and biopharmaceutical companies, along with continuous technological innovation, further strengthens the growth outlook of the U.S. life science tools market during the forecast period.

Key Life Science Tools Market Trends:

-

Increasing demand for precision medicine is driving adoption of advanced life science tools like NGS and CRISPR technologies.

-

Rising focus on personalized therapies is boosting the need for efficient genetic research and diagnostic platforms.

-

Growing adoption of laboratory automation enhances efficiency, reduces errors, and accelerates high-throughput screening.

-

Integration of AI and machine learning optimizes data analysis, protein design, and drug development processes.

-

Expansion of decentralized clinical trials and digital health technologies increases demand for tools enabling remote data collection and analysis.

Life Science Tools Market Growth Drivers:

-

Growth Drivers in the Life Science Tools Market Including Precision Medicine, Automation, and AI Integration

One of the primary drivers is the increasing demand for precision medicine, fueled by advancements in genomics, diagnostics, and drug development. Tools such as next-generation sequencing (NGS) platforms and CRISPR-based technologies are accelerating genetic research and enabling the development of targeted therapies. The rising focus on personalized medicine is pushing the demand for more sophisticated and efficient life science tools.

Another significant driver is the growing adoption of automation and AI in laboratories. Automation enhances laboratory efficiency by reducing human error, speeding up repetitive tasks, and increasing throughput, particularly in high-throughput screening and genomic analysis. For instance, automated systems for liquid handling and sample processing are crucial in large-scale drug discovery efforts. AI, particularly machine learning, is further optimizing data analysis, protein design, and drug development pipelines.

Life Science Tools Market Restraints:

Stringent regulatory requirements in clinical and research settings can delay product development and market entry, posing compliance challenges for life science tool manufacturers. Additionally, as these tools increasingly handle big data and genomic information, concerns over data privacy, security, and potential misuse of sensitive health information create significant barriers, impacting adoption and overall market growth.

Life Science Tools Market Segment Analysis:

By Product

NGS (Next-Generation Sequencing) was the dominant segment in the life science tools market in 2025, with a market share of over 30.0%. This dominance can be attributed to its broad applications in genomics, oncology, and personalized medicine. The technology enables high-throughput sequencing of DNA and RNA, allowing for rapid and cost-effective genomic analysis, which has driven its adoption in research, clinical diagnostics, and drug development. The increasing demand for precision medicine, which requires detailed genomic insights, has further fueled the growth of NGS.

The NGS segment continues to grow rapidly, with a compound annual growth rate (CAGR) of around 12.0%. The growth is driven by advancements in sequencing technologies, such as single-cell sequencing, and the expanding use of NGS in liquid biopsy and rare disease detection. Its ability to deliver detailed genetic information quickly and at a lower cost has led to increasing adoption in both research and clinical applications, especially in oncology, where it is used for cancer genomics and liquid biopsy-based early detection.

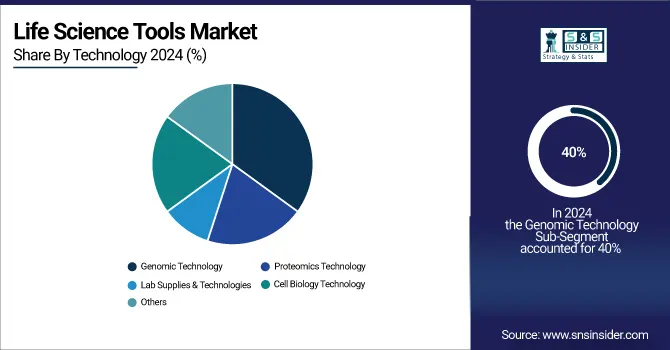

By Technology

In 2025, Genomic Technology was the dominant segment of the life science tools market, commanding more than 40.0% of the market share. This dominance can be attributed to significant advancements in genomic sequencing technologies, the rise of CRISPR gene editing, and their widespread application in personalized medicine and diagnostics. The increasing adoption of genomic tools in clinical settings for disease diagnosis and treatment is a key driver of this growth. However, the fastest-growing segment in the life sciences tools market is Cell Biology Technology, with a CAGR of 14.0%. This rapid growth is driven by breakthroughs in single-cell analysis, stem cell research, and its expanding role in drug discovery. Technologies such as single-cell RNA sequencing and advancements in cellular models are revolutionizing biological research, enabling scientists to understand diseases at a more granular level, leading to improved drug development processes. As a result, cell biology technologies are playing a crucial role in accelerating therapeutic discoveries, particularly in oncology and regenerative medicine. This surge in interest and investment in cell biology research further underscores its transformative potential across life sciences and healthcare sectors.

Life Science Tools Market Regional Analysis:

North America Life Science Tools Market Insights

In 2025, North America was the leading region in the life science tools market, accounting for the largest market share. The region’s dominance is primarily driven by substantial investments in biotechnology and healthcare infrastructure, particularly in the United States. The presence of key market players, such as Thermo Fisher Scientific, Illumina, and Agilent Technologies, bolsters the market, alongside increasing research and development (R&D) activities in genomics, diagnostics, and drug discovery. Additionally, the adoption of advanced technologies like CRISPR gene editing and genomic sequencing further supports market growth in North America. The region’s focus on personalized medicine and precision healthcare also drives demand for life science tools.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Europe Life Science Tools Market Insights

Europe held a significant share of the market as well, driven by strong government funding in biomedical research and healthcare systems. The European Union's ongoing investment in genomics and biotechnology, along with the growing number of clinical trials, fosters the growth of life science tools in the region.

Asia Pacific Life Science Tools Market Insights

Asia-Pacific (APAC) is the fastest-growing market, with a CAGR of over 12.0%, spurred by the increasing demand for diagnostics, research capabilities, and improved healthcare systems in countries like China, India, and Japan. The growth of biopharma sectors and the rise of genomics and biotechnology industries in APAC are key contributors to this rapid expansion. The region’s investment in healthcare infrastructure is accelerating the adoption of cutting-edge life science tools. The Asia Pacific market is driven by rising investment in biotechnology, genomics, and pharmaceutical research. Rapid adoption of advanced laboratory automation, AI integration, and precision medicine initiatives, along with increasing R&D funding and growing life sciences infrastructure, is fueling demand for sophisticated life science tools across the region.

Latin America (LATAM) and Middle East & Africa (MEA) Life Science Tools Market Insights

The LATAM and MEA markets are expanding due to increasing healthcare and research investments, growing adoption of genomic technologies, and rising focus on personalized medicine. Government initiatives, expanding clinical research, and the need for efficient laboratory tools are driving growth in these emerging regions.

Life Science Tools Market Key Players:

-

Agilent Technologies, Inc. – DNA Microarrays, Liquid Chromatography Systems, Mass Spectrometers, PCR Tools, Microfluidics, Flow Cytometry Instruments

-

Becton, Dickinson, and Company (BD) – Flow Cytometers, Cell Sorters, Culture Media & Reagents, Automated Liquid Handling Systems, Syringes, and Needles (for laboratory use)

-

F. Hoffmann-La Roche Ltd. – PCR Machines, Mass Spectrometry Systems, Laboratory Reagents, Immunoassay Analyzers, DNA Sequencers, Clinical Diagnostics Instruments

-

Bio-Rad Laboratories, Inc. – PCR and qPCR Systems, Electrophoresis Equipment, Western Blotting Systems, Cell Biology Reagents, Chromatography Systems, Life Science Reagents

-

Danaher Corporation – Flow Cytometry Instruments, PCR Systems, Laboratory Automation Equipment, Life Science Reagents, Microscopes, Spectrophotometers

-

Illumina, Inc. – DNA Sequencers (Next-Generation Sequencing), Microarrays, Bioinformatics Software, PCR Reagents, Genomic Assays

-

Thermo Fisher Scientific, Inc. – PCR and qPCR Systems, Mass Spectrometers, Chromatography Equipment, Flow Cytometers, Cell Culture Reagents, DNA and RNA Analysis Kits

-

QIAGEN N.V. – PCR Kits and Reagents, DNA/RNA Extraction Kits, Automated Workstations, Sequencing Solutions, Assay Development Kits

-

Merck KGaA – Cell Culture Media, PCR Reagents, Microarray Tools, Chromatography Systems, Spectroscopy Equipment, Protein Analysis Kits

-

Shimadzu Corporation – Chromatography Systems, Mass Spectrometers, Spectrophotometers, PCR Equipment, Analytical Instruments

-

Hitachi, Ltd. – Mass Spectrometers, Fluorescence Microscopes, X-ray Systems for Biological Applications, Automated Laboratory Systems

-

Bruker Corporation – Mass Spectrometry Systems, NMR Spectrometers, X-ray Diffraction Systems, FTIR Spectrometers, Microscopy Equipment

-

Oxford Instruments plc – Microscopes (Electron and Atomic Force), Spectrometers, NMR Systems, Cryogenics for Life Science Applications

-

Zeiss International – Microscopes (Fluorescence, Confocal, Electron Microscopy), Imaging Solutions, Life Science Imaging Systems, Microscopy-based Analytical Tools

Competitive Landscape for Life Science Tools Market:

Parallel Fluidics specializes in advanced microfluidic and liquid handling solutions for life science research. The company provides innovative platforms that enhance automation, improve assay throughput, and enable precise sample processing. Its technologies support genomics, drug discovery, and diagnostic applications, helping laboratories achieve greater efficiency, accuracy, and scalability in modern life science workflows.

-

Parallel Fluidics secured a USD 7M seed funding round in November 2024 to advance the development of microfluidic technologies, which are crucial for the next generation of life science tools. The funding will accelerate innovations in microfluidics, enabling advancements in applications like diagnostics and drug development. This development is expected to bolster the adoption of life science tools by enhancing their capabilities and precision in various research areas.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 175.96 Billion |

| Market Size by 2033 | USD 408.15 Billion |

| CAGR | CAGR of 11.09% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (NGS, Sanger Sequencing, Nucleic Acid Preparation, Nucleic Acid Microarray, PCR & qPCR, Flow Cytometry, Mass Spectrometry, Separation Technologies, Electron Microscopy, NMR, Others) • By Technology (Genomic Technology, Cell Biology Technology, Proteomics Technology, Lab Supplies & Technologies, Others) • By End-User (Biopharmaceutical Company, Government & Academic Industry, Health Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Agilent Technologies, Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc., Danaher Corporation, Illumina, Inc., Thermo Fisher Scientific, Inc., QIAGEN N.V., Merck KGaA, Shimadzu Corporation, Hitachi, Ltd., Bruker Corporation, Oxford Instruments plc, Zeiss International. |