Cloud Microservices Market Report Scope & Overview:

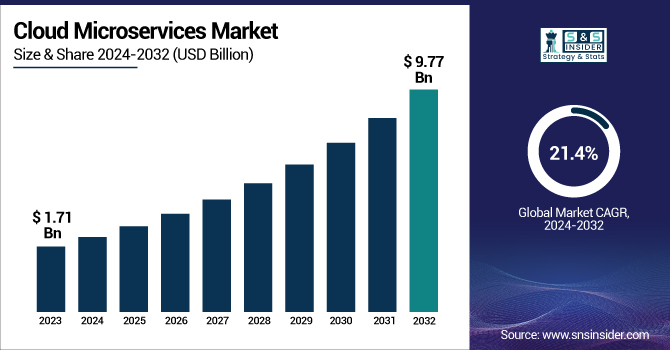

The Cloud Microservices Market Size was valued at USD 1.71 billion in 2023 and is expected to reach USD 9.77 billion by 2032 and grow at a CAGR of 21.4% over the forecast period 2024-2032.

To Get more information on Cloud Microservices Market - Request Free Sample Report

The market is experiencing the fastest growth. This allows for services that are highly scalable, flexible resources that can be independently deployed, which hastens development and deployment. This is the reason companies opt for microservices instead of a traditional model to achieve agility and operational efficiency. Major companies like AWS, Microsoft Azure, and Google Cloud are offering strong frameworks and orchestration tools that facilitate this shift. The demand is elevated further by the significance of DevOps, CI/CD pipelines, and serverless computing. Industries such as BFSI, healthcare, retail, and telecom are adopting microservices to enhance scalability, real-time processing, and system reliability

U.S. Cloud Microservices Market obtained an invoice of USD 0.50 billion in 2023, and as per the estimate, it will be worth USD 2.54 billion by 2032 and run with the CAGR of 19.7% throughout the projection period of 2024–2032.

The U.S. Cloud Microservices Market. To attain agility, scalability, and rapid deployment, organizations are moving from monolithic architectures to microservices. This shift is propelled by the growth of DevOps methodologies, containerization tools like Docker and Kubernetes, along with a requirement for ongoing integration and deployment. AWS, Microsoft Azure, Google Cloud, and various other cloud providers are enhancing their microservices capabilities to cater to enterprise-level services.

Cloud Microservices Market Dynamics

Key Drivers:

-

Rising Need for Agile and Scalable Application Development Drives Cloud Microservices Market Growth

Increased adoption of cloud technologies is leading to greater demands for more flexible, agile, and scalable application development, which is a significant factor driving growth in the Cloud Microservices Market. Many traditional monolithic application architectures are failing to address today's demands for scalability, deployment velocity, and flexibility. Cloud-based microservices architecture enables software developers to break their applications into tiny, independent deployable or runnable pieces, which can be independently updated or scaled without affecting the overall system.

The modularity greatly improves productivity, accelerates time-to-market, and enables continuous delivery principles. Microservices are more effective in maintaining a workflow in organizations that have adopted DevOps and CI/CD practices. As businesses aim to offer faster innovation and digital transformation, particularly in domains like BFSI, e-commerce, and healthcare, the use of microservices is growing increasingly popular.

Restrains:

-

High Complexity in Managing Distributed Systems Restrains Cloud Microservices Market Growth

The complexity of managing distributed systems is still a major constraint on the Cloud Microservices Market growth. Unlike traditional monolithic models, the microservices architecture consists of many independently running services that are distributed over a wide area, making orchestration, monitoring, and debugging significantly more complex. Maintaining each microservice can require a higher level of skill and specialized tools, as each microservice might utilize different languages, databases, or frameworks. Such complexity tends to bring higher infrastructure costs and longer turnaround times for the development team onboarding. Core challenges include ensuring consistent performance, handling inter-service communication, and managing data consistency across services.

Enforcing security practices in a large, distributed environment is a completely different challenge altogether. The hurdles are daunting for many smaller organizations with limited resources, which may slow down the adoption of these technologies. Without mature governance frameworks and tooling, organizations risk losing control of the complexity of their architectures, undermining the scalability and agility benefits microservices bring to the table.

Opportunities:

-

Growing Adoption of DevOps and Serverless Computing Offers Lucrative Opportunities in Cloud Microservices Market

The adoption of DevOps culture and serverless computing in enterprises the meanwhile, provides lucrative growth avenues in the Cloud Microservices Market. Microservices architecture perfectly aligns with DevOps, as it focuses on continuous integration, constant delivery , and the collaboration of development and operations. Microservices durability: Microservices enable DevOps teams to independently evolve, deploy, and scale services, allowing them to iterate more quickly and ship higher-quality applications.

Moreover, serverless platforms like AWS Lambda, Azure Functions, and Google Cloud Functions are an optimal execution environment for microservices without having to deal with server infrastructure management. They boost up on each demand and optimize the resource usage, making them cost-effective and efficient to deploy microservices. With businesses accelerating their need to innovate and improve customer interaction, the combination of DevOps and serverless computing will open new ground for deploying microservices at scale. Inspect would accelerate further, particularly amongst startups and digital-first organisations looking for lean, agile, and resilient cloud native solutions.

Challenges:

-

Challenges in Ensuring Data Security and Compliance Across Distributed Microservices Hinder Market Growth

The Cloud Microservices Market would be facing a grave challenge of managing data security and regulatory compliance in the decentralized microservices architecture that is decentralized. As the services are distributed in various cloud environments, securing each endpoint, managing data integrity, and ensuring encrypted communication between the services becomes more challenging. Organizations that deal with sensitive data, particularly in industries like healthcare, finance, and government, are subject to strict regulations such as GDPR, HIPAA, and PCI-DSS. If not done properly, implementing compliance across many microservices can create security gaps.

In addition, tracking access management, logging events, and identity management across many services requires a complex identity and access management (IAM) system. The need for end-to-end visibility and governance tools becomes critical, but most do not have the time or resources to implement them effectively. Data sovereignty and auditability are high on the list of priorities for many organizations, and these issues may force organizations to postpone microservices adoption, thereby stifling mass market expansion.

Cloud Microservices Market Segments Analysis

By End-User

In 2023, the IT and telecommunications sector had the highest share of 28% in the Cloud Microservices Market due to its considerable application in scalable, flexible, and resilient architectures. With digital transformation maturing, telecom companies and IT enterprises are adopting cloud microservices to revamp their legacy systems and build cloud-native applications. These microservices enable agile operations, allowing for faster deployment of new services faster & enhanced customer experience. Ericsson and Nokia, for instance, have been embedding microservices into their respective 5G and network management platforms to provide modular capabilities.

The healthcare segment is expected to grow at the fastest CAGR of 26.6% during the forecast period due to increasing digitalization, patient-centric care models, and regulatory compliance requirements. With cloud microservices, healthcare organizations can enjoy the flexibility to launch features quickly, maintain interoperability between systems, and adjust infrastructure to meet needs. Microservices modularity allows secure access to specific patient data, supporting telemedicine platforms for healthcare and electronic health records (EHRs) and mobile health apps. As recently as October 2023, health-tech firm hospitals and networks have developed container-based microservices that allow for real-time diagnostics, processing, and personalized medicine.

By Deployment Mode

The Cloud Microservices Market was dominated by the hybrid deployment segment, which contributed a share of 50% to the market revenue in 2023, due to the increased flexibility, security, and control it provides. Many organizations and enterprises are adapting to hybrid cloud architectures to combine the elasticity of public clouds with the control of private environments. This balance is particularly valuable for enterprises handling sensitive data and mission-critical workloads. Deploying microservices in a hybrid configuration enables their distribution across environments, which allows for effective segmentation of workloads and cost management/optimization. Big names like Microsoft Azure and Google Cloud have expanded their hybrid cloud capabilities in recent years to include Kubernetes-based microservices platforms like Azure Arc and Anthos.

The private segment of the Cloud Microservices Market is expected to grow at the highest CAGR of 22.9% during the forecast period, as security, customization, and compliance needs support the segment's growth. Large organizations are moving their microservices to the private cloud, especially those working with sensitive information, such as finance, healthcare, and government, satisfying their need to maintain complete control over their data and infrastructure. In private deployments, organizations can achieve industry-specific compliance while reaping the benefits of microservices architecture. Custom private microservices platforms have been built by leading technology providers like IBM and VMware that use containerization, orchestration, and monitoring in private cloud infrastructures.

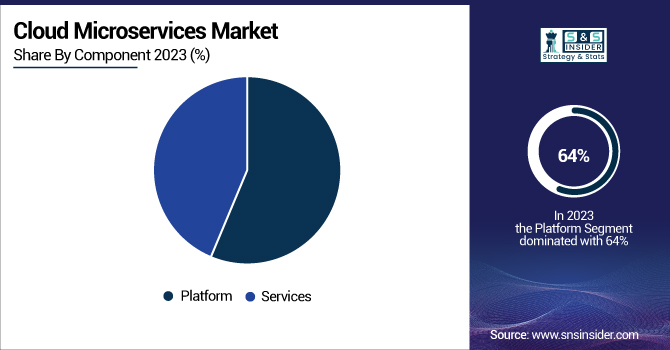

By Component

The platform segment held the majority Cloud Microservices Market share—64% revenue share in 2023. Local development tools and cloud-native platforms provide integrated environments for services like logging, container orchestration, API gateways, monitoring, service discovery, etc, prerequisites for microservices to run successfully. Trends like Kubernetes applications and microservices are gaining popularity, as they offer developers the ability to build modular, scalable applications on popular platforms like Red Hat OpenShift, AWS Fargate, and Microsoft Azure Kubernetes Service. These platforms are increasingly used by companies to speed up application delivery and simplify DevOps workflows by automatically scaling and sequentially automating DevOps delivery pipelines.

The Cloud Microservices Market has been segmented into services and solutions services segment is estimated to lead the Cloud Microservices Market with the highest CAGR of 24.6% due to the increasing demand for professional consulting, integration, and maintenance support. As enterprises adopt microservices architectures, they increasingly look to managed services and third-party providers to take care of deployment strategies, security configurations, and lifecycle management. Furthermore, cloud providers like AWS and Google Cloud also provide specialized services to help organizations manage container orchestration, service mesh implementations, and continuous delivery pipelines.

By Enterprise Type

In 2023, large enterprises held the largest revenue share, 68% of the Cloud Microservices Market, due to their strong infrastructure, thinking globally, and embracing digital transformation. Such organizations need to adopt scalable, secure, and resilient architectures to manage their large application ecosystem and respond to market changes within minutes. Microservices empower large businesses to innovate at scale, improve customer experiences, and increase operational efficiency. They use these architectures to migrate legacy systems, enable faster release cycles, and meet business continuity requirements. The demand for real-time analytics, personalization, and a connected enterprise (API) future is only fueling this explosion.

The Cloud Microservices Market for small and medium-sized enterprises (SMEs) is anticipated to develop at the fastest CAGR of 24.7%, owing to rising access to affordable cloud infrastructure & digital innovation. Small and Medium Enterprises are increasingly moving away from traditional monolithic systems on the road to agile microservices to improve product development, accelerate go-to-market strategy, and remain competitive.

Also, managed services and low-code development platforms are enabling SMEs to deploy microservices with the necessary technical resources. With digital-first strategies and remote work trends continuing to undergird the expansion of cloud microservices, demand will rise among SMEs, driving further adoption of clouds and cloud microservices.

Regional Analysis

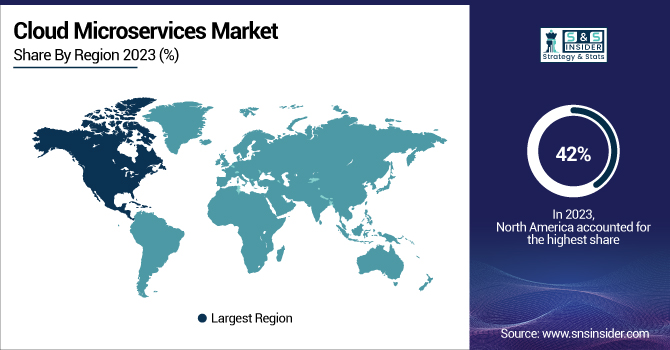

In 2023, North America held the largest share of the cloud microservices market, contributing approximately 42% to the total market share. This leadership position is the outcome of the presence entitled to heavyweights like Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and IBM Cloud. These major players provide powerful microservices frameworks and tools for various industries such as BFSI, healthcare, retail, and telecom. Moreover, this dominance has been fueled by the region’s advanced IT infrastructure, strong adoption of DevOps practices, and widespread digital transformation initiatives.

In 2023, Asia Pacific represented the fastest-growing Cloud Microservices Market, estimated to grow at a rate of 24.6% over the forecasting period. This growth can largely be attributed to the growing speed of cloud adoption, thriving digital economies, and an increase in startups and SMEs in countries such as China, India, Japan, and Southeast Asia. With the growing IT outsourcing market and an increased emphasis on scalable digital platforms, enterprises are being forced to adopt microservices architecture.

Companies in India and Southeast Asia, for example, are utilizing platforms such as Google Cloud Run and Azure Kubernetes Service to deploy elastically scalable applications for e-commerce and financial services. This accelerated adoption is further supported by the region’s growing tech-savvy population and government-backed digital initiatives.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Amazon Web Services (AWS) (AWS Lambda, Amazon ECS)

-

Microsoft Corporation (Azure Kubernetes Service, Azure Functions)

-

IBM Corporation (IBM Cloud Kubernetes Service, IBM Cloud Pak for Integration)

-

Salesforce Inc. (Salesforce Platform, MuleSoft Anypoint Platform)

-

F5, Inc. (F5 BIG-IP, Nginx by F5)

-

Broadcom (Broadcom API Gateway, Broadcom DevOps Automation)

-

Software AG (webMethods, Cumulocity IoT)

-

Ksolves India Limited (Ksolves Microservices Solutions, Ksolves Cloud Solutions)

-

Datadog (Datadog APM, Datadog Log Management)

-

WeaveWorks (Weave Kubernetes Platform, Weave Cloud)

Recent Trends

-

In October 2024, Salesforce announced the launch of its new cloud-native microservices platform designed to streamline application development and deployment. This platform enables developers to build and manage scalable applications using a modular architecture, enhancing flexibility and reducing time-to-market. By adopting microservices, Salesforce aims to improve its cloud offerings, providing customers with more agile and efficient solutions in the cloud microservices market.

-

In December 2023, the UK's Competition & Markets Authority (CMA) indicated a potential investigation into the cloud computing dominance of Microsoft and Amazon. The inquiry panel expressed concerns about rising costs, reduced choice, and lower service quality for businesses and consumers, suggesting that the current competitiveness in cloud services may be insufficient.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.71 Billion |

| Market Size by 2032 | US$ 9.77 Billion |

| CAGR | CAGR of 21.4 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Platform, Services [Consulting Services, Integration Services, Training, Support, and Maintenance Services]) • By Deployment Mode (Public, Private, Hybrid) • By Enterprise Type (Large Enterprises, SMEs) • By End-User (IT and Telecommunications, BFSI, Retail and Consumer Goods, Healthcare, Education, Media and Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services, Inc., Microsoft Corporation, IBM Corporation, Salesforce Inc., F5, Inc., Broadcom, Software AG, Ksolves India Limited, Datadog, WeaveWorks. |