Online Language Learning Market Report Scope & Overview:

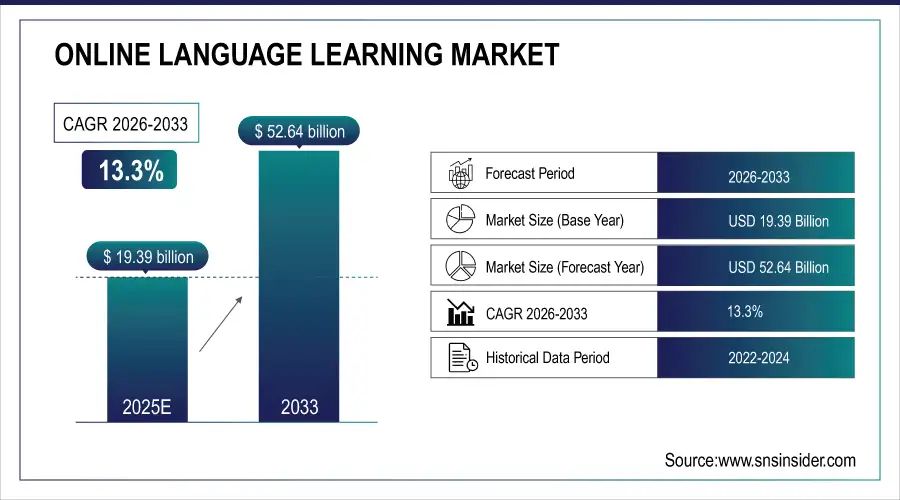

The Online Language Learning Market Size was valued at USD 19.39 Billion in 2025 and is expected to reach USD 67.59 Billion by 2035, growing at a CAGR of 13.3% over the forecast period 2026-2035.

The market for online language learning is expanding rapidly because of globalization and the increasing need for multilinguals. In the U.S., more than 15% of employment is related to international trade, with 10% requiring multilingual skills, and 20% of households speak languages other than English. In Europe, 95% of secondary school students study a foreign language, and in Asia, more than 300 million Chinese people study English.

Online Language Learning Market Size and Forecast:

-

Market Size in 2025: USD 19.39 Billion

-

Market Size by 2035: USD 67.59 Billion

-

CAGR: 13.3% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Get more information on Online Language Learning Market - Request Free Sample Report

Online Language Learning Market Report Trends:

-

Rising demand for multilingual skills and globalization drives growth across education, corporate training, and personal learning.

-

Self-learning apps dominate the market due to accessibility, affordability, gamification, and flexible mobile-based learning.

-

AI-powered platforms enhance personalization, real-time conversation practice, and learner engagement, boosting adoption globally.

-

Government initiatives and digital education policies in regions like Asia-Pacific and Europe support online language learning expansion.

-

Smartphone penetration, high-speed internet, and affordable platforms accelerate adoption in developing markets.

-

Investment challenges and competition from free AI tools may affect funding and slow growth for smaller edtech providers.

The U.S. Online Language Learning market size was estimated at USD 7.35 billion in 2025 and is projected to reach USD 24.73 billion by 2035, growing at a CAGR of 12.9% during the forecast period of 2026-2035. The growth of the market is fueled by the increasing need for flexible and personalized learning solutions, the increasing adoption of e-learning platforms among academic, corporate, and individual users, and the increasing need for multilingual skills in a globalized workforce. The increasing adoption of AI-powered language learning applications, gamified content, and mobile-based platforms is accelerating the growth of the market. Moreover, the increasing corporate training programs, the adoption of immersive technologies such as AR/VR, and the significant investments in digital education are further enhancing the growth prospects of the U.S. online language learning market over the forecast period.

Online Language Learning Market Drivers:

-

The rise of mobile-first applications and smartphone penetration, particularly in developing countries, has broadened the market by providing on-the-go learning solutions.

One of the key drivers for the online language learning market is the rapid growth of e-learning platforms. Digital technology’s advancement allows platforms like Duolingo, Babbel, Coursera, and others to offer online language learning solutions that are accessible, affordable, and flexible. Language learners can study at their own pace and from wherever in the world they are. These platforms offer interactive and stimulating methods, such as gamification and the option to book live tutoring sessions, to appeal to a wide range of people, including students, professionals, and those planning on traveling. For example, as of 2023, Duolingo boasts 74 million monthly active users, showing that a large number of people are currently using online language learning tools. One of the reasons for this is that Duolingo is free and offers entertaining and bite-sized lessons for all its users, keeping them engaged while they go through the course, which is also gamified by tracking the students’ daily progress. Babbel also proves that 92% of its users believe that its courses are useful for its users to learn a language better in their daily lives, further emphasizing the relevance and popularity of these courses.

Online Language Learning Market Restraints:

-

The increasing use of personal data, including voice recordings and behavioral data, raises concerns about privacy and security, which may hinder user adoption.

A significant constraint in the online language learning market is the inability to deliver a personalized learning experience. Although the performance of adaptive learning has benefited from advancements in AI and machine learning, there are still numerous opposing circumstances. These include, but are not limited to, ineffective individual feedback that would cover the diversity of language needs of a unique user. In the case of the traditional classroom setting, the learner has more access to an individualized experience. He or she interacts directly with an instructor who can moderate the pace of a learner’s engagement or adapt the lesson based on a student’s progress, cultural context, and learning style. The focus in many online learning platforms, particularly in those with pre-recorded lessons, is predominately spent on learning generic content.

Online Language Learning Market Opportunities:

-

Emerging Growth Prospects in the Online Language Learning Market

The market for online language learning offers immense opportunities for growth as the adoption of digital technology is accelerating across the world. The growing need for multilingual capabilities in educational, commercial, and travel contexts fuels the demand for the platform. The use of sophisticated technologies such as AI-based tutors, speech analysis, and customized learning plans improves engagement and results. Mobile applications, gamified learning, and engaging content facilitate flexible and anytime-anywhere learning, which appeals to a wide range of users. New business opportunities emerge in the corporate training, test preparation, and specialized language markets. Partnerships with educational institutions and content publishers further expand the reach. Growing internet and smartphone penetration in emerging markets offers unexplored territory for fast growth.

Online Language Learning Market Segmentation analysis:

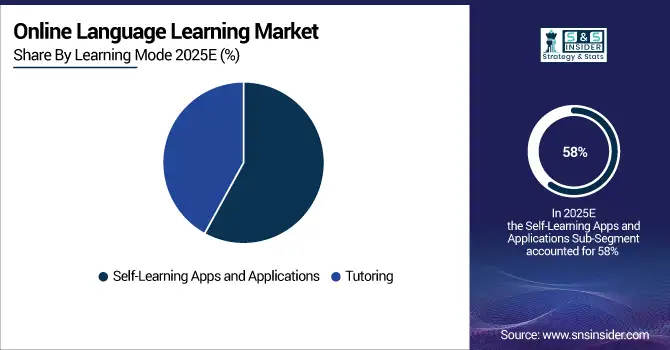

By Learning Mode, Self-Learning Apps Dominate Online Language Learning Market Driven by Accessibility, Affordability, and Digital Adoption

In 2025, self-learning apps and applications emerged as the largest segment in the online language learning market, accounting for approximately 58% of the market share. Demand is attributed to the popularity of these applications due to the accessibility, affordability, and provision of on-demand learning. According to the report issued by the U.S. Bureau of Labor Statistics on digital adoption trends, other factors contributing to the growth of the segment include the availability of interactive and semiformal learning tools. Many platforms offer interactive and gamified exploits targeting younger demographics buoyed by the use of mobile applications enabling flexible use by many practitioners at their time of availability. The sector also recorded significant growth due to the penetration of smartphones and high-speed internet in developing economies. Governments worldwide have been initiating digital learning tools in their policy frameworks. This is occurring subsequent to the shifts in learning from traditional classrooms to digital platforms. The accessibility of these practices and reduced cost or no cost at all saw the population opt for these applications as their primary platforms for new languages. Casual and professional learners topped the list as they allocated time to study new languages during their free time.

By Language Type, English Dominates Online Language Learning Market with Over 55% Share Driven by Global Demand and Government Initiatives

In 2025, English held the dominant position of being the most adopted language for online learning, held more than 55% of the market share. According to government data from the British Council, English serves as the official language in more than 50 countries. In addition to the 360 million native speakers in the United States, the United Kingdom, and other Anglo countries, English is spoken as a second language by more than 1.5 billion people around the world. The predominance of English is also determined by the functions and tasks it is able to perform; that is, it is the universal lingua franca in such areas as international business, science and technology, and other fields of international, as well as domestic activities, from academia to TV shows. Furthermore, governmental support in non-English-speaking countries also contributed to the rapid growth of English on the market. For example, South Korea’s Ministry of Education continues the implementation of large investments in English language programs. The “Double Reduction” policy in China became another reason for the upsurge in private English tutoring leading to the spike in demand for online English teaching. Moreover, the demand for English in the business process outsourcing (BPO) sector, particularly in countries like India and the Philippines, has further driven the expansion of this language segment.

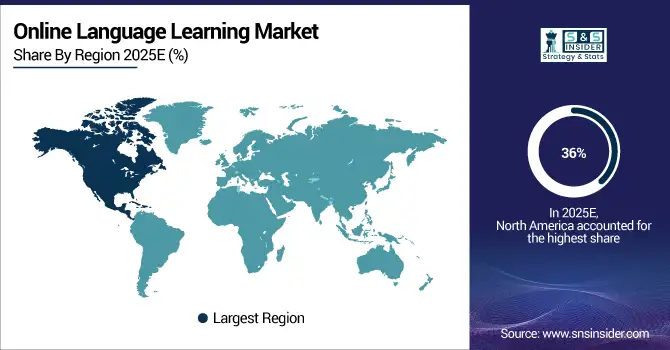

Online Language Learning Market Regional Insights:

North America Leads Global Online Language Learning Market with 36% Share Fueled by AI-Powered Self-Learning Apps

North America accounts for a whopping 36% of the worldwide online language learning market in 2025. This is a result of the emerging self-learning applications and information and communication technology incorporation in the education sector. The return of some of the bigger players in the market is helping to grow the market in many ways. As an example, in December 2024, the AI-based language learning startup Speak coordinated a USD 78 million Series C round from Accel, the OpenAI Startup Fund, Khosla Ventures, and Y Combinator. As a product of this investment, Speak is growing within OpenAi's real-time conversation technology, doubling Speak's valuation to USD 1 billion from before.

United States Leads North American Online Language Learning Market Through EdTech Innovation and High Connectivity

Need any customization research on Online Language Learning Market - Enquiry Now

United States Leads North American Online Language Learning Market Through EdTech Innovation and High Connectivity

The United States is at the forefront of the North American market because of its substantial number of English learners, a high penetration rate of smartphones and internet use, and significant investments in ed-tech start-ups. The presence of companies such as Duolingo and Rosetta Stone, which are based in the United States, is the key reason why the United States is the major contributor to the market.

Asia-Pacific Fastest-Growing Online Language Learning Market in 2025 CAGR Driven by Smartphone Penetration

Asia-Pacific Fastest-Growing Online Language Learning Market in 2025 CAGR Driven by Smartphone Penetration

Asia-Pacific is the fastest-growing region in the online language learning market in 2025, with a CAGR. Growth is fueled by rising smartphone penetration, growing demand for English proficiency, and government support for digital education.

China Dominates Asia-Pacific Online Language Learning Market with Government Initiatives and Expanding Digital Education

China leads the Asia-Pacific market because of massive government programs supporting English education, like incorporating foreign languages into school curricula and investing in online learning platforms. Moreover, the Indian market is also prominent because of programs initiated by the National Education Policy 2020, which promotes multilingual education. The increasing use of the internet and the popularity of self-learning applications also boost the market.

Europe Holds Significant Share in Online Language Learning Market in 2025E Fueled by Foreign Language Education and Tech Infrastructure

In 2025, the online market for language learning in Europe is a major segment, fueled by the adoption of foreign language education, technology, and business needs. Students from Europe are increasingly using online platforms to learn English, French, Spanish, and German.

Germany Leads European Online Language Learning Market Through Robust Digital Education and Corporate Multilingual Demand

Germany leads the market in Europe because of its well-developed digital education infrastructure, strong business need for multilingual talent, and government initiatives to promote language learning in educational institutions and companies. The emphasis on vocational and professional language skills in Germany makes it an important driver of the online language learning market in Europe.

MEA and Latin America Emerging as Growth Markets for Online Language Learning in 2025E Driven by Digital Access

In 2025, the MEA and Latin America markets are emerging markets for online language learning. The growth of the internet and smartphones has driven the demand for English and global languages, and governments are launching initiatives to promote digital education.

UAE and Brazil Lead Regional Online Language Learning Adoption Through EdTech Investments and Bilingual Education Initiatives

Countries like the UAE in MEA and Brazil in LATAM are leading adoption due to investments in edtech infrastructure, bilingual education initiatives, and corporate training programs. Affordable mobile apps and self-learning platforms enable learners in both regions to access language education efficiently, supporting the growing online language learning market.

Online Language Learning Market Competitive Landscape:

Duolingo, established in 2011 and headquartered in Pittsburgh, USA, is a popular online language learning platform that provides gamified courses for more than 40 languages. Duolingo uses mobile and web-based applications to deliver interactive lessons, quizzes, and immediate feedback to learners worldwide. Duolingo uses AI-powered personalization to adjust lessons according to the learning speed and preferences of individual learners. Duolingo’s freemium business model provides free access to basic content, while paid subscriptions provide ad-free experiences and extra services. Duolingo has gained more than 500 million registered users and is currently a leading online language learning platform in the world.

-

In April 2025E, Duolingo, Inc. significantly expanded its offerings by introducing 148 new language courses, strengthening itself in the online language learning space. This big expansion improves global access to language education and aligns with Duolingo’s mission to provide high-quality learning opportunities to users everywhere and every time. The new courses are available globally on both the Duolingo app and website.

Founded in 2007, in premises based in Berlin, Germany, Babbel is a subscription-Based online language-learning platform that aims to impart real-life language skills. With trimmed-down bites of grammar, vocabulary, and culture, the platform offers lessons in 14 languages. Babbel is also designed for people who want to learn on the go and be able to learn wherever they want and whenever they want. The very platform exactly employs the use of speech recognition technology that allows users to work on their pronunciation and speaking skills. Babbel provides a language learning solution for adults who want to learn a language for work or for personal purposes. Babbel is a well-known brand for its proven, straightforward, and effective online language learning solution used globally even by millions of paid subscribers.

-

In March 2025, Babbel GmbH, an online language learning platform, became the official language learning partner of Major League Soccer’s Inter Miami CF. Through this partnership, the team’s diverse players and staff represent over 15 nationalities who will have access to Babbel’s corporate language tools, including the Babbel App and Babbel Live virtual classes, to support better communication and team unity. Marking Babbel’s first collaboration with an MLS team, this partnership highlights the increasing importance of digital language learning in promoting multicultural collaboration in professional sports.

Online Language Learning Market Companies:

-

Duolingo (Duolingo Mobile App, Duolingo for Schools)

-

Babbel (Babbel Language Learning App, Babbel Live (Interactive Classes))

-

Rosetta Stone (Rosetta Stone Language Learning Softwarem Rosetta Stone for Enterprise)

-

Busuu (Busuu Mobile App, Busuu for Business)

-

Memrise (Memrise Language App, Memrise Pro)

-

Preply (Preply Online Language Tutoring, Preply Business Courses)

-

Italki (italki Online Language Lessons, italki Community (Language Exchange))

-

Lingoda (Lingoda Language Courses, Lingoda Sprint (Intensive Courses))

-

Pimsleur (Pimsleur Audio Lessons, Pimsleur All Access Subscription)

-

FluentU (FluentU Video-Based Learning, FluentU for Schools)

-

Mango Languages (Mango Languages App, Mango Classroom)

-

Clozemaster (Clozemaster App, Clozemaster Pro)

-

Open English (Open English Live Classes, Open English Junior)

-

Voxy (Voxy English Learning Platform, Voxy for Enterprise)

-

HelloTalk (HelloTalk Language Exchange App, HelloTalk VIP Subscription)

-

Yabla (Yabla Video Language Immersion, Yabla for Schools)

-

Cambly (Cambly English Tutoring, Cambly Kids)

-

Speexx (Speexx Corporate Language Training, Speexx Live Coaching)

-

Lingvist (Lingvist App, Lingvist Pro)

-

Mondly (Mondly Language Learning App, Mondly VR (Virtual Reality Language Learning))

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 19.39 Billion |

| Market Size by 2035 | USD 67.59 Billion |

| CAGR | CAGR of 13.3% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Learning Mode (Self-Learning Apps and Applications, Tutoring) • By Target Audience (Individual Learners, Educational Institutions, Corporate Sector, Government and Non-Profit Organizations) • By Age Group (<13 Years, 13-17 Years, 18-20 Years, 21-30 Years) • By Language type (English, French, Spanish, Mandarin Chinese, German, Italian, Arabic, Japanese, Korean, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Berlitz Corporation, Rosetta Stone Inc., Memrise Inc, Inlingua International Ltd., Sanako Corporation, Duolingo Inc., Babbel, Busuu Ltd, iTutor Group, Open Education LLC, and Linguistica 360, Inc. |