Cloud-Based Language Learning Market Key Insights:

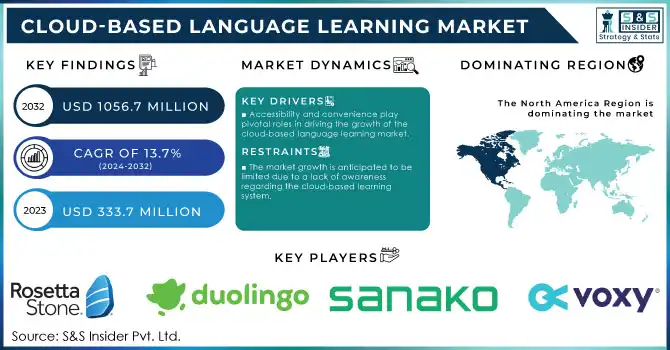

The Cloud-Based Language Learning Market Size was valued at USD 333.7 Million in 2023. It will reach to $1056.7 Mn by 2032 and grow at a CAGR of 13.7% over the forecast period of 2024-2032.

To Get More Information on Cloud-Based Language Learning Market - Request Sample Report

The increasing penetration of smartphones has greatly supported the growth of the cloud-based language learning market in the segments of mobile learning. Due to the increasing availability of affordable smartphones around the world, learners are using mobile-friendly platforms to gain access to language courses, practice exercises, and interactive tools. Such platforms allow for on-the-go learning because users can engage with lessons during transit, over breaks, or at other times that may be most convenient, integrating them into how education becomes a more customizable experience. Other features such as push notifications, offline downloads, and real-time progress tracking provide a much more enjoyable learning experience making sure it is seamless and engaging. In emerging markets, where mobile internet is on the rise, this trend is pronounced, closing educational gaps and providing equitable access to high-quality language learning resources

According to data from the U.S. Department of Education in 2020, nearly 40% of U.S. college students were taking at least one online course, compared to just 15% in 2003. This trend highlights the shift toward online and remote learning, emphasizing the growing demand for flexible, cloud-based educational solutions.

Cloud-based language learning platforms are integrating gamification and interactive learning features to boost the language learning experience. Quizzes, rewards, language challenges, and other gamification elements not only enhance the fun aspect of learning but also help in developing a habit of coming back out of motivation. This is especially popular with younger audiences because the playful, game-like take on language acquisition creates a lesson that feels less like a traditional classroom-dependent activity and more like a game. High-octane aspects like video calls, group discussions, and live lessons facilitate a more lively and social learning ecosystem. These components provide learners with real-world communication practice, immediate feedback, and peer collaboration to create a more experiential and collaborative environment.

The U.S. Department of Education published a report on the use of technology in education, revealing that 45% of U.S. students in grades 3-12 reported using interactive digital tools, such as video calls and collaborative platforms, in their learning. These tools are essential in fostering more social and collaborative learning environments, which are critical for language acquisition.

Market Dynamics

Drivers

-

Accessibility and convenience play pivotal roles in driving the growth of the cloud-based language learning market.

-

Increasing demand for technology-enabled tools that can enhance user engagement, motivation, and collaboration.

-

Increasing demand for multilingual skills has driven market growth.

The high multilingual demand has notably contributed to the development of the cloud-based language learning market. The ongoing increase in globalization has created an even higher demand for multicultural communication and soft skills and at the same time an acknowledgment to be trained in such. Specifically, businesses are looking for multilingual employees to access international markets, negotiate deals, and communicate with various clients and partners. Demand for multilingualism has created not only a strong push in language education for personal development reasons but also an added value in the workforce. Many learning platforms provide cloud-based solutions that are portable and affordable and have gained immense popularity over the years. The students have the flexibility of attending language courses at their hours, speaking with natives, and gaining resources from anywhere on the globe. The increasing demand for the online environment along with the growing significance of being multilingual within an increasingly globalized world sustains the growth of the market.

In the UK, the Department for Education (DfE) recognizes the importance of language learning as part of its national curriculum. In a 2021 report, the DfE highlighted that languages are now considered a core skill, with a commitment to ensuring that 75% of pupils in England study a foreign language at GCSE level. This increasing focus on multilingual education by government bodies reflects the recognition of language proficiency as a key asset in the global economy.

Restraints

-

The market growth is anticipated to be limited due to a lack of awareness regarding the cloud-based learning system.

Although the demand for cloud-based language learning is expected to grow significantly, a lack of awareness about the advantages and features of these systems is likely to pose a challenge to the overall growth of the market. The potential user base in many cases, especially in the areas where access to highly developed digital infrastructure or low technological literacy is present, is not aware of the benefits of the cloud-based platforms in terms of flexibility, scalability, and access to learning material from any device and at any time. Also, many educational systems are built around traditional classroom-based education models, and resistance to the adoption of new, technology-driven solutions is both natural and expected. Sometimes both the educators and the learners are reluctant to move to digital platforms because they are more effective than face-to-face learning. Cloud-based learning is a brand-new approach, and from what we discovered, many users still have no clear understanding of what it means or the advantages it carries. This lack of widespread awareness could therefore be a significant barrier to adoption, as those who aren’t able to picture how cloud-based learning can enrich their language learning experience are less likely to sign up for the challenge.

Opportunities

-

The surge in demand for online education creates an opportunity in the market.

The surge in demand for online education has brought about a significant transformation in the global education sector. With the ever-increasing accessibility of the internet and continuous technological advancements, the way people access and interact with educational content has been revolutionized. Online education provides a flexible and easily accessible learning environment that caters to individuals of all ages and backgrounds. The convenience of learning from the comfort of one's own home or any location with an internet connection has greatly expanded the scope of education, demolished geographical barriers, and fostered inclusivity in the learning process.

Key Segmentation Analysis

By Language

English Language held the largest market share around 34% in 2023. it is being served as a lingua franca in the scope of business, education, and international communication, resulting in tremendous demand for English learning platforms. Various cloud-based learning platforms emphasize primarily English Courses catering the learners across the globe. And this is especially true in countries where English is not the main language as the willingness to learn English is often regarded as the key to career opportunities, access to a world of content, and world-related markets. The widespread use of English in business and academia, the mass availability of content in English on cloud platforms, as well as the sheer number of English speakers in the world, also work as factors of use that confirm it as a dominant language within the language market. While people practice other languages such as Spanish, Chinese, French, and German, the global use of the English language as a daily life necessity keeps making it the largest driver of the cloud-based language learning growth.

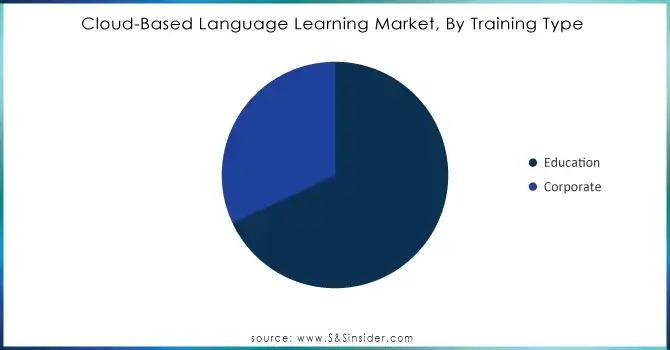

By Training Type

Education held the largest market share around 68% in 2023. The education sector, which includes K-12 schools, universities, and language learning centers has been slowly moving towards the cloud with their solutions that provide flexible, scalable, and accessible tools for language learning. As remote and hybrid learning models continue to gain traction, educational institutions have increasingly relied on cloud platforms to provide students with access to language courses on demand, interactive learning materials, as well as the ability to track their progress against personal goals. These systems are inexpensive and allow schools and universities to grow their language programs without building new infrastructure, which is why they are a popular solution for institutions around the world. Furthermore, cloud-based language learning tools are being utilized to improve the performance of students of all ages; from children to adults, hence, enhancing the share of the market in the education sector. Although the corporate sector is similarly a growing sector particularly for employee-skills development and cross-cultural communication, the size and steady needs of the education market make education by far the largest market driver in cloud-based language learning.

Do You Need any Customization Research on Cloud-Based Language Learning Market - Enquire Now

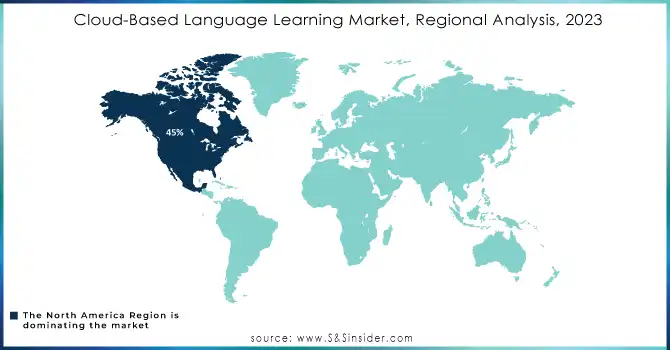

Regional Analysis

North America region held the largest market share around 45% in 2023. This is due to advanced digital infrastructure, high internet penetration, and a culture of integrating technology with education and corporate training. Most importantly, the proliferation of e-learning options in the schools, universities and businesses of the region has been a crucial factor in helping the rise of cloud-based language learning software. In the US for example, a significant amount of schools have translated their methods into the classroom around technology, assisted by the local authority in popularizing virtual schooling. The growing presence of the big tech firms and language learning platform providers including Duolingo, Rosetta Stone, etc. has thrown up new opportunities for the expansion of innovation and accessibility in the market. North America corporate sector is also a major player, as commercial group focuses on language training for communicating worldwide and multicultural workforce. In addition, given the history of high disposable income levels and a propensity for consumers to invest in personal development and growth, North America continues to be the largest and most financially attractive market for cloud-based language learning systems.

Key Players

-

Rosetta Stone Inc. (Rosetta Stone Foundations, Catalyst)

-

Duolingo (Duolingo App, Duolingo English Test)

-

EF Education First Ltd. (EF English Live, EF Classroom Apps)

-

Sanako Corporation (Pronounce Live, Study 1200)

-

Voxy, Inc. (Voxy Personalized Learning, Voxy Proficiency Assessment)

-

Lesson Nine GmbH (Babbel) (Babbel App, Babbel Live)

-

Culture Alley (Hello English, English App for Corporates)

-

Speexx (Speexx Coach, Speexx Essentials)

-

SANS Inc. (SANS FLEX, Interactive Language Learning Program)

-

Linguatronics LC (Proficiency Suite, Speech Recognition Tools)

-

Busuu Ltd. (Busuu App, Busuu for Business)

-

Memrise (Memrise App, Video Learning Courses)

-

Mondly (Mondly App, Mondly VR)

-

Italki (Italki Tutor Marketplace, Italki Classes)

-

Preply, Inc. (Preply Learning Platform, Preply Language Tools)

-

LingQ (LingQ App, Vocabulary Trainer)

-

HelloTalk (HelloTalk App, Live Classes Feature)

-

Cambly Inc. (Cambly App, Cambly Kids)

-

FluentU (FluentU Video Learning, FluentU for Schools)

-

Open English (Open English Platform, Open English Junior)

Recent Developments:

-

In 2023, Duolingo introduced new AI-powered features to enhance personalized learning experiences, leveraging advancements in generative AI. This aligns with the broader trend of integrating AI in language education to boost engagement and effectiveness

-

In 2023, Speexx launched real-time analytics tools to provide detailed learner progress tracking. This caters to corporate clients aiming to assess training ROI effectively

-

In 2022, Busuu, acquired by Chegg continues to integrate with Chegg’s ecosystem, focusing on student-centric solutions that blend language learning with academic resource.

| Report Attributes | Details |

| Market Size in 2023 | US$ 333.7 million |

| Market Size by 2032 | US$ 1056.7 million |

| CAGR | CAGR of 13.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Language (English, Spanish, Chinese, French, German, Japanese, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Rosetta Stone Inc., Duolingo, EF Education First Ltd., Sanako Corporation, Voxy, Inc., Lesson Nine GmbH., Culture Alley, Speexx, SANS Inc., Linguatronics LC |

| Key Drivers |

• Increasing demand for multilingual skills has emerged |

| Market Restraints |

• The market growth is anticipated to be limited due to a lack of awareness regarding the cloud-based learning system. |